编译:深潮TechFlow

摘要:在区块链的星辰大海中,Arbitrum 正以"数字主权国度(Digital Sovereign Nation)"的雄心布局,通过高利润区块空间和创新收入流驱动 DAO 财政增长,编织出一张技术、治理与经济激励交织的生态网络,让我们共同见证这个区块链帝国的星火燎原。

关键见解

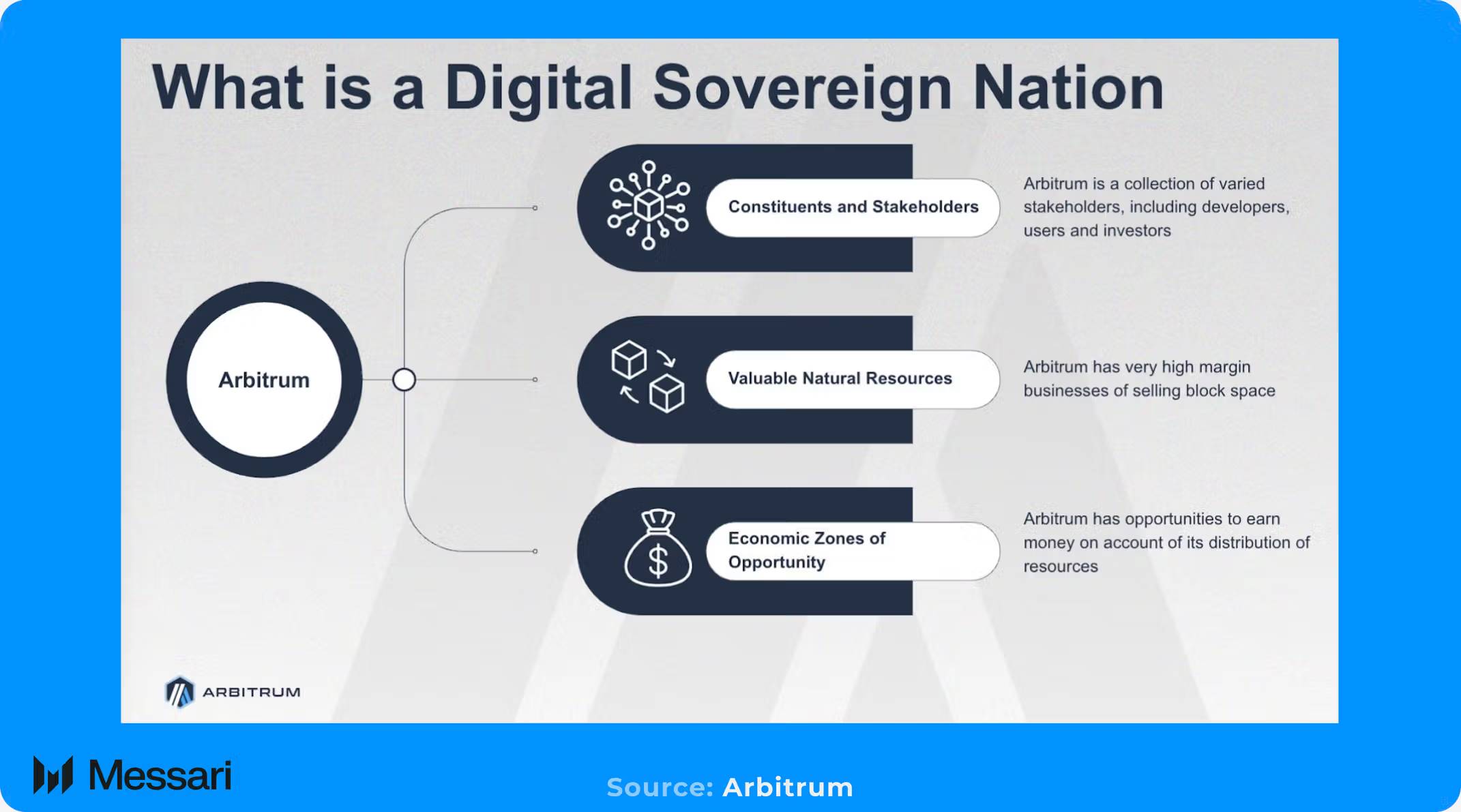

Arbitrum 的发展以建立“数字主权国度(Digital Sovereign Nation)”的愿景为指导,开创了一种模型,即去中心化治理的链上实体如何利用其资源来增加对其产品的需求并增加其财富。

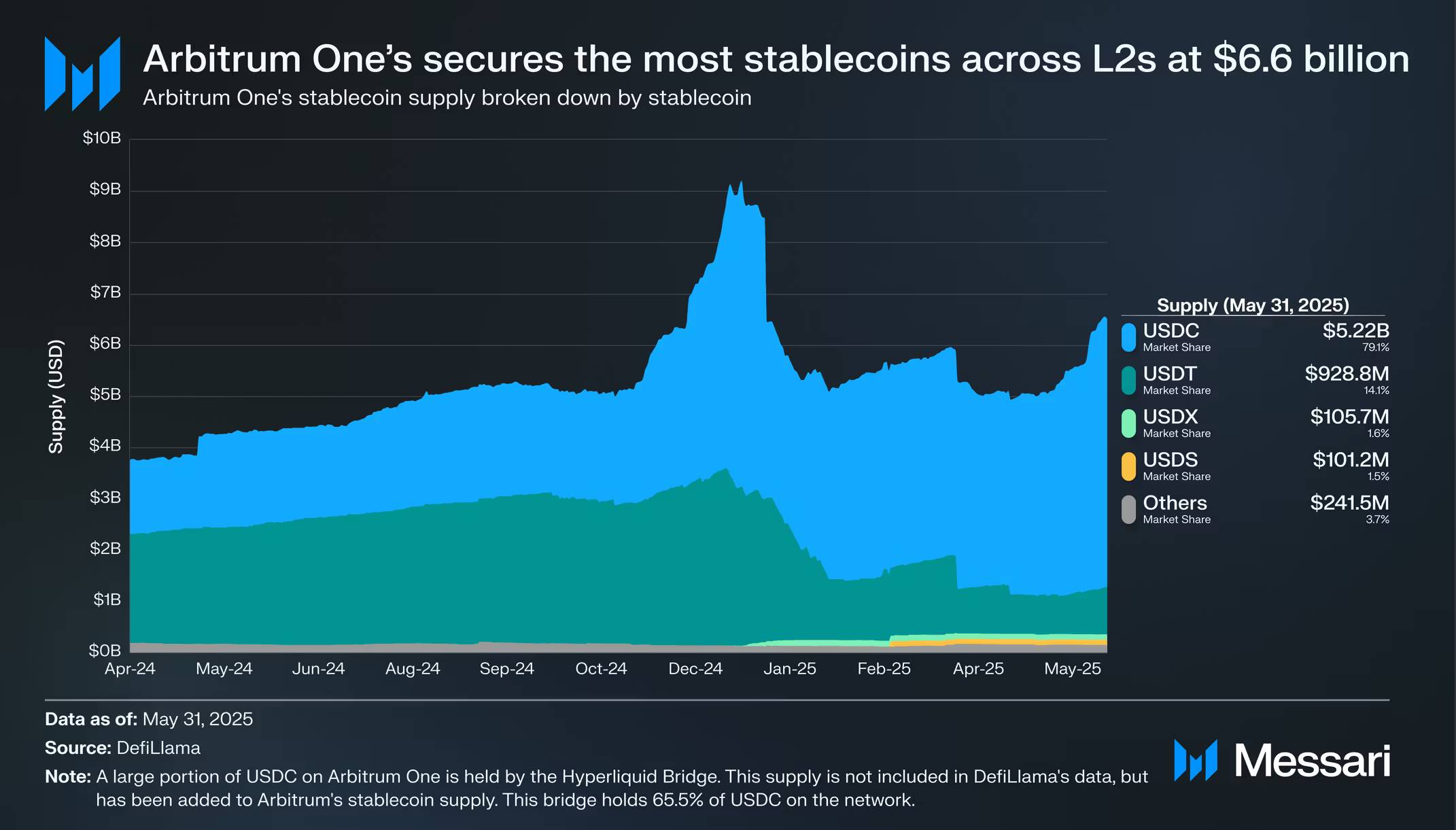

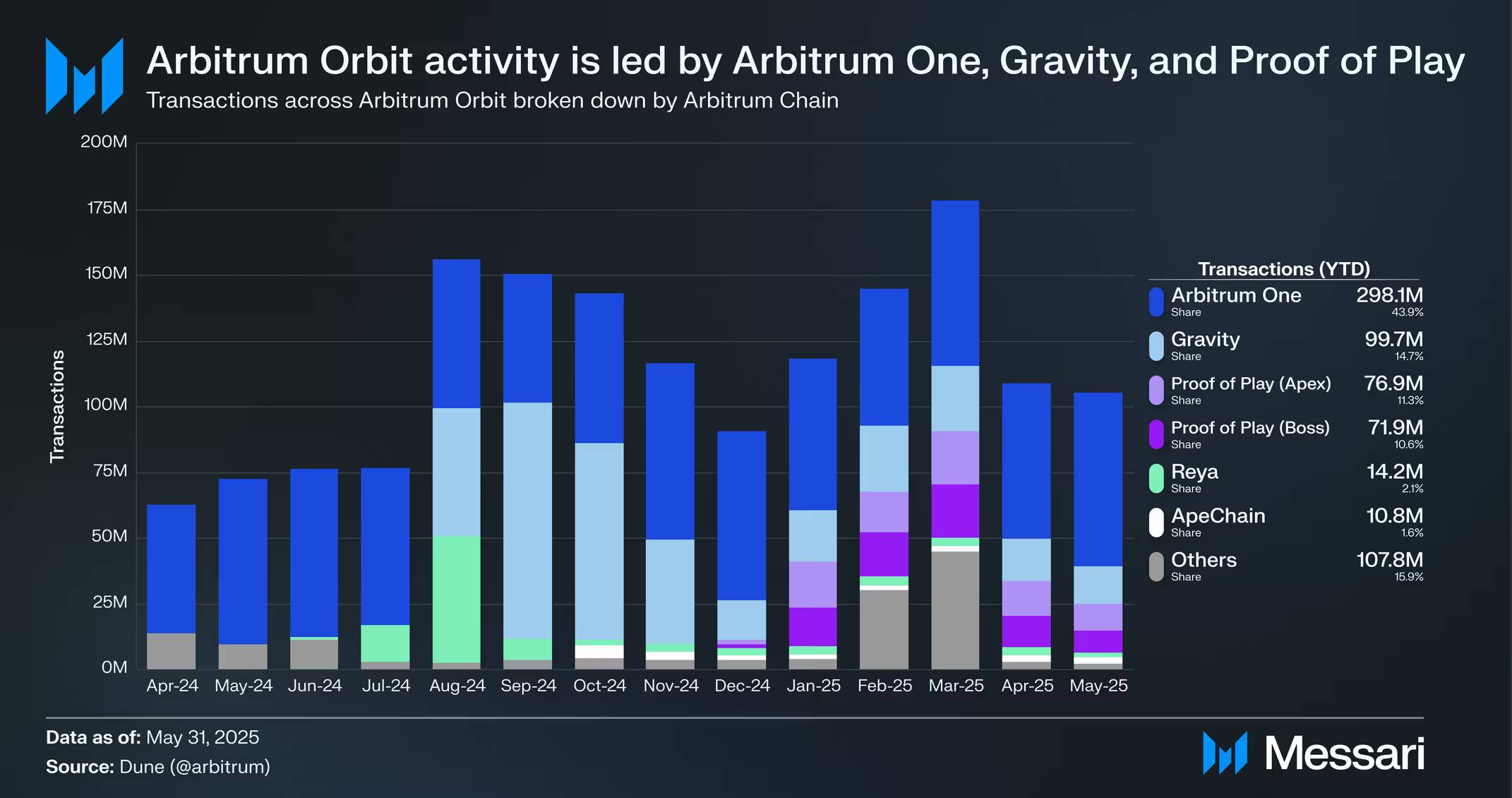

Arbitrum 提供双重产品: Arbitrum One 是最活跃、流动性最强的网络之一,拥有 66 亿美元的稳定币供应量和 25.9 亿美元的 DeFi TVL;而另一个产品 Arbitrum Orbit,则是由在主网上运行的 48 个定制 Arbitrum Chains 组成的多样化生态系统。

这种双重产品执行了“Arbitrum Everywhere”战略,使开发人员可以灵活地利用 Arbitrum One 上的共享流动性或自定义创建具有“开放中立区块空间(Opinionated Blockspace)”的汇总,以满足各种新兴用例的需求。

Arbitrum 的经济引擎由多种链上收入流推动,包括核心协议收入和 Timeboost 拍卖,后者捕获 MEV 并在推出后的前 44 天内为 DAO 创造了超过 100 万美元的收入。

ArbitrumDAO 引领增长飞轮,用部署财政资产来资助生态系统投资计划,并通过稳定财政捐赠计划 (STEP) 和 Arbitrum Gaming Ventures (AGV) 等举措支持经济试验区。

今天的 Arbitrum

Arbitrum (ARB) 以其 Arbitrum One 而闻名,Arbitrum One 是一个 Layer-2 区块链,已成为加密货币领域最活跃、流动性最强、性能最高的区块链之一。然而,这仅涵盖了 Arbitrum 产品的一部分,该平台已发展成为一个全面的多产品技术平台。Arbitrum 的主张由两款截然不同但又相互关联的产品组成,服务于不同的细分市场。

-

Arbitrum One:旗舰级 L2 Rollup,具有提供与 EVM 同等功能的共享执行环境。其成功体现在其年初至今的链上 GDP 为 2.149 亿美元,TVL 为 25.9 亿美元,稳定币供应量 为 66 亿美元,是截至 2025 年 5 月 31 日 L2 中的最高值。

-

Arbitrum Orbit:Arbitrum Nitro 技术框架使项目能够使用与 Arbitrum One 相同的底层基础架构部署定制的 L2 或 L3 网络。这些 Arbitrum Chains 可以根据特定用例进行定制,同时保持与更广泛的 Arbitrum Orbit 生态系统的互操作性。

这种双产品战略使 Arbitrum 能够从共享基础设施和定制部署需求中获取价值,从而应对过去被视为相互竞争的细分市场。Arbitrum One 和 Arbitrum Orbit 共同支撑着“Arbitrum Everywhere”的愿景,将 Arbitrum 定位为广泛应用的基础架构层。

“Arbitrum Everywhere”愿景体现了支持完整应用程序开发生命周期的战略,从最初在共享流动性层上的部署,到未来随着需求发展迁移到专用定制网络。这一愿景由三大核心支柱引领:性能、统一性和去中心化。其既定目标是同时推进这三大支柱,而不是在它们之间进行权衡。

实现这一愿景不仅需要技术创新,还需要在 2023 年 3 月随着 ArbitrumDAO 的创建,项目治理模式发生根本性转变。这标志着 Arbitrum 从 Offchain Labs 旗下一家公司主导的项目转型为由 ARB 代币持有者共同治理的去中心化协议。此举旨在赋能社区,体现了 Arbitrum 的核心信念:Arbitrum 的故事不再局限于以太坊的扩容,而是重新定义最初加密梦想中蕴含的去中心化精神。

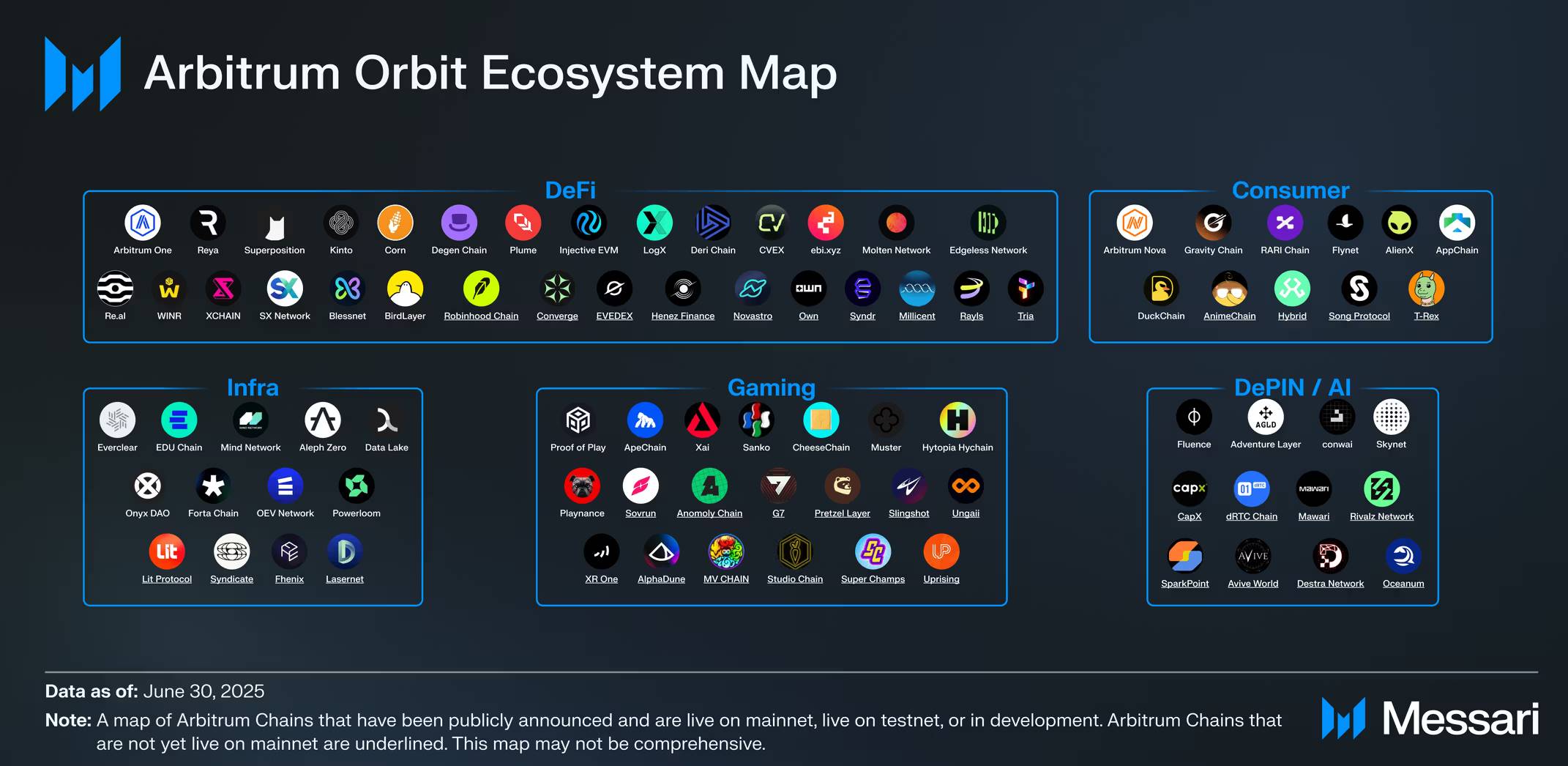

ArbitrumDAO 初始化并部署链上治理后,Arbitrum 便做好了扩展的准备。具体来说,Arbitrum 将成为一个使用 Arbitrum Nitro 定制构建、由 ArbitrumDAO 治理的共享 rollup 生态系统。Arbitrum Orbit于 2023 年 10 月上线,目前已发展到 48 条已在主网上线的公开宣布的 Arbitrum Chains,这为“Arbitrum Everywhere”的美名增添了可信度。

2025年,Arbitrum 开启了新一轮发展,将重点转向构建充满活力的链上经济。“数字主权国度(Digital Sovereign Nation)”的基础已经奠定,Arbitrum 的目标是开创一种去中心化协议如何实现长期经济繁荣的典范。

Arbitrum One

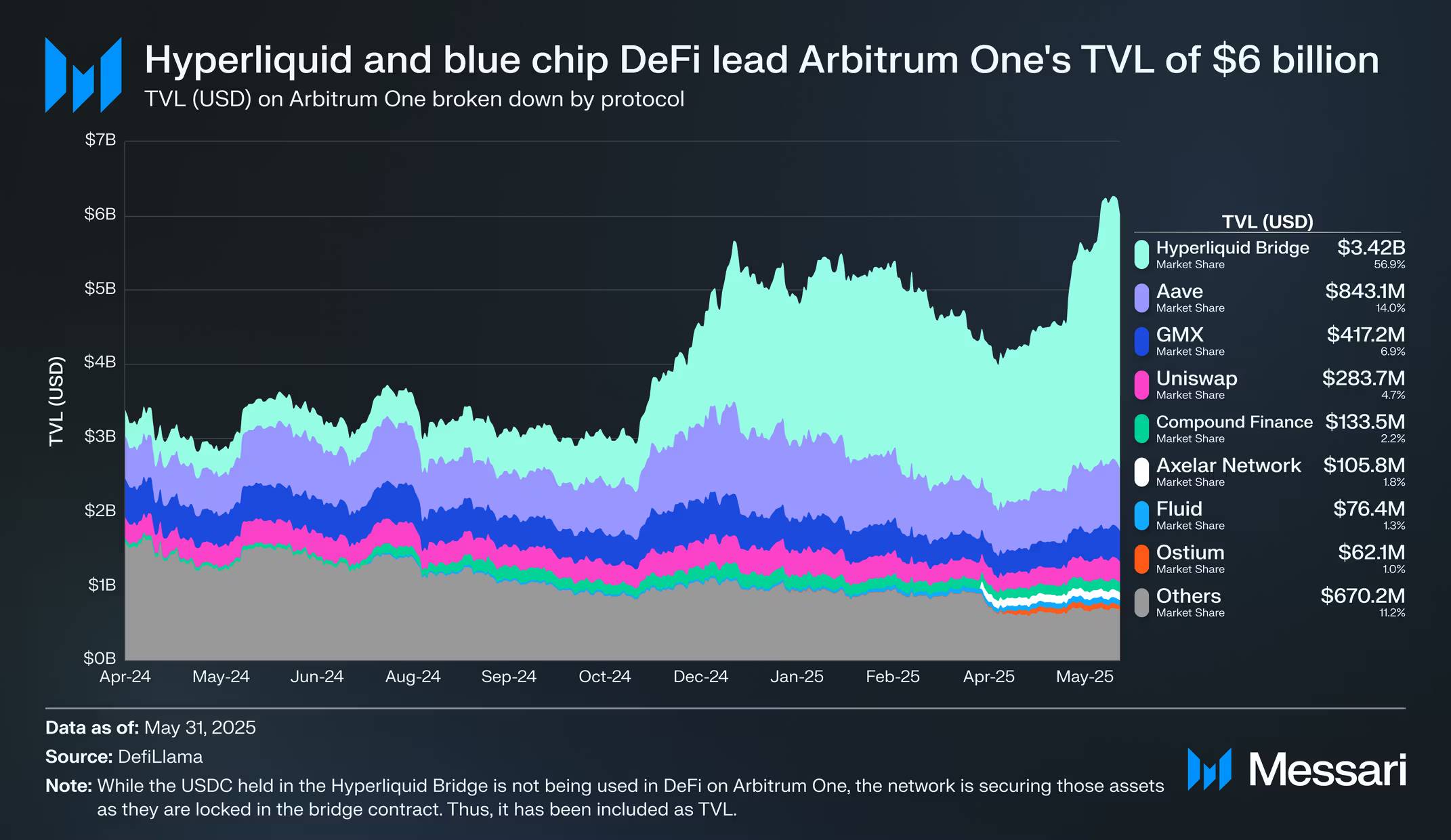

Arbitrum One 的专长源于其对 DeFi 的专注。它是 Arbitrum Orbit 生态系统中流动性最强的 DeFi 平台,截至 2025 年 5 月 31 日,其 DeFi 总锁定价值(TVL) 为 25.9 亿美元。然而,如果将 Hyperliquid 和 Hyperliquid Bridge 纳入其中,Arbitrum One 的总锁定价值 (TVL) 将跃升至 60 亿美元。Hyperliquid Bridge 的所有 USDC 流动性均来自 Arbitrum One,占总锁定价值的 56.9%,达到 34.2 亿美元。

Arbitrum One 还拥有蓝筹 DeFi 协议的最大规模 L2 部署,例如 Aave(8.431 亿美元)、Uniswap(2.837 亿美元)、Compound(1.335 亿美元)以及 Arbitrum 原生的GMX(4.172 亿美元)。此外,Arbitrum还包含一些新兴协议,例如:

-

Fluid:一个借贷协议,其中存入的资产也用于支持其去中心化交易所(DEX)。有关 Fluid 的全面概述,请参阅 Messari 的 Initiation of Coverage 报告。

-

Ostium :一个面向现实世界资产(RWA)的永续合约期货交易所。有关包括 Ostium 在内的现实世界永续合约市场的概述,请参阅 Messari 关于“现实世界资产的去中心化”的报告。

-

Renegade:一个链上暗池,提供现货代币交易,同时保持隐私并消除最大可提取价值(MEV)。

截至 2025 年 5 月 31 日,Arbitrum One 的稳定币供应量 6 亿美元,是所有 L2 中最高的。Hyperliquid Bridge 持有 Arbitrum One 所有稳定币(66 亿美元)的 51.8%(34.2 亿美元)。这使得 Circle 成为 Arbitrum One 上今年迄今为止领先的创收协议,从网络稳定币供应中产生了 6210 万美元的收入。USDT 是 Arbitrum One 上第二大稳定币,占所有稳定币的 14.1%,达到 9.288 亿美元。2025 年 1 月,USDT0 作为 USDT 的全链实现上线,并使用 Arbitrum One 作为其中央流动性枢纽。

Arbitrum One 的链上 GDP ,也就是网络上产生的应用程序总收入,从2025年初截止2025年5月31日,已达2.149亿美元。Uniswap、GMX 和 Aave 已占 Arbitrum One 链上 GDP 的 40.5%。

网络的应用收入捕获率 (App RCR) 是指其应用产生的收入与其实际经济价值(REV) 的比率。以 Arbitrum One 为例,REV 定义为基础交易费、优先费和 Timeboost 拍卖收入的总和。截至 2025 年 5 月 31 日,该网络的 REV 总额已达 740 万美元,年初至今的应用 RCR 为 2,904%。这可以理解为,在 Arbitrum One 上每花费 100 美元用于费用和拍卖,应用就能获得 2,904 美元的收入。

如果网络上的应用程序成功地将活动货币化和/或交易成本较低,那么该网络的应用收入捕获比率(App RCR)可以大于1。就 Arbitrum One 而言,两者兼具。项目的收入流甚至可以流向项目代币持有者。例如,在 GMX 上产生的应用程序收入会部分与 GMX 质押者共享。

Arbitrum Orbit

Arbitrum Orbit 已于 2023 年 10 月上线主网,这意味着任何人都可推出自己的Arbitrum Chains。Caldera 、Gelato、Conduit、Alchemy 和 AltLayer 等 Rollup 即服务(RaaS) 提供商简化的构建流程,为 ApeChain、Proof of Play 和 ReyaChain 等 Arbitrum Chains提供支持。

Arbitrum Orbit 增长的关键驱动力在于其技术灵活性。该技术栈允许开发者进行网络级定制,创建针对特定用例的专属区块空间。其中定制化功能包括:

-

自定义 Gas 代币:Arbitrum 允许 Arbitrum Chains 使用任何 ERC-20 代币(通常是项目自己的代币)作为网络交易费用的支付。

-

AnyTrust 协议:Arbitrum 的替代数据可用性 (DA)解决方案,通过信任数据可用性委员会(DAC)的链下行动来优化性能。值得注意的是,Arbitrum Nitro 还支持Celestia 和 EigenDA 等外部 DA 提供商。

-

Layer-3s::Arbitrum 允许 Arbitrum Chains 充当 L3,它们汇总到像 Arbitrum One 这样的 L2,而不是像以太坊这样的 L1。

Arbitrum Chains 既可以像L2一样在以太坊这样的 L1 上进行结算,也可以像L3一样,在 Arbitrum One 这样的L2 上进行结算。截至 2025 年 5 月 31 日,Arbitrum Orbit 生态系统已包含 48 条已在主网上线的已官宣的 Arbitrum Chains,另有 38 条正在测试网或开发中。Arbitrum Orbit 累计拥有超过 110 万个周活跃地址,总锁仓量 (TVL) 达 137 亿美元,总交易量达 18.9 亿笔,并占据所有 L2 交易的 31.8%。

Arbitrum 的经济引擎

数字主权国度(Digital Sovereign Nation)

Arbitrum 的下一步发展源于成为一个自给自足的“数字主权国度(Digital Sovereign Nation)”的愿景。“ Arbitrum Everywhere ”战略催生了一种经济和治理模式,可以通过三个核心要素来理解:多元化的参与者和利益相关者、有价值的数字资源以及由财政部署产生的经济试验区。

-

多元化的参与者和利益相关者:第一支柱由 Arbitrum 的参与者和利益相关者组成,包括开发者、用户和投资者,均由 ArbitrumDAO 代表。Arbitrum 的模式独特之处在于,它赋予 ArbitrumDAO 全部权力,ArbitrumDAO 对协议升级和资金持有拥有完全的链上控制权。这种控制权是实现数字主权国度(Digital Sovereign Nation)的基础。

-

有价值的数字资源:第二大支柱是 Arbitrum 宝贵的数字资源。在这里,这些资源指的是 Arbitrum 的区块空间和执行环境,它们充当着高利润的数字商品。Layer2 的经济性使其能够保留大量的网络收入,这与 Layer1 不同,Layer1 会分配大部分网络收入并发行新代币以激励验证者维护网络安全。Arbitrum One 交易的平均毛利率超过95%,并且 Timeboost 和 Arbitrum 扩展计划(AEP)等项目也产生了额外收入,Arbitrum 链上活动产生的价值直接累积到 ArbitrumDAO 财政中。

-

财政部署产生的经济试验区:第三大支柱是经济试验区,它们为增长飞轮提供动力。创造和保留收入的能力使 ArbitrumDAO 能够将资产再投资于新的项目。这些项目反过来又会推动对 Arbitrum 区块空间和活动的需求,从而进一步推动飞轮增长,并强化数字主权国度(Digital Sovereign Nation)的长期愿景。

增长飞轮

Arbitrum 向数字主权国度(Digital Sovereign Nation)转型的过程中,其核心在于一个增长飞轮,将价值回馈给其成员和利益相关者。首先,收入来自区块空间和执行环境等数字资源。这些收入将分配给完全由 ArbitrumDAO 管理的金库。DAO 投资于生态系统投资项目和经济试验区,从而推动其产品需求的复合增长,同时扩大其资产基础。

核心协议收入

ArbitrumDAO 直接从 Arbitrum 核心产品(包括 Arbitrum One 和 Arbitrum Orbit)的使用中获取价值。这种将价值直接累积到 DAO 控制的金库的模式是 Arbitrum 的关键差异化因素。Arbitrum One 和 Arbitrum Nova 将 100% 的排序器利润贡献给 ArbitrumDAO。所有其他 Arbitrum Chains都需要分享 10% 的排序器利润作为 Arbitrum 扩展计划(AEP) 许可费的一部分,其中 8% 归属于 ArbitrumDAO,2% 归属于Arbitrum 开发者协会。值得注意的是,结算到 Arbitrum One 等 Arbitrum Chains的 L3 免于利润分享。从年初截至 2025 年 5 月 31 日,ArbitrumDAO 已从这些收入来源获得了 750 万美元的收入 。

Timeboost

2023 年 3 月,Offchain Labs 宣布开发 Timeboost 协议,该协议将修改序列器的交易排序。此项修改旨在保留Arbitrum 一贯秉持的公平先到先得模式,同时通过拍卖优先交易的方式为 ArbitrumDAO 创造新的收入来源。Timeboost 增加了约 250 毫秒的延迟,引入了一条可拍卖的交易快速通道,从而能够从原子套利和清算等策略中获取最大可提取价值(MEV) 。

Timeboost 于 2025 年 4 月 17 日上线,首先在 Arbitrum One 和 Arbitrum Nova 上线。上线 44 天后,Timeboost 的总收入超过 100 万美元 。截至 2025 年 5 月 31 日,Timeboost 按计划实现了 1130 万美元的年化收入(基于30 天移动平均线)。其中,97% 的大部分收入分配给 ArbitrumDAO,剩余 3% 分配给Arbitrum 开发者协会。

Timeboost 拍卖一直占Arbitrum One 产生的网络 REV (实际经济价值)的50% 以上,超过 99% 的拍卖都有活跃竞标者。同时,其他 Arbitrum Chains也可以选择将 Timeboost 作为其 Arbitrum Nitro 实现的一部分。随着 Timeboost 被其他 Arbitrum Chains采用,其重要性可能会不断提升。

生态系统投资计划

任何基于 Arbitrum One 和所有 Arbitrum Chains构建的应用程序均有资格获得 Arbitrum 生态系统投资计划的支持。在 ArbitrumDAO 的发展历程中,生态系统投资计划持续发放 ARB 代币,以促进 Arbitrum 的长期增长,并提升市场对 Arbitrum 平台的需求。这也是 Arbitrum 愿景“让 Arbitrum Everywhere”以及“成为一个自给自足的数字主权国度(Digital Sovereign Nation)”的重要组成部分。

DeFi复兴激励计划 (DRIP)

DeFi 复兴激励计划(DRIP)于 2025 年 6 月 23 日获批,旨在激励 Arbitrum One 上的 DeFi 活动,以实现特定目标,例如成为“以 wstETH 为抵押借入 USDT、USDC 和 ETH 的最佳平台”。DRIP 将推出最多四个为期 3 个月的季度,每个季度最多分配 2000 万 ARB(占代币总供应量的 0.2%)。Entropy Advisors、Arbitrum Foundation 和 Offchain Labs 将担任该计划的管理者,该计划计划于 2025 年 7 月启动。

Onchain Labs

2025年3月,Arbitrum基金会和 Offchain Labs 成立了 Onchain Labs,旨在“加速Arbitrum上创新的链上体验”。Onchain Labs 孵化的首个项目 Talos 于 2025 年 7 月发布。Talos 是一个即将推出的协议,将由一个人工智能代理控制,该代理自主管理资金资产、代币经济学和协议机制。然而,该代理将由其未来的代币持有者管理,他们将在社区公开投票后通过 GitHub 提出升级建议。

其他生态系统资助计划

Arbitrum 基金会和 ArbitrumDAO 也支持资助计划。过去,这些计划包括 Trailblazer AI 资助计划、Stylus Sprint、Arbitrum x Farcaster Buildathon、Uniswap-Arbitrum 资助计划、Pluralistic Grants 资助计划和 ArbiFuel。

Arbitrum DAO(域名分配器产品)奖励计划第三季于 2025 年 2月获批,自 2023 年 10 月起运行两个季度,持续一年,至 2026 年 3 月结束,将通过 Questbook 向五类项目发放 2340 万个 ARB(占代币总供应量的 0.23%)。

从此前看,ArbitrumDAO 还批准了几个激励计划,这些计划在 Arbitrum Orbit 生态系统中分发 ARB 代币:

-

短期激励计划(STIP):STIP 于 2023 年 10 月获得批准,向 30 个Arbitrum Orbit 项目分配了 5000 万 ARB(占代币总供应量的 0.5%),作为激励措施分发给其用户。

-

STIP Backfund:STIP Backfund于 2023 年 11 月获得批准,向 26 个Arbitrum Orbit 项目分配了 2150 万 ARB(占代币总供应量的 0.22%),这些项目已获得 STIP 批准,但由于未进入获得“赞成”票的前 30 名而未获得资助。

-

STIP Bridge:STIP Bridge 于 2024 年 5 月获得批准,向 STIP 或 STIP Backfund 的先前接收者额外分配了 3750 万 ARB(占代币总供应量的 0.37%) 。

-

长期激励计划 (LTIP):LTIP 于 2024 年 2 月获得批准,向获得 STIP 的项目分配高达 4500 万 ARB(占代币总供应量的 0.45%)。

经济试验区

截至 2025 年 5 月 31 日, ArbitrumDAO 财政持有的资产价值12.1 亿美元,并持续从核心协议收入中增长。ArbitrumDAO 利用这些资产投资于具有机遇的经济领域,从而带来新的收入来源。这种积极的资本配置策略是增长飞轮的核心组成部分,使 DAO 能够持续投资于 Arbitrum 的增长。

稳定财政捐赠计划(STEP)

2023年12月,一项提案获得批准,成立一个财务和可持续发展工作组,以支持ArbitrumDAO 的财务运营。2024年1月,kpk 发布了《Arbitrum 财务和可持续发展研究报告》,评估了潜在的 ARB 代币销售的影响,探索了以 ETH 计价的序列器收入的潜在用途,并制定了有效的财务管理指南。

实现财库持有多元化并创造收益的努力始于稳定财库捐赠计划 (STEP)。该计划旨在将部分财库持有多元化,转化为能够产生收益的稳定现实世界资产(RWA),并推动Arbitrum One 上RWA 的采用率大幅增长。

-

步骤 1:由财政和可持续发展工作组提出,并于 2024 年 4 月获得批准。步骤 1 将 3500 万枚 ARB(占代币总供应量的 0.35%)转换为 RWA。共收到 33 份申请,其中 6 份通过 Snapshot 的链下投票获得批准。ARB 的出售收益为2930 万美元,随后被转换为 Securitize 的 BUIDL(960 万美元)、Ondo 的 USDY(520 万美元)、Superstate 的 USTB(520 万美元)、Mountain 的 USDM(350 万美元)、OpenEden 的 TBILL(350 万美元)以及 Backed Finance 的 bIB01(350 万美元)。

-

步骤 2:由财政和可持续发展工作组提出并于 2025 年 2 月获得批准,步骤 2 将把3500 万 ARB(代币总供应量的 0.35%)转换为 RWA,具体为 WisdomTree 的 WTGXX、Spiko 的 USTBL 和 Franklin Templeton 的 BENJI。

截至 2025 年 5 月 31 日,ArbitrumDAO 财政的RWA 持有量 总计 2760 万美元。自成立以来,STEP 已产生总计 74.5 万美元的利息收入 。

Arbitrum 游戏风险投资公司 (AGV)

Arbitrum Gaming Ventures(AGV,前身为 Gaming Catalyst Program (GCP))于 2024 年 6 月获得批准,将拨款高达 2 亿 ARB(占代币总供应量的 2%),用于投资 Arbitrum Orbit 游戏工作室、应用程序和连锁店。AGV 的目标是“引进优秀的开发者,并帮助他们在游戏生命周期的各个阶段加速开发”。资金分为以下三类:

-

建设补助金:2500 万 ARB(占代币总供应量的 0.25%),用于“加速 Arbitrum 早期开发的团队,或激励用户加入”。

-

投资:1.35 亿 ARB(占代币总供应量的 1.35%),用于“寻求超过 500,000 ARB 或初始开发之外的额外开发资金的团队”。

-

基础设施赏金:4000 万 ARB(占代币总供应量的 0.40%),用于“创建游戏专用技术,使 Arbitrum 成为游戏开发者的最佳选择”。

AGV 还发行了 2500 万枚 ARB(占代币总供应量的 0.25%)用于运营。AGV 是一个与 Arbitrum 保持一致的实体,根据其章程和关键绩效指标 (KPI)进行领导,并接受由五人组成的 CGP 理事会的监督。

分配给 GCP 的 ARB 绝大部分旨在用于风险投资,这些投资将为 ArbitrumDAO 带来数倍回报。AGV于 2025 年 5 月 8 日宣布了其首笔投资,总计 1000 万美元,投资对象包括Wildcard、Hyve Labs、T-Rex、Xai和Proof of Play。AGV于 2025 年 5 月 31 日发布的最新更新强调,有超过 70 个项目正在筹备投资中。Arbitrum Gaming Ventures 的完整投资清单可在Messari Fundraising上查看。

Arbitrum 技术

Arbitrum技术栈为构成 Arbitrum Orbit 生态系统的 Arbitrum Chains提供支持。Arbitrum 技术的核心是 Arbitrum Nitro,这是 Offchain Labs 开发的一个技术栈。Arbitrum Nitro 已成为一个不断发展的技术栈,能够满足各种新兴用例的需求。Arbitrum Nitro 的一个关键原则是注重可定制性和自主的区块空间,这使得开发者能够根据其协议的需求进行网络级定制,从而支持“Arbitrum Everywhere”的愿景。

Stylus

2023 年 2 月,Offchain Labs 宣布开发 Stylus,这是一款升级版虚拟机,可与EVM并行运行。Stylus于 2024 年 9 月上线,首先在 Arbitrum One 和 Arbitrum Nova 上运行。它允许开发者使用 Rust, C/C++, Zig, 和 Bf 等非 EVM 编程语言编译为WebAssembly (WASM),从而保持与 EVM 的互操作性。因此,用不同语言编写的智能合约可以相互交互(例如,用 Solidity 编写的智能合约可以调用用 Rust 编写的智能合约)。目前使用了Stylus 的协议包括 Renegade Finance, Superposition, Uniswap, 和 Fairblock等。

有限流动性延迟(BoLD)

2023 年 8 月,Offchain Labs 宣布开发有限流动性延迟(BoLD) 协议,该协议将引入一个无需许可的防欺诈系统,让单个诚实验证者能够保护 rollup 免受恶意排序器的攻击。BoLD 的争议协议允许任何人在其母链(例如用于 Layer2 的以太坊或用于 Layer3 的 Arbitrum One)上发布关于 Arbitrum Chain 状态的声明。如果挑战成功,恶意方提交的保证金将被没收。为了更深入地了解 BoLD,Offchain Labs 撰写了关于BoLD 的协议白皮书、技术白皮书和经济白皮书。

经过十个月的测试网测试并获得 ArbitrumDAO 的批准,BoLD于 2025 年 2 月正式上线。Arbitrum的BoLD满足了Vitalik Buterin提出的“rollup 迈出第一步的里程碑”中定义的去中心化第一阶段的五个必要条件之一。截至 2025 年 5 月 31 日,只有Arbitrum One 和 Kinto 两家 Arbitrum Chains达到了去中心化第一阶段的水平,这需要:

BoLD 还满足了被归类为第 2 阶段的三个必要要求之一,另外两个要求是,如果出现不必要的升级,用户应至少有 30 天的时间退出网络,并且安全理事会应该只在出现严重协议缺陷,且如果不加以解决,可能会造成重大损害的情况下才有权进行干预。

研究与开发

Offchain Labs 由 Ed Felten, Steven Goldfeder, 和 Harry Kalodner 创立,已筹集超过 1.2 亿美元用于开发。该公司作为核心技术开发商,投资于 Arbitrum Nitro 的研发。目前,Offchain Labs 正在开发通用意图引擎 (Universal Intents Engine),以提升 Arbitrum Orbit 的互操作性,强化 Arbitrum Everywhere 的价值主张:

-

基于意图的互操作性计划于 2025 年上半年实现,并将在“不到三秒”的时间内实现跨链代币交换和代币转移。

-

跨链操作计划于 2025 年下半年推出,并将在协议级别实现互操作性,从而以“快速、廉价和无需信任的方式”实现跨链操作。

此外,Offchain Labs 正致力于增加对去中心化排序器集的支持,并引入与 Arbitrum Orbit 的原生互操作性。Offchain Labs 还计划在未来增加对 Reth, Erigon,和 Nethermind等其他 EVM 客户端的支持,以继续提升 Arbitrum Chain 的性能。2025 年 5 月,Erigon 和 Nethermind 正式承诺在开发其执行客户端的同时,支持 Arbitrum Nitro。

Arbitrum Nitro 的其他重要升级包括影响状态转换函数(STF) 以及后续执行环境 ArbOS 的升级。这些升级通常与以太坊主网硬分叉同时发生,并且必须在实施前获得 ArbitrumDAO 的批准。历史上,ArbOS 有过三次重大升级,包括 ArbOS 11, ArbOS 20 Atlas , ArbOS 32 Bianca, 和 ArbOS 40 Callisto.

Arbitrum 生态系统

Arbitrum 的经济引擎和“数字主权国度(Digital Sovereign Nation)”战略已得到平台广泛参与者的认可。其技术、生态系统投资计划和经济机会区域的结合,已在多个关键垂直领域取得了切实的应用。

机构和现实世界资产 (RWA) 的采用

主要的增长领域是 RWA 的代币化,几家主要的传统金融机构都在 Arbitrum One 上部署了产品:

-

BlackRock:美元机构数字流动性基金(BUIDL)于 2024 年 11 月在 Arbitrum One 上推出,截至 2025 年 5 月 31 日,网络供应量 达到 3110 万美元。BUIDL 是由 BlackRock 开发的代币化美元货币市场基金,并作为STEP 投资组合中的最大份额持有在 ArbitrumDAO 财政。

-

Franklin Templeton:链上美国政府货币基金 ( FOBXX ) 投资于美国政府证券、现金和回购协议。该基金在 Arbitrum One 上被Franklin Templeton代币化为BENJI。BENJI 在 Arbitrum 上的供应量 为 9200 万美元,并被选为第二阶段的最大分配对象。

-

WisdomTree:WisdomTree Connect于 2025 年 4 月在 Arbitrum One 上推出。它提供对货币市场工具、股票、固定收益和资产配置策略中的 13 种代币化基金的访问权限,扩大了机构对代币化资产的访问权限。

代币化资产平台

提供收益型 RWA 产品的加密原生平台生态系统已扩展到 Arbitrum One:

-

Ondo Finance :由Ondo Finance运营,USDY 部署在 Arbitrum One 上,由美国国债和银行存款支持,旨在成为一种具有广泛可及性的收益型稳定币。截至 2025 年 5 月 31 日,USDY 在 Arbitrum One 上的供应量 为 630 万美元。

-

Spiko:由 Spiko 运营的欧元国库券 (EUTBL) 和美国国库券 (USTBL) 是部署在 Arbitrum One 上的代币化货币市场基金。截至 2025 年 5 月 31 日,Spiko在 Arbitrum One 上的TVL 为 9400 万美元。

-

OpenEden :由 OpenEden 提供,美国国债通过Arbitrum One 上的 TBILL 进行代币化,并包含实时储备证明和通过授权第三方的托管。截至 2025 年 5 月 31 日,TBILL在 Arbitrum One 上的供应量 为 570 万美元。

企业与金融科技整合

Arbitrum One 还可作为其他成熟公司和协议的关键基础设施层:

-

Robinhood:于 2024 年 2 月将基于 Arbitrum One 的兑换功能集成到其自主托管钱包中,使其用户能够访问 Arbitrum One 的 DeFi 生态系统。2025 年 6 月,随着 Robinhood 宣布将在 Arbitrum One 上推出股票代币,双方的合作关系进一步扩大。股票代币涵盖了OpenAI 和 Space X 等私营公司的投资机会,并计划未来将该产品引入即将上线的 Robinhood 链。

-

Hyperliquid:一家专注于永续合约交易的L1平台,取得了巨大的成功,它使用Arbitrum One作为其主要的USDC入口。截至2025年5月31日,Hyperliquid Bridge已从Arbitrum One获得34.2亿美元的USDC流动性。

Arbitrum Orbit

截至 2025 年 5 月 31 日,已在主网上线的48 条公开宣布的 Arbitrum Chains的月平均交易总额为 1.358 亿笔。除 Arbitrum One 外,最活跃的 Arbitrum Chains包括:

-

Gravity:Gravity 由 Galxe 于 2024 年 8 月推出,是一个由 Conduit 和G 代币支持的 L2 层。Gravity数字身份、社区参与和链上凭证验证生态系统提供支持。Gravity 最初作为Arbitrum Orbit 的一部分推出,计划于 2025 年第四季度过渡到高性能L1 层。

-

2025 年,该网络占 Arbitrum Orbit 交易量的 14.7%,总交易量达 9970 万笔,总锁仓量( TVL ) 为 270 万美元。更多信息,请参阅 Messari 近期关于Gravity 的报告。

-

-

Proof of Play: Proof of Play是一家游戏工作室,旗下拥有热门游戏《海盗国度》(Pirate Nation),这是一款海盗主题的角色扮演游戏 (RPG)。Proof of Play拥有两款 L3 链,分别为 Apex(于 2024 年 3 月上线)和 Boss(于 2024 年 8 月上线),由 Conduit提供支持。该工作室还提供各种链上服务,例如可验证随机数和镜像。

-

该网络占 2025 年 Arbitrum Orbit 交易量的 21.9%,达到 1.489 亿。

-

-

ReyaChain: Reya于 2024 年 4 月上线,是由 Gelato 提供支持的 L2 链,其协议提供永续期货交易和 rUSD 稳定币。最近,Reya 推出了rUSD 质押服务,并计划发布打造去中心化纳斯达克的更新愿景。

-

该网络占 2025 年 Arbitrum Orbit 交易的 2.1%,TVL为1080万及1610万美元。。

-

-

ApeChain: ApeChain于 2024 年 10 月上线,是由 Caldera 和APE 代币支持的 L3 链。ApeChain 是ApeCoin和Bored Ape Yacht Club (BAYC)的母公司,专注于三大支柱:内容、工具和分发。用户可以质押资产并获得收益,并使用游戏和元宇宙领域的应用程序。

-

2025 年,该网络占 Arbitrum Orbit 交易量的 1.6%,交易量达 1.489 亿笔,TVL 达 1000 万美元。更多信息,请参阅 Messari 近期关于 ApeChain 的报告。

-

2025 年期间也陆续推出几条仍在不断发展的新 Arbitrum Chains,其中包括:

-

Superposition:Superposition于 2025 年 1 月上线,是由 Conduit 提供支持的 L3 平台,并计划推出中心化限价订单簿 (CLOB)。目前,首批上线的功能是超级资产 (Super Assets)和奖励用户的自动做市商(AMM)。

-

Edu Chain:Edu Chain由Open Campus于 2025 年 1 月推出,是一个由 Gelato 和EDU 代币支持的 L3。该网络专注于为全球学生和教育工作者提供教育服务。有关 Open Campus 的全面概述,请参阅 Messari 的 Initiation of Coverage 报告。

Arbitrum Orbit 的增长将持续进行,以下为一些已官宣但截至 2025 年 5 月 31 日尚未在主网上线的 Arbitrum Chains,包括:

-

Converge:Converge 是一个预测试网,由Ethena 和 Securitize共同构建,它将是一个 L2 层,旨在成为传统金融和数字美元的结算层。Converge 将实现USDe 和 USDtb 等定制 gas 代币、由 sENA 担保的 Converge 验证器网络 (CVN) 以及Conduit G2 序列器。

-

AnimeChain :由 Azuki 构建的预测试网 AnimeChain 将是一个由 ANIME 代币驱动的 L3 网络。AnimeChain旨在成为动漫文化的网络,涵盖粉丝数据、知识产权(IP) 和收藏品。

-

Huddle01: Huddle01自 2025 年 1 月起在测试网上上线,是一个 L3 层,旨在通过去中心化的物理基础设施网络(DePIN)为实时通信(RTC)提供支持。该网络将由HUDL提供支持,第二阶段测试网已于 2025 年 4 月上线。

-

CapX: CapX是一个 L2 协议,自 2024 年 12 月起在测试网上上线,旨在为链上 AI 代理的创建、部署和货币化提供支持。该协议包含CapX 超级应用和CapX 云服务,并由Symbiotic 上超过 3 亿美元的再抵押资产提供担保。CapX于 2025 年 3 月在由 Manifold 和 Luganodes 领投的种子轮融资中筹集了310 万美元。

随着大量 Arbitrum Chains 准备在主网上线,Arbitrum 从区块空间中获取核心协议收入的能力将不断增强,从而为其增长飞轮提供动力。

ArbitrumDAO 治理

ARB 是ArbitrumDAO 的治理代币,ArbitrumDAO负责管理协议升级、资金支出,并驱动数字主权国度(Digital Sovereign Nation)的增长飞轮。ArbitrumDAO 资金库中的资产通常通过 DRIP、STIP 和 LTIP 等生态系统投资计划进行部署,以促进 Arbitrum 的增长。STEP 和 AGV 等经济试验区域创造了新的收入来源,这些收入来源与核心协议收入相结合,共同驱动飞轮。

ARB 代币持有者可以通过 Snapshot 参与链下治理,并通过 Tally 参与链上治理,将投票权委托给自己或其他代表,其中一些代表还可以通过 ArbitrumDAO 代表激励计划(DIP) 获得奖励。

Arbitrum 的链上治理系统允许代币持有者对 Arbitrum One 和 Arbitrum Nova 智能合约进行变更、分配资金、修改ArbitrumDAO 章程、授权新的 Arbitrum Chains(除在 Arbitrum One 上结算的 L3 链外,这些链可以无需许可地部署),并影响 Arbitrum 的其他关键方面。截至 2025 年 5 月 31 日,ArbitrumDAO 历史上已提出 74 项链上Arbitrum 改进提案(AIP) ,其中 59 项已获通过。拥有至少 100 万 ARB 的代表可以提出两种类型的 AIP :

-

宪法 AIP :修改 AIP-1 中规定的宪法或程序、修改仲裁参数、引入新的仲裁链或采取任何需要“链所有权”的行动的提案。

-

宪法AIP的通过,提案只需获得简单多数票,且“赞成或弃权”票数需达到所有可投票代币(截至2025年5月31日, ARB数量为2.209亿)的至少5%。然而,根据宪法法定人数削减法案的投票结果,该比例将降至4.5%。

-

非宪法性 AIP:不旨在执行任何宪法性 AIP 行动的提案(例如,提议将财政资金分配给生态系统投资计划)。因此,非宪法性 AIP 不会影响 Arbitrum 的行为或技术架构。

-

非宪法 AIP 要获得通过,提案需要获得简单多数票,并且“赞成或弃权”票数需要达到所有可投票代币的至少 3%(截至 2025 年 5 月 31 日为 1.326 亿 ARB)。

Arbitrum 设有一个由 12 名成员组成的安全委员会,其中一半成员由 ArbitrumDAO每六个月选举产生。该委员会负责监督Arbitrum 的技术风险,并主要负责制定紧急响应决策,以保护 ArbitrumDAO 的利益,这需要 12 名成员中的 9 名达成共识。

Arbitrum-aligned 实体

ArbitrumDAO 通过引入与 Arbitrum 合作的实体,不断实现模块化,这些实体支持 Arbitrum 并充当各自领域的专家。DAO 成立之初,其大部分工作由Arbitrum 基金会领导。Arbitrum 基金会已获得7.5 亿 ARB(占代币总供应量的 7.5%),作为中立的管理者,协助 ArbitrumDAO 各项计划的实施,以履行其促进生态系统发展、深化开发者教育、领导社区计划和支持技术进步的使命。

随着 Arbitrum 逐渐发展成为数字主权国度(Digital Sovereign Nation),其他与 Arbitrum 合作的实体,例如 Offchain Labs, Entropy Advisors, 和 Arbitrum Gaming Ventures,也在各自的领域提供卓越的运营服务。 Operation Company (OpCo)即将全面投入运营,成为 ArbitrumDAO 的“运营网格层”。OpCo 将设立一个监督和透明委员会 (OAT),负责监督与 Arbitrum 合作的实体,对其进行监督,并确保它们履行各自的职责。

2025年4月4日, Patrick McCorry, A.J. Warner, 和 Frisson当选为OAT委员会的首批成员,担任主席。此外,三位理事会成员还任命了 Pedro Breuer 和 Gavin Wang 为OAT委员会的另外两名成员。

ArbitrumDAO 财政

ArbitrumDAO 财政主要由 ARB 组成,目前已分配35.3 亿 ARB(占代币总供应量的 35.3%),并正被用于推动数字主权国度(Digital Sovereign Nation)的增长飞轮。此外,ArbitrumDAO 正在努力实现财政持有的多元化,以通过风险加权资产 (RWA) 和 DeFi创造收益。截至 2025 年 5 月 31 日,ArbitrumDAO 财政持有的资产价值为 12.1 亿美元。ARB 占ArbitrumDAO 财政 的 92.7%,ETH 占 4%,RWA 占 2.3%,USDC 占 1%。

ARB 代币

ARB 是 Arbitrum One 上的 ERC-20 等价代币,总发行量为 100 亿。该代币已空投给 Arbitrum 的早期用户,以启动其去中心化进程:

-

用户空投:2023 年 3 月向用户地址空投了 11.6 亿 ARB(占代币总供应量的 11.6%),每个地址获得的数量根据其满足空投条件的操作行为而定。

-

生态系统空投:2023 年 4 月,1.13 亿 ARB(占代币总供应量的 1.1%)被空投给各个 Arbitrum Orbit 项目和以太坊贡献者,分配金额取决于协议指标。

ARB 的每月归属率为 1.086 亿 ARB(占代币总供应量的 1.1%),预计到 2027 年 3 月所有分配都将完全归属。然而,在 2025 年 3 月,Offchain Labs 宣布了一项战略购买计划,加强了对 Arbitrum 的承诺,该公司将自行决定在公开市场上购买 ARB 代币。

ARB 积极履行与治理和资金相关的职能:

-

治理:ARB 授予代币持有者将 ARB 委托给自己或其他代表的能力,从而授予ArbitrumDAO 内的治理权以及对 ArbitrumDAO 财政和协议的最终所有权。

-

资金:Arbitrum 的利益相关者通常会通过 ArbitrumDAO 批准的生态系统投资计划获得激励,为 Arbitrum 生态系统做出贡献。此外,ArbitrumDAO 批准的运营项目也由 ARB 代币资助。

总结

Arbitrum 过去几年的发展轨迹展现出令人瞩目的演变。它不再仅仅由 Arbitrum One 定义,而是由功能丰富的技术栈驱动的不断扩展的 Arbitrum Chains生态系统所定义。这些技术栈共同将 Arbitrum 定位为一个支持开发者和用户全生命周期的平台,并致力于成为最大的数字主权国度(Digital Sovereign Nation)。这一愿景不仅仅是一个愿景,而是正在通过以 ArbitrumDAO 为中心的、系统化的治理、技术和激励机制架构来实现。

Arbitrum 的成功很大程度上源于其对技术和经济基础的精心改进。Arbitrum 技术栈持续创新,推出了 Stylus、BoLD 和 Timeboost 等升级版本,使开发者能够部署专门构建的 Rollup 系统。同时,ArbitrumDAO 的生态系统投资计划和经济机会区域策略激活了飞轮,使收入、投资和增长形成了一个自我强化的循环。

Arbitrum 无处不在,它构建的不仅仅是基础设施。ARB 代币不仅管理协议,还管理着经济引擎。ArbitrumDAO 是一个日趋成熟的实体,拥有监管架构、投资部门以及不断扩展的经济影响力。

Arbitrum 的故事如今代表着一个更宏大的愿景:重新定义去中心化、社区治理的经济体。Arbitrum 不仅有望成为一个成功的生态系统,更在链上去中心化治理和可持续价值创造方面,展现出引领行业的先锋姿态。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。