撰文:0xYYcn Yiran,Bitfox Research

稳定币市场规模与重要性持续激增,其动力源自加密货币市场的热度和主流应用场景的拓展。截至 2025 年年中,其总市值已突破 2500 亿美元,较年初增长超过了 22%。摩根士丹利报告显示,这些与美元挂钩的代币目前日均交易量超千亿美元,且在 2024 年驱动链上交易总额高达 27.6 万亿美元。据纳斯达克数据,该交易规模已超越 Visa 和 Mastercard 的总和。然而,在此繁荣景象的背后,潜藏着一系列隐患,其中尤为关键的是,发行商的商业模式及其代币的稳定性本身,与美国利率变动紧密捆绑。值此联邦公开市场委员会(FOMC)下一次决策临近之际,本研究聚焦法币抵押型美元稳定币(如 USDT、USDC),采用全球视角,深入探讨美联储利率周期以及其他潜在风险将如何重塑该行业格局。

稳定币 101:在热潮与监管中成长

稳定币定义:

稳定币是一种旨在维持恒定价值的加密资产,每枚代币通常以 1:1 的比例锚定美元。其价值稳定机制主要通过两种方式实现:以足额储备资产(如现金及短期证券)支持,或依赖特定算法调控代币供应。以 Tether(USDT)和 Circle(USDC)为代表的法币抵押型稳定币,通过持有现金及短期证券为其发行的每一单位代币提供完全抵押担保。该保障机制是其价格稳定的核心。根据大西洋理事会(Atlantic Council)数据,目前约 99% 的稳定币流通量由美元计价类型主导

行业意义与现状:

2025 年,稳定币正跃出加密领域的藩篱,加速融入主流金融与商业场景。国际支付巨 Visa 推出支持银行发行稳定币的平台,Stripe 整合稳定币支付功能,Amazon 和 Walmart 也在酝酿发行自己的稳定币。与此同时,全球监管框架日趋成型。2025 年 6 月,美国参议院通过里程碑式的《稳定币支付清晰法案》(GENIUS Act),成为联邦层面首部稳定币监管法律;其核心要求包括:发行商必须以高质量流动性资产(现金或三个月内到期的短期国债)维持稳定的 1:1 支持率,并明确持币人权利保障义务。在跨大西洋的欧洲市场,《加密资产市场监管法案》(MiCA)框架实施更为严格的规定,赋予当局在稳定币威胁欧元区货币稳定时限制非欧元稳定币流通的权力。在市场层面,稳定币展现出强劲增长动能:截至 2025 年 6 月,其流通总值已超 2550 亿美元。花旗集团(Citi)预测,该市场规模有望于 2030 年前激增至 1.6 万亿美元,实现约七倍增长。这清晰地表明,稳定币正走向主流化,但其快速增长亦伴生新的风险与摩擦。

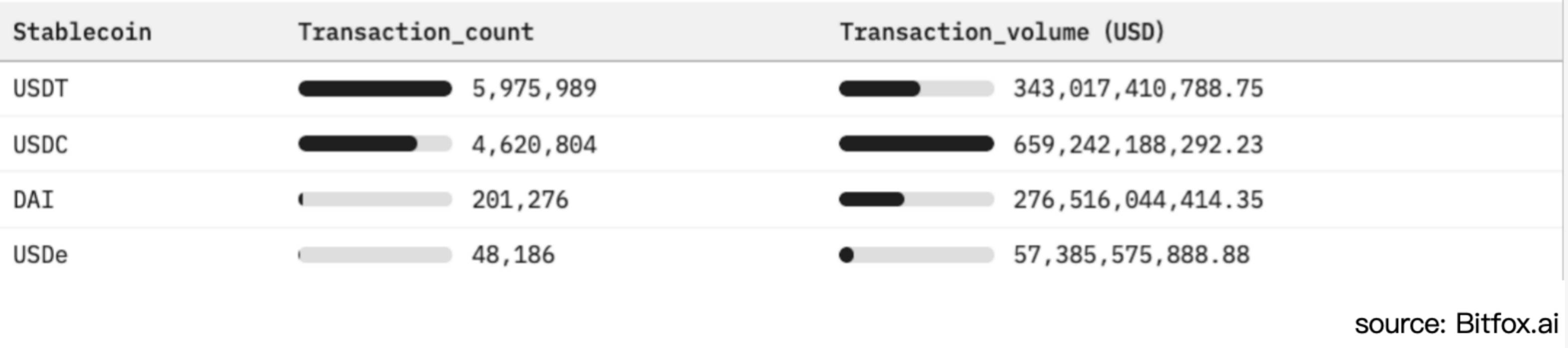

图 1:以太坊稳定币采用对比与市场活跃度分析(过去 30 天)

法币支持稳定币与利率敏感模型

与传统银行存款会为客户带来利息不同,稳定币持有者通常不享有任何收益。依据《稳定币支付清晰法案》(GENIUS Act),法币抵押型美元稳定币的用户账户余额明确设定为无息状态(0%)。此监管安排使发行商得以保留储备金投资所产生的全部收益。在当前的利率高位运行环境下,这一机制已促使如 Tether(泰达币)和 Circle(USD Coin 发行方)等公司转化为高利润主体。然而,该模式亦使其在利率下行周期中面临极高的脆弱性

储备投资结构:

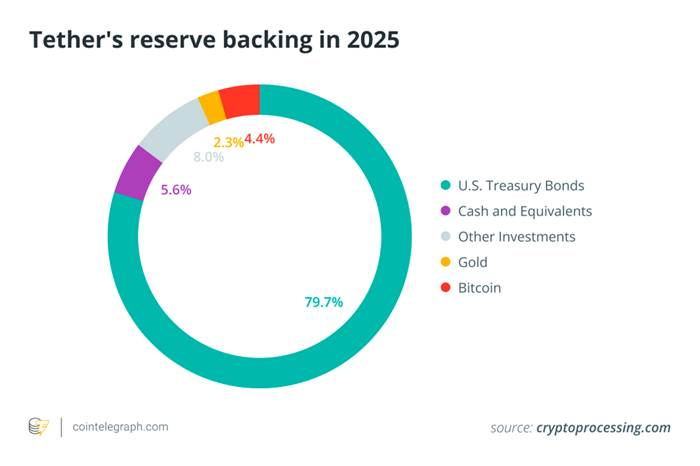

为确保流动性和维持稳定币挂钩价值,主要发行商将其储备金的主体配置于短期美国国债(U.S. Treasury bills)及其他短期限金融工具。截至 2025 年初,Tether 公司持有的美国政府债务规模达 1130 亿至 1200 亿美元,约占其总储备金的 80%,位列全球前 20 大美国国债持有方。下图展示了 Tether 储备资产配置的详细构成,清楚表明其资产高度集中于国债、现金类资产,其他证券、黄金以及比特币等非传统资产在资产组合中所占比例显著较低

图 2. 2025 年 Tether 储备资产构成(以美国国库券为主),反映了法币支持稳定币对计息政府资产的高度依赖

高质量储备资产在维持挂钩价值、增强用户信心的同时,也产生了实质性的利息收入——当前稳定币商业模式的生命线。2022 至 2023 年间,美联储(Federal Reserve)的激进加息政策推动短期国债(T-bills)收益率及银行存款利率升至多年高位,直接放大了稳定币储备的投资回报。以 Circle 公司披露的财报为例,其 2024 年 16.8 亿美元总收入中,高达 16.7 亿美元(占比达 99%)来源于储备资产的利息收益。另一方面,据 Techxplore 报道,2024 年 Tether 公司利润据报达 130 亿美元,足以匹敌或超越高盛(Goldman Sachs)等华尔街头部银行的盈利规模。此类盈利规模(以 Tether 公司约 100 人左右的运营团队创造)尤为凸显高利率环境对稳定币发行商收入的强力助推效应。本质上,稳定币发行商运作的是一种高回报的「利差交易」(Carry Trade),即将用户资金配置于收益率超 5% 的国债资产,并因用户接受零利率而全额获取该利差收益。对利率波动的脆弱性。

利率波动风险敞口

稳定币发行商的收入模型对美联储利率变动具有极高敏感性。例如,仅 50 个基点的降息(0.50%),即可能导致泰达币(Tether)年利息收入锐减约 6 亿美元。诚如纳斯达克(Nasdaq)分析机构所警示:「对利息收入的过度依赖,将使 Circle 等发行商在降息周期中陷入脆弱境地」。

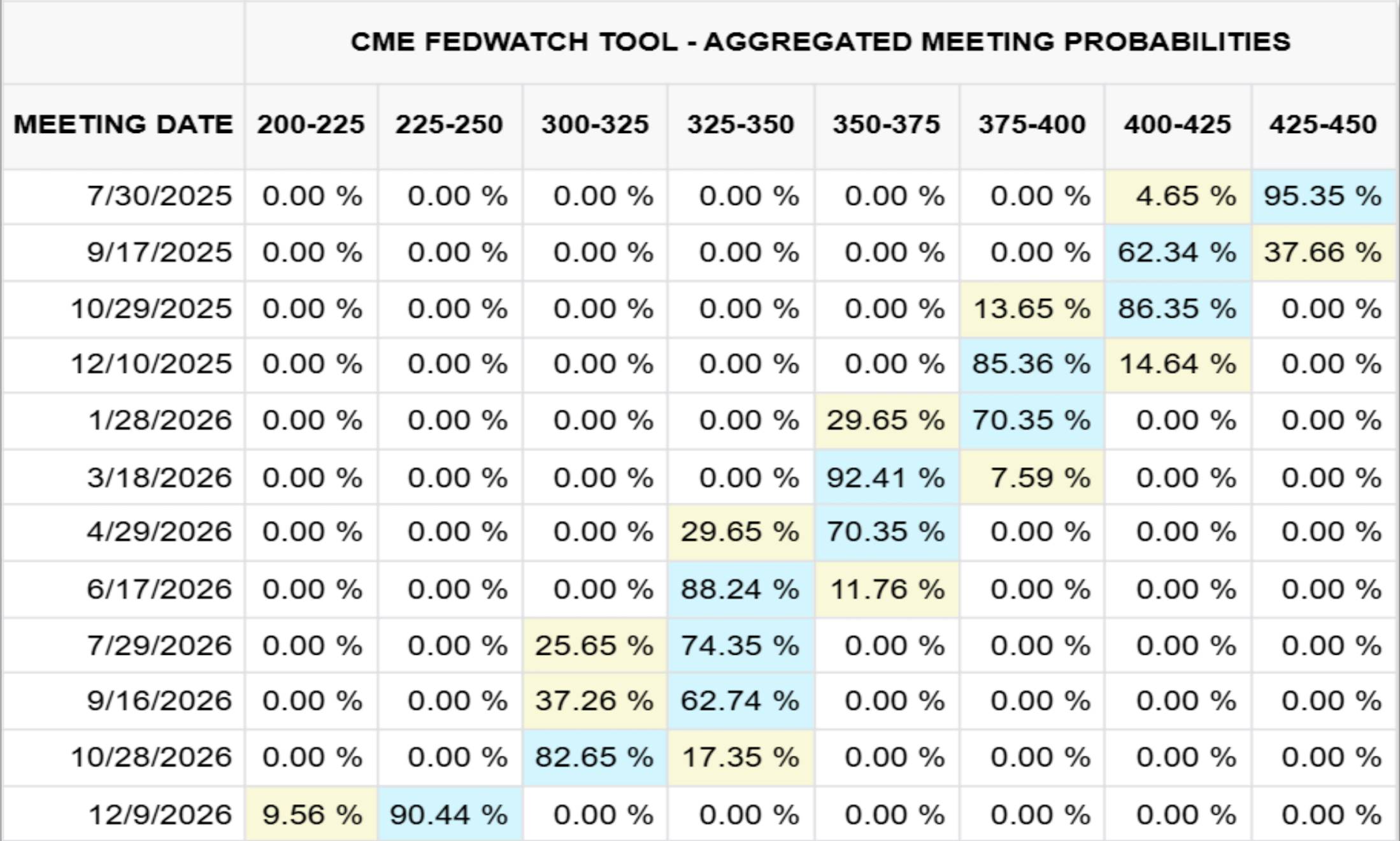

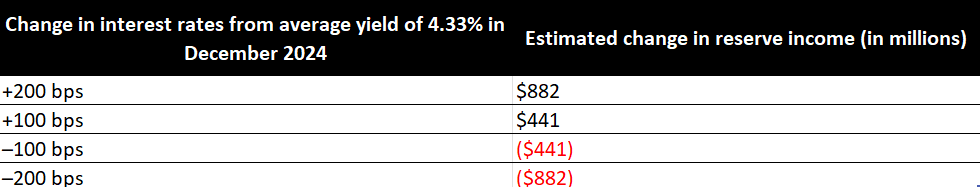

下文图 3 展示了芝加哥商品交易所(CME)基于 2025 年 7 月 23 日市场预期绘制的联邦基金利率曲线走势(预测期至 2026 年底);图 4 则通过百万美元量级的量化分析,具体阐明利率变动对 Circle 公司储备收益的冲击机制。

图 3. 2026 年 12 月联邦基金利率展望(CME,2025 /07/23)

图 4. Circle 储备收入对利率变动的敏感度

以 2024 年为例,Circle 公司储备资产利息收入达 16.7 亿美元,占其总收入(16.8 亿美元)的 99%。基于芝加哥商品交易所(CME)数据模型(截至 2025 年 7 月 23 日),若联邦基金利率于 2026 年 12 月回落至 2.25%–2.50% 区间(概率约为 90%),Circle 预计将损失约 8.82 亿美元利息收入,超过其 2024 年相关收入总额的五成。为弥补此收入缺口,该公司须于 2026 年底前实现其 USDC 稳定币流通供应量的倍增。

除利率外的其他核心风险:稳定币体系的多重挑战

尽管利率动态对稳定币行业占据核心地位,但该体系内仍存在多种其他关键风险和挑战。在行业乐观预期弥漫的背景下,亟需对这些风险因素进行系统性归纳,以提供冷静的全面剖析:

监管与法律不确定性

稳定币运营现受制于诸如美国《稳定币支付清晰法案》(GENIUS Act)与欧盟《加密资产市场监管法案》(MiCA)等碎片化监管框架。该框架虽赋予部分发行商合法性,却同时带来高昂合规成本与突发性市场准入限制。监管机构针对储备金透明度不足、规避制裁(例如 Tether 在受制裁地区涉及的数十亿美元交易)或侵害消费者权益的行为实施强制措施,可迅速导致特定稳定币的赎回功能中止或其被逐出核心市场。

银行合作及流动性集中风险

法币抵押型稳定币的储备托管及法币通道(入金 / 出金)服务高度依赖有限合作银行。合作银行突发性危机(如硅谷银行 SVB 倒闭导致价值 33 亿美元的 USDC 储备被冻结)或大规模集中赎回潮可快速耗尽银行存款储备,引发代币脱钩,并在批发式赎回压力击穿银行现金缓冲时,威胁更广泛银行体系的流动性稳定。

锚定稳定性与脱锚风险

即便宣称全额抵押,稳定币在市场信心动摇时仍可能且实际发生过挂钩机制崩溃(如 2023 年 3 月因储备资产可及性担忧,USDC 价格曾暴跌至 0.88 美元)。算法稳定币(Algorithmic Stablecoins)的稳健性曲线更为陡峭,TerraUSD(UST)于 2022 年的崩盘即为此提供了显著例证。

透明度与交易对手风险

用户依赖发行商(通常按季度)发布的储备证明报告(Attestations)来评估资产真实性与流动性。然而,缺乏全面公开审计导致可信度存疑。无论是存放于银行的现金、货币市场基金份额抑或回购协议资产,储备资产均蕴含交易对手风险和信用风险,在压力情景下可实质性损害赎回保证能力。

运营与技术安全隐患

中心化稳定币可冻结或没收代币,以应对攻击,却也带来单点治理风险;DeFi 版本则易遭智能合约漏洞、跨链桥攻击和托管机构被黑等威胁。同时,用户操作失误、网络钓鱼以及区块链交易不可逆等因素,也对持币者构成日常安全挑战。

宏观金融稳定隐患

高达数千亿美元稳定币储备资金集中于短期美国国债市场,其大规模赎回行为将直接影响国债需求结构与收益率波动性。极端流出情景可能触发国债市场的恐慌性抛售(Fire-sales);而稳定币的广泛美元化应用可能削弱美联储(Fed)货币政策传导效力,进而加速推动美国央行数字货币(CBDC)的研发或更严苛监管护栏的设立。

结论

随着联邦公开市场委员会(FOMC)下一次会议临近,虽然市场普遍预计将维持利率不变,但接下来的会议纪要和前瞻指引将成为关注焦点。如 USDT、USDC 等法币抵押型稳定币的显著增长,掩饰了其与美国利率变动深度绑定的商业模式本质。展望未来,即便温和降息(例如 25-50 个基点)亦可侵蚀数亿美元级利息收入,迫使发行商重新评估增长路径或通过向持币者让渡部分收益以维持市场采用率。

除了利率敏感性,稳定币还必须应对不断演进的监管环境、银行与流动性集中风险、锚定完整性挑战,以及从智能合约漏洞到储备透明度不足的运营隐患。尤为关键的是,当此类代币成为短期美国国债的系统性重要持债主体时,其赎回行为或将冲击全球债券市场定价机制,并干扰货币政策效力的传导路径。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。