作者:BitpushNews

近日,比特币(BTC)已数次刷新历史高点,一度突破 12.3 万美元 / 枚。在比特币强势上行的背景下,加密市场内部正出现显著的资本轮动迹象,一批此前表现相对沉寂的老牌大型山寨币(Altcoin)正逐渐活跃,其涨幅甚至超越了近期比特币的表现。

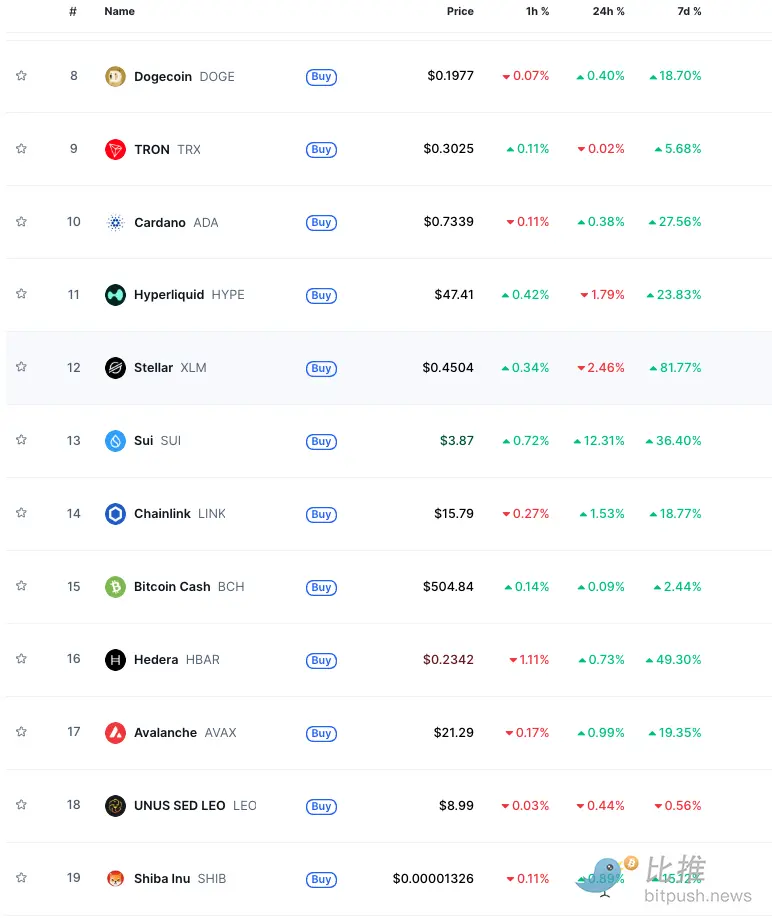

CMC 市场数据显示,在市值前 20 位的加密资产中,部分「元老级」第一层(L1)山寨币表现突出,7 日涨幅普遍达到两位数。其中领跑者是 Stellar(XLM):作为市值排名第 12 位的加密资产,周涨幅高达 82%,在同类资产中处于领先地位。市值排名第 10 位的 ADA 7 日涨幅近 30%;瑞波(XRP)29%;狗狗币(DOGE)18%。

一些相对较新的山寨币,如专注于去中心化交易所(DEX)的 L1 项目 Sei(SEI)和合成美元协议 Ethena(ENA)涨幅同样不俗,7 日涨幅也超过了 30%。

Delphi Digital 近期的一项研究报告指出,那些历史悠久、经历多个牛熊周期的老牌代币自今年 1 月以来,其整体表现甚至超越了当时备受关注的 AI 和 DePIN(去中心化物理基础设施网络)概念代币。

分析人士指出,老牌山寨币共同走强被解读为散户资金或正回流的早期信号,这些代币代表着加密市场中存在时间较长且市值较大的加密货币,其活跃度往往能反映散户的市场参与度和资金偏好,同时交易者也对具备创新叙事和高增长潜力的新兴项目保持关注。

山寨币的「BANANA ZONE2.0」

市场观察人士 @MerlijnTrader 监测了 TOTAL3 图表,该图表追踪的是除比特币(BTC)和以太坊(ETH)之外的加密货币总市值,能够有效反映山寨币的整体动能。他指出,TOTAL3 图表正进入「香蕉区 2.0(Banana Zone 2.0)」,这通常意味着在一段盘整期后,市场将迎来爆炸性的突破阶段。

该交易员认为,与 2020 年的山寨币浪潮相比,即将到来的这波行情将「更大、更快,并有真实世界用例和巨额资金支持」。这预示着山寨币市场可能不再仅仅是投机狂热,而是由基本面和机构资金驱动的更可持续的增长。

「山寨季」的信号

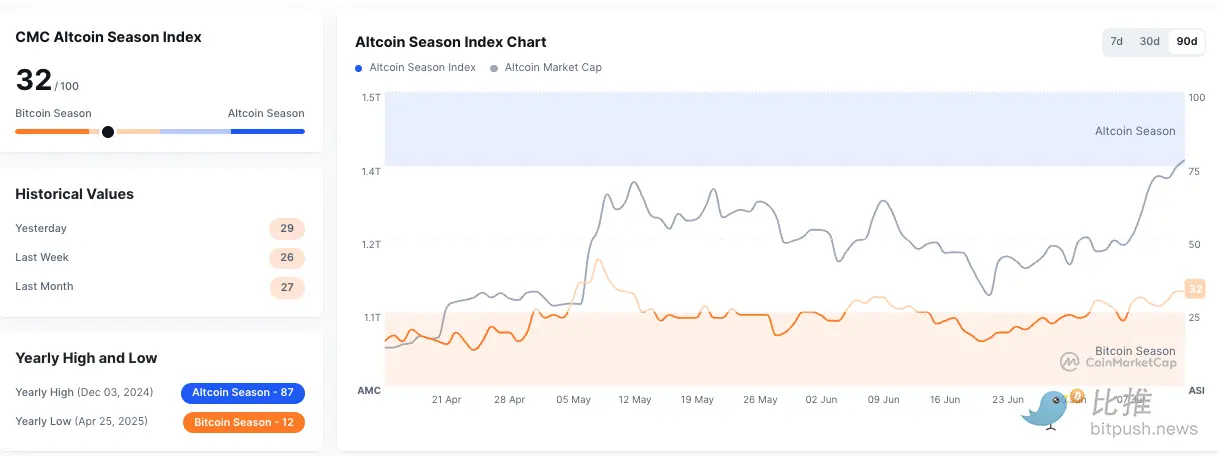

根据 CMC 山寨币季指数(CMC Altcoin Season Index)的定义,当除去稳定币和封装代币后,前 100 种山寨币中,有 75% 在过去 90 天内表现优于比特币时,即正式进入「山寨币季」。这个阈值反映了资金从比特币主导地位向多元化山寨币增长的广泛市场轮动。

目前,山寨币季指数为 32/100,距离 75 点的阈值尚远,这表明市场仍处于比特币主导阶段。然而,该指数近期出现了积极的向上趋势(从上周的 26 点上升到今天的 32 点),这暗示了早期轮动迹象正在显现。

山寨币季来临的关键信号包括:

- 山寨币主导地位增强: 在过去的山寨币季中(如 2021 年 5 月),前 100 名山寨币的总市值曾超过比特币总市值的 130%。这种扩张标志着资本流入山寨币的增加。

- 价格迅速上涨: 山寨币在短时间内常会出现剧烈涨幅。2021 年初,大型山寨币的平均回报率达到 174%,远超比特币同期仅 2% 的温和增长。

- FOMO 情绪与散户狂热: 山寨币季通常伴随着高 24 小时交易量和强烈的看涨情绪。市场乐观情绪导致购买压力增加,进一步推动价格上涨,并吸引新的参与者进入。

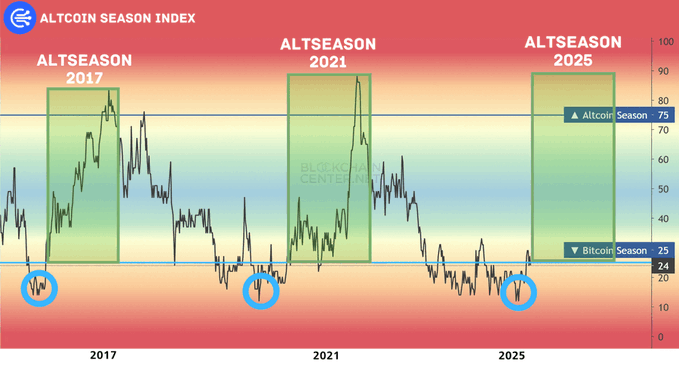

当前市场的一个重要特征是比特币主导地位(Bitcoin Dominance)的下降。加密分析师 Satori 观察到,在历史周期中,当比特币价格保持稳定或温和上涨,而其在加密总市值中的占比却出现下降时,这通常被视为资金从比特币向山寨币轮动的迹象,从而预示着「山寨币季」(Altcoin Season)的可能到来。

Satori 指出,这一模式在 2017 年和 2021 年等历史周期中均有体现。目前,山寨币已开始普遍表现,交易量稳步上升,这表明机构和散户投资者可能正在将其资金分散配置到替代性数字资产中,这源于多重催化剂的共同作用:

- 现货 ETF 的推出:美国现货比特币和以太坊 ETF 为机构资金提供了合规入场通道,解锁了大量机构流动性。当这些资金涌入比特币和以太坊后,部分资金可能溢出并流向具备更高增长潜力的山寨币。

- Layer 2(L2)解决方案的进步:L2 技术的发展提升了以太坊等 L1 的扩展性和效率,降低了交易成本,为更多应用场景的落地提供支持,进而利好其生态内的山寨币。

- 人工智能(AI)与区块链的结合、真实世界资产(RWA)代币化的发展,以及区块链游戏基础设施的完善,都为山寨币带来了新的价值叙事和应用前景,提供了基本面支撑。

因此,虽然「迷你山寨季」能持续多久还有待观察,但市场释放的积极信号表明,投资者正重新拥抱风险,为市场注入久违的活力。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。