来源:Bankless

编译及整理:BitpushNews

以太坊如今已走过十个年头。在主网持续产出区块整整十年后,2025 年的链上数据显示其活跃度仍在爆发式增长!

尽管替代性公链和以太坊自身的 Layer2 网络确实分流了部分用户活动,但以太坊始终是加密经济跳动的核心——在开发者动能、抗审查能力以及众多关键链上指标方面,它依然引领着行业前进。

那么,这个智能合约鼻祖在十年发展后究竟呈现出怎样的面貌?以下 10 组核心数据告诉你以太坊历久弥坚的统治地位。

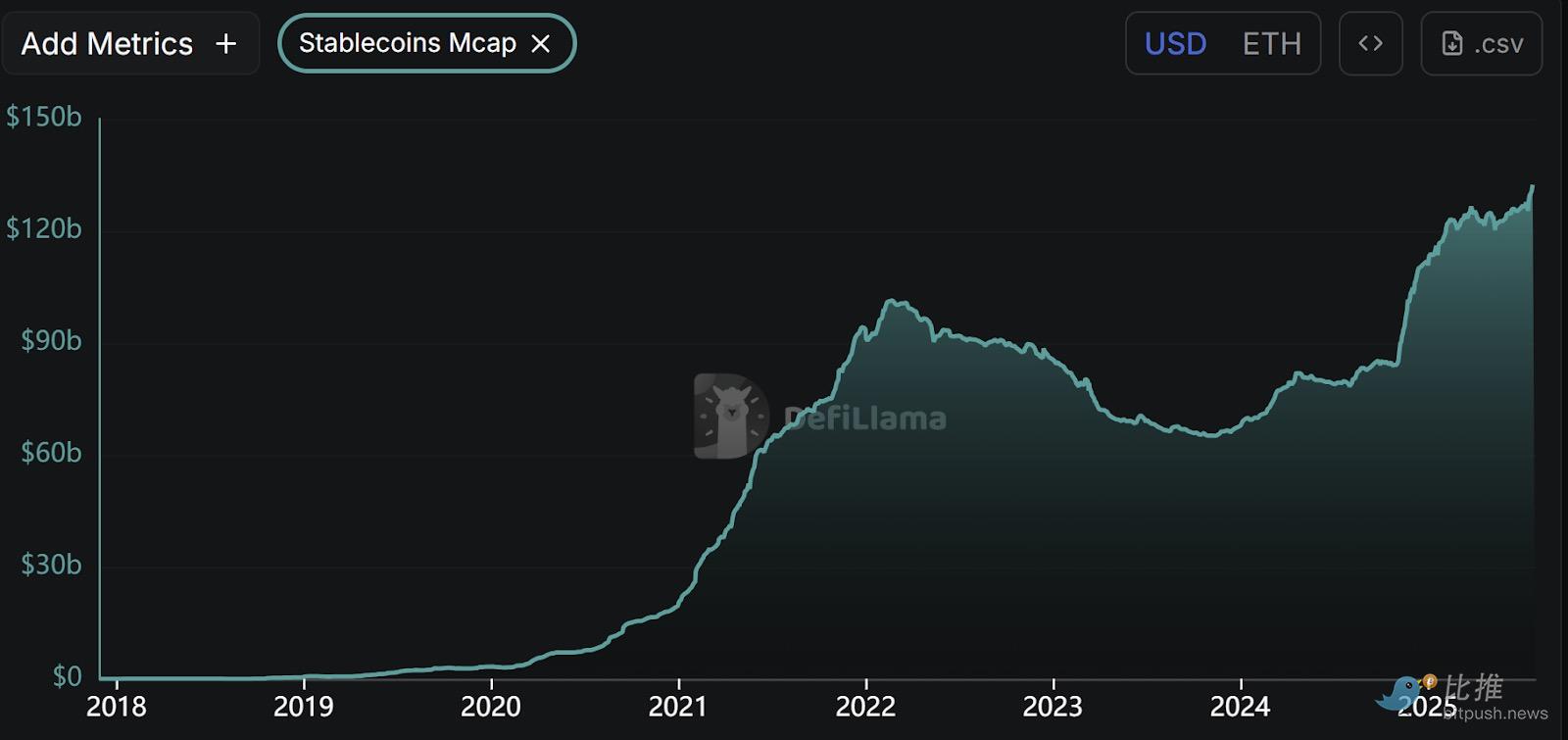

1. 稳定币供应量

Tether 在 2015 年与加密交易所 Bitfinex 共同开创了与美元挂钩的稳定币,自这些代币于 2017 年首次开始链上迁移以来,以太坊网络上的稳定币供应量一直以惊人的速度扩张。

除了在上次加密熊市最严重时期出现短暂下降外,以太坊网络上的链上稳定币供应量在历史上几乎一直保持「只升不降」的态势,于 2024 年末突破 1000 亿美元大关,并且在近几个月没有任何放缓的迹象。

目前,与美元挂钩的代币发行商已达数十家,其中包括 PayPal 和摩根大通等传统金融巨头。同时,美国近期通过的《GENIUS 法案》正在为机构采用扫清道路,该领域作为日常支付的替代媒介,也正受到主流观察者的关注。

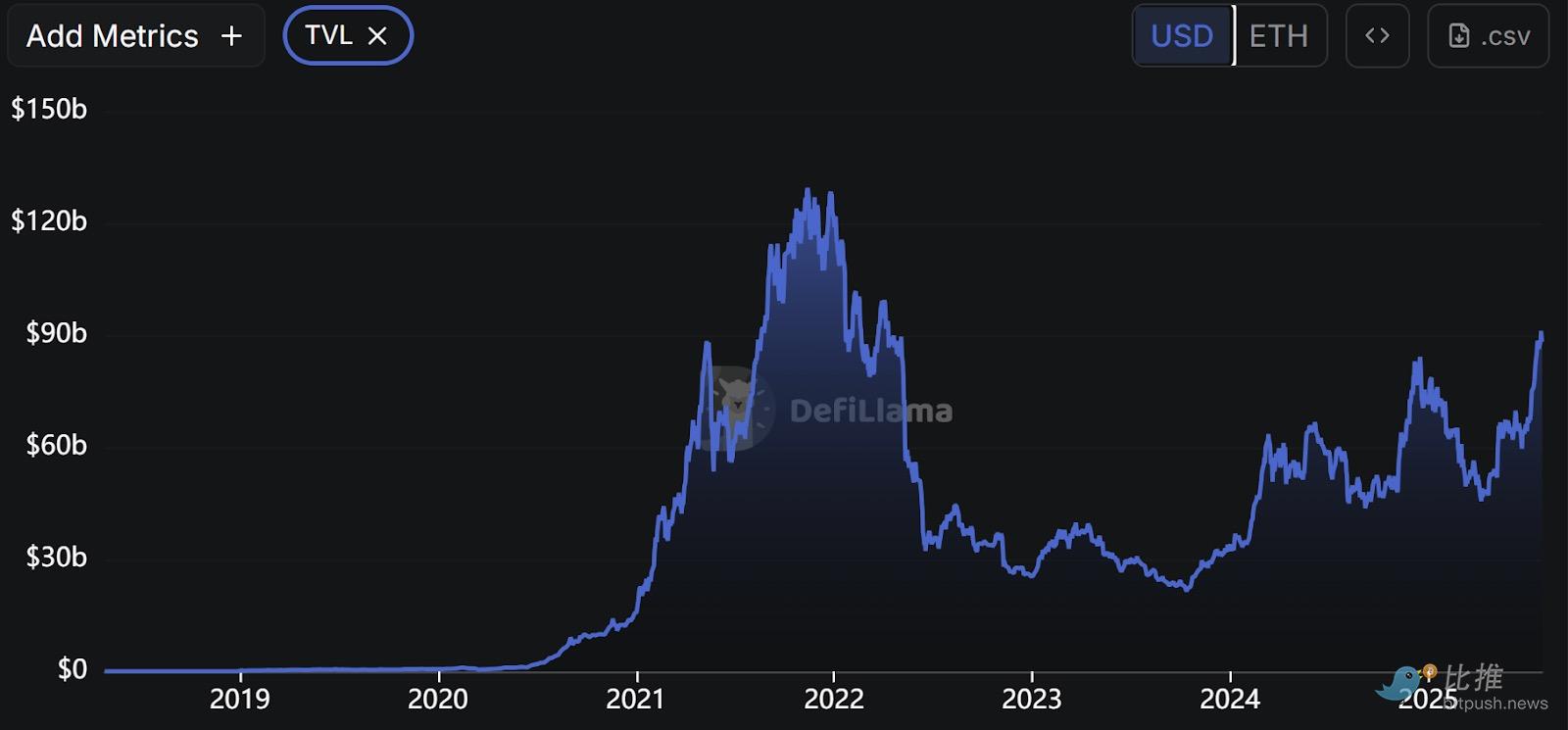

2. 总锁定价值(TVL)

以太坊是最初的智能合约平台,尽管多条 L1 竞争链及其集成的 L2 网络分流了以太坊自身的锁定价值,但该链在总锁定价值(TVL)方面仍位居领先区块链之列。

存储在链上智能合约及其相关应用中的 TVL,是每个加密网络的命脉:它代表了用户信任并存入链上金融系统的价值量。

尽管上一次熊市中,随着加密货币价格暴跌,用户从应用中撤出或迁移到竞争链,以太坊的 TVL 遭受重创,但自今年 4 月以来,这一数据一直在爆炸式增长,已创下超过 880 亿美元的新周期高点,并正积极追逐新的历史最高纪录。

来源:DeFiLlama

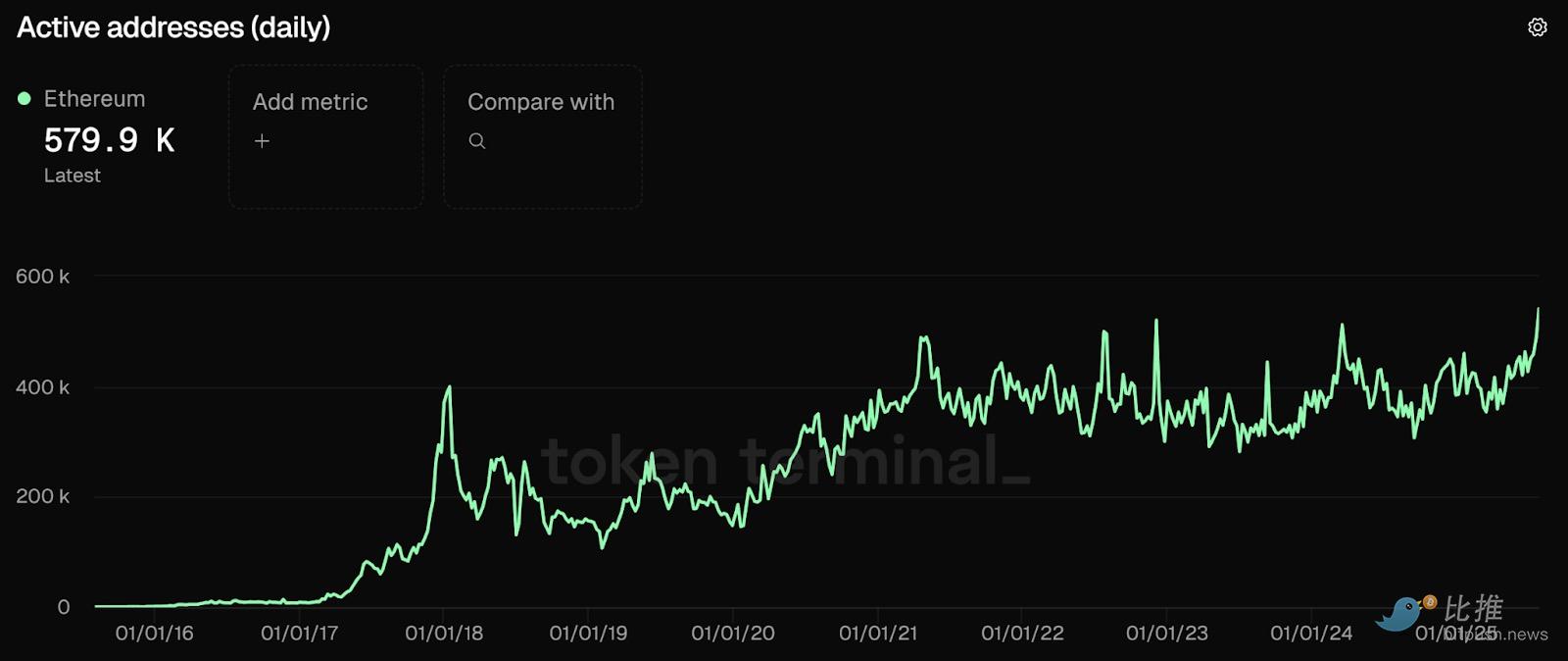

3. 活跃用户数

即使休闲的以太坊生态系统用户活动已迁移到 L2,也未能减缓以太坊日常活跃用户数的增长,该数据最近创下了 58 万个独立地址的历史新高。

在过去的熊市中,日活跃地址数保持稳定,并且在整个 2025 年持续攀升,越来越多的用户转向以太坊 L1,以获取世界领先的链上金融生态系统提供的独特属性。

如果将以太坊 L2s 上的活跃地址计算在内,这种增长则更为惊人;仅 Coinbase 的 Base L2 每天就有 130 万活跃地址。同时,Arbitrum、Celo、Ink 和 World Chain 等领先 L2s 又增加了 120 万个地址。

来源:Token Terminal

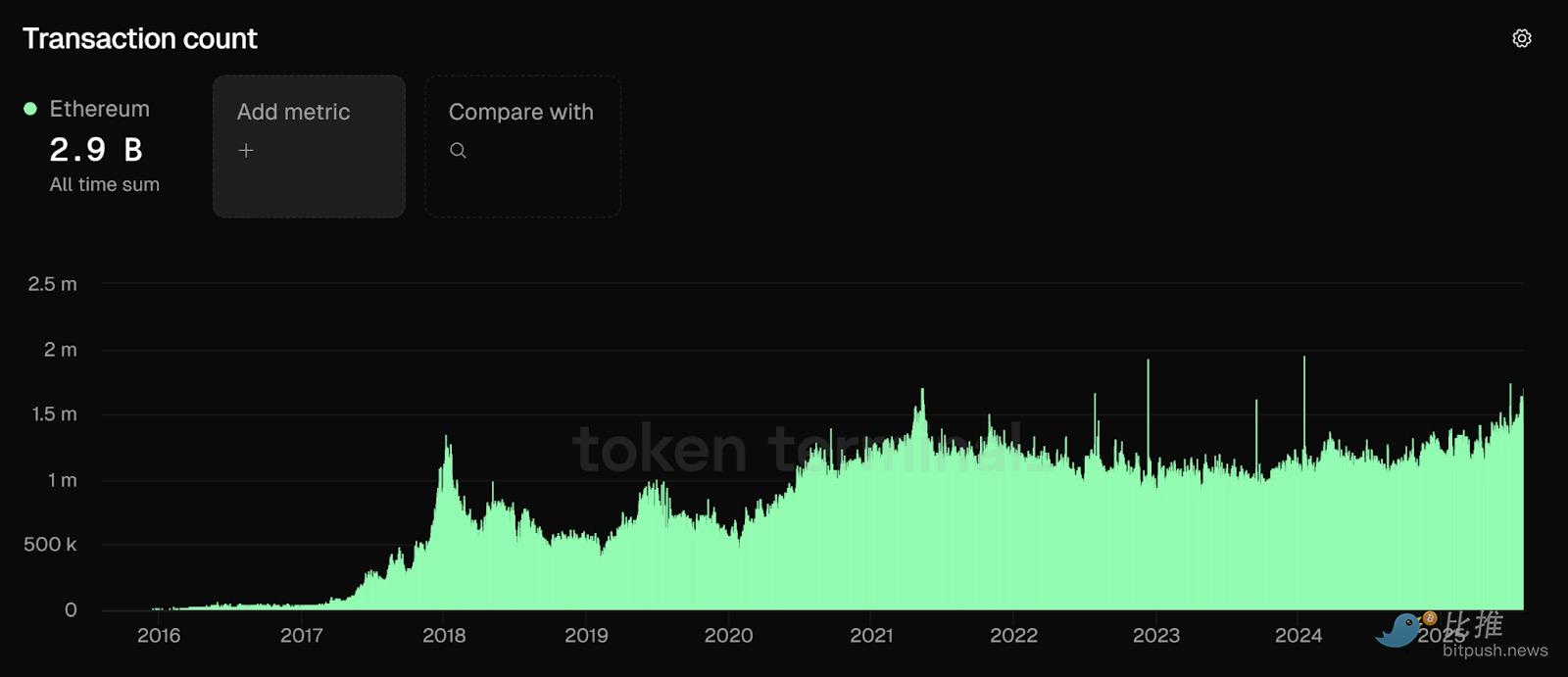

4. 日交易量

随着以太坊 L1 上活跃用户数的增加,交易数量也随之增长。自 2023 年 10 月以来,日交易量持续稳步上升,撰写本文时,日交易量地板价保持在 170 万笔以上。

尽管此指标在投机活动剧烈时期会急剧飙升,但以太坊的日交易量在历史上基本呈「只增不减」态势,自网络创世以来累计已完成 29 亿笔交易。

当算上以太坊的众多 L2s 时,此统计数据也显得越来越乐观。包括领先 L2s 在内,以太坊生态系统的每日活动量远超 5 亿笔交易。

来源:Token Terminal

5. 机构采用

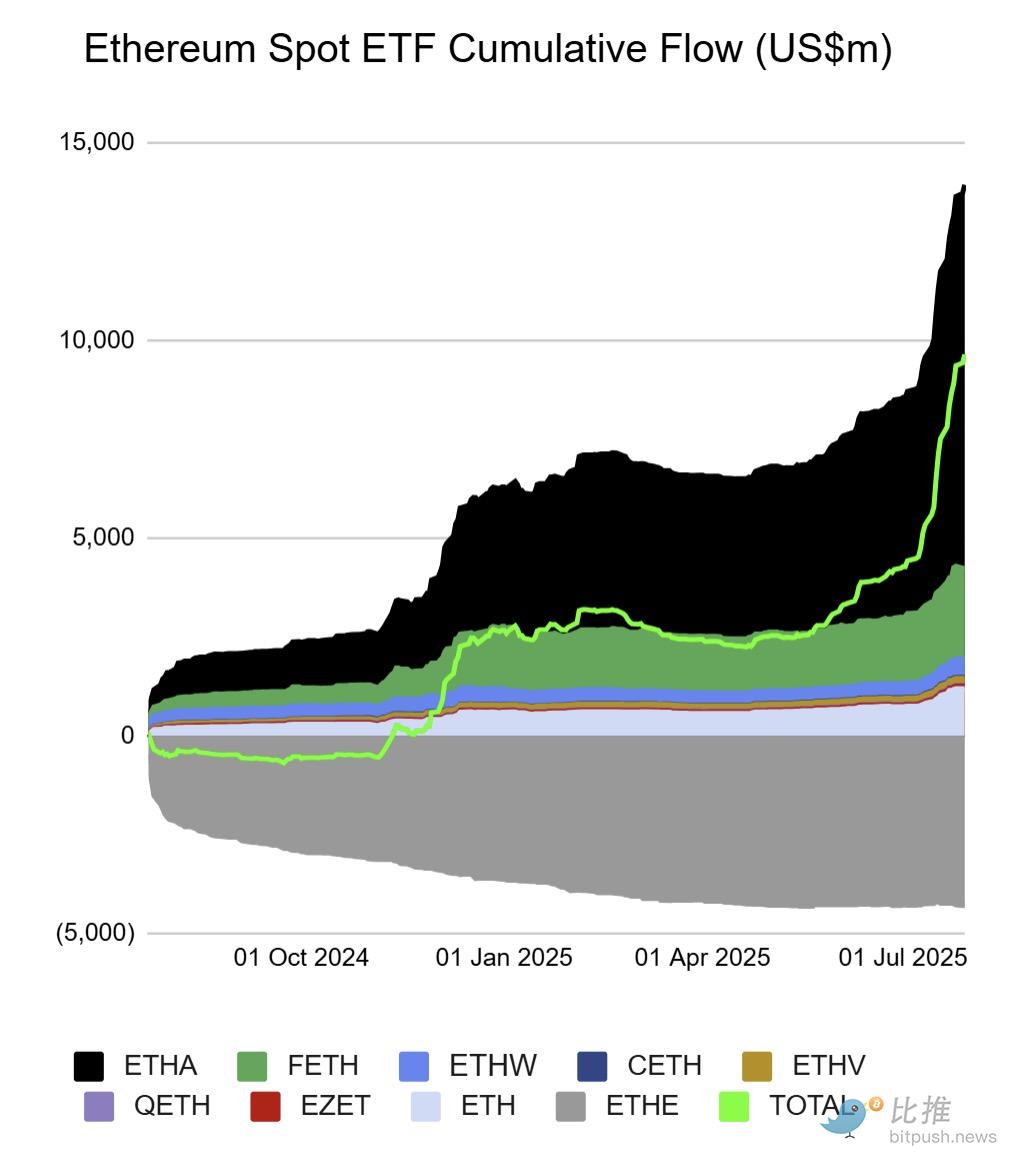

以太坊长期以来一直是链上爱好者推崇的区块链,而在 2025 年,这个加密网络打破了其小众定位,成为机构玩家青睐的知名智能合约平台。

唐纳德·特朗普总统在 2024 年选择以太坊网络作为其「世界自由金融项目」的归属地,早早地加入了这一趋势。银行业巨头摩根大通于今年 6 月在 Base 链上部署了存款代币,以太坊 L1 已确立自身作为现实世界资产(RWA)主导平台的地位,控制着近 70 亿美元的价值,并占据该领域 54% 的市场份额。

近几个月来,以太坊财库公司——包括由 Consensys 的 Joe Lubin 和华尔街的 Tom Lee 领导的公司——以巨大的价格超额表现抢走了比特币竞争对手的风头。同样,以太坊 ETF 的流入量在过去几周也急剧膨胀,每天吸引数亿美元资金,预示着以太坊热潮正席卷散户市场。

来源:Farside

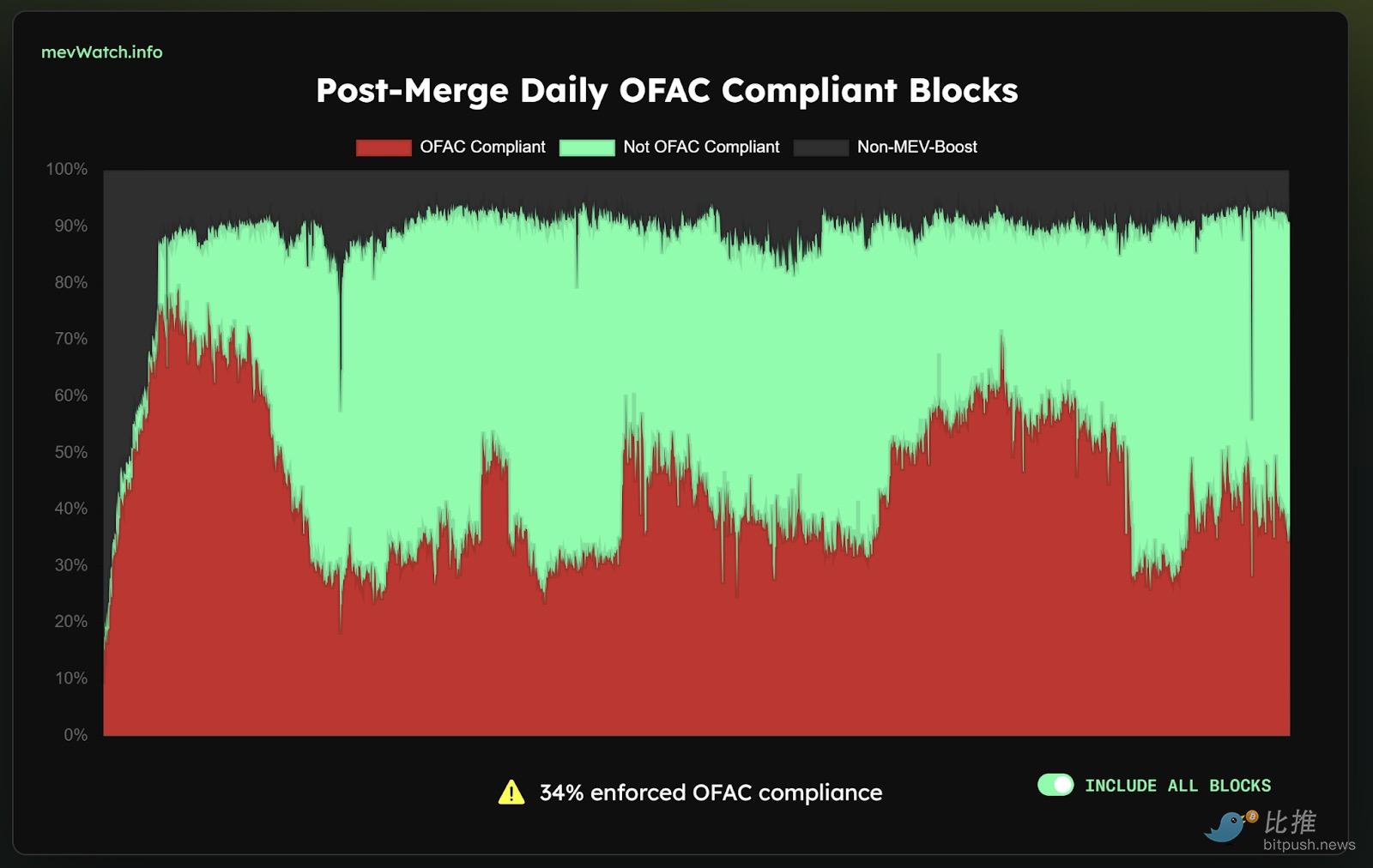

6. 抗审查性

以太坊 L1 以其抗审查能力而自豪,通过允许任何人广播交易而无需担心其操作能力会受到单一行为者或民族国家的损害,从而提供了一个开放的金融系统。

与经常回滚链以防止资金落入不良行为者手中的其他加密网络不同,以太坊的文化以其对代码的盲目信任而独树一帜,确保所有交易都是最终的,无论后果如何。

这些价值观延伸到区块构建方面,大多数区块构建者选择处理所有交易,无论地址或智能合约是否已被民族国家行为者标记为恶意。

自唐纳德·特朗普总统就职以来,2025 年对美国外国资产控制办公室(OFAC)制裁名单的遵守度显著下降,并且主要的区块构建者已承诺处理所有交易,无论其来源如何。

此外,领先的以太坊开发者仍然致力于采用「包含列表」(inclusion lists),这将迫使所有验证者和区块构建者仅根据费用来包含交易。

来源:MEV Watch

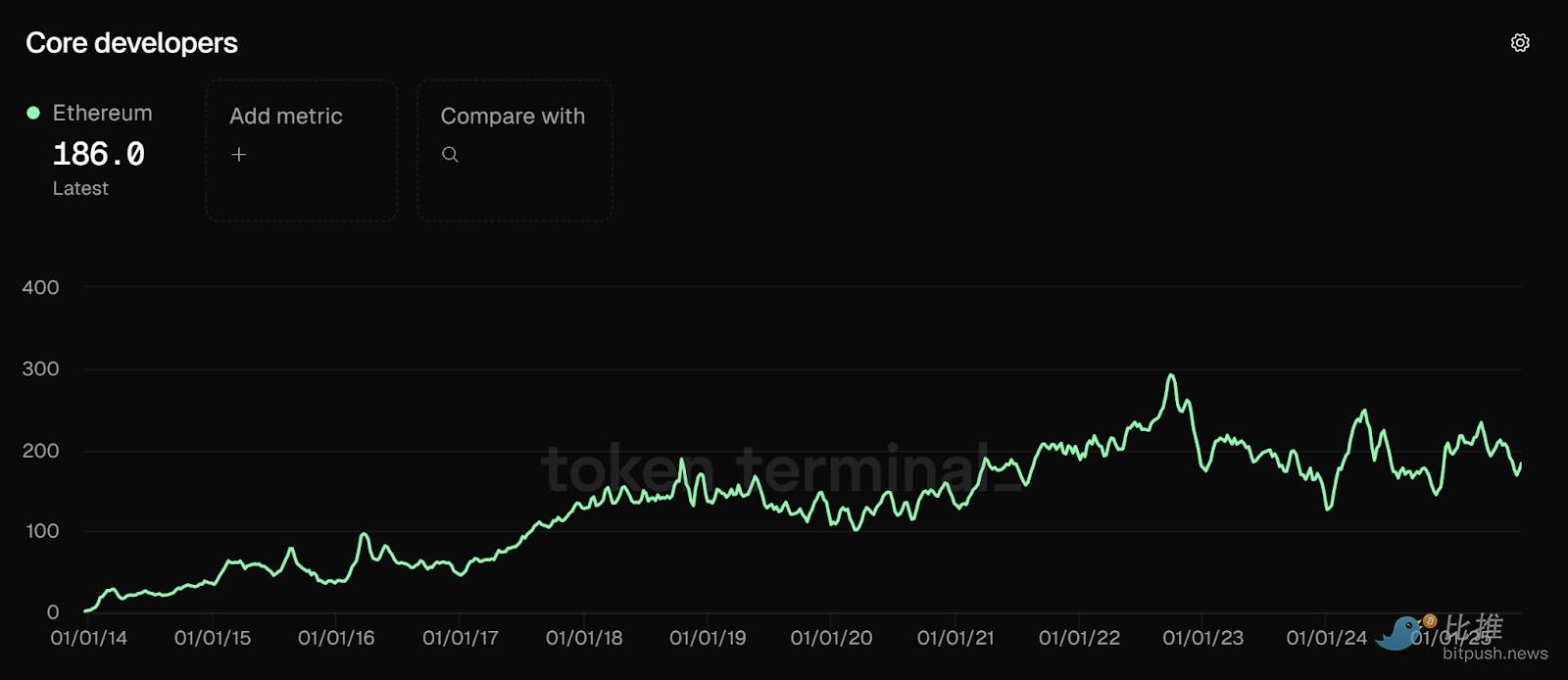

7. 活跃开发者

以太坊核心开发者社区的状态——过去 30 天内至少向其公共代码库提交过一次代码的不同 GitHub 用户数量——仍然强劲!

尽管活跃开发者数量低于上次牛市周期的峰值,但以太坊核心活跃开发者的数量(拥有 186 名独立贡献者)仍超过了所有其他加密项目。

以太坊的 EVM(以太坊虚拟机)已成为基于区块链开发的默认标准,其应用程序在主流链上享有广泛兼容性。

来源:Token Terminal

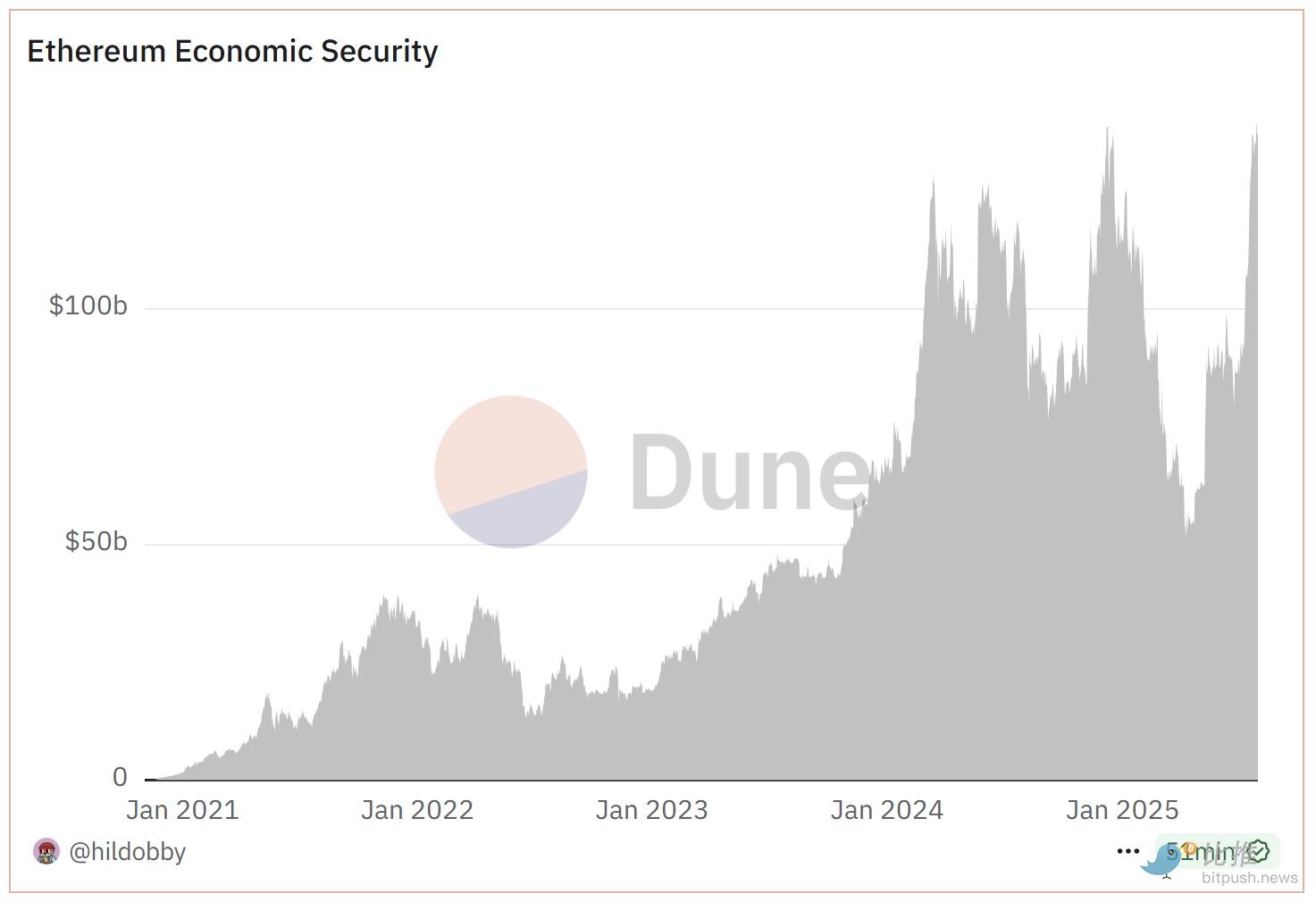

8. 经济安全性

除了极短暂的几次中断(其中最长的一次发生在 2024 年 11 月至 2025 年 2 月),自 2020 年 11 月「信标链」质押首次启用以来,质押的 ETH 数量一直在稳步增加。

结合 ETH 爆炸性的价格走势,ETH 质押的持续上升趋势使得以太坊的「经济安全性」——即验证者为保护网络而质押的 ETH 价值——达到了 1400 亿美元的历史新高。

随着以太坊经济安全性的增长,各类用户可以更加放心地进行交易,因为他们知道自己的资产越来越受到保护,免受可能操纵区块链账本的恶意行为者的侵害。

来源:Dune Analytics

9. 合约部署量

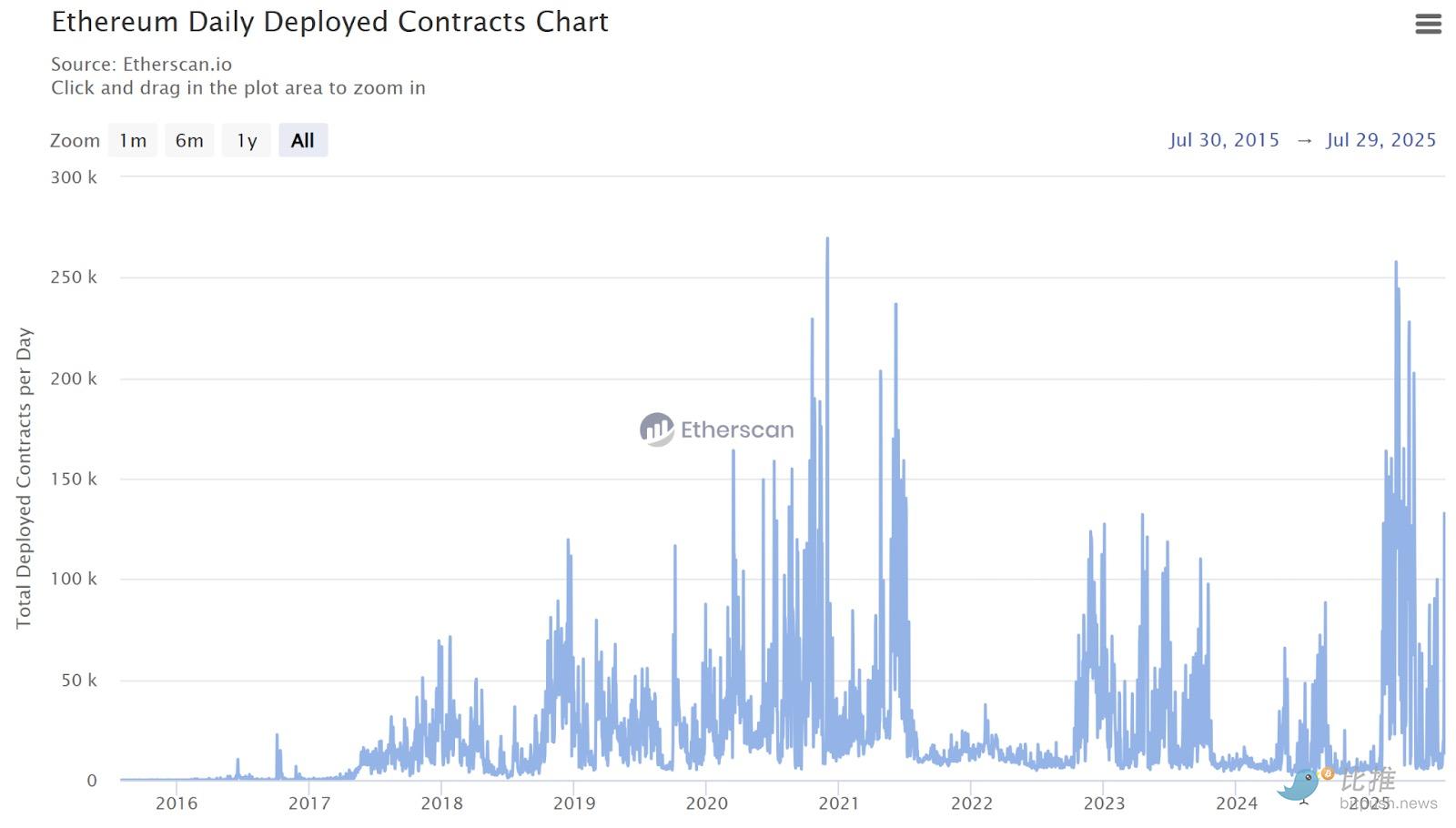

区块链的存在是为了服务用户交易,而合约部署量则提供了对链上活动不断演变范围的洞察。

这些合约可以从简单的代币部署到复杂的应用程序,但每个新合约都代表着用户潜在的新行为或用例。通过这种方式,合约部署可以作为链上创新和实用性增长的信号。

虽然以太坊合约部署量在 2024 年末和 2025 年初有所放缓,但近几个月来却出现了猛烈的发展热潮,今年多次出现每日新合约部署量突破 20 万个。尽管开发者已转向 L2s,但以太坊 L1 仍然是一个充满活力的活动中心。

来源:Etherscan

10. ETH 价格

可以说是任何加密项目最受关注的成功指标就是其原生代币的价格。尽管以太坊曾多年来在与其他替代加密货币的竞争中表现挣扎,但自 2025 年 5 月以来,该代币强劲反弹,兑比特币升值 75%。

以太坊已成为近几个月表现最佳的加密资产之一,随着加密原住民和机构投资者对 ETH 的热情高涨,其行业主导地位几乎翻了一番。

尽管以太坊距离创下历史新高还有 10% 的差距,但根据最近的价格表现,这一目标可能在几天内实现。如果从对数图表上看,突破这一水平可能使其离 1 万美元仅一步之遥……

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。