Source: Daily Economic News

On Tuesday local time, the cryptocurrency regulatory bill supported by U.S. President Trump faced a significant setback.

According to Caixin, during a procedural vote on Tuesday, conservative Republicans in the U.S. House of Representatives successfully blocked the legislative process for three cryptocurrency bills, including the stablecoin bill (GENIUS Act).

The procedural vote held on Tuesday afternoon ended with 196 votes in favor and 223 votes against, with 13 Republican members voting no. From their statements, it was clear that, in addition to political disagreements, there was also dissatisfaction expressed towards their Senate colleagues.

Republican Representative Marjorie Taylor Greene from Georgia told the media that she voted against the bill because she wanted to bundle the stablecoin bill with two other pieces of legislation (one on market structure and one prohibiting the Federal Reserve from issuing digital currency), but the House leadership refused to allow a vote on this amendment.

Greene emphasized, "The stablecoin bill does not reflect President Trump's executive order from January 23, which clearly states that central bank digital currencies should be prohibited."

Republican Representative Warren Davidson from Ohio, while voting in favor of the procedural rules, emphasized his opposition to the stablecoin bill. Davidson stated, "The House has become accustomed to not receiving any respect when we send things to the Senate. I want to see what we can do next. I hope we can come up with a plan that truly focuses 'Crypto Week' on cryptocurrency."

Recent market news indicates that the House may attempt to vote again later on Tuesday. If the vote passes, debates on cryptocurrency legislation could begin immediately, with a final vote potentially taking place later this week.

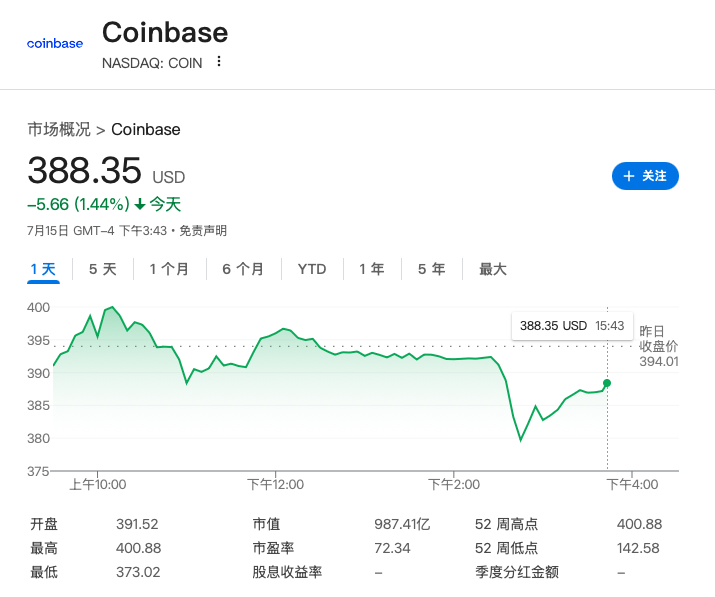

After the vote failed, stocks related to cryptocurrency began to decline. Shares of stablecoin company Circle fell more than 7% at one point, later narrowing the decline to around 4.5%. Coinbase's stock dropped over 4% at one point, later narrowing to about 1.4%. Digital asset company MARA Holdings saw its stock fall more than 2% at one point, later narrowing to around 1.8%.

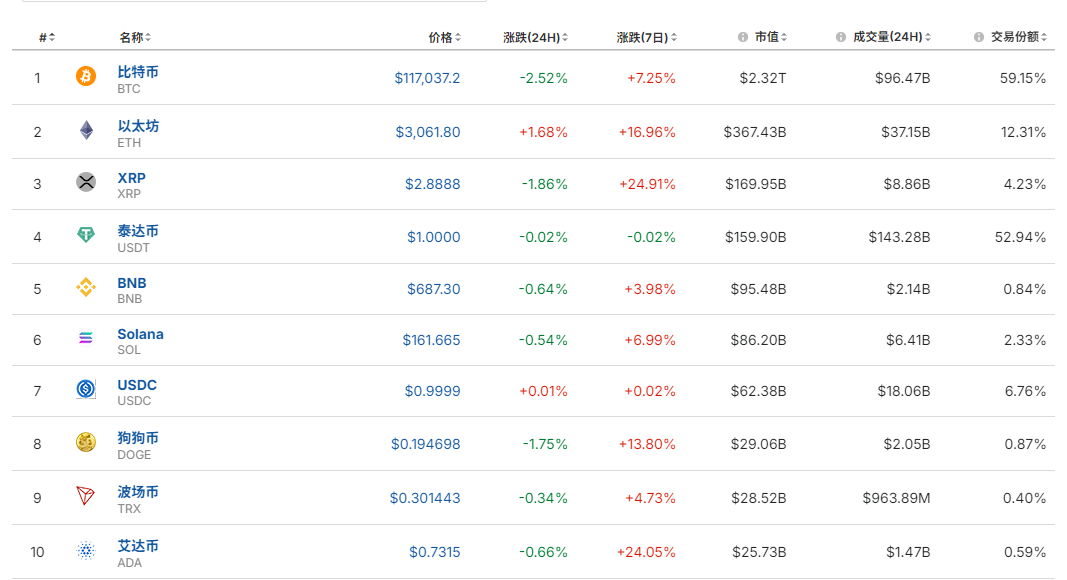

Additionally, on July 15, the cryptocurrency market experienced a collective plunge, with Bitcoin dropping more than 5% at one point, while Stellar, Hedera, Dogecoin, and others fell over 8%.

As of July 16, Bitcoin was down 2.52%. Coinglass data shows that in the past 24 hours, over 130,000 people in the cryptocurrency market have been liquidated, with a liquidation amount of $493 million. Among them, long positions accounted for $393 million, while short positions accounted for nearly $100 million.

As early as July 3 local time, the U.S. House of Representatives announced that the week of July 14 would be designated as "Crypto Week," during which it would review several bills, including the "Digital Asset Market Transparency Act," the "Anti-CBDC Surveillance State Act," and the "Guidance and Establishment of a National Innovation Act for U.S. Stablecoins" (GENIUS Act), providing the long-requested national regulatory framework for the digital asset industry.

Among these, the most important bill is undoubtedly the GENIUS Act, which will establish federal rules for stablecoins. President Trump has previously referred to himself as the "crypto president" and urged policymakers to amend rules favorable to the industry.

According to the Economic Daily, on June 18, the U.S. Senate passed the GENIUS Act with a vote of 68 in favor and 30 against.

Analysts believe that against the backdrop of U.S. national debt exceeding $36.2 trillion, the core intention of promoting stablecoin development in the U.S. is to create sustained demand for the U.S. debt market through financial innovation tools, alleviating debt pressure.

First, the bill will deeply bind stablecoins to U.S. Treasury bonds. The GENIUS Act stipulates that stablecoin issuers must allocate 100% of reserve assets to U.S. dollar cash or short-term U.S. Treasury bonds maturing within 93 days, and strictly limit non-licensed institutions from entering the market. Due to recent large-scale sell-offs of U.S. Treasury bonds, this mandatory reserve requirement is seen as helpful in filling the gap left by traditional sovereign buyers reducing their holdings of U.S. debt. If the bill is successfully signed, stablecoin issuers are expected to become a new source of structural demand for U.S. Treasury bonds. U.S. Treasury Secretary Yellen testified in early May before the House of Representatives that "the demand for U.S. Treasury bonds from (stablecoins and other) digital assets could reach $2 trillion in the coming years," expressing optimism about stablecoins helping to smoothly digest U.S. debt.

Second, stablecoins can help lower financing costs, thereby stabilizing U.S. Treasury bond prices. On one hand, stablecoin issuers can concentrate on purchasing short-term Treasury bonds, driving up bond prices and lowering yields. Research shows that for every 1 percentage point increase in market share of U.S. stablecoin issuer Tether, the yield on one-month U.S. Treasury bonds decreases by 3.8 basis points, potentially saving the U.S. government about $10 billion to $15 billion in interest expenses annually. On the other hand, the U.S. Treasury can increase the proportion of short-term Treasury bond issuance to cater to the preference of stablecoins for short-term assets, replacing long-term risks with short-term debt.

Furthermore, promoting the development of stablecoins is also beneficial for extending the dollar's hegemony into the digital realm, expanding the circulation radius of the dollar, and indirectly supporting the credit of U.S. Treasury bonds. Some analysts point out that if the mechanisms envisioned by the bill are implemented, then when payments are completed globally using stablecoins, the funds will ultimately flow to the U.S. Treasury bond accounts through stablecoin issuers. This mechanism will transform U.S. national debt into distributed holdings, allowing global users to become invisible holders of U.S. Treasury bonds, indirectly expanding the demand for the dollar and solidifying its status as a reserve currency, enhancing the global credit foundation of U.S. Treasury bonds. When the chain of "U.S. Treasury bond issuance - stablecoin companies purchasing - issuing stablecoins - global circulation - funds flowing back to U.S. Treasury bonds" is completed, the dollar can penetrate into "unbanked" areas that traditional finance cannot cover through blockchain technology, establishing a "on-chain U.S. Treasury bond circulation" mechanism.

(Disclaimer: The content and data of this article are for reference only and do not constitute investment advice. Investors operate at their own risk.)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。