Tether 与 Circle 的“监管套利”生意经

Tether (USDT):

2024 年利润:约 130 亿美元,几乎全部来自 1200 亿美元美债投资组合的利息收入

与此同时,USDT 持有者未从业务中获得任何收益。

Circle (USDC):

2024 年收入:17 亿美元,其中 99% 为 USDC 储备金的利息收入(储备金约 80% 投资于短期美债,20%存放在银行)

同样的,Circle 保留全部国债收益,USDC 用户收入为零。

早有分析师指出,这种收入模式实质上是“无利息支出的窄银行”架构,是教科书式的监管套利。

未来趋势

有鉴于上述背景,一个合理的推测是,稳定币演化的下一步,是从单纯的价值储存工具演进为兼具稳定性和收益性的金融产品,即“收益型稳定币”。摩根大通此前预测,收益型稳定币将在 2030 年占据约 50% 的稳定币市场份额(目前这一数字是 6%)。

按照收益来源,可以将收益型稳定币分为衍生品模型、RWA 模型以及 DeFi 收益模型三种。我们以 @levelusd 为例,看下其收益模式是如何运作的。

根据官方最新的文章,Level 的 slvlUSD 通过将 7158 万美元储备金分配到精选借贷市场来产生收益。具体为:

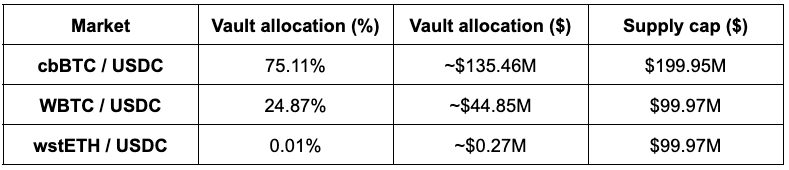

46% 配置于 Morpho Steakhouse USDC 金库

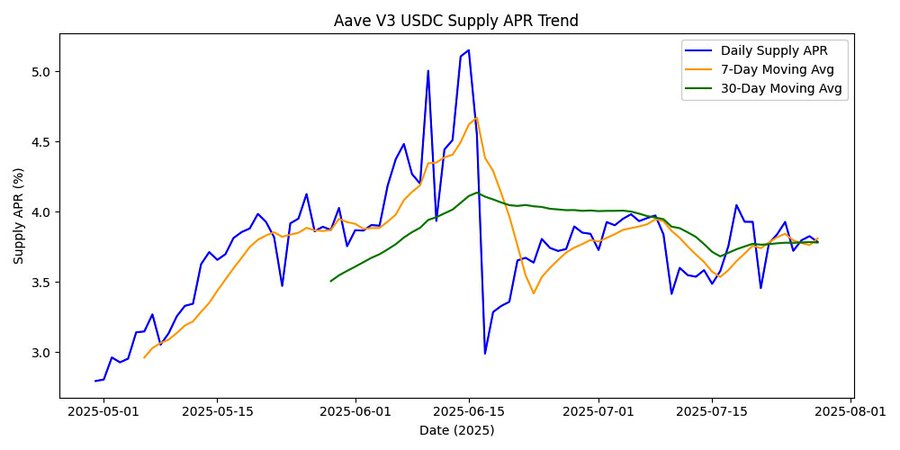

47% 配置于 Aave v3 USDC 市场

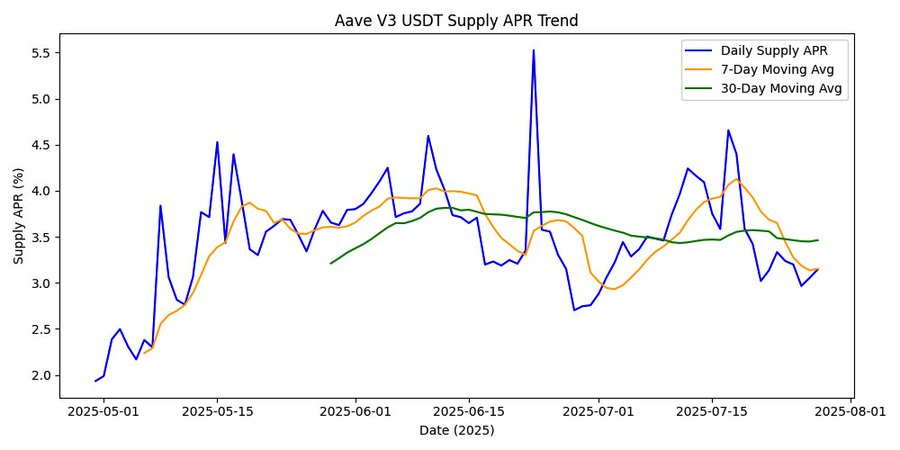

少量配置于 Aave USDT 市场

Aave:利率经历 5-7 月的上升后,于 7 月下旬趋于平稳

Morpho:金库收益率上升,7天 APY 达6.84%

Level 通过跨平台配置策略,持续监控市场利用率和动态调整配置,为 slvlUSD 持有者提供了竞争性的可持续回报。值得一提的是,$lvlUSD 只能通过 USDC 或 USDT 铸造,也就是说,Level 弥补了 USDC 或 USDT 持有人原本缺失的收益环。

个人论断是,收益型稳定币很可能成为传统稳定币的重要补充,但替代仍需时间。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。