RedStone Atom is a fundamental transformation in the oracle space—it is designed for protocols, not built around them.

RedStone proudly introduces a significant breakthrough in oracle technology: RedStone Atom—the first oracle with settlement intelligence.

Unlike traditional oracles, RedStone Atom is the first solution that can actively enhance the efficiency of lending protocols. It introduces zero-latency oracle updates, allowing protocols to settle positions faster, improve loan-to-value (LTV) ratios, and deliver better risk-adjusted returns than competitors.

Atom also dynamically captures Oracle Extractable Value (OEV) when pricing is put on-chain and returns that value to the protocol, which can be used for revenue, enhancing user yields, or reducing borrowing costs.

Atom is powered by the innovative Application Specific Sequencing technology from FastLane Labs, which does not introduce settlement delays or additional security assumptions.

RedStone Atom can be enabled on any RedStone data source and any chain without code changes or engineering investment.

Atom has launched on Unichain, providing security for Compound Finance, Morpho, Venus Protocol, and Upshift, and can be integrated into BNB Chain, Base, Berachain—soon to be available on Ethereum, HyperEVM, Arbitrum, and more. To enable Atom on any RedStone data source, please contact the RedStone team.

Key Takeaways:

- Enhanced Lending Protocol Performance: Atom turns oracles into performance engines. Instant settlement unlocks higher LTV and better yields, providing measurable competitive advantages for protocols.

- Zero-Latency Settlement: Atom instantly updates prices when they can be settled, unlocking stricter risk parameters, outpacing all competitors.

- Native OEV Capture: Traditional oracles have leaked over $2 billion in OEV to MEV bots. Atom captures liquidation value through sealed auctions and returns it to the protocol.

- Atomic Transactions: Price updates, settlements, and OEV payments are settled in a single transaction of about 300 milliseconds in FastLane's Atlas.

- No Integration Work Required: Atom can be instantly activated on any RedStone data source and any chain without code changes.

RedStone Atom Makes Lending More Powerful

“RedStone Atom is a fundamental transformation in the oracle space—it is designed for protocols, not built around them. Atom gives lending protocols an unfair advantage in the race for the best yields while addressing the long-standing hundreds of millions of dollars OEV efficiency problem in DeFi. In short, Atom is the super engine for DeFi lending, tailor-made for protocols.”

——RedStone Co-founder Marcin Kazmierczak

Atom is a complete reimagining of oracle technology, addressing the core issues of the most commonly used oracles in DeFi.

Most lending protocols rely on so-called push data sources, which push price updates on-chain under preset conditions (such as time intervals or price changes reaching a certain percentage).

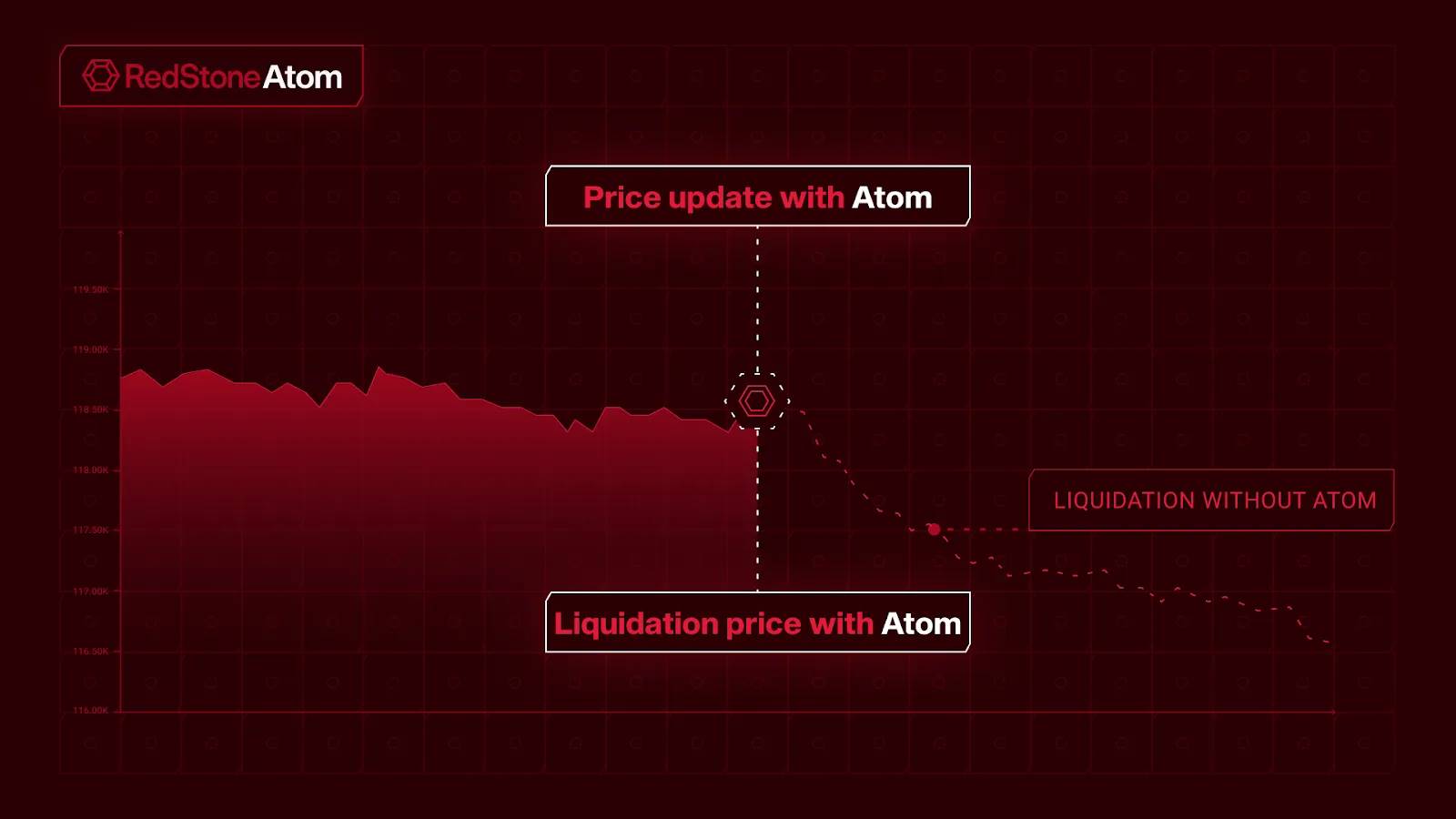

Once prices are on-chain, DeFi protocols can utilize this data, sometimes triggering liquidations. Faster oracle updates allow lending protocols to adopt more aggressive risk parameters, increasing the collateralized borrowing limits, making them more attractive to DeFi users. If updates are slow or delayed, risk parameters must be more conservative to prevent the protocol from incurring bad debts.

Since pushing new prices on-chain consumes gas, traditional push data sources typically have lower update frequencies, sacrificing the granularity of price updates for sustainability. This has become a limiting factor for lending protocols: blockchain oracles update at their own pace, not when the protocol needs them.

RedStone Atom achieves, for the first time, an instant update push data source when the protocol needs it.

With innovative application-specific sequencing technology, RedStone Atom upgrades the RedStone data source, allowing anyone to call the update for zero-latency price updates as long as a new price can trigger a liquidation.

In the lending space, the first to liquidate wins. With RedStone Atom, DeFi protocols can settle faster and more efficiently than their competitors. This, in turn, can improve LTV ratios, providing users with higher yields and value. Lending protocols using RedStone Atom will surpass competitors using traditional push data sources.

The $500 Million Problem: OEV and the Shortcomings of Traditional Oracles

Since the deployment of the first push data source on the Ethereum mainnet, Oracle Extractable Value (OEV) has been a significant vulnerability in blockchain oracles. OEV is extremely difficult to quantify, but conservatively, the total loss of OEV has exceeded $500 million. For AAVE v2 and v3 on the Ethereum mainnet alone, OEV losses could exceed $300 million.

When blockchain oracles push prices on-chain, triggering liquidations in lending protocols, potential OEV is generated. To incentivize security and ensure timely liquidations before positions turn into bad debts, lending protocols reward liquidators with "liquidation bonuses," sometimes exceeding 10% of the liquidation amount. Since these liquidations are risk-free profits for liquidators, competition is fierce, leading to most bonuses being used as priority fees, effectively costing the protocol dearly for its own security.

In 2024, the first products attempting to capture OEV emerged, but none achieved large-scale application or captured significant OEV. Existing OEV solutions are merely simple tools that capture OEV without improving the underlying oracle infrastructure, and in some cases, worsen the situation by introducing settlement delays or relying on difficult-to-scale off-chain infrastructure. Many solutions also require developers to undertake time-consuming and risky protocol upgrades, making integration into existing mainstream markets challenging.

RedStone established four key criteria when developing OEV solutions:

- There should be no settlement delays, and it should even accelerate settlement (Atom achieves this).

- No additional security risks or trust assumptions should be introduced.

- It should easily scale to any EVM chain.

- It should have a high capture rate, meaning it can capture over 90% of liquidations in the integrated market.

Atom OEV Auctions Implemented by FastLane

RedStone Atom meets all criteria and further enhances the OEV concept through innovative application-specific sequencing technology.

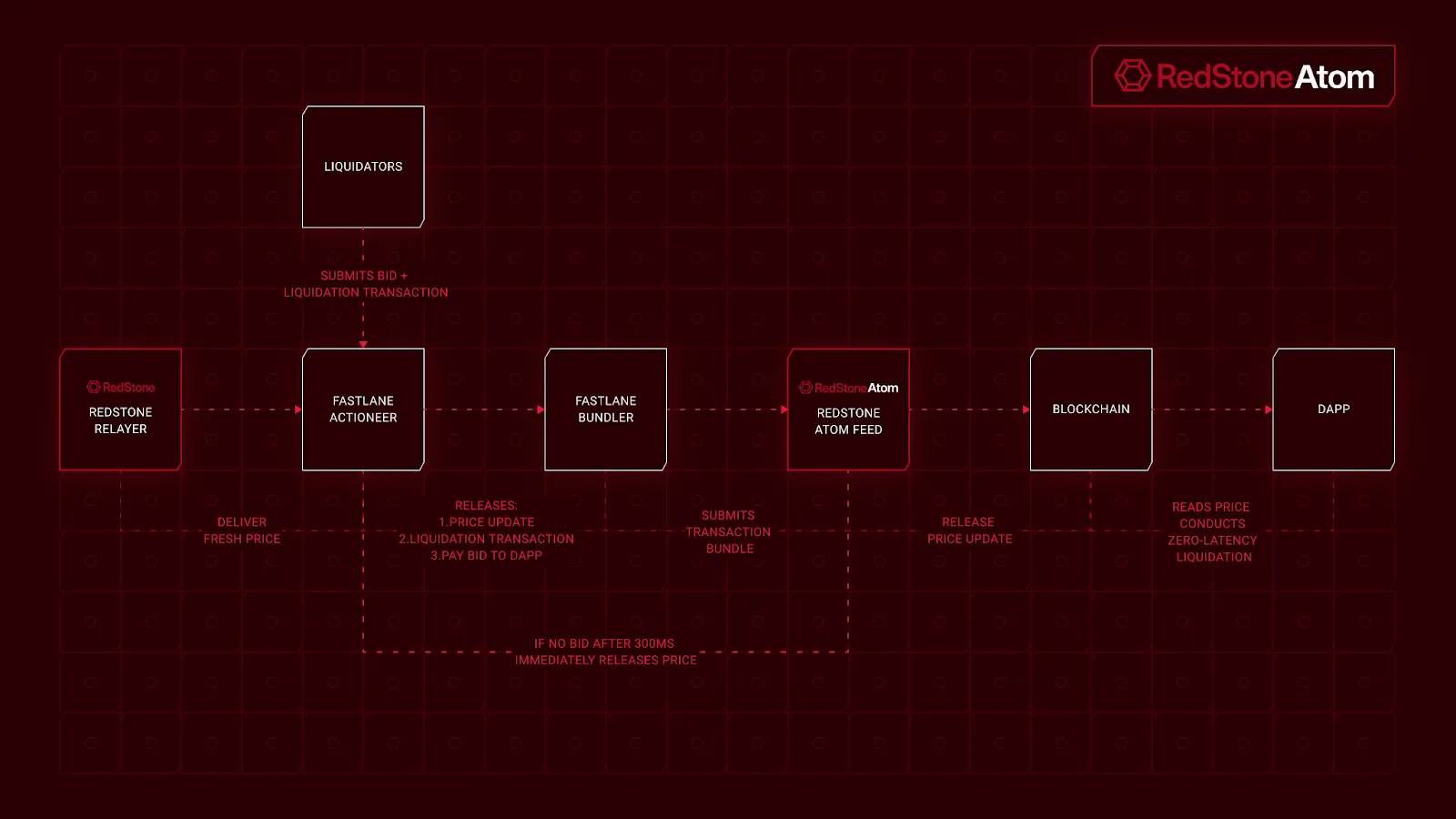

In Atom, RedStone data sources utilize FastLane's Atlas for Atom OEV auctions.

FastLane brings new RedStone price streams into off-chain auctions that last less than 300 milliseconds. During this time, liquidators bid for the liquidation bonus.

After each auction ends, FastLane submits bids to the Atlas smart contract in the order of bids. The Atlas smart contract then atomically updates the data source and settles the auction, determining the highest bid on-chain. When there are bids from liquidators in the auction, Atlas packages three operations into a single atomic transaction:

- Push the new signed oracle price

- Execute the liquidation

- Transfer the winning amount to the designated recipient

Since the three operations settle within the same block, the oracle update and liquidation are inseparable and atomic. There are no other transactions that can preempt the liquidation, and there will be no missed liquidations due to protocol delays.

Once an off-chain price makes a position liquidatable, Atlas opens a millisecond-sealed window auction, where liquidators (or any resolvers) bid for exclusive liquidation rights. If a bid rolls back, Atlas's internal try/catch immediately switches to the next resolver.

The protocol receives most of the liquidation bonus as revenue, while the winner retains the remainder. If the auction does not generate valid bids, RedStone relay nodes will push prices like standard contracts, and the protocol will operate as usual. If the Atlas liquidation fails on-chain, the price update will be immediately open to everyone, allowing anyone to liquidate in the standard way.

In exceptional paths, everything falls back to the verified standard process; in the ideal path, liquidation occurs with zero latency, and OEV is captured by the protocol.

“Fastlane is committed to building a leverage minting factory for DeFi—a real-time, optimized liquidation risk engine. RedStone Atom not only brings better outcomes for users and protocols but also returns the forefront of crypto innovation on-chain.”

——FastLane Founder Alex Watts

Integrating RedStone Atom

Atom requires no technical integration. It is an upgrade that can be natively enabled on any RedStone price source and any chain. Once enabled, Atom will provide zero-latency settlement and OEV capture for all protocols using that price source. Protocols do not even need to change the data source contract address.

To enable Atom, simply:

- Request RedStone to enable Atom on the data source used by the protocol

- Provide an address to receive OEV

RedStone will deploy the Atlas contract on the specified chain and notify the team once the Atom upgrade is live.

A New Era of Blockchain Oracle Technology

Atom debuted on Unichain, marking a significant leap in oracle technology. Today, there is almost no substantial difference between blockchain oracle products; aside from security records, ETH/USD price sources on the same chain are nearly indistinguishable. Atom changes all of that.

Lending protocols that adopt Atom to upgrade their data sources will be able to surpass competitors with more aggressive risk parameters, providing users with higher yields. This will make RedStone data sources the preferred choice for all lending protocols.

Other blockchain oracles cannot replicate RedStone Atom. Even attempts to implement similar technology cannot achieve the native integration that Atom has with RedStone's modular architecture due to monolithic design limitations.

Additionally, RedStone and FastLane Labs will retain a portion of the OEV captured by Atom, which will be directed to a publicly declared on-chain address for the future development of the protocol and ecosystem.

To learn more about RedStone Atom, you can watch our presentation at ETHcc 2025:

- RedStone Co-founder Marcin Kazmierczak: https://www.youtube.com/watch?v=dQxkAPp3z9Y

- Head of RedStone Atom Mike Massari: https://youtu.be/M1YFKQZ55UM

About FastLane

FastLane has extensive experience in the MEV space, operating validator block auctions on Polygon PoS for years, with approximately 75% of staked assets now integrated. The latest collaboration with RedStone focuses on building a permissionless execution platform for lending protocols, providing infrastructure and mechanisms for RedStone data sources to enhance the leverage that DeFi protocols can safely offer.

About RedStone

RedStone is a modular blockchain oracle optimized for DeFi and on-chain finance, focusing on yield-bearing assets such as appreciating stablecoins, liquid staking tokens (LSTs), and re-staking tokens (LRTs). It provides secure, reliable, and customizable data sources across more than 110 chains and is trusted by over 170 clients, including leading protocols like Securitize, Ethena, Morpho, Drift, Compound, ether.fi, and Lombard.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。