Good timing is better than everything, and luck is also a part of strength.

Author: Howe

This article is a supplement and expansion based on Sister Nan's “How are the financing and valuation of Web3 VCs derived?”.

Therefore, I recommend reading the previous article before looking at this one. I will try to express my views in simple and understandable terms.

1. Financing and Valuation Process

Here we need to further categorize VCs into three types: VCs with leading investment capabilities, VCs with leading investment capabilities but not leading, and VCs without leading investment capabilities.

In the financing and valuation process of a project, the power dynamics are as follows: VCs with leading investment capabilities >> VCs with leading investment capabilities but not leading ≈ VCs without leading investment capabilities.

Moreover, the earlier the financing round, the greater the power of the leading VC. Based on my observations of project financing phenomena, leading VCs generally only appear in the first two rounds of financing; beyond that, it is mostly strategic financing or ordinary rounds without leading investments.

So why is this the case?

The biggest problem an early-stage project faces in financing is — where can they find money? Most project teams have very narrow channels to pitch to investors; they either seek introductions from acquaintances, connect with VCs through financial advisors, or ask angel investors for help.

When a leading VC intervenes in early rounds, they generally not only provide investment but also act as a consultant. Internally, they assist in adjusting narratives, modifying decks, designing tokenomics, and formulating financing terms; externally, they connect with various VCs, introduce project collaborations, and endorse marketing activities.

It can be said that the level and status of the leading VC in the earliest round basically determine the project's ceiling. VCs with leading capabilities but not leading and those without leading capabilities typically only provide funding, although the former may occasionally offer some additional resource support. Therefore, project teams at this stage need to carefully choose their leading partners.

After categorizing VCs, we also need to divide projects into existing track projects and brand new track projects.

The valuation of existing track projects is relatively easier to determine, roughly based on the total market capitalization of the track the project is in, as a proportion of the entire market, and then benchmarking the market capitalization of the leading projects in that track. If the project has some additional bargaining power, the proportion can be increased.

The valuation of brand new track projects is generally more challenging. Typically, these projects are first engaged by the top leading VCs, who then conduct preliminary pricing of the track through a series of “standards/data/processes” before roughly determining the specific project's valuation.

Generally, early-stage projects that secure a position may have some valuation premium, as long as the track is not discredited, pricing a bit higher within a reasonable expectation can help expand market size (creating a bubble).

But frankly, I believe that no matter how much analysis is done, it is difficult to provide a reasonable valuation range for a track in the early stages; it is mostly a matter of taking one step at a time and gradually correcting.

At the same time, regarding the analysis of track valuation, why can only the top leading VCs do this? Can other VCs do it?

The answer is yes, but it’s not very useful. Because this kind of analysis requires sufficient quantity and accuracy of market information, and the top leading VCs have a significant advantage in this regard (comparable to top predators in an ecosystem).

Other VCs can also conduct this analysis, but without sufficient information sources, it is challenging to arrive at a reasonable and accurate result. Therefore, most of the time, they just listen to the “boss.”

2. How Project Teams Determine Their Project Valuation

This section aims to demystify the process; what you think of as project valuation is derived from individual calculations and research, but in reality, it is just a few cases in the vast sea of data. Most of the time, it is:

➣ Looking at the financing information of neighboring competitors and adjusting a bit up or down.

➣ Being deceived by early-stage VCs who want to gain more leverage, and the project team foolishly complies (a common pitfall for first-time entrepreneurs).

➣ Mysterious confidence, coincidentally hitting a corresponding market boom, leading the project team to become overconfident and raise prices arbitrarily.

➣ Completely following the leading VC’s guidance; whatever the financial backer says is what it is.

……

In many cases, project teams find it hard to make sense of their own accounts; the saying “the world is a huge makeshift stage” is still gaining relevance.

As the early domestic venture capitalist Zhuang Minghao said, most investments and valuations are “black boxes.” VCs do not have a mature methodology or investment logic before investing in a project. It can be said in hindsight, but it cannot be predicted beforehand.

I also highly recommend watching the video by @HanyangWang titled “Zhuang Minghao: Is there a methodology for VC investment? Decisions, regrets, taste, and stories from the chaotic early years of mobile internet”, which can provide you with more different perspectives on VC operations than what I wrote in my previous article “The Three-Part Evolution of VC: A Chronicle of Arbitrage”.

3. Is the Discussion of Financing and Valuation Significant?

Personally, I think it can be significant or insignificant, but it should not be completely trusted. Because I believe the process of financing and valuation is very well illustrated by Zhuang Minghao's metaphor.

VC investment, especially in the early stages, is very much like ancient rituals for rain. Looking back now, there is no scientific basis for such rituals, but why have similar ceremonies existed in the history of so many countries for so many years? Because humans seek to find something that can be established amid great uncertainty, to be repeated continuously. If it is realized, even partially, it will be maintained as a ritual; this ritual, to put it bluntly, is the fund's taste/preference/strategy.

This process involves a lot of timing, location, and human factors, with many uncertainties.

For example, when ancient people performed rain rituals, they might have coincidentally experienced sea winds bringing moisture to cool and condense into clouds and rain. Yet people mistakenly believed that the rituals were effective, placing their hopes in this uncertainty.

Let’s take an industry example: in 2021 and 2022, Opensea had a valuation of over $10 billion during a bull market with ample liquidity and a hot NFT track. Was this valuation a reasonable one derived by VCs through various methods? Did any VC think this valuation was too high at that time? In fact, most VCs were just afraid of not being able to invest; who cares if the valuation is reasonable or expensive (don’t think VCs won’t fomo).

Opensea Financing History

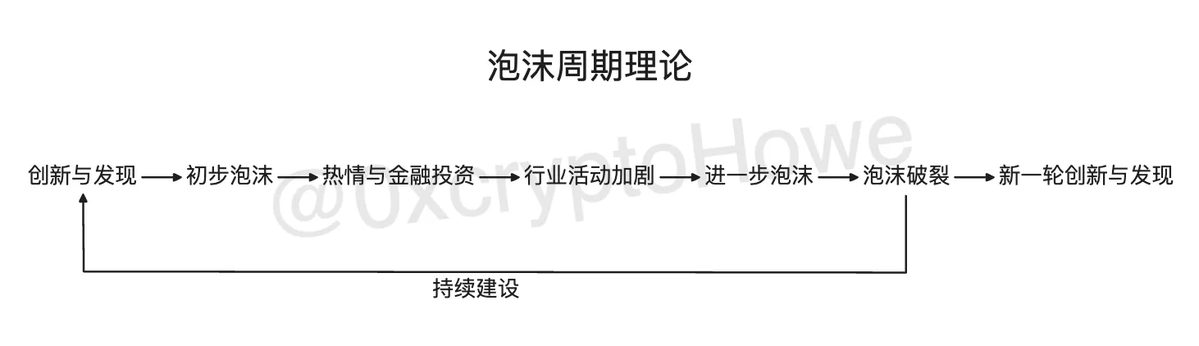

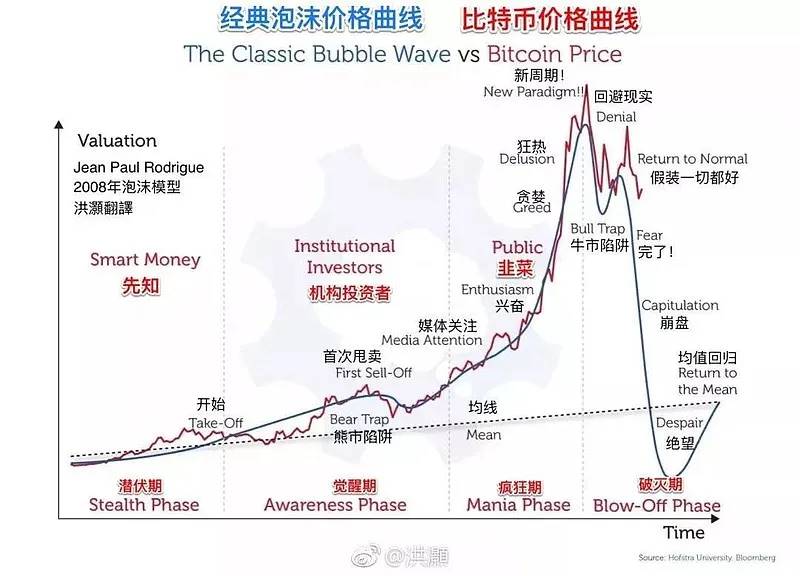

The so-called timing, location, and human factors essentially correspond to the theory of bubble cycles. Different periods of bubbles correspond to varying market liquidity and emotions, and these liquidity and emotions lead to certain deviations in financing and valuation, meaning fomo causes financing valuations to be higher than normal, while fud causes them to be lower.

Bubble Cycle Theory

Additionally, there is a very interesting phenomenon — some VCs or investors have investment logic in a certain track that, in hindsight, is very instructive, but did they ultimately make money relying on their logic? Not necessarily; most did not make much (a bit of self-criticism here).

So sometimes, having more theories is not as good as having good timing to intervene.

History always repeats itself. When you look back at the past two investment cycles, they generally follow the trend shown in the image below:

4. Some Supplementary Points Based on the Original Text

This section will present personal opinions on some subsections of Sister Nan's original text for reference only.

- The number of projects at different levels of “valuation/financing”

It is necessary to exclude special values from the existing data, such as the previously mentioned $10 billion valuation of Opensea; these special variables have a significant impact on the results and lack reference significance.

Essentially, these projects are subject to overvaluation or undervaluation due to the market environment driven by greed/panic, deviating from normal market sentiment. Therefore, either choose to exclude them or separately conduct statistics on them.

- The impact of financing rounds on the “valuation/financing” multiples

From what I have observed, the total number of financing rounds is generally 3-4 rounds or fewer. More rounds are not very meaningful for crypto projects; currently, only major infrastructure projects from the first two rounds and leading innovative tracks during bull market fomo exceed this number.

Moreover, projects emerging in the past two years generally do not exceed this number. If there are so many rounds of financing, it inevitably spans a bull and bear cycle; in such cases, unless the project continuously pivots to find VCs to take over and then pour into retail investors, I cannot think of any other possibilities.

- The impact of financing years on the “valuation/financing” multiples

This part essentially corresponds to the previously mentioned bubble cycle theory; the degree of fomo varies across different periods. You will also find that the current dividends and liquidity in crypto are in a declining state.

The ICO boom in 2017, the DeFi Summer in 2021, the inscription ecosystem in 2023, and the meme wave in 2024. Each macro wave carries less liquidity, and the market's ability to overflow liquidity is diminishing. The grand scene of flooding and reviving everything may be hard to see; at most, it will just be a few blossoms.

From the current perspective, I believe that the accumulation of crypto over the past decade or so represents a complete bubble cycle theory. With the introduction of various compliance policies in the past two years, we are about to enter a new cycle of innovation and discovery, and I look forward to seeing more opportunities emerge.

- The relationship dynamics among project teams, VCs, exchanges, and ordinary investors in different market environments

This dynamic has many possibilities; different roles have their own agendas, but they all share a common goal — to maximize their own interests. There are many ways to achieve this goal, and it is a very large ecological map that will change with the development of the industry.

If you can figure out this ecological map, I believe you will understand many things, such as who is making what money, and you will also know which path suits you and what money you can make. Unfortunately, I only know a few rare insights at this point.

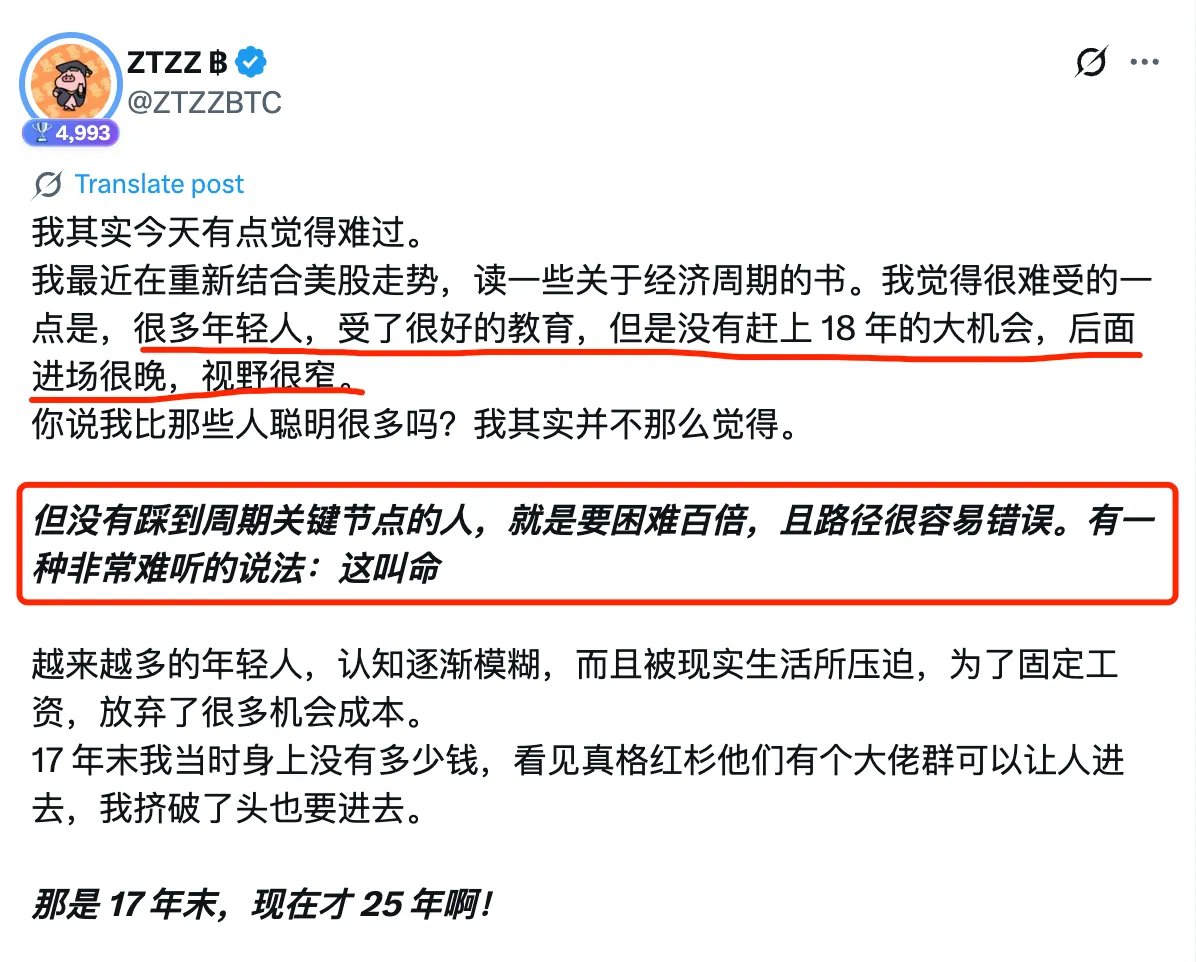

That said, after being in the circle for more than two years, I have found that when it comes to making money, good timing is better than everything, and luck is also a part of strength.

This point has actually been mentioned by Teacher ZZ as well; entering the right industry at the right time can make money feel like picking it up off the ground. However, often the awareness of such people is disproportionate to their asset scale. Just like the recent incident where “a user lost about 4 million yuan in assets due to purchasing a cold wallet on JD.com”, those who are unaware of the basic survival rules of the dark forest can still possess enormous wealth, which further confirms that choice is more important than effort.

https://x.com/ZTZZBTC/status/1948687136322191450

Finally, I wish everyone can seize their own opportunities. Slow is fast; many things are not as “grand” as they seem. Demystification is for better profit, so let’s encourage each other 🫡

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。