作者:1912212.eth,Foresight News

7 月 12 日,PUMP 代币公募 5 亿美元额度,仅用时 12 分钟即宣告售罄,币安永续合约盘前交易价格现报 0.006 美元,相较于初始 40 亿美元 FDV,增幅近 20 亿美元。据链上分析师余烬监测,从目前的 PUMP 链上持仓来看,6 家参与 PUMP 公募的 CEX 或已收到 PUMP。这几家的链上地址目前持有:Kraken:75 亿枚、Bitget:75 亿枚、Gate:64 亿枚、Bybit:50 亿枚、MEXC:50 亿枚、Kucoin:41 亿枚。

Pump.fun 自 2024 年以来迅速成为加密货币生态中的现象级存在。该平台允许任何人以极低的门槛创建和发射 Meme 币,通过一种独特的「公平发射」机制,将代币直接推向市场,而无需复杂的智能合约或预售阶段。

此次发售的规模堪称加密史上第三大代币销售事件,仅次于某些主流公链的 ICO。Pump.fun 团队表示,资金将用于扩展平台,包括推出自家 DEX(PumpSwap)和将 PUMP 作为 Meme 币的基础配对货币。

然而,Pump.fun 的成功也引发太多争议。批评者将其视为「散户赌博」的温床,指责它通过无限碎片化的市场吸走流动性,导致无数散户投资者在短暂的上涨后遭受巨额损失。平台创始人及其团队被指责通过费用提取了约 8 亿美元,却未向用户提供任何回报,如空投或分成。

5 亿美元额度,12 分钟售罄

PUMP 的正式发售定于 7 月 12 日,北京时间 22:00 公售正式开始后,仅仅用时 12 分钟,即完成公售。

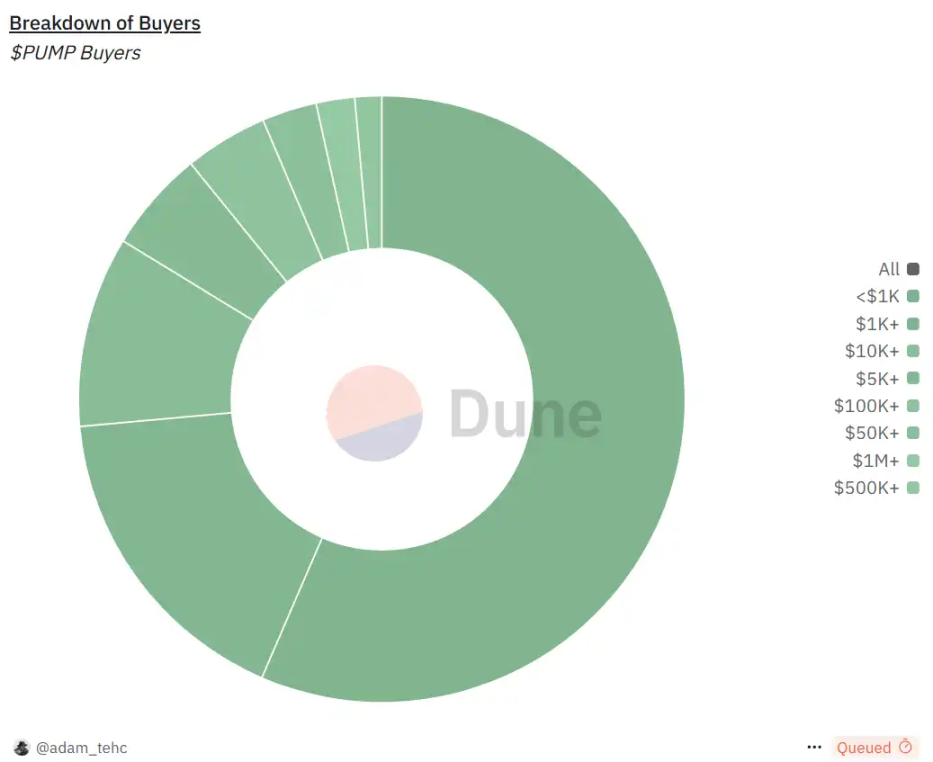

据 @Adam_Tehc 的 Dune 面板数据,参与 Pump.fun 官网预售并完成 KYC 的钱包地址数为 23,959 个,成功买入的钱包地址数为 10,145 个,平均申购额 44,209 美元。PUMP 代币预售的 89.7% 通过官网完成,各 CEX 出售总额占比仅 10.3%。

官网预售中申购额达 100 万美元地址数 202 个,50 至 100 万美元 138 个,10 万至 50 万美元 445 个,1 万至 10 万美元 1,030 个。申购额 1000 美元以下用户最多,为 5,758 个。

通过官网参与公售的玩家成功买入,不过对于通过交易所等渠道买入的则成了大冤种。从上述数据中不难看出,各 CEX 出售总额占比仅仅 10%。

有用户抱怨「进入 Bitget 没找到入口,Gate 网络报错,Bybit 上则很快被抢抢光」。预售机制看似简单:用户通过 API 提交订单,平台根据时间戳分配。但实际过程一片混乱。

发售启动后数秒内,Bybit 报告 API 延迟问题,导致订单堆积。结果是严重超卖:系统接收了超出可用供应的订单,一些用户成功获得分配,其他人则被拒绝。Bybit 官方在 X 上承认:「由于意外 API 延迟,销售被超额认购,导致部分用户成功获得分配,而其他人未能。」

抛开公募过程中的种种问题,此次公募仍表明社区有雄厚的资金愿意追逐热门项目。加密 KOL Miles Deutscher 针对 PUMP 12 分钟卖出 5 亿美元一事发表观点称,这表明,当有合适的机会时,仍然有大量的流动资金愿意参与。山寨币并没有「死亡」,他们只是需要正确的叙述。

交易所超售,巨鲸链上博弈

后续,Bybit 对所有用户的订单状态进行全面复核。为确保公平透明,代币分配严格遵循「先到先得」原则。在 Bybit 确认 PUMP 代币发售最终状态后 10 分钟内,所有超额认购资金已全额原路退还。发售结束后,Bybit 于 7 月 13 日确认所有超卖资金已退款,用户可通过平台检查状态。

Bieget 也则针对问题进行了回应,谢家印发文回应 PUMP 公募分配问题,称本轮通过 Bitget 参与公募的用户共计 10,144 人。此外,Bitget 团队最终决定按比例分配 PUMP 代币。

「今天有好几个信源,说是 Pump fun 把交易所的募资给鸽了,所以导致 6 家都出现了失败问题,目前这几家所,有些计划通过 OTC 份额补给用户,也有还在交涉的。」推特 KOLAB 如此表示。

预售价格基于 40 亿美元 FDV,单枚 PUMP 约 0.004 美元。发售后首日,不少玩家均选择套保,如知名交易员 0xSun 就发推表示在 0.0054 美元的价格套保了 100 万美元。

据最新币安合约数据显示,7 月 12 日,PUMP 合约报价曾一度跌至 0.004589 美元附近,随后 7 月 13 日曾一度冲至 0.007189 美元,现回落至 0.006 美元附近徘徊。据 Lookonchain 监测,当日某交易员通过做多 PUMP 已获利超过 150 万美元。交易员 0x6b78 一天前对 PUMP 开设了 3 倍杠杆多头头寸,并在价格突破 0.007 美元时开始获利了结。

Pump.fun 用户长期以来在平台上遭受重创。历史数据显示,平台上 90% 以上的 Meme 币在绑定曲线后崩盘,狙击手通过最后时刻捆绑(8-12 SOL 供给)并在 Raydium 上抛售,获利数百万。 此次 PUMP 发售被视为延续:团队提取费用后出售代币,散户成「退出流动性」。X 用户@beaniemaxi 称:「Pump.fun 提取 5 亿美元费用,数十亿 SOL 永锁死池,这是加密史上最大提取骗局。」

买家亏损还涉及机会成本:Solana 价格因 $PUMP 基础配对机制下跌 10%,影响整个生态。 一些分析师预测 PUMP 可能像 TRUMP 一样短期有上涨空间,但长期乏力。

发售前:社区态度两极分化

发售前的准备阶段从 2025 年 6 月上旬开始,当时 Pump.fun 通过官方渠道宣布 PUMP 代币计划。PUMP 是 Pump.fun 代币启动平台和兑换平台的效用代币,之后也会考虑费用返还、代币回购或其他激励等效用机制。PUMP 最大供应量为 1 万亿枚,具体分配如下:

- 33% 将在首次代币发行中出售

- 24% 分配给社区和生态系统计划

- 20% 分配给团队

- 2.4% 用于生态系统基金

- 2% 用于基金会

- 13% 给现有投资者

- 3% 分配给直播

- 2.6% 用于流动性 + 交易所

根据 PUMP 释放时间表,分配给团队(20%)和现有投资者(13%)的代币将从 2026 年 7 月份开始逐步解锁;分配给社区和生态系统计划(24%)的部分会从代币发行首日逐步解锁,并在 2026 年 7 月分配完毕;其他分配给 ICO 、流动性 + 交易所、基金会的代币份额会在代币发行首日完全解锁。

市场反应两极分化。一方面,Pump.fun 的忠实用户和 Meme 币爱好者视其为「最大提取事件」(Max Extraction Event),期待通过购买分享平台的未来收益。平台已证明其盈利能力:仅 2025 年 5 月就产生 5000 万美元费用,累计费用达 8 亿美元。

Meme 交易员 Ansem 则在推特上公开喊单将会购买更多的 PUMP 代币。

另一面,质疑声浪汹涌。

知名加密分析师和 KOL(如@hodl_strong 和@RuneCrypto_)公开批评此次发售为「退出骗局」。他们指出,Pump.fun 已从市场提取 10 亿美元以上费用,却选择不通过空投回馈用户,而是直接出售代币。这被视为对社区的背叛,尤其在 OpenSea 等前车之鉴后(OpenSea 未及时推出代币,导致营收暴跌 90%)。此外,团队的匿名性和缺乏透明度加剧了担忧:资金用途不明,是否用于开发还是个人套现?IOSG 创始合伙人直言 Pump.fun 公募更像是团队寻求退出流动性,项目及市场基本面无法支撑虚高估值。

交易员 Eugene 也在其个人社区发文表示,「我对 pump.fun 的看法很简单:直接忘了它吧。它已经被过度分析到没有任何新意了,而无论它以什么价格开始交易,市值 40 亿美元都像个沉重的锚,压住了币价。现在市场上有太多更有潜力、回报更具非线性的机会,远比它更值得关注。别再在一个所有人都在琢磨的东西上浪费脑细胞了。」

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。