原文 |Keisan.hl

编者 | Odaily 星球日报

译者 | 叮当

编者按:在加密市场充满泡沫与叙事的今天,Hyperliquid(HYPE)为何能在短时间内跻身百亿市值俱乐部?是阶段性热度的结果,还是源于其自身产品与机制的长期价值?本文作者 Keisan.hl 从代币经济模型出发,结合对传统金融与加密头部项目的横向对比出发,系统梳理了 Hyperliquid 当前的市场表现与潜在逻辑,构建出一套相对完整的估值框架。

距离我第一次发布关于 HYPE 的估值框架已经过去大约六个月。这段时间内,许多事情发生了变化,但也有很多事情保持不变。我对 HYPE 的看好程度一如既往。

让我们来看看一些数据。

收入估算(Underwriting Revenue)

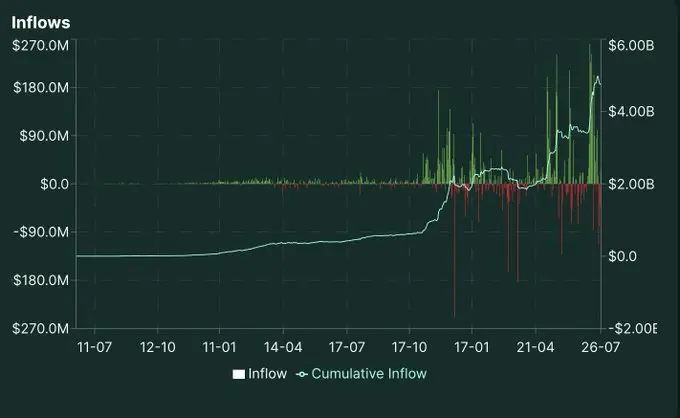

评估 HYPE 最大的挑战之一,是如何为年化收入(即现金流)做出一个让人安心的估值。Hyperliquid 是一家早期创业公司,增长极快。因此,你可能会考虑将增长纳入你的数字中。但它也处于一个周期性行业,熊市交易量可能比牛市低约 50%。我个人的观点是,Hyperliquid 的快速用户增长、资金流入和其他利好催化剂,将足以抵消熊市带来的交易量下降。从过去六个月的增长来看,平均每日收入已经大幅上升,验证了这一点。

至于熊市期间交易量的变化,我认为即使未来短期内比特币进入熊市,交易量的下降也不会像以前那样剧烈,因为有 ETF 的资金持续流入,加上当前美国政策对加密货币的态度更加友好。当然,这仍然是一个需要考虑的因素,收入可能会在几年内减少约 50%,因此我们将保守地使用最近的牛市平均交易量作为我们的前进基准(300 万美元),即不考虑增长。

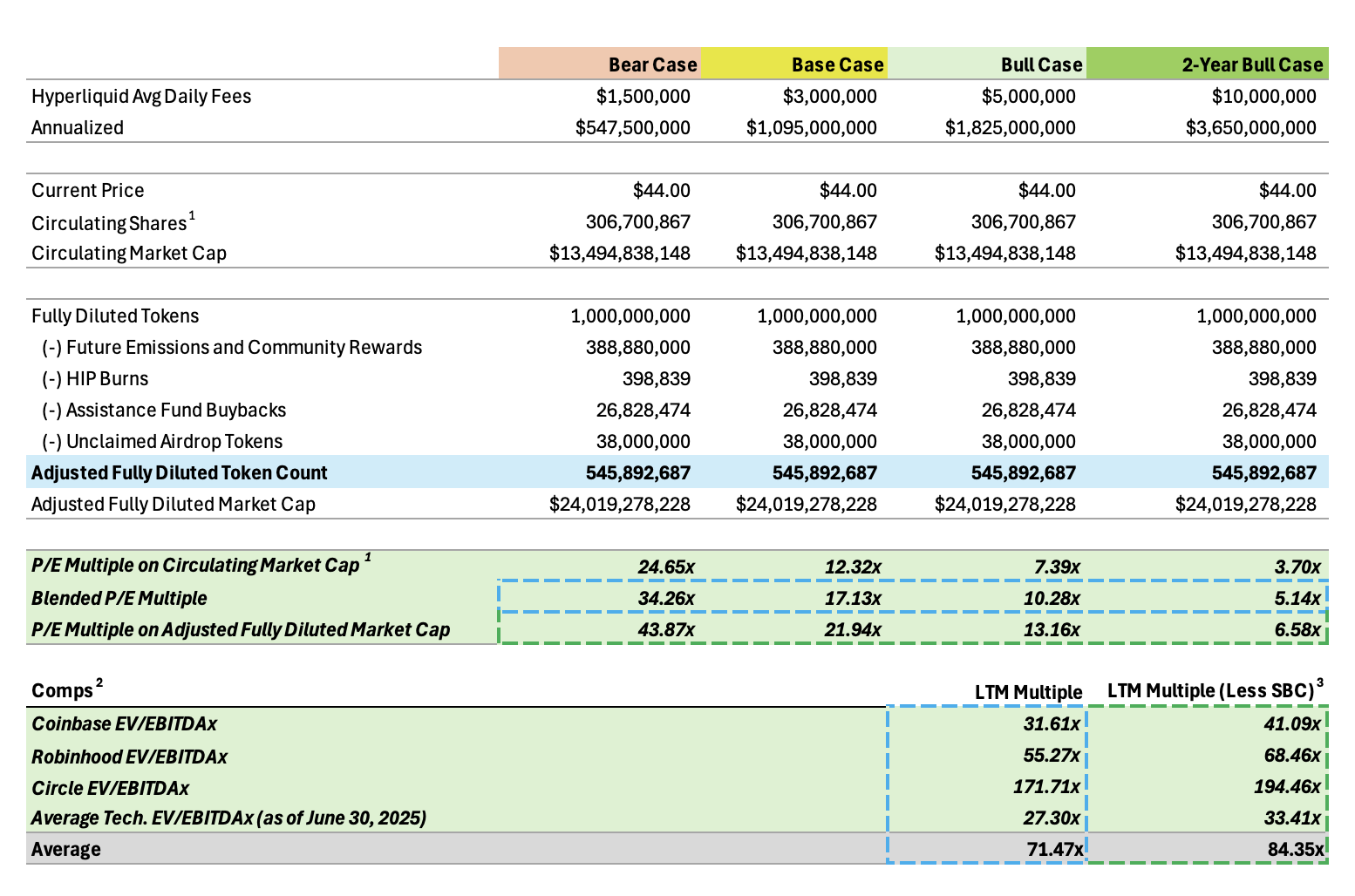

Odaily 注:本文作者在一月份曾发布过一份估值框架,我们在编译时仍采用原来的估值方法解释该图表数据。

一个估值倍数由两个核心要素构成:价格(估值)和收益(收入/手续费)。

首先,我将手续费数据按不同时间段进行了拆分分析。

然后,我从两个维度来考察代币的总量:流通量和调整后的完全稀释供应量。

- 流通量很好理解,就是当前市场上实际流通的代币数量,大致等于空投发放的数量,减去通过 HIP(治理提案)销毁的部分和援助基金的回购。

- 完全稀释供应量这一概念则常常让人困惑,很多人误以为它就是评估项目估值时必须采用的参考数值。实际上,HYPE 的完全稀释供应量是固定的(没有通胀),其中 38.888%被预留用于未来的代币释放和社区奖励。此外,还有 3%用于社区资助计划,1.2%已被基金回购,0.1%已通过 HIP 交易费销毁。

在我的计算中,我已经剔除了回购和销毁部分,也剔除了未来释放/社区资助这类尚未发放的代币。我的假设是,这部分 38.888%的代币中很大一部分将以质押奖励的形式,在很长时间内逐步释放。而社区资助的部分,我认为属于正期望值(+EV)投入,是为了加强社区和生态系统而进行的正向支出。

剩下的未流通代币中,有 23.8%预留给团队及未来成员,6.0%预留给基金会。我在调整后的供应量中将这两个部分全额计入,但实际上这个假设是偏保守的,因为团队短期内几乎不可能出售或分发这些代币。这些代币的释放节奏非常缓慢,因此在估值中应该给予高折扣处理。需要再次强调的是,这个团队并不需要套现或实现流动性事件。

就我个人而言,我认为最合理的估值基础代币数量应当介于流通量与调整后完全稀释供应量之间。

基于 7 天数据计算出的市盈率(P/E)如下:

- 按流通量计算的市盈率约为 12.3 倍

- 按调整后的完全稀释供应量计算的市盈率约为 21.9 倍

我认为最合理的估值基准应介于这两者之间。我们可以称之为混合市盈率(Blended P/E Multiple),约为 17.1 倍。

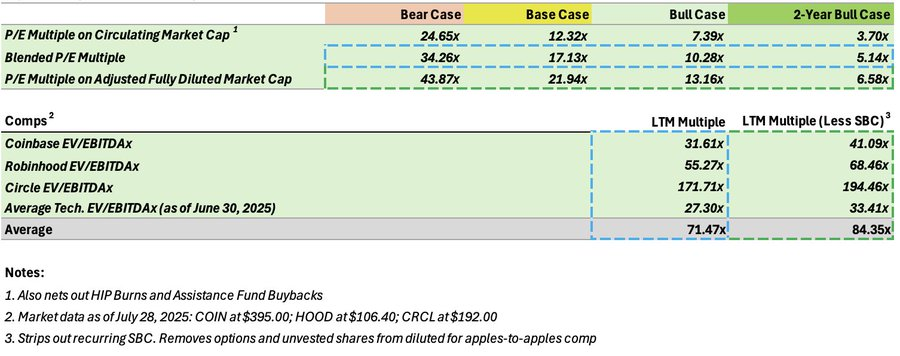

上市公司比较(Comps)

我们进入估值最有趣的部分:与上市公司进行对比。HYPE 当前的价格非常便宜。

如果你一直关注我,应该听过我多次说“没人知道该怎么给 HYPE 估值”。确实,很多人都没有搞清楚其中逻辑,尤其是团队代币如何计入完全稀释总供应量(FDV),以及这种方式与传统上市公司应该如何对齐的问题。

上市公司通常会发放一种叫“股权激励”(SBC, Stock-Based Compensation)的股票奖励,主要给高管团队和核心员工。许多分析师倾向于把这些看作一次性费用,不纳入公司运营支出。但我不这样看。在我看来,把每年重复出现、金额高达数亿美元的支出当作一次性费用,是极不合理的。

我可以确认,Coinbase(COIN)、Robinhood(HOOD)、Circle (CRCL)的 SBC 占它们调整后 EBITDA 的比例大约是 25%,并且这个比例持续多年。这些并非一次性发行,而是真实的、持续的股权支出。它们通过增发股票直接进入高管口袋,同时也稀释了现有股东的权益。这是实打实的成本。

因此,如果我们要将这些支出纳入估值,就必须将已经计入股本的股票期权剔除出去,因为它们在未来几年会逐步解锁。我在“LTM 倍数(扣除 SBC)”那一栏中做了相应的调整,将“待发行”的 SBC 股票剔除,并把 SBC 金额重新计入支出(这些公司在报告 EBITDA 时往往将这部分排除)。

为什么这点很关键?因为很多人评估 HYPE 的时候,把团队持有的全部代币 100% 计入 FDV,但却忽略了上市公司实际上拥有“无限 FDV”,它们每年都可以不断向高管发放 SBC。

所以,如何实现一个公平、可比的估值方法?我的方法如下:

- 如果你想用实际股东收到的净现金流来对比,那就用“LTM 倍数(扣除 SBC)”来比较上市公司估值,同时将 Hyperliquid 的团队代币 100% 计入总供应量。

- 如果你想采用上市公司惯用的“调整后 EBITDA(息税折旧摊销前利润)”报告口径(即不考虑 SBC 的持续性),那么就使用“混合供应量倍数”:流通中的代币(不含团队代币)+ 按 50% 比例计入的团队代币。这相当于假设团队已经拿到其中一半,剩下那一半会在未来几年陆续释放,就像 SBC 一样。

值得一提的是,SBC 是无限发行的,而团队代币是总量有限的。你可以看到,无论用哪种方式估值,HYPE 都显得极具吸引力。

最后说说盈利能力。Coinbase、Robinhood 和 Circle 的自由现金流利润率显著低于 Hyperliquid。这意味着它们在收入下降时,EBITDA 会大幅缩水,而支出仍然庞大。而 Hyperliquid 的自由现金流更“干净”、更可持续,具有更强的防御能力。

再补充一个数据:Coinbase 有 4300 名员工,Robinhood 有 2500 人,而 Hyperliquid 核心团队仅有 12 人。

HYPE 的牛市预期

说到牛市预期,我认为大部分人都严重低估了 HYPE 的潜力。他们仅根据当前收入进行估值,并简单地将牛市溢价打折处理。

但他们是否考虑过,这个市场的 TAM(总可寻址市场)到底有多大?

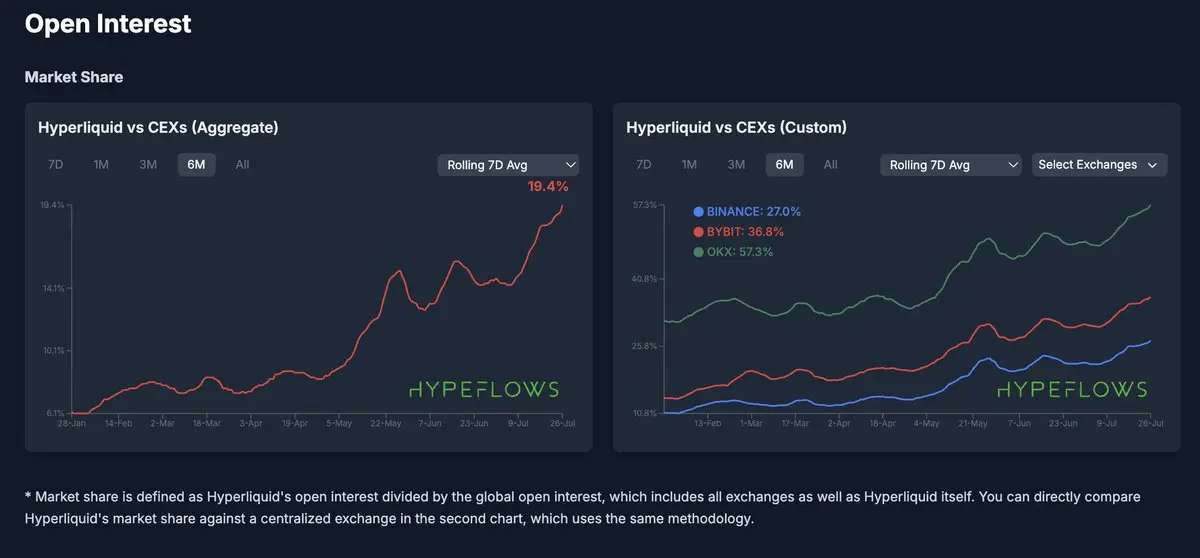

永续合约(perpetuals)是仅次于稳定币的加密领域最大市场之一。目前,Hyperliquid 大约占永续合约市场的 10%。而在现货 CLOB(集中限价订单簿) 市场中占比还更低。

更重要的是,HyperEVM 刚刚起步。而 HIP-3 和未来将推出的各种新型永续合约,将使 Hyperliquid 从“加密永续合约平台”扩展成“全球一切资产的永续交易平台”。我最期待的几个方向包括股票、IPO 前的私募企业、预测市场、外汇、商品等。

永续合约是地球上最优秀的金融产品,而 Hyperliquid 则是“永续合约界的 AWS”,具有极强的扩展性,完全去中心化且透明。

传统金融界和其他非加密圈层还没有真正理解永续合约的威力。但这个产品一旦被发现,其潜力将是巨大的。

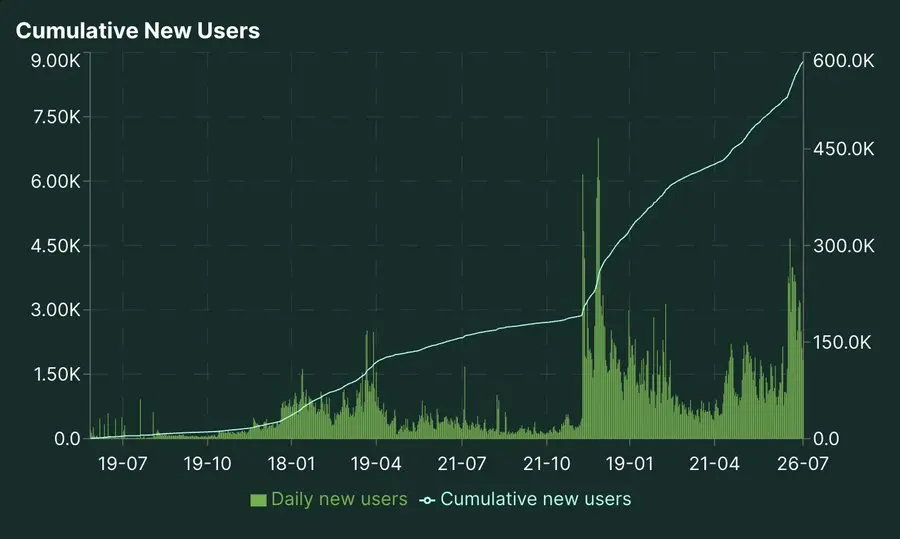

回到数字层面。六个月前,我第一次写估值框架时,Hyperliquid 每天大约产生 100 万美元收入(那时是因为 TRUMP 推出后,交易量短期激增)。现在,这个数字已经稳定在每天 250–300 万美元之间,增长超过两倍。用户和资金流入也同步增长。

目前,Hyperliquid 占所有 CEX 交易量的约 5%。想象一下,如果这个数字未来几年达到 25%,意味着每日收入可能提升至 1500 万美元。以此推算,HYPE 的自由现金流估值倍数将下降至 5 倍。

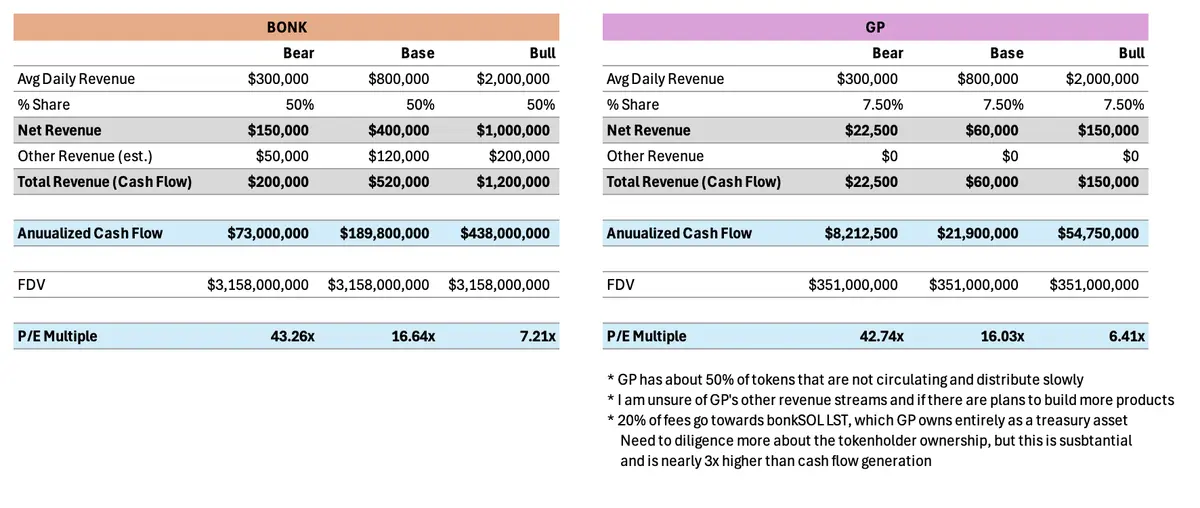

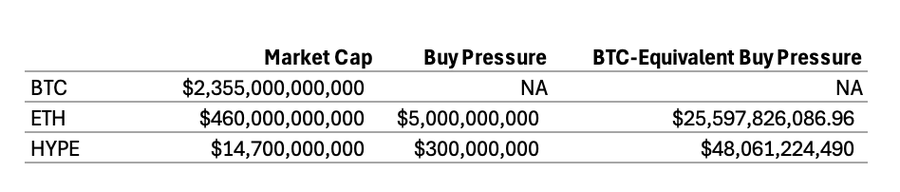

与其他加密代币的对比

将 HYPE 与其他代币进行对比其实不太公平,因为没有多少真正可比的项目。

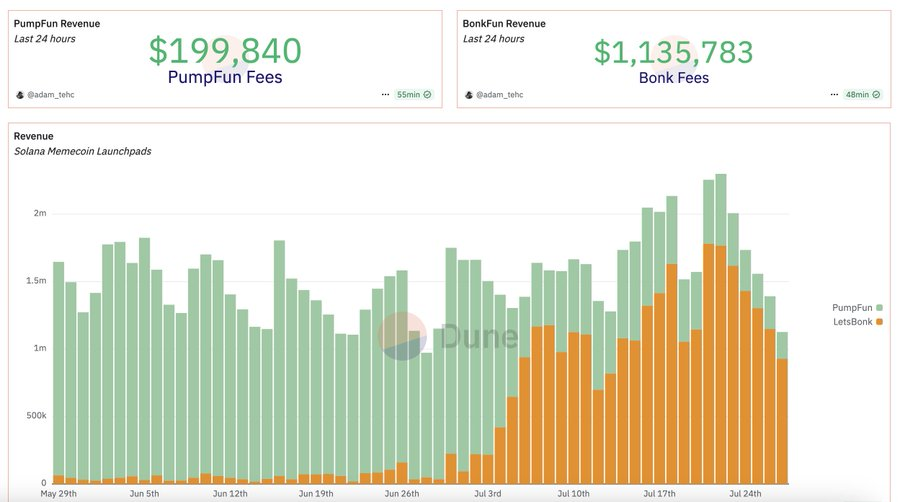

目前唯一可参考的,是几个具备强大产品市场契合度(PMF)并能稳定产生现金流的 memecoin 启动平台,比如 BONK、GP、PUMP。

我持有 BONK 和 GP 的仓位,并认为它们是目前除 HYPE 外最被低估的项目之一。

PUMP 我曾做过长线投资,但现在已经减仓。我认为他们已经在竞争中出局,这也是情理之中的。它们的模式缺乏护城河,极易被其他平台颠覆。而 BONK 的非剥削型模式正在获得胜利,这点从各项链上数据中都能看出。

传统金融的关注

传统金融正在进入加密领域。自从 ETF 推出以来,比特币和以太坊吸引了 500 到 1000 亿美元的资金流入,创下 ETF 历史纪录。

那么,传统金融最有可能青睐什么资产?当然是一个能产生可观现金流、有可持续护城河、并且模式防御性强的代币。

一位彭博分析师曾问:“Hyperliquid 背后到底是什么?”这个问题虽然有些嘲讽,但它正是传统金融多年来对加密提出的核心疑问。

而现在,我们终于有了答案,而且是一个全场满贯的答案。

HYPE 在传统金融圈尚未被广泛发现,仅仅是因为团队没有做任何市场营销。如果换做其他团队,早已打了上千个电话拉投资了。但 Jeff 和团队有他们的风格。

不过,不要被表象迷惑。华尔街迟早会发现 HYPE。

我认为,一旦 SONN 上线,这将成为一个巨大拐点。SONN 拥有 3 亿美元储备资金可用于购买 HYPE,并将与 Paradigm、Galaxy Digital 一起对 HYPE 进行全面推广。

Odaily 注:SONN 是 Sonnet BioTherapeutics ,其与 Rorschach I LLC 达成了一项价值 8.88 亿美元的业务合并协议,将其转型为一家名为 Hyperliquid Strategies Inc. (HSI) 的加密储备公司。

这一购买力相当于 480 亿美元比特币购买力(今年比特币 ETF 仅吸收 150 亿美元资金流入)。可以说是一个超级催化剂。

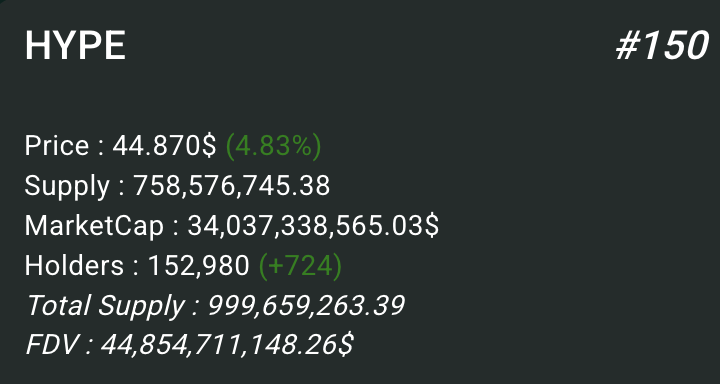

代币分发

目前 HYPE 只有约 15 万个持币地址,这个数字比许多 Solana 上的 memecoin 还低(例如 SOL 的持币数已超 1000 万)。

问题在于当前 HYPE 分发渠道不畅,普通用户买入困难。现有持有者多数已获利丰厚,不一定有强烈动力继续加仓。这会抑制价格上涨。

但一切正在改变。Coinbase 和 Binance 出于显而易见的原因拒绝上线 HYPE。但许多前端和法币入口正在为 Hyperliquid 构建。Phantom 已推出基于 Hyperliquid 构建者代码的永续合约前端,两周内就吸引了 1.5 万到 2 万名用户。利用这个分发网络可能是 $HYPE 的巨大催化剂,此外还有其他正在建设中的分发网络。像 SONN 和 HYPD 这样的财库公司,我认为也将成为很好的分发网络,不仅仅是传统金融的大资金。这可能需要时间,并且在它们更成熟时会更加显著。

数据表现

Hyperliquid 的数据表现亮眼,甚至在所有加密货币中都是最好的之一。在 Hyperliquid 近期经历了巨大的增长后,再看到当前的价格位置真是令人惊叹。我就只发几张图。

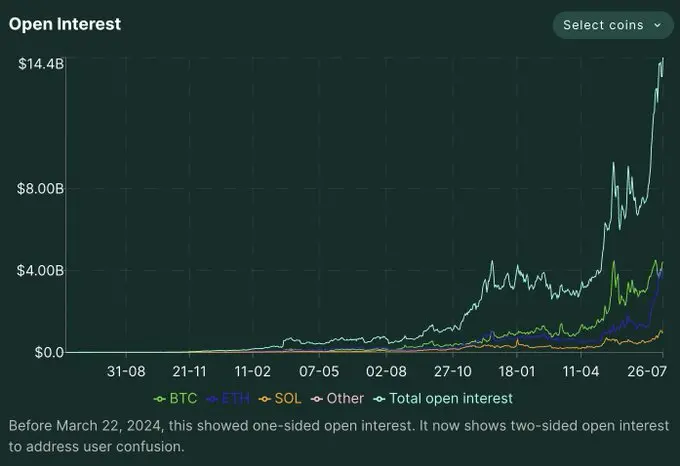

用户增长速度创下自 TGE 以来的新高,资金流入加速并达到历史高点,未平仓合约(OI)也达到历史高点。

Hyperliquid 和 CEX 数据对比:交易量对比 CEX 处于历史最高点;持仓量对比 CEX 继续打破历史最高点。

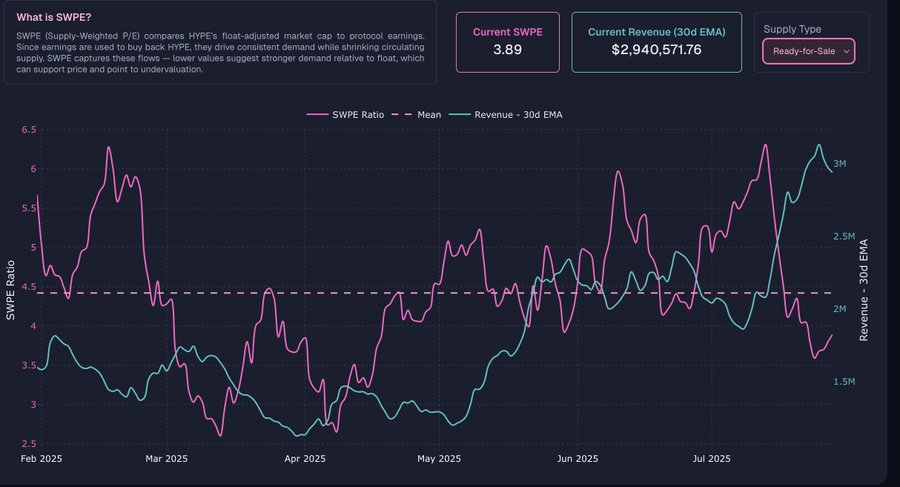

同时,SWPE(相对溢价指标)处于 4 月以来最低点,暗示着当前价格具有吸引力。

下一轮增长的驱动力

接下来我认为会推动 HYPE 增长的关键因素包括:

- 前端分发:构建者代码是 Hyperliquid 最好的创新之一。前端还将进行营销,而 Hyperliquid 至今从未做过任何营销。

- 法币入口的建设:我从几个不同来源(不是直接来自 Hyperliquid,但与 Hyperliquid 相关的应用程序或前端)听说这即将推出。

- HIP-3:一个仅在 Hyperliquid 上可能实现的新产品,它将为 HYPE 带来巨大的代币销毁。

- SONN:将把华尔街资金引入 HYPE,并为 HYPE 注入 3 亿美元的买压。

- 用于永续合约交易的现货抵押品:根据测试网部署情况,这似乎正在进行中,我认为这对平台和 HYPE 代币来说将是一个巨大的解锁。可能会看到交易量增加,BTC 大户也会因此将资金存入 Hyperliquid。

- 更多现货资产上线。@hyperunit 一直在努力工作,并继续列出顶级资产。PUMP 的推出非常成功,证明了我们团队的实力,Hyperliquid 在 TGE 前列出了永续合约,@hyperunit 在 TGE 时立即推出了现货,迅速形成了最厚的订单簿。这两个事件都是巨大的用户引入,从那些天的资金流入可以看出。

这些只是其中一部分催化剂。我已经写了一个多小时,仍然无法涵盖所有内容。

总结

HYPE 当前的估值依然非常便宜,你持有的还不够,也可能还没真正理解它的潜力。

HYPE 当前的估值依然非常便宜,你持有的还不够,也可能还没真正理解它的潜力。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。