作者:陈璐瑶,易简财经

编辑:张恺翀,易简财经

私募大佬但斌最新美股持仓曝光了。

7月30日,根据东方港湾海外基金向美国证券交易委员会提交的文件,截至二季度末,该基金共持有13只美股标的,较一季度增加3只。

该基金持仓市值达11.26亿美元(约合人民币81亿元),较一季度末的8.68亿美元增长约30%。

前十大重仓股分别为英伟达、谷歌、3倍做多FANG+指数ETF、3倍做多纳指ETF、Meta、微软、亚马逊、苹果、特斯拉和奈飞。

来源:私募排排网

其中绝大多数标的在二季度上涨,如英伟达涨幅达45.77%,谷歌涨幅达13.54%,3倍做多纳指ETF涨幅达45.4%,仅有苹果表现疲软,拖累了收益。

一、减持标的达 7 只

从具体持仓变化来看,二季度,英伟达、3倍做多纳斯达克100ETF、Meta、微软、亚马逊、苹果、2倍做多英伟达ETF等标的遭到减持。

其中,虽然英伟达涨了不少,也仍位居该基金持仓第一,但持股从137.84万股减持至126.78万股,少了11万股。

英伟达是但斌近年来的“心头好”,但在近几个季度遭到不断减持。去年三季度末,东方港湾对英伟达的持股还有208.23万股,对比来看,减持约40%。

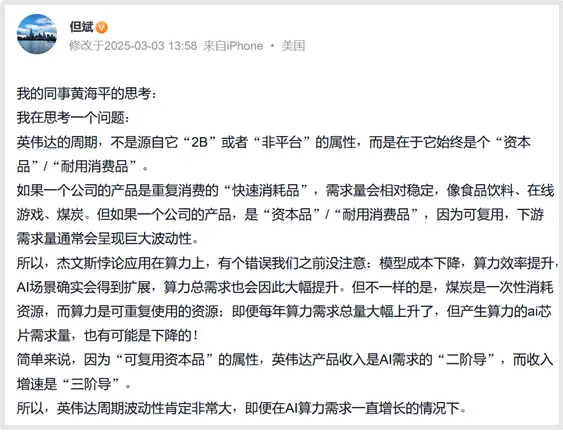

早在今年3月,但斌就分享了一段思考,核心意思就是:

即便未来算力需求大幅提升,但由于算力可以重复使用,所以产生算力的AI芯片需求量,也有可能是下降的,那么英伟达收入也有可能下降,从而导致股价大跌。

今天,但斌在雪球发布帖文称,“我对今年全球芯片巨头的目标价预判为180-200美元区间,目前第一目标价已近在咫尺。当然,相较于去年我所预测的未来超10万亿市值,当下仍有漫长的路要走……我们正身处一个伟大的时代,唯有全力以赴,方能不负时代馈赠。”

来到今天13点,据报道,国家互联网信息办公室约谈英伟达公司。这或将对其股价造成一定的负面影响。从这个角度来说,但斌“部分”地躲过了股价可能下跌的风险。

二、加仓谷歌、台积电

谷歌与台积电,成为为数不多加仓标的。

特别是谷歌,从上季度的第六位跃升到第二位,持仓从65.43万股提到92.16万股。

这一操作背后或是对AI商业化落地的精准押注。

谷歌母公司ALPHABET近日发布的2025年第二季度财报显示,公司营收达到964.28亿美元,同比增长14%;净利润为281.96亿美元,同比增长19%。

其CEO在财报中指出,AI正在对公司业务的各个方面产生积极影响,推动公司强劲发展。例如,搜索业务通过引入AI Overviews与AI Mode等新功能,实现了双位数的增长。

三、新进特斯拉、奈飞公司和 COINBASE

与此同时,但斌把前一季度清仓的特斯拉买了回来,并首次配置了奈飞和Coinbase。

但斌对马斯克的评价很高,认为“马斯克是理想主义者,对他是越来越敬佩,持仓特斯拉,就是对理想主义者的致敬。”

历史也不断证明,一个不好的公司,股价无论如何疯炒,最终都会跌落,而一家好公司,股价即使崩盘,最终都会回来。特斯拉属于后者。

自六月份特斯拉股东大会召开以来,特斯拉股价就开始一扫上半年阴霾,走出了一条漂亮的上扬曲线。

奈飞是美国视频流媒体服务的领头羊,市场消息显示,奈飞已开始使用初创企业Runway AI的人工智能视频生成软件。

而Coinbase是美国最大的数字货币交易平台,于2021年成功上市,是首个登陆美股市场的大型加密公司。业务范围包括法币加密资产兑换、托管服务、链上基础设施及开发者工具平台等。近年来在Web3生态中的地位逐步上升。

早在2021年,但斌就曾公开示好比特币,“已购买1%的比特币ETF基金,虽然有点晚,但想通了就践行!希望保持对新生事物的好奇心!”

今年以来,比特币不断创下历史新高。2025年二季度,Coinbase一跃成为但斌海外基金的核心持仓标的,释放出或将加密资产视为未来数字经济基础设施的战略级定位。

据了解,3倍做多FANG+指数ETN的基金管理人蒙特利尔银行已赎回发行的所有FNGU份额,该ETN于5月15日正式退市。

四、结语

在今年7月举行的2025金长江私募基金发展论坛上,但斌曾表示,投资要独立思考、不要盲从市场噪声。

“这两年我一直强调投资要找主因,不要被次要因素和噪声干扰,担心美国经济衰退、担心日元加息、巴菲特卖股票都是噪音。做投资一定要站在巨人肩膀上成长,不能刻舟求剑(如巴菲特减持科技股),而是学习其分析逻辑,他对商业模式、护城河的理解,而非简单模仿操作。”

但斌说,从过往数据来看,暴跌往往是最好的历史机遇,投资有时候不仅需要智慧,还需要坚强的意志力和克服困难的勇气。

但斌成功的核心原因是,坚定押注AI技术革命,他认为AI是堪比蒸汽机、互联网的划时代革命,周期长达10-30年。他忽略短期噪音(如加息、地缘冲突),将AI视为“主因”,80%仓位押注AI。

推荐阅读:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。