21Shares的ONDO ETF会推动机构加密货币的激增吗?

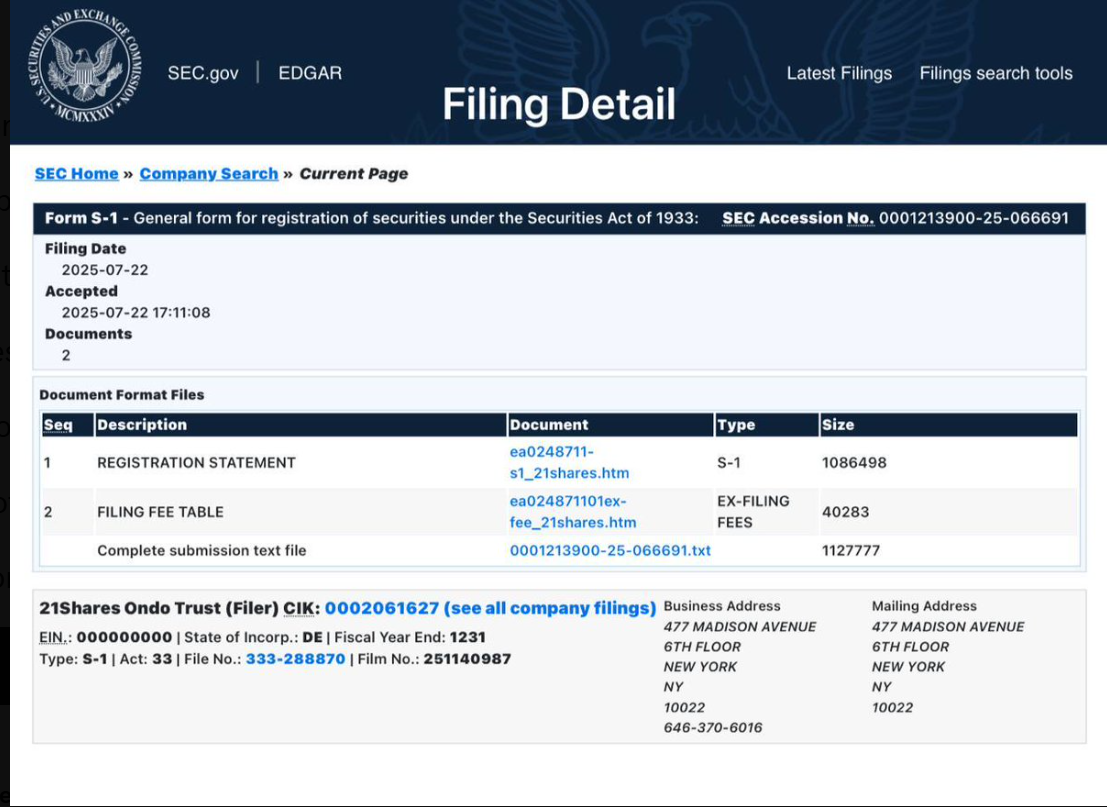

21Shares向美国证券交易委员会(SEC)提交了ONDO ETF的S-1申请,旨在上市和交易该交易所交易基金。此申请是连接加密货币和传统金融市场的重要一步。OndoFinance专注于将现实世界资产进行代币化。

来源:SEC.gov

ONDO ETF旨在连接DeFi和传统金融

一旦获得批准,Coinbase Custody将作为保管人,提供对OndoFinance的代币化资产生态系统的合规接触。该上市旨在推动机构对ONDO ETF及其他基于区块链的资产的采用。通过将美国国债放入DeFi系统,可能会提高DeFi的整体锁定价值和流动性。在过去几周中,该公司与Pantera合作,代表着对代币化现实世界资产的2.5亿美元投资。ONDO ETF处于代币化通过提高可接触性、效率和透明度来改变金融的前沿。

ONDO ETF将推动收益产品进入DeFi

由于OndoFinance对超过5亿美元资产的代币化,零售和机构用户现在可以在链上访问美国国债和收益工具。通过连接DeFi和传统金融,该平台提供了实用的收益,而无需传统中介。

这可能表明RWA代币正在被广泛使用,这将大大增加它们在加密原生社区之外的实用性。

在机构兴趣的推动下,交易量激增21%

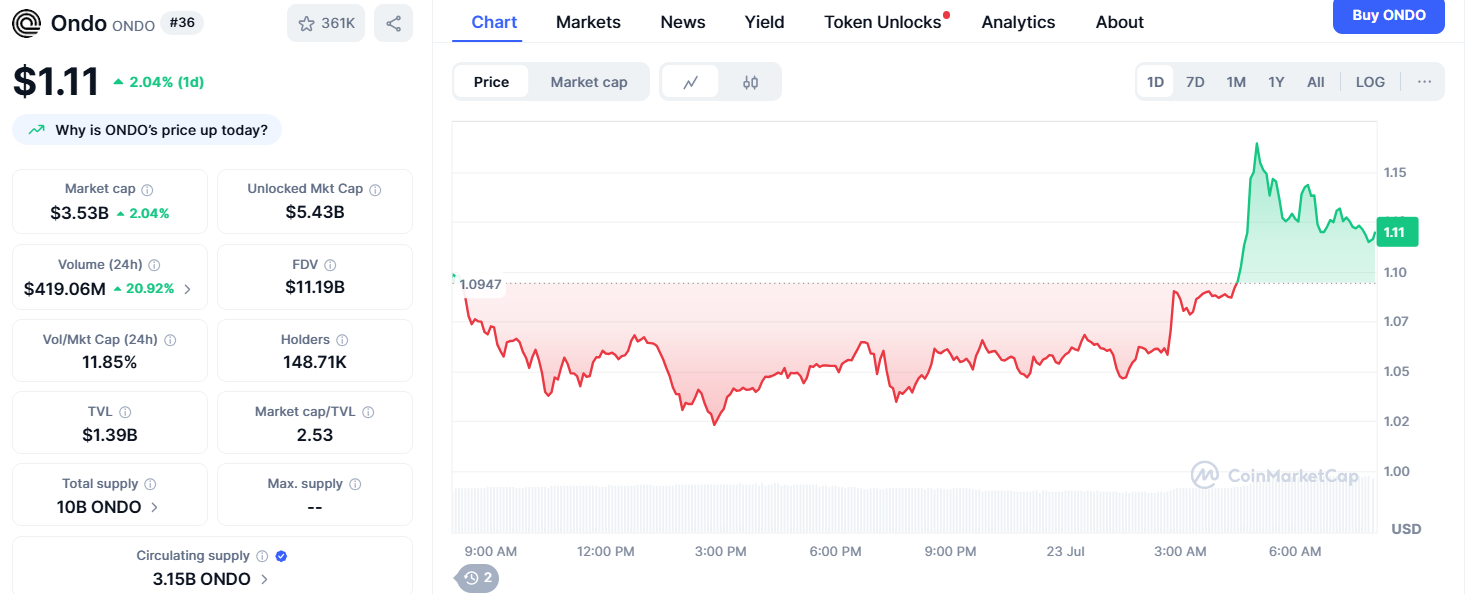

来源:Coinmarketcap

由于这一消息,价格从1.08美元上涨至1.16美元,24小时交易量增加20.92%至4.19亿美元,表明机构兴趣。尽管全球加密货币市场在此期间仅上涨约0.67%,但市值增加了2.04%,达到了35.3亿美元。目前代币价格为1.11美元。尽管在过去30天内代币价格上涨了64%。随着市场兴趣的增长,ONDO ETF的推出可能在这一价格波动中发挥了作用。通过这样的申请增加的机构参与可能会激励全球加密货币市场的活跃。

批准可能吸引养老金和机构资本

作为欧洲加密ETP行业的主要参与者,21Shares正在迅速进入美国市场。这一提交是其不到两年内的第三个重要交易所交易基金提案,展示了其对代币化资产将成为下一个获得监管批准的信心。随着代币化继续改变金融市场,如果成功,这可能会引发其他RWA和DeFi协议类似注册的浪潮。作为首个具有交易所交易基金级别支持的RWA原生代币,此举进一步突显了OndoFinance,并可能吸引来自顾问、受监管平台和养老金基金的额外资金。

尽管许可仍在待定中,但信息显而易见,代币化资产正在走出加密货币的阴影,进入传统金融的主流。

另请阅读: 加密市场24小时更新:顶级赢家ZORA、Spark、BNB

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。