Nativo Resources 比特币国库押注可能触发下一个 BTC 牛市

当一家黄金矿业公司决定押注 BTC 时会发生什么?这正是现在正在发生的事情,因为 Nativo Resources 的比特币国库策略令加密货币和传统金融界都感到震惊。作为一家以开采自然资源而闻名的公司,它现在正在其资产负债表上积累世界上最大的加密货币。

随着通货膨胀担忧的上升和上市公司竞相进入加密货币,真正的问题是:这是否意味着更大事情的开始?

从黄金尘到数字黄金:为什么 Nativo 刚刚做出了这个跳跃

在一个将传统与创新相结合的举动中,Nativo Resources,一家在英国上市的企业,正式步入加密货币世界。

来源:X

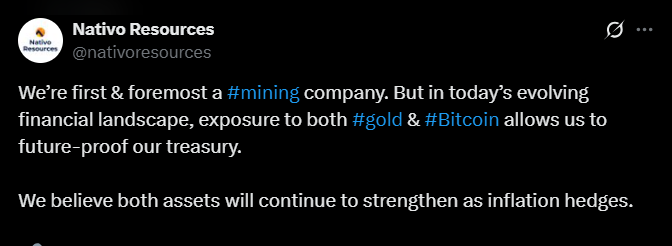

该公司宣布了一个大胆的决定,开始将部分资本储备分配给 BTC。消息在 X 上发布,公司表示:“我们首先是一家矿业公司。但在当今不断变化的金融环境中,接触到黄金和这种货币使我们能够为我们的国库做好未来的准备。”

这一新的 Nativo Resources 比特币国库计划是在公司准备重启其在秘鲁的 Tesoro 黄金特许权经营时提出的。

这使得该公司加入了越来越多的公共公司行列,朝着 比特币国库新闻 策略迈进,包括 GameStop、Sequans 和 Trump Media。

为什么选择 BTC?战略背后的通货膨胀对冲

执行主席 Christian Yates 清楚地解释了动机:“随着对法定货币贬值、全球债务上升和通货膨胀的担忧加剧,我们相信这两种资产将继续作为通货膨胀对冲而增强。”

来源:NTVO 比特币国库

这种储备多样化使 Nativo 接触到 数字黄金与真实黄金,与当今快速变化的金融环境相一致。

作为一名加密分析师,我认为 Nativo Resources 的比特币国库举动是一个明确的信号——大公司不再只是观望,他们正在为一个这种代币可能比法定货币更安全的未来做好准备。

风险还是革命?BTC 波动性仍然是个问题

尽管令人兴奋,但公司对风险保持诚实。该机构表示,接触世界上最大的加密货币可能带来价格波动、监管不确定性和投资者认知挑战。

为了应对这些担忧,该公司与 Copper.co 合作进行安全存储,并与 Nemean Services 合作进行数字资产恢复。

尽管如此,公司警告称,持有这种加密货币可能会影响其筹集资金的能力,因为市场的不确定性——尤其是在传统金融领域。

BTC 价格反应:这可能是下一个牛市的触发因素吗?

目前价格约为 118,500 美元,24 小时上涨 0.66%。日交易量上涨超过 11%,表明市场活动正在增加。

虽然这项投资本身不会推动市场,但它为比特币采用新闻的上升叙事增添了动力。随着越来越多的 上市公司像 GameStop 一样购买比特币,累积效应可能会为比特币价格提供坚实的支持,并支持更广泛的牛市。

结论:真实黄金公司加入数字黄金狂潮

Nativo Resources 比特币国库的故事展示了传统行业如何重新思考其资本策略。曾经被视为风险的事情现在正变得标准化。

该公司通过同时维持实物和数字储备,正在演变为一个双资产强国——为通货膨胀情景和创新金融领域做好准备。

另请阅读: Xenea 钱包测验答案 2025 年 7 月 25 日:玩游戏并赚取 $Gems

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。