似乎为了配合这个有重要意义的 10 周年纪念日,ETH 正在重新冲击 4000 美元。

从 2015 年 7 月 30 日主网上线,到 2025 年今天,十年间,它不仅见证了整个区块链行业的兴衰轮替,也用一次次升级、一次次共识,构建起一个前所未有的「世界计算机」。曾经不被看好的智能合约,如今已成为 Web3 世界最通用的操作系统。ETH 也从众筹时的几毛钱,走到了市值超过 3000 亿美元的大资产。

与此同时,以太坊基金会也完成了一次重要「换血」。内部在变,外部也在变。在过去一年中,一批传统金融背景的公司陆续买入 ETH,SharpLink、BTCS、BMNR 等机构宣布将 ETH 纳入战略资产储备。

所有这些变化,都发生在这个特殊的年份:2025 年,以太坊主网上线整整十年。

这十年,是区块链史上最浓墨重彩的一章。从一篇白皮书到一个全球数千亿美元的生态网络;从「八王议政」的创世团队,到「以太坊杀手」围剿中的孤岛突围;从 PoW 到 PoS,从技术实验室到公共基础设施,以太坊完成了自己的第一个轮回。

但它真正的故事,或许才刚刚开始。

以太坊的「前传」

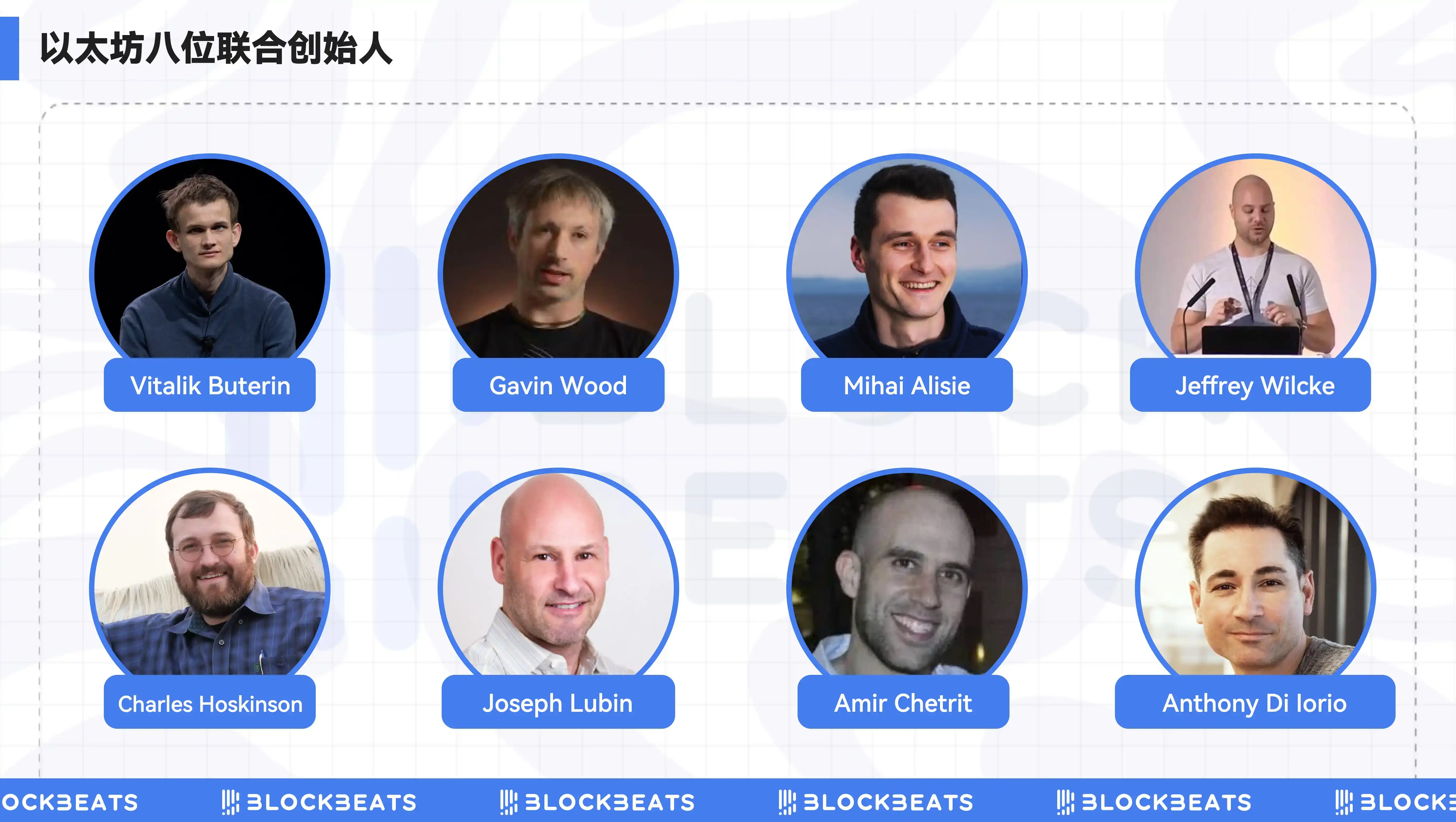

这个阶段的重点是以太坊创始团队的分裂与理念冲突,时间是在 2014-2015 年期间。Vitalik Buterin,这位总是对技术侃侃而谈的程序员天才,在被问到在以太坊旅程中最大的遗憾是什么时,他总会回答是「8 位联合创始人的事情」。显然,这 8 位早已出走的创始人是他的一件心事。

在 Vitalik 除了有一个 idea 之外什么都没有的时候,他迎接了前 10 位回应想要加入的开发者,并从中选了其中 5 位做领导层,也就是以太坊的 5 位创始人:Vitalik Buterin、Anthony Di Iorio、Charles Hoskinson、Mihai Alisie 和 Amir Chetrit。

「这显然是一个很严重的错误决定,他们看着就像是好人,而且他们想帮忙,所以当时我想,为什么不让他们成为领导层呢?」Vitalik 回顾自己当时的决定时这么说道。

关于以太坊的联合创始人,这是一个有争议的话题,网络上的版本又很多,甚至连维基百科的相关条目也不断地被编辑修改。在 Vitalik「亲口认证过 8 位联创」之后,社区广泛认可的版本是:继 5 位创始人之后,在 2014 年有另外三位开发者成为了联合创始人: Joseph Lubin、Gavin Wood 和 Jeffrey Wilcke。

至此,以太坊完成了早期的 8 位核心领导组建,像极了元清初期为了防止皇帝(大汗)独断专行实行的「八王议政」。

柏林「朝圣」

在去年上线的《Vitalik: An Ethereum Story》纪录片里,Vitalik 回忆到自己是从 2013 年中期开始数字游民生活的。

那是以太坊的史前时期,比特币只有 204 美元,距离 Vitalik 与 Mihai Alisie 创办 Bitcoin Magazine 过去一年的多时间。在建设以太坊时,因为受到全球各社区的邀请,他在全球到处跑。2013 年和 2014 年,以太坊在瑞士和柏林都有了总部,白皮书问世,Vitalik 到访中国,为以太坊众筹,拜访矿工。

柏林,是他长待的城市。

「朝圣」,Vitalik 这么描述当时自己活跃在柏林的 Bitcoin Kiez 区域。柏林的 Bitcoin Kiez 区域,加密货币支付非常普遍。大约几百米的范围内,有十几家商店都接受 BTC 支付。社区的中心地带「Room 77」餐吧也是一个社区中心,技术开发者、政治活动家等各色人群都会经常光顾。

Room 77 餐吧,Vitalik Buterin 摄于 2013 年,现已关闭

就在这个区域附近,以太坊租了一个办公室,距离「Room 77」餐吧只有 1.5 公里,Vitalik 走路不出 20 分钟就能到。现在在谷歌地图搜索以太坊办公室的地址「Waldemarstraße 37A, 10999 Berlin」,还能看到这个地址被标注上了 Ethereum Network Launch (30/07/2015),以及当时以太坊核心早期成员的合影照。

2014 年初期,当时大部分以太坊的核心成员基本都在 Vitalik 身边,以太坊的团队处于高度凝聚的状态。

那年 1 月份的迈阿密比特币大会上,Vitalik 和他的联合创始人们,第一次站在一起向世界展示了他们的项目,效果不错,以太坊正式进入公众视野。但,这也是分离的前夜。

2014 年 1 月在迈阿密举行的第一次以太坊聚会,图源网络

瑞士分裂

整个 2014 年对币圈来说都不是那么平凡,门头沟被盗破产使比特币的价格严重下滑,从高峰值 951.39 美元跌至 309.87 美元,跌幅高达 67%。也是这一年,CZ 卖掉了上海的房子,以 600 美元的价格梭哈比特币担任 OK CTO。刚从麻省理工毕业的 SBF,正在华尔街投简历。

而对以太坊来说,2014 年更是一个重要的年份,上演了加密版的「硅谷八仙童出走」,这场会议的分裂,决定了以太坊的未来走向。

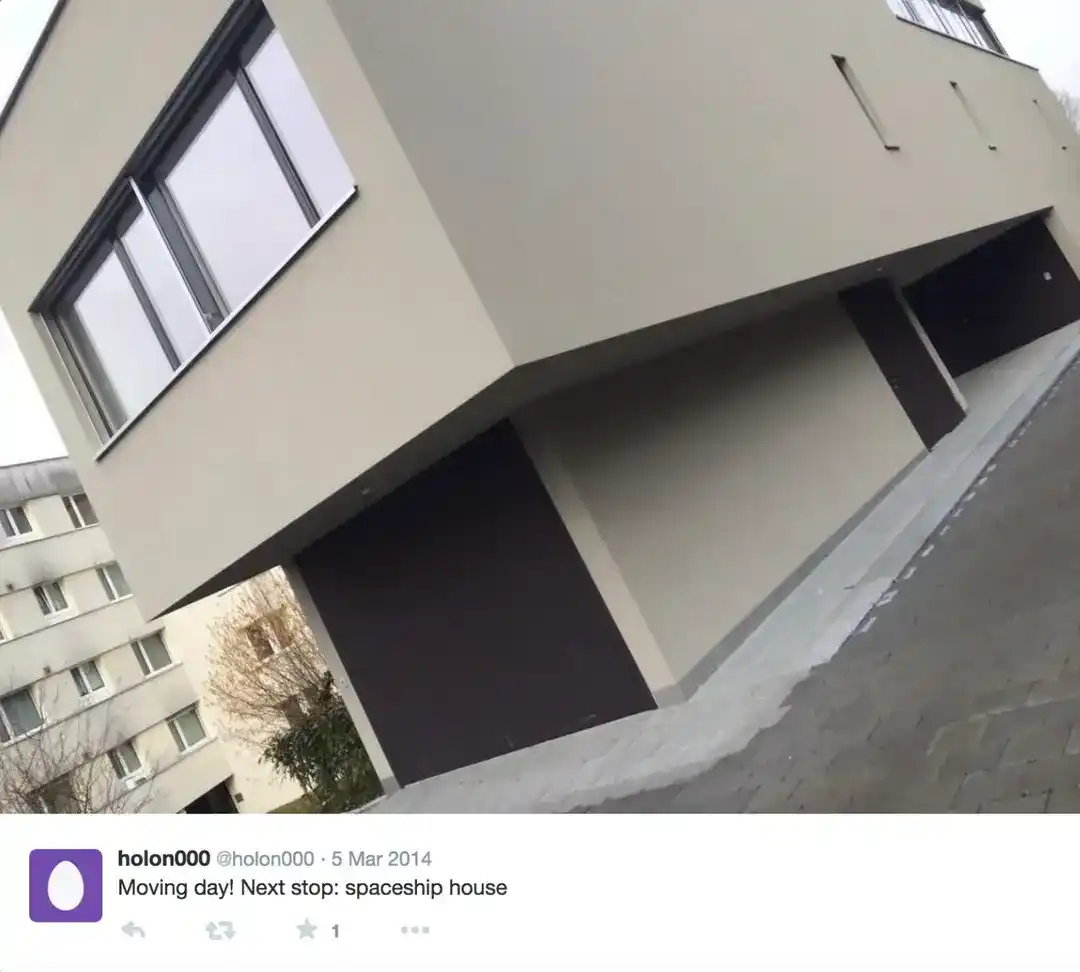

2014 年,6 月 7 日。以太坊所有的领导层成员都在瑞士参加内部会议,会议讨论的重点是以太坊的未来走向。瑞士的 Spaceship house,会议地点就选在了这里。这是 ETH 的起源地,也以太坊的第一个总部。

Spaceship house,图源:Mihai Alisie

事实上,在这场会议之前,这个话题就已经在内部争执了很久,甚至早已衍生出了派别。以太坊内部的关系变得紧张,「到底是拿风险投资资金的钱,还是从所有普通人那里众筹资金;到底是走盈利路线,成为加密届的谷歌,还是一个纯粹的非盈利组织?」成了一个不断出现的争论。

Vitalik 回忆这段记忆的时候说道:「我曾一度被说服,倾向于让以太坊走向更企业化的路线。但这件事从来没有让我感到更舒服,甚至让我觉得有些肮脏。」

据说,这场决定以太坊「生死」的会议持续了一整天,Vitalik 的决定是选择了去中心化和非盈利的路线。「我整个过程中都在试图推卸责任,因为我真的不想承担责任,最终我不得不清除一些人。」

这个决定成为了以太坊历史上的第一个转折点,直接导致了团队的第一次重大分裂。

Charles Hoskinson 是这次冲突中最为明显的反对者,他一直主张以太坊应该成为一家商业化公司,通过风险投资获得资金,并在之后发展成为盈利的技术巨头。「一个横向的权力结构,那么清洁工和高层将处于同样的地位,这简直疯了。」

离开以太坊之后,Charles 创立了开发公司 IOHK(后重组为风险投资工作室),并推出了一个 Pos 公链 Cardano。这是连续多年的山寨龙头,因为早期重点建设在日本市场而称为「日本以太坊」,也是第一代的「以太坊杀手」,市值常年加密前十。

紧接着 Charles Hoskinson 之后,Joseph Lubin 也决定不再参与核心开发,转向创立孵化器 ConsenSys,2022 年以 70 亿美元估值完成了 4.5 亿美元的 D 轮融资,融资方包括 ParaFi Capital 、淡马锡、软银愿景基金二期、微软等顶级 VC。这些年里 ConsenSys 孵化了大量区块链初创企业,也为以太坊建设了一批批丰富的生态项目,最成功的是插件钱包小狐狸 MetaMask,以太坊生态中最常用的钱包,每周收入达 30 万美元,总收入近 3 亿美元。

与 Joseph Lubin 类似,Anthony 也是一个家底雄厚的富二代,参与以太坊的原因就是为了赚更多钱。因此在以太坊确立了非盈利的运营模式后,Anthony 开始逐渐退居二线,处于半退出状态,创建了 Decentral,开发 Jaxx 数字钱包,(最终在 2015 年 12 月确定离开以太坊的工作)。2018 年福布斯排行榜估计他的净资产为 7.5 亿至 10 亿美元,入选加密货币领域富豪前 20 名。不过在 2021 年,他宣布基于个人安全考量决定「清仓」退圈,不再资助任何区块链项目,后续打算投身于慈善和其他事业。

而 Amir Chetrit,则是因为缺乏对以太坊的投入,在这次瑞士的会议上受到其他开发者和创始人的抨击而离开,后投身于其他行业,因为一直匿名且注重隐私保护,他的信息少之又少。

到 2014 年底尘埃落定时,原八位联合创始人中,仅剩 Vitalik Buterin、Gavin Wood、Mihai Alisie 和 Jeffrey Wilcke 四位还留在团队中。

Vitalik 也曾反思,自己在挑选团队时过于急迫,并未能考虑到各个成员之间的深层次分歧,理念的冲突和利益的碰撞,远比他当初设想的要复杂得多。「我确实是在那时意识到,加密货币领域的人并不是,都像我一样为理想而奋斗,很多人确实只是想赚很多钱。人与人之间的关系是个现实问题。」

工作还要继续,Vitalik 和其他留下的人工作接着展开。对于 Vitalik 来说幸运的是,当时基金会正在接管更多工作,而他身边最重要的技术伙伴 Gavin Wood,仍然与他并肩作战。

跌跌撞撞的基金会

2015 年 7 月 30 日,是以太坊主网上线的历史性时刻。

一些早期成员都围在柏林的办公室里,一起见证 1028201 个区块后自动启动的以太坊。一张极具历史意义的照片,记录了当时的一些核心成员。与 Vitalik 同框的人包括了几位值得一提的核心开发者包括:

Gustav Simonsson 是以太坊早期的安全顾问,在以太坊主网的安全发挥了至关重要的作用。离开以太坊后,他加入了 Dfinity,继续在去中心化计算网络的领域深耕。

Christian Reitwiessner 是 Solidity 编程语言的开发者,为以太坊运行智能合约提供了基石。

在 Solidity 开发团队中,Liana Husikyan 也是一个重要成员,她是 Remix IDE 的主开发者之一。Remix 是用于编写和部署智能合约的集成开发环境,帮助简化了智能合约的开发流程。

与此同时,Christoph Jentzsch 是 Slock.it 的创始人,也是 The DAO 的发起者之一。虽然在 2016 年因安全漏洞导致了分叉,但 The DAO 仍是区块链历史上最重要的实验之一,推动了去中心化治理模式的探索。

此外,还有 ERC 20 和 ERC 725 的作者 Fabian Vogelsteller 、推动了以太坊从工作量证明(PoW)向权益证明的过渡的 Vlad Zamfir 以及是以太坊基金会的安全负责人 Jutta Steiner(后来成为了 Gavin 创立的 Parity Technologies 的 CEO)。

同时,这张照片里还有一个总被津津乐道的细节:Vitalik 躲在照片的角落里被挡住半张脸,而他最重要的技术伙伴 Gavin Wood 却在照片正中,更像是一位正儿八经的 CEO。

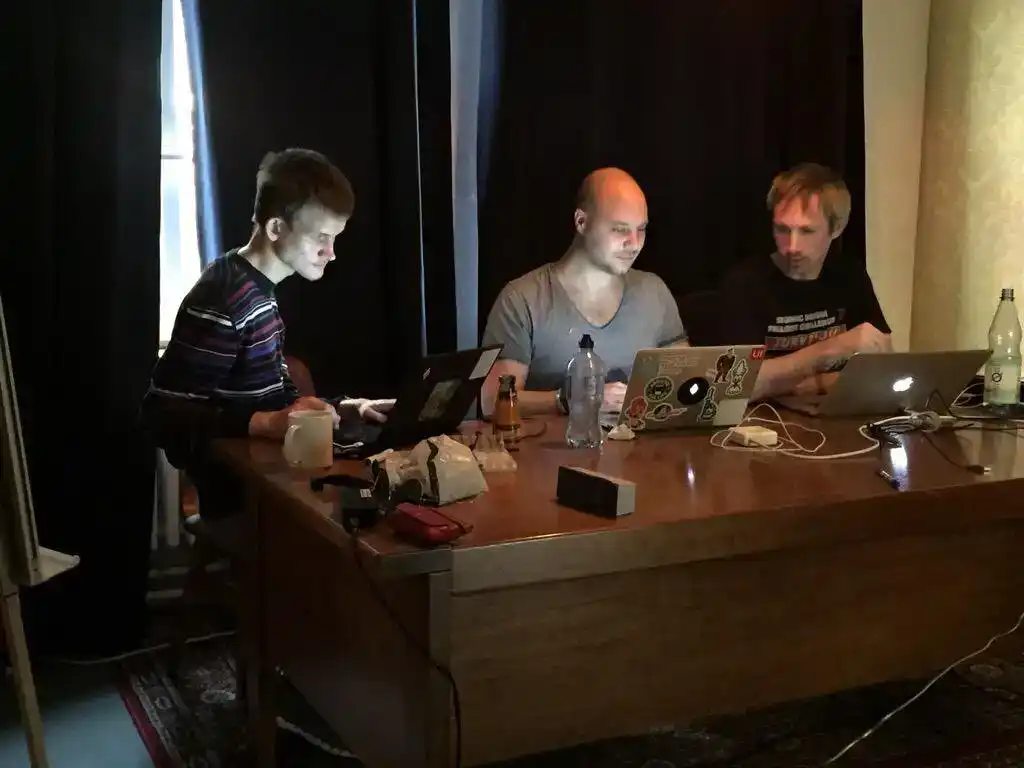

在过去的一些照片里,我们也能看到 Vitalik 和 Gavin 之间密切的合作关系。然而,谁也没有预料到,这个以太坊工程团队的领导者、以太坊黄皮书的编写者会成为接下来离开的人。

2014 年 11 月 28 日,以太坊柏林办公室举办了 DEVCON 第 0 次开发者会议,大部分成员都聚集到了柏林,此前大家都是通过 Skype 进行交流,这是第一次见面。会议留下的照片里,Vitalik 和 Gavin 两人一如既往地搂在一起

就在主网上线的 3 个月后,Gavin Wood 选择了离开,他认为以太坊需要一个更为中心化的工程管理模式将更高效。然而,Vitalik 再一次说了「NO」。巨大的分歧最终促使 Gavin 离开了团队,并创立了自己的公司——Parity(Ethcore)。Parity 很快成为了以太坊网络的重要节点运营方,一度控制了 40% 以上的网络节点。随后,Gavin 全力推动 Polkadot 的开发,在很长一段时间里都是以太坊的重要竞争对手之一。

Gavin 的离去直接削弱了以太坊在工程实现方面的能力,他的领导作用和技术专长在以太坊初期的开发中至关重要。随着他的离开,团队的效率问题也逐渐暴露出来。以太坊的 Geth 客户端开发者分布全球,团队的管理和协调问题频繁出现,开发进度也因此受到影响。

Vitalik、Jeff、Gavin,图源:Vitalik

然而在 Gavin 离开后,仅剩的两位联创 Mihai Alisie 和 Jeffrey Wilcke 都在这一时期内先后离开了。

Mihai Alisie 是 Vitalik 最早的合作伙伴之一,两人共同创办了《Bitcoin Magazine》,他曾协助以太坊在瑞士设立法律框架,并担任基金会的副主席。Mihai 的离开较为自然,他并未与团队产生激烈的冲突,但以太坊早期建设的核心力量进一步减少了。

Jeffrey Wilcke 逐渐退出的时间是在 The Dao 被黑客盗取巨额 ETH 导致以太坊分叉后,将以太坊 Go 客户端 Geth 的开发工作和技术监督权交给了他的助手 Péter Szilágyi,自己的精力转向了游戏开发和陪伴家人,时间大概是 2018 年 3 月。

Jeffrey Wilcke 照顾自己的孩子,图源网络

随着这些创始成员的离去,Vitalik 在以太坊中的孤独感与日俱增。有开发者透露,2015 年对于 Vitalik 而言是孤独而艰难的一年,他常常在柏林的办公室中过夜。

第一代基金会

最早创建时,以太坊基金会的许多成员都是临时顶上任命的。比如 Kelley Becker 和 Frithjof Weinert,分别短暂的担任了以太坊基金会的首席运营官和首席财务官,负责基金会的日常运营管理和财务管理,确保基金会有足够的资金来支持以太坊的开发和运营。但他们的任期都不长,很快就离开了基金会。

2015 年,以太坊在大规模招聘的同时,基金会也接管了更多工作,以太坊核心开发者被归入了以太坊基金会的研究小组。

直到 2015 年 4 月 10 日,以太坊基金会开始有了自己的组织架构,开启了董事会选择,运作逐渐走上正轨。2015 年年中,在 IT 和管理咨询领域拥有多年的经验的 Ming Chan 被任命为以太坊基金会的新执行董事,处理基金会的日常运营事务,使其规范的管理,确保技术开发和社区运营在法律和监管的框架下顺利进行。

基金会的内部架构也进一步明确。除了 Vitalik 依然作为技术和社区的核心人物外,Lars Klawitter、Vadim Levitin 和 Wayne Hennessy-Barrett 也加入了基金会的董事会。

Lars Klawitter 在基金会中负责技术与创新的整合工作,他早年作为创业者活跃于互联网革命时期,曾担任劳斯莱斯汽车的创新业务负责人。而 Vadim Levitin 则是一位曾为联合国工作、拥有广泛国际经验的技术专家,帮助以太坊基金会在全球范围内拓展影响力。Wayne Hennessy-Barrett,是另一位为基金会带来全球视野的董事会成员,在非洲新兴市场有着丰富的运营经验。

随着这些新成员的加入,以太坊基金会逐步完善了自己的治理结构,基金会的核心任务也逐渐从技术开发向社区协调和资源分配转变。

当时基金会还持有大量的 ETH 资产,并通过资助各种研究项目和开发者团队来支持以太坊生态系统的发展。

第二代基金会

2018 年,币圈已经历了 ICO 大爆发和 94 大暴跌,开始了加密货币的「监管清算之年」,比特币价格从最高 19870 美元跌至最低 3000 美元左右,Binance 一跃成为全球最大的交易平台。距离主打高性能高效率高吞吐量的「以太坊杀手」Solana 问世还有 2 年时间。

而人们说起以太坊时,伴随提到的事基本是两件:一是以太坊 2.0 的升级,二是以太坊基金会又又又卖币了。

基金会控制的 ETH 供应量在几年里不断减少不断抛售,社区成员表现出的负面情绪偏多,不过也有以太坊基金会成员表示,这是基金会有意去中心化的表现之一,「EF 有意识的想减弱自己的影响力和作用,是一件好事。」

确实,自从 2018 年 Aya Miyaguchi(宫口礼子)接替 Ming Chan 担任以太坊基金会的新任执行董事后,基金会不再像最初那样是所有开发工作的中心枢纽,更多地转向了支持和协调不同项目之间的沟通与合作,以及扩大基金会与外部合作伙伴的合作,比如 ConsenSys。

Aya Miyaguchi 上任之后,EF 的职责划分更清晰了,主要限于:

1、每年举办一次 Devcon 或 Devconnect;

2、维护一个执行客户端 Geth,但不维护任何共识客户端;

3、每年向更广泛的社区提供数千万美元的无附加条件的资助;

4、主持电话会议:比如由 Tim Beiko 主持的 All Core Devs(ACD),由 Alex Stokes 主持的 All Devs Consensus(ACDC)等等;

5、做研究:这可能是仍然集中化的部门之一,但有可能部分 EF 研究团队将会独立;

6、路线图制定:Vitalik 更新了路线图图示,然后有几十项工作由不同团队并行开发;

以太坊基金会官网目前公开的领导层成员只有三位,除了 Aya Miyaguchi 和 Vitalik 之外,还有一位董事会成员 Patrick Storchenegger。

在这一时期中,以太坊基金会中几位新一代的核心开发者逐渐崭露头角,成为了以太坊 2.0 以及整个生态系统中的关键人物,以下是我个人认为在以太坊中很重要的人员名单包括:Danny Rya、Justin Drake、Tim Beiko、Dankrad Feist、Solidity 的创造者 Christian Rwitqiessner 和 Péter Szilágyi 等。(在我看来,没有特定的顺序,也不一一细数了)

Danny Ryan 是以太坊 2.0 团队的核心成员,被社区誉为「以太坊 2.0 的总工程师」,在协调以太坊 2.0 的开发进程中起到了至关重要的作用,特别是在信标链的推出和合并升级过程中,并在纪录片《Vitalik: An Ethereum Story》中作为第一个出镜的以太坊基金会研究员。

自 2017 年加入以太坊基金会以来,Justin Drake 的主要工作也是以太坊向权益证明(PoS)的转型,并且在 ETH 合并的执行中发挥了关键作用。此外,Justin Drake 也是社区中关于以太坊未来技术路线图的主要发言人之一,经常参与播客和访谈来教育公众,比如以太坊基金会的 Reddit AMA,Justin Drake 也是几个主要发言人之一,在社区中的基础非常好。

Tim Beiko 自 2018 年全职加入以太坊基金会,并在 2021 年成为核心开发者的领导之一,负责组织 ACD 电话会议,是以太坊核心开发者之间的重要桥梁。作为协议工程师,他的工作涵盖了多个以太坊改进提案的推进。

Dankrad Feist 是以太坊基金会的重要研究员,专注于无状态(Statelessness)和数据可用性(Data Availability)问题的研究。他提出的「Danksharding」概念在以太坊的分片技术路线中,因此以太坊主网最后选取的拓展方案就是以 Dankrad Feist 以自己的名字命名。同时,他对 MEV(最大可提取价值)问题的研究也对以太坊的安全性提供了新的见解,不过在这个问题上,他与 Geth 目前的开发负责人 Péter Szilágyi 曾产生过公开的争执,最终迫使 Vitalik 出面调停。

完成了团队成员的稳固后,从 2018 年到 2022 年,以太坊生态扩张获得了主流认可。2019 年,Uniswap、Compound 、SushiSwap 等 DEX 为任何提供流动性的 DeFi 用户提供了丰厚的收益率,DeFi Summer 让以太坊的 TVL 快速增长。2021 年,是「元宇宙的世纪元年」,Facebook 更名为 Meta,为 NFT 的大爆发做出铺垫。2022 年,币圈经历了「雷曼时刻」,Luna 和 FTX 先后倒下,Solana 生态受到重锤,而以太坊成功从 PoW 转为 PoS,Layer2 赛道蓬勃,一时风光无两,完成了自己的爆发期。

「中年危机」

然而,月盈亏,水满溢,凡事盛极必衰,物极必反,阴阳转化,盈虚消长。2024 年,以太坊终于迎来了自己的「中年危机」,币价停滞不前。

2024 年,也是一个重要的年份,ICO 10 周年。10 岁的 Apple 差点破产,市值最高也才 200 亿美元。上市十年的微软市值从 6.7 亿美元增长到 1300 亿美元。而以太坊的市值,是 3210 亿美元。虽然在这 10 年里的市值增长上,以太坊几乎比现在所有的科技巨头表现都更迅猛,甚至一度被认为将会超越比特币。

但金融界有一个规律是,当一个资产规模达到 3000 亿或 5000 亿美元时,都会面临一个「增长瓶颈」。作为全球第 34 大资产,ETH 的市值是 3210 亿美元,正值「增长瓶颈」内。「车」太重,「庄」太散,在这种规模下,以太坊的增长是非常困难的,几乎是在与「重力」抗争。

以太坊滞涨,比特币却屡创新高,Solana「置之死地而后生」。没人能用三言两语讲述完当时以太坊基金会存在的问题和故事的全貌。但我们都知道的是,ETH 币价的低迷表现,让这一两年的以太坊和以太坊基金会一直站在风口浪尖。

作为一个去中心化的非盈利组织,处理好以太坊的内部组织架构也并不容易。回顾以太坊一路走来,从 8 个创始团队理念不合「各自分离」,上演加密版的「硅谷八仙童出走」。而如今在币价滞涨的背景下,社区的不满情绪陷入了周期性的愤怒循环,时不时就会爆发一次,社区嘲讽 ETH 价格的梗图也更新了一波又一波。甚至以太坊基金会内部的复杂关系和理念冲突也在继续,研究员互喷是常事,Vitalik 被骂也是常事。

除了 Vitalik 外,还有一个人感觉也很不好。那就是以太坊基金会的前执行董事 Aya Miyaguchi(宫口礼子)。

在过去一年的时间里,Aya 都受到了以太坊社区的诸多声讨,在以太坊中文区和英文区都是一个颇具争议的角色。

近一年以来,以太坊最大的杀手 Solana 置之死地而后生,除了创始人 Toly 为各种「solana 赌场文化 meme」的努力站台之外,Solana 基金会主席 Lily Liu 的工作也得到社区的认可,比如提出了「用链上质押生息支付链下现实交易」的 PayFi 概念、举办了很多场质量极高的黑客松比赛、投资了不少 Solana 生态的优质项目。

而在不少以太坊社区人的眼中,Aya 任以太坊基金会执行董事的 7 年里,几乎没有任何「成果」。

「被雇佣做一份不具备资格的工作 7 年,不做任何工作却能获得报酬」,英文社区中以 CoinMamba 为首的交易员和 KOL 对她的怨念最深。

他们甚至试图通过舆论压力让 Aya 离开:发表过「Aya 离开的那天就是以太坊的解放日」、「Aya 离开的两周内 ETH 就会新高」、「我们继续施压,她就会辞职」等言论。甚至有一些人对她发出不理性的辱骂和死亡威胁。

如果大家还记得过年那段时间 Vitalik 各种破防的推特,比如抄送 Milady 的抽象用语,甚至想过离开以太坊等「精神状态良好」的发言时期,正是那段时间,Vitalik 受到了社区给予的极大的舆论压力。

第三代基金会

直到 2025 年 3 月,以太坊基金会终于宣布了一项领导层的重大变动:执行董事 Aya Miyaguchi 卸下日常管理职责,转而担任基金会主席。两位全新的联合执行董事,来接替 Aya 原来的位置——Hsiao-Wei Wang 和 Tomasz Stańczak。

Hsiao-Wei Wang 最开始是一位后端工程师,2016 年因偶然接触区块链。当时 Vitalik 正在寻找对以太坊研究感兴趣的贡献者,Hsiao-Wei 主动申请成功加入,成为核心开发者之一。

这位来自中国台湾的区块链先驱,专注于以太坊的核心研究已经 7 年了,在分片(Sharding)和 Beacon Chain 领域做出了重要贡献。分片技术是解决以太坊扩展性问题的关键升级,显著提升网络吞吐量,使以太坊在处理大量交易时更加高效流畅。此外,她还长期负责以太坊协议的审查和概念验证(PoC)开发,为以太坊 2.0(即 Eth2)的推进打下了坚实的技术基础。

尽管在技术领域深耕多年,Hsiao-Wei 并没有让自己局限于代码世界,而是积极投身于社区建设。她经常代表以太坊基金会参加并组织各种技术会议,尤其是在台湾地区,她策划并推动了许多高质量的以太坊技术交流活动,成功搭建起本地开发者与全球以太坊生态的桥梁。例如,在 2018 年台北以太坊碎片研讨会(Ethereum Sharding Workshop Taipei)上,她作为组织者,还在技术讨论环节中居于核心位置。

2018 年台北以太坊碎片研讨会 Hsiao-Wei Wang 居 C 位

另一位以太坊基金会的联合执行董事 Tomasz Stańczak。作为 Nethermind 的创始人,他不仅是以太坊核心开发者之一,还在 MEV(最大可提取价值)和 PBS(提议者-构建者分离)等关键领域进行了深度研究。

在进入区块链领域之前,Tomasz 曾是一名金融市场的工程师,拥有丰富的技术经验。2017 年,他正式加入以太坊开发团队成为核心开发,是 FlashBots 的早期团队成员,也是 Starknet Foundation 的董事会成员。

之后他还创立了 Nethermind,以太坊如今最重要执行客户端之一。Nethermind 最初只是一个实验性项目,但在 Tomasz 的领导下,它迅速成长为以太坊生态系统中最重要的基础设施之一,与 Geth、Besu、Erigon 并列为五大执行客户端之一。相比于 Geth 的历史积淀,Nethermind 以其高效的代码架构、灵活的定制性和强大的企业级支持,吸引了越来越多的开发者和机构用户。

Hsiao-Wei Wang 和 Tomasz Stańczak 则被任命为新的共同执行董事,同时前 EF 研究员 Danny Ryan 的回归也迎来社区一阵欢呼。

正如前文所说,Danny Ryan 是以太坊 2.0 团队的核心成员,被社区誉为「以太坊 2.0 的总工程师」,在协调以太坊 2.0 的开发进程中起到了至关重要的作用,特别是在信标链的推出和合并升级过程中,并在纪录片《Vitalik: An Ethereum Story》中作为第一个出镜的以太坊基金会研究员,且在一次 Ether 的非正式社区投票中,Danny Ryan 曾被被选为担任 EF 唯一领导人的最佳人选。在 2024 年 9 月 13 日宣布因个人原因无限期退出以太坊的开发,结束了七年以太坊开发生涯。今年 3 月,Danny Ryan 宣布重回以太坊生态,担任以太坊生态机构级营销与产品部门 Etherealize 联创。

换庄的真相

换庄这个故事,在 2024 年就已经传得沸沸扬扬。香港大会后,更是传出「以太坊地下车库换庄」的轶闻。

链上的数据能嗅到一丝蛛丝马迹。2024 年 12 月至 2025 年 4 月,是以太坊价格自由落体的阶段,但也是赫芬达尔-赫希曼指数(HHI)悄然拐头向上的时刻。

图源为 Glassnode

HHI 是衡量资产集中度的指标,在以太坊链上,它代表着筹码的归属趋势。价格暴跌的同时,HHI 却在快速上升,说明 ETH 并没有被市场普遍抛售,相反,它正在从分散的散户手中,集中到少数大户甚至机构地址中去。

数据和趋势之外,更明显的是,在以微策略为首的加密战略储备叙事主导的新一轮涨幅中,扮演 ETH 战略储备的上市公司也屡见不鲜。

2025 年 5 月,SharpLink Gaming($SBET)宣布通过 PIPE 融资 4.25 亿美元,购入 176,271 ETH,当时市值超 4.6 亿美元。

6 月,BitMine Immersion Technologies($BMNR)宣布,将通过 PIPE 融资 2.5 亿美元购入 ETH,明确「转型为 ETH 基础设施资产管理商」。消息发布后,BMNR 连续多日暴涨,成为 SBET 之后的又一支「ETH 概念股」。

与 SBET 不同,BMNR 不再只是「买币屯币」,而是将目标明确指向 ETH 质押收益、链上现金流和 DeFi 生态参与。这是传统矿企首次以「类 ETF 逻辑」转型做多 ETH,也表明庄家的思维已经从方向性下注,变成结构性捕捉。

几乎与此同时,BTCS($BTCS)。它没有高调公布一口气买多少 ETH,而是强调融资结构的创新性:「DeFi + TradFi」的混合融资模型。它买的不只是 ETH,而是买入一种稳定币流动性的锚定资产。

Bit Digital($BTBT)也悄然披露其购入 2 万枚 ETH,计划从原本的 BTC 矿企转型为 ETH 质押节点运营方。在这轮换庄中,BTC 阵营里部分玩家,已经开始站到对岸。

从 SBET 打响第一枪,到 BMNR、BTCS、BTBT 等美股和矿企依次接棒,整个过程不到 1 个月,节奏迅猛、清晰而有序。

而同样值得注意的是,目前最大的 ETH 战略储备公司 SBET 公开的最大个人股东不是别人,正是以太坊的八大联创之一的 Joseph Lubin,如前文所说他因理念不同而离开以太坊之后创建了 ConsenSys。Joseph Lubin 本人不仅持有大量以太坊,还在投资 SharpLink 后,成为其董事会主席,持有 SBET 9.9% 的股份。

有意思的是,在 2024 年 7 月份布鲁塞尔的 EthCC7 会议上,Vitalik 演讲结束后,曾经的以太坊三位核心创始人 Vitalik Buterin、Joseph Lubin 和 Gavin Wood,完成了世纪大合影,算是给曾经这段的「决裂」闭环了一个体面的句号与和解。

没有 Vitalik 的以太坊

在 Vitalik 父亲的回忆里,以太坊刚建立的时候,Vitalik 没有想做什么领导,更多的想法是:「嘿,我想出了一个很酷的点子,让我先写下来,然后或许会有一些聪明有影响力的人做点什么。」

但是然后,事情发生了一些变化,很多人加入项目,他们告诉 Vitalik :「应该推动这个项目的人,是你。」于是,人们就将他推向了领导者的位置,但这一切不是顺其自然的,对他来说,这是他舒适区之外的事,这仍然是他面临的最大挑战之一。

「Vitalik 曾几乎完美的满足了我们的社会对科技创始人的那种深化形象,对年轻的崇拜,对某种天真无邪却又拥有强大力量的执着迷恋。」就像多次采访过 Vitalik 的经济学教授 nathan schneider 说的那样。

但 2025 年,Vitalik 31 岁了。

在黑山做 Zuzalu 时,他看到比他年轻整整十岁的人在各种项目中担任领导角色,作为组织者或开发人员;在韩国的一个 30 人左右的黑客聚会,他第一次成为房间里最年长的人。

Vitalik 满足了一大批程序员对理想中的自己的想象,年轻,传奇。Vitalik 是一种符号,不再年轻的他已经不适合做这样的角色了,他自己也意识到了这一点。

10 年前,他想的是做点很酷的东西,很多人都称赞他是像扎克伯格这样的改变世界的、厉害的、年轻的神童之一。而现在经历了加密时代的变更、俄乌战争、生存与死亡后,Vitalik 有了新的感悟:「我现在正扮演着完全不同的角色,是时候让下一代接过曾经属于我的衣钵了。」

「我很好奇如果没有 Vitalik 的领导,以太坊是否还能生存?」此前,一个相关的讨论帖子在以太坊 reddit 上得到了许多讨论:「过去几年,Vitalik 确实不像人们想象的那样引领以太坊」、「我甚至听说,Vitalik 甚至不是解释以太坊路线图的最佳人选。」

在以太坊基金会工作的 marcocastignoli,也表达了自己的个人观点:「虽然我不是其中之一,但我清楚的知道 Vitalik 只是 EF 研究团队一员,研究团队都是一群太聪明的大脑组成的,而 Vitalik 在他们中间只是平均水平」

前文提到过的几位新的核心成员逐渐崭露头角,成为以太坊社区中的核心开发。

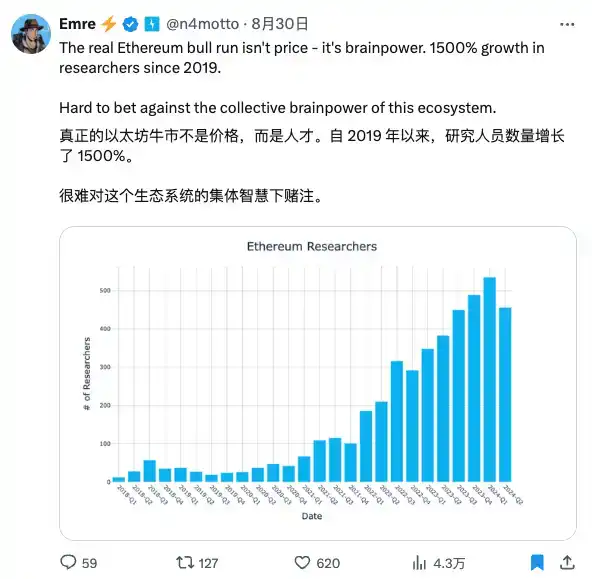

况且根据 Electric Capital 的统计,目前活跃的以太坊核心开发者多达 99 名,这一数据远远领先于其他区块链项目,如比特币、Cardano、EOS 或 Tron。再往更大的范围看,目前以太坊网络已经拥有超过 25 万名开发和研究人员,是最去中心化的区块链开发社区之一。

年轻的 Vitalik 在被暴雪抛弃时,他能用自己的技术创造一个新世界,似乎一切都是由技术创造的。而经历过这几轮以太坊团队成员的大洗牌之后,他发现自己终于无能无力了,Vitalik 的自我就是从这时开始被解构的。

就像他 30 岁人生感悟的结尾写道的那样:社区、意识形态、「场景」、国家,或者非常小的公司、家庭或关系——都是由人创造的。

而不是由技术创造的。况且 Vitalik 也早已经不是以太坊中最年轻、最聪明甚至最能代表路线图的技术研究员了。Vitalik 的角色将继续弱化,终有一天,以太坊会成为没有 Vitalik 的以太坊。

或许现在是时候,想象一下没有 Vitalik 的以太坊了。

作者注:本文尝试概括以太坊的核心组织成员变化,但以太坊的成员比我已知的要丰富得多,把它们都放在一篇文章结构里需要略去许多细节,因此略有疏漏。感谢每一位提供信息和其它反馈的朋友。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。