How Trump tariff India threat could push shift to decentralization

Rising tensions over Russian Oil

The relationship between IND and the U.S is experiencing a major strain as the U.S president Trump tariff India continued purchase of oil from Russia.

The nation is dependent on discounted Russian crude oil and is now making up nearly one-third of its imports that has become a central point of US criticism.

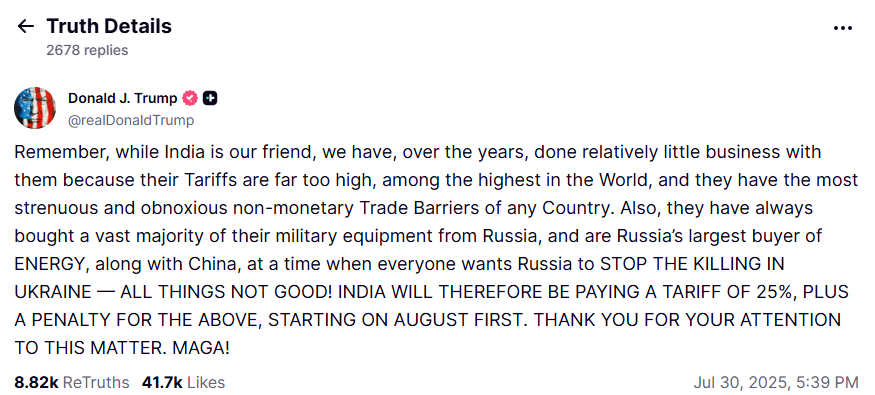

Donald recently slammed India on his social platform Truth social for buying cheap Russian oil, saying it’s helping fund the Ukraine war. While country and the US have shared strong ties, Trump tariff India seems unhappy with country's growing trade with Russia.

It’s like being stuck between two angry friends and now, nation faces a 25% tax from the US as a result.

Source: Truth social

Potential Ripple effect on the Global Crypto market from Trump tariff India

If Trump tariff India follows through with steep tariffs and trade restrictions on IND then it could create market uncertainty both in financial and crypto space. This kind of trade disruptions, fluctuating oil prices and strained US-IND relations may trigger volatility in the cryptocurrency markets.

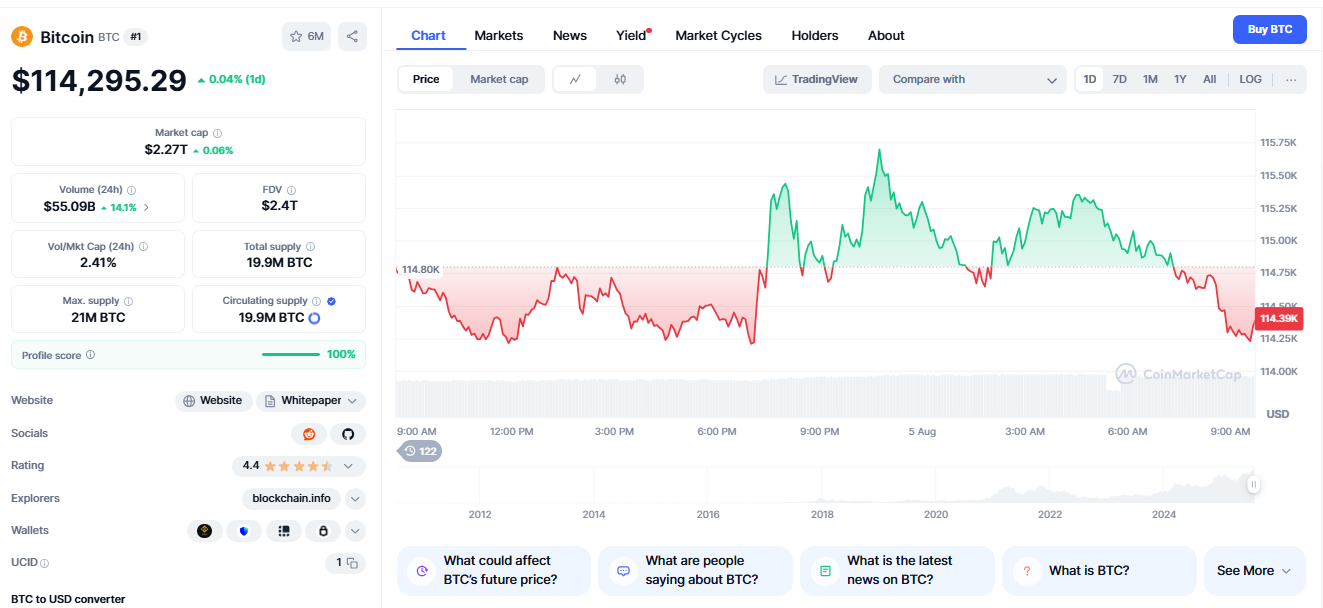

Previously , when Donald warned to impose 100% secondary tariffs on all countries that support Russia , that time Bitcoin showed a sudden decline in its price from $117,687 to a decrease of 2.97% in its price.

Currently , it is trading at $114,322 (at the time of writing) and shown a decline of 1.5% in its price. It clearly shows that any decision on tariffs will impact the crypto market too.

Source: CoinMarketCap

Tariff threats and pressure on Russia-Ukraine Peace Talks

Trump tariff India proposed 25% baseline tariffs and potential 100% secondary sanctions on countries trading with Russia; it could intensify global economic fragmentation.

Such measures might pressure the nation to negotiate long-term energy contracts that impact its balance of payments and trade deficit. Market investors warned that these tax could lead to supply shocks and further strain emerging economies interconnected with Russian trade networks.

With the global tensions rising and the dollar under question, IND might see value in building stronger crypto frameworks.

Conclusion

The growing geoeconomic tensions between the US and IND over Russian crude is not just a diplomatic issue but it also holds a significant downfall in the crypto market too.

Also read: Mamo Listing Confirmed on Coinbase Roadmap Amid Price Surge免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。