利率新闻:日本的稳定政策加剧市场担忧

利率新闻:日本在脆弱复苏中维持利率不变

根据路透社的最新报道,日本银行(BOJ)决定将基准利率维持在约0.5%,这与美国联邦储备委员会最近连续第五次维持利率的举措一致。

来源:Forexfactory

这一利率新闻的决定显示出日本在经济复苏方面采取的谨慎态度,尤其是在与美国的贸易谈判仍在进行之际。

分析师认为,考虑到经济脆弱的状态以及全球关税政策的不确定性,中央银行正在谨慎行事。

尽管前景乐观,通胀担忧依然存在

在利率新闻中,日本银行的决定得到了专家们的一致认可,他们指出通胀仍然是一个持续关注的问题。

福冈金融集团首席策略师佐佐木徹表示:“虽然日本银行可能采取鹰派立场,但由于与美国贸易政策相关的风险,它仍然小心翼翼。”

中央银行略微上调了2026年的CPI预测,突显出温和的预期。实际利率仍处于极低水平,如果经济条件改善,未来可能会有加息的空间。

2025年7月23日,美国总统宣布与日本达成贸易协议。该国将把汽车进口税削减至15%,并在美国工厂投资5500亿美元,以促进就业和当地自豪感,这些税收间接影响市场价格。

日本宣布63亿美元救助计划

为了应对可能的美国关税带来的不确定性,该国推出了63亿美元的救助计划。专家建议,这一刺激措施可能间接有利于加密市场,因为额外的流动性通常会提升投资者信心。

来源:路透社

日本银行(BOJ)还重申了其以可持续和稳定的方式实现2%通胀目标的承诺,旨在使货币政策调整依赖于未来的经济数据。

加密市场显示出早期疲软迹象

美联储越是保持利率新闻稳定,唐纳德·关税越是加大贸易行动,这种拉锯战正在扰动加密市场。

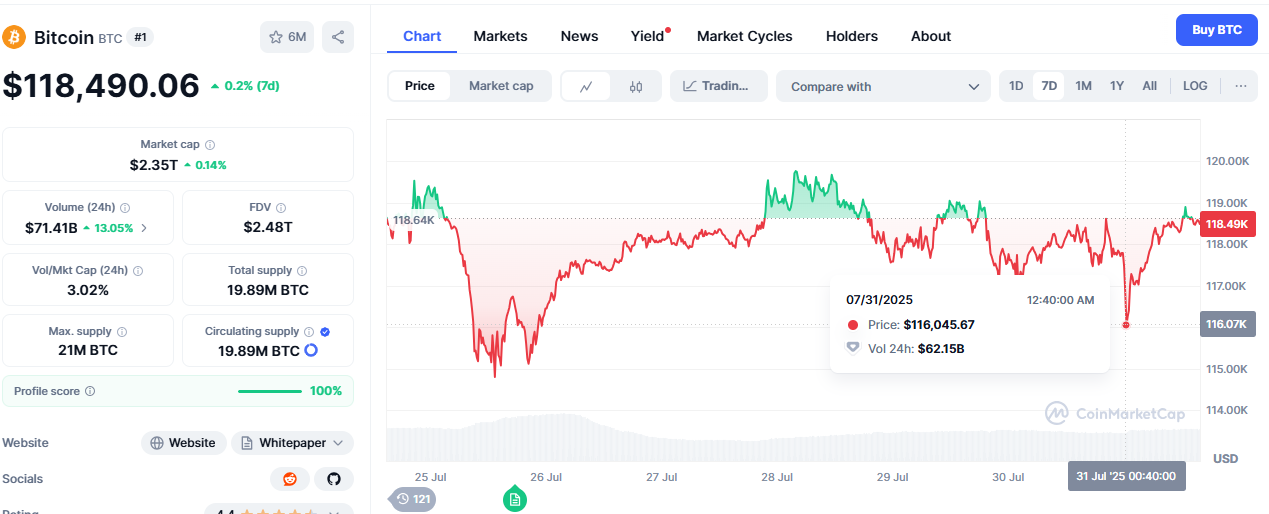

目前全球加密市场总市值为3.89万亿美元,上涨0.76%,主要资产显示出混合信号。比特币的价格一度跌至116,000美元,随后回升至118,490美元(截至撰写时)。

来源:CoinMarketCap

以太坊触及3680美元的低点,但迅速回升,而XRP则跌至六天低点3.062美元。分析师暗示,经济不稳定和谨慎的金融政策可能会引发数字资产的谨慎阶段。

结论

利率新闻,日本银行的决定给全球加密市场带来了新的不确定性。尽管突然的影响仍然有限,但潜在的加息、贸易紧张局势和通胀风险可能会导致未来几周的波动加剧。

投资者可能需要保持谨慎,因为市场情绪仍在波动。

另请阅读: 为什么中本聪时代的比特币钱包在2025年突然移动?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。