Injective ETF News: Cboe’s Bold Move Could Redefine Staked Crypto ETF

Cboe BZX files for first-ever staked Injective ETF news in the U.S

The Cboe BZX exchange has filed a fresh filing with the U.S Securities and Exchange Commission (SEC) for an Exchange Traded Fund that would track Injective’s (INJ) native token.

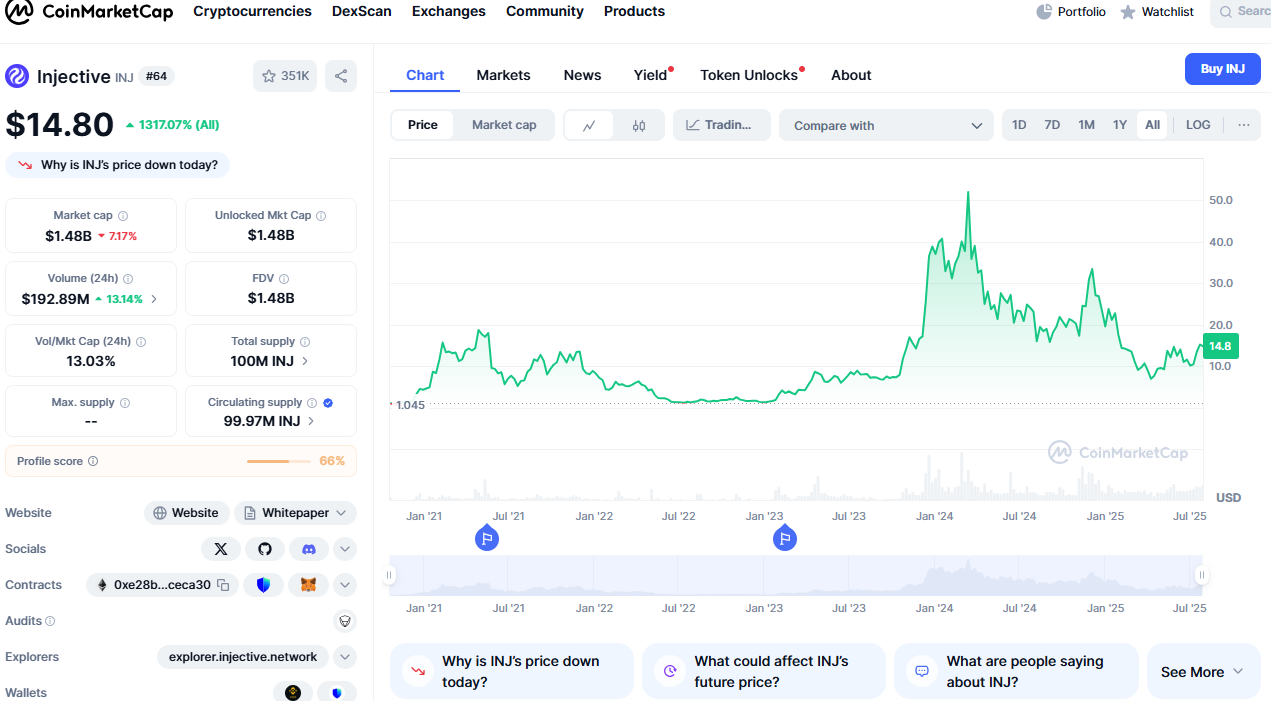

This filing was made on behalf of Canary Capital Group LLC which proposed the launch of the "Canary staked INJ ETF” and potentially marking a breakthrough for bonding enabled crypto funds in the U.S market. Currently Injective is trading at $14.81 even after the filings no growth has been seen in the prices.

Source : CoinMarketCap

Canary capital leads efforts for bonded altcoin

Canary capital first proposed this earlier this month which aims to introduce a yield bearing product tied to the INJ. If the file gets approved, then Canary staked Injective ETF news would not only allow investors to gain exposure to INJ but it also potentially provides benefit from its staking rewards.

This is one of the first serious attempts to bring a staking based altcoin ETF to mainstream U.S equities exchanges.

Regulatory climate turning positive for Crypto

The filing comes as the SEC considers dozens of new proposals for digital asset including the funds tied to Solana (SOL), Dogecoin (DOGE) and XRP. Since President Donald Trump held office earlier this year.

The Securities and Exchange Commission had already approved spot Bitcoin and Ethereum under the previous administration which followed a pivotal court ruling and setting a precedent for more digital asset funds.

In May, the Securities Exchange Commission’s division of Corporation Finance explained that certain blockchain staking activities may not fall under securities offerings. This statement has opened the door for innovative models like the Canary staked Injective ETF news to enter into the US market.

Growing interest in staking enabled funds

Earlier, Rex-Sprey launched the first ever staked crypto in the U.S. Though under a different regulatory framework. The Cboe’s latest filing adds momentum to the growing trend of combining staking rewards with spot ETFs and giving investors new ways to earn yields on their crypto holdings.

Conclusion

Canary staked injective ETF news signals a major step toward Altcoin based and staking enabled in the U.S. If the SEC approves the filing it could pave the way for more innovative digital asset funds and expanding investor options in the rapidly evolving crypto market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。