作者:佐爷歪脖山

暴富秘诀 = 创新资产类型 + 提升资本效率

$PUMP 发币造势、喧嚣到寂静的全流程中,最大的受益者已经出现,MemeCore,其代币 $M 不仅抢占 CT 热榜,还成功拿下币安 Alpha,其次是 Bonk 紧跟其后,盯上了中文区用户。

英文项目方说中文,又让我想起来 SBF 的时代,那时候世界还是大同的。

图片说明:Bonkfun 说中文

图片来源:@SolportTom

不过别紧张,今天不是分析 PUMP 们的价格走势,而是想聊一下为什么 Meme 平台发币,以及在 Meme 大周期结束后,竟然发币还能掀起浪花朵朵。

赚走最后一个铜板

PumpFun 发币是把自身作为 Meme 平台价值最大化。

正常的 Meme 平台应该死于 CZ 携 FourMeme 入场时宣告终结,请注意,我说的是 Meme 平台作为全行业共识,作为主流资产发行平台的结束,如果是 Meme 本身,那要追溯到 1 月份 $TRUMP 的出炉。

前文回顾:Meme 从海上来,又从海上去

随后的 PumpFun 和 Raydium 分手,你建 AMM 池,我建 Meme 发射台,都是共识分裂的明证。

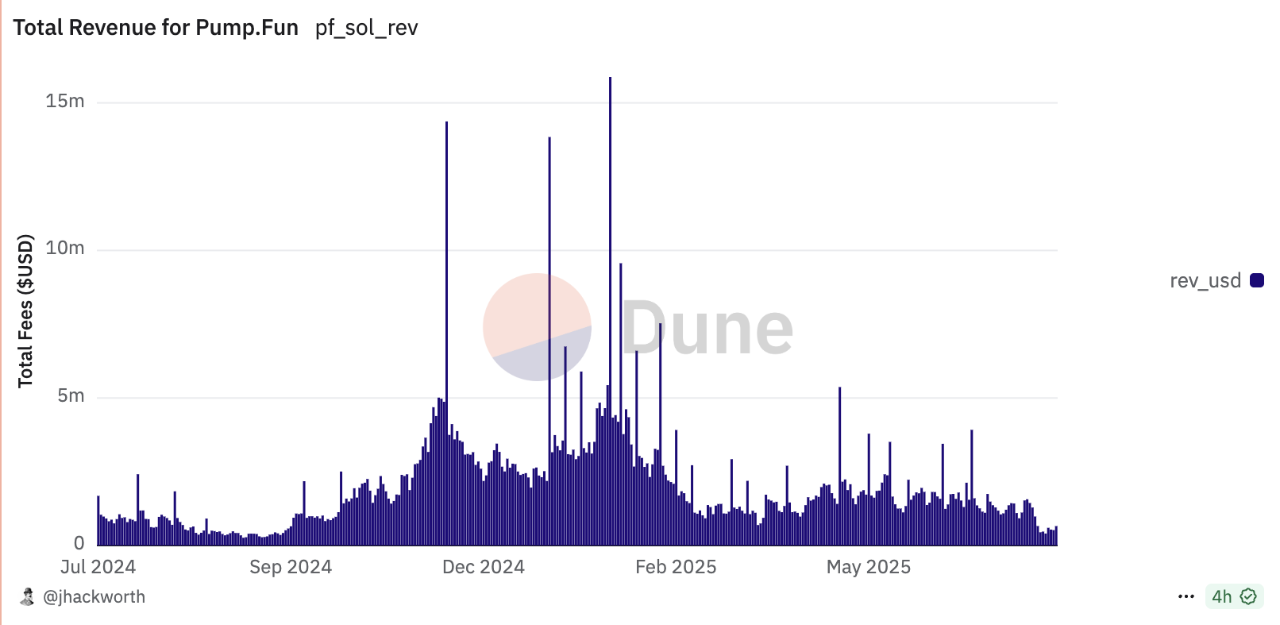

图片说明:PumpFun 利润走势

图片来源:@jphackworth42

愈发奇怪,怎么在近半年后的不仅 Pump Fun 平台币成为全场焦点,还能吸引 Bonk 和 $M 等众多同类分食流动性,参考 DePIN、NFT、BTCFi 和 L2 赛道,基本都不会在主叙事终结后,还能维持发币时的泼天流量。

更正常的节奏是,在行业共识最聚焦之时,直接发币榨干市场流动性

-

• 比如 NFT 的“正面案例” Blur,反面案例是 OpenSea;

-

• DePIN 的 Filecoin、Helium(Mobile),反面的 Starpower;

-

• BTCFi 的 Babylon,反面的一众 BTC L2

但是 Meme 正常的流动性都被 $TRUMP 吸走,理论上 FourMeme 的出现就该是 PumpFun 的死期,但是,PUMP 代币竟然还能搅动风云。

PumpFun 给出了消亡赛道的最完美退出方式,赚走市场积攒的最后一个铜板。

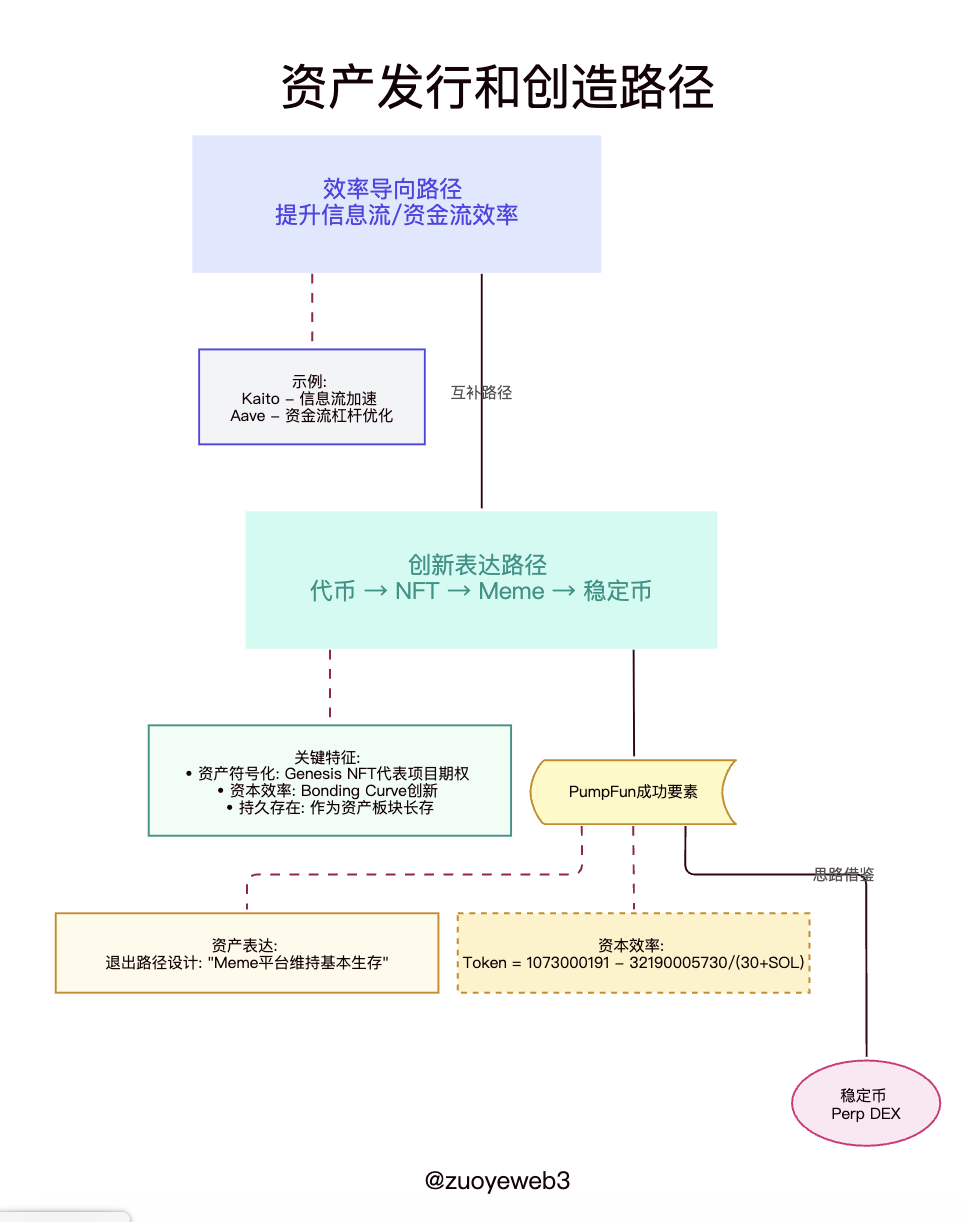

加密资产创造和表达,一种是效率导向,让信息流(Kaito)或者资金流(Aave)转的更快、杠杆更高,一种是创新表达方式,沿着代币—NFT--Meme--稳定币发展。

如果要回答 PumpFun 怎么做到的,首先回顾下 NFT 的成功和失败,不同于铭文、BTCFi 这些最后被证伪的赛道,NFT 在项目方领域找到了自己的位置。

Genesis NFT 代表项目的期权,甚至是某种 Coinlist 的类似物,取决于项目方如何设计,作为时尚符号和门票的 NFT 失败,换来资产符号的成功。

NFT 趋势肯定不会回来,我的理解是 Meme 作为一种资产板块会长存。

就像是山寨季不再回来,也不影响大家继续发山寨,做 Alpha 积分。

Meme 也是如此,人们的估值体系会变化,PumpFun 不会是币安,也不会是 Hyperliquid,但是 Uniswap不也活着吗。

在彻底失败和走向成功之间,还有平安落地的选择,是非功过,留下世人评说。

下一个能落地的场景

之前,加密行业认为能落地是走向 Mass Adaption;

现在,加密行业认为落地是能完成最后的发币动作;

图片说明:资产发行和创造路径

图片来源:@zuoyeweb3

不会所有人都沉醉于 Meme,但只要有人愿意参与,那么作为一个资产类型和发射平台就能维持基本生存,总要给人买链上茅台和虚拟 $LABUBU 的地方。

从蓝筹 NFT 到 Genesis NFT,从 $TRUMP 到 $PUMP,一个时代就此结束,在加密小周期内,Meme 跑了 6 个月时间,比众多 2-3 个月的技术叙事反而要长久。

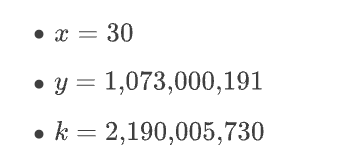

唯一留下的是 Bonding Curve 的未解之谜,我们知晓 AMM DEX 的 x*y=k,但是至今也不知道 Bonding Curve 具体参数如何得来。

一个冷知识,FriendTech 也用的是 Bonding Curve,更早之前的 2020 DeFi Summer,实际上是 AMM、订单簿和 Bonding Curve 的三国杀,只不过 Uniswap 拿走 AMM,dYdX 拿走订单簿,Bonding Curve 直到遇见 PumpFun 才发光发热。

PumpFun 留下的另一个秘诀是,Bonding Curve 提升了资本效率,Meme 从来都不是单纯的资产新类型,PumpFun 作为平台的资本效率导向也是产品设计上的决胜之道。

参考 @CuntouErjiu 的算法,Pump Fun 算法是 x*y=k 的超级魔改,Bonding Curve 等式:

数量数量

其中参数值为:

其他 Meme 发射平台,可以反推和参考 PumpFun 的具体参数,但是这个公式本身如何推导出来,已经快成币圈未解之谜了,就像 AI 大模型,开源代码没有意义,只有开源训练方法和数据集才是真开源。

很可惜,至今也没人真的反编译出 PumpFun 的原始算式,基于此,那么 PumpFun 提升资本(Meme)效率的护城河依然坚固,即使 Meme 不再火热,残存的流量依旧可以作为 $PUMP 的价值基础。

在这一点上,PumpFun 比很多鬼链要可靠的多,USDT退出 Algorand/EOS 说明被遗忘的可不是 Meme。

不过必须承认,Meme 作为一个时代的代表是彻底结束了,曾经辉煌过已然不易,能够长红的也只有 BTC、ETH,SOL 想入局还需要历经众多考验。

至少 SOL 并不受 PumpFun 认可,赚到的 SOL 全部换成 U 本位资本,EOS 可是把募集的 BTC 持有到现在,以太坊基金会卖 ETH 该属于哪一类呢?

结语

当前热点当属 RWA、稳定币, 紧盯着 PumpFun 已没有意义,但是 PumpFun 比 FriendTech、Blur 这些单品,Meme 比 NFT、BTCFi 都会活的更好,PumpFun 的思路值得借鉴。

以终为始,Founder 必须在一开始设计好退出路径,不是单纯的上所发币,而是要回答,在加密大舞台中,在火爆出圈后,还能不能在台下幕后找一个合适的位置。

可以预告下,Perp DEX 也会如此,因为我们难以发现订单簿的链下撮合算法。

与之类似的,还有

1. DEX 聚合器的路由算法

2. 暗池 DEX 的交易撮合算法

3. 链上期权产品的流动性“引爆”算法

尤其是链上期权,现在也是和前 PumpFun 时代 Meme 交易难以维持的相同困境,流动性太低,DEX 常用的 LP Token 补贴模式似乎并不奏效。

多说一句,链上期权产品模式上也需要重新发明,要么是 Meme 这种原创加密产品,要么是类似永续合约的币圈改造,也许 VIX 是个好想法?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。