In ten years, cryptocurrency will no longer be a niche market discussed by tech enthusiasts, but will become a core technology supporting everyday life.

Written by: Paul Veradittakit

Translated by: AididiaoJP, Foresight News

Key Points

Crypto company IPOs release significant value, despite challenges in market pricing.

The token transparency framework aims to enhance market clarity and attract more institutional funds into the token market.

Stock tokenization is reshaping financial markets, improving efficiency and expanding global capital access.

Mispriced Crypto IPOs

Coinbase's performance since its IPO serves as a typical case, revealing the pricing dilemma in the public market for cutting-edge financial infrastructure innovations. We witnessed COIN surge 52% from its opening price, briefly surpassing a valuation of $100 billion, only to deeply retrace as market sentiment and crypto cycles fluctuated. Each market turn seems to reprice Coinbase with a new valuation framework, leaving long-term value investors and builders perplexed.

The Circle IPO is another recent example: despite strong market demand for stablecoin exposure, Circle earned $1.7 billion less on its first day of trading, becoming one of the most underpriced IPOs in decades. This is not just a peculiarity of the crypto industry but a structural pricing challenge faced by a new generation of financial companies entering the public market.

The crypto industry needs a more adaptive price discovery mechanism, one that can bridge the gap between institutional demand and the true value of the platform during market cycle transitions.

New Valuation Framework

The crypto market still lacks a standardized disclosure system similar to S-1 filings. The mispricing of crypto IPOs demonstrates that when underwriters cannot map token economics to GAAP (Generally Accepted Accounting Principles) checklists, they either overestimate due to hype or underestimate due to fear. To fill this gap, Cosmo Jiang of Pantera Capital collaborated with Blockworks to launch the "Token Transparency Report"—which includes 40 indicators that transform protocol opacity into IPO-level clarity. This framework requires founders to:

Calculate revenue based on actual entities

Disclose labeled internal wallet ownership

Submit quarterly token holder reports (covering treasury, cash flow, and KPIs)

Disclose details of market maker or CEX partnerships, allowing investors to assess liquidity risks before listing

Why can this system enhance valuations?

Lower discount rates: Clear circulation and unlocking data bring market pricing closer to intrinsic value

Expand buyer base: Institutional investors previously blocked by "black box" protocols can participate in certified projects

Regulatory alignment: The SEC's crypto issuance guidelines released in April 2025 align closely with this framework, allowing projects to complete much of the paperwork upon application submission, speeding up approvals and narrowing the public-private valuation gap

Ethereum's latest upgrade perfectly illustrates the difference between blockchain and traditional enterprises: each new block destroys a portion of ETH (similar to automatic stock buybacks), while providing stakers with a 3-5% yield (similar to stable dividends). The correct approach is to view "issuance minus destruction" as free cash flow, with the resulting valuation reflecting on-chain ecosystem valuation rather than just the balance sheet. However, scarcity is just the first step; on-chain activity tells the complete story: real-time data on stablecoin cross-wallet flows, bridging activities, and DeFi collateral movements fundamentally support token prices.

A comprehensive valuation approach should be based on traditional cash flows, with on-chain revenue (staking yield minus transaction fee destruction) as a core verification element. By continuously monitoring staking yields, real-time traffic metrics, and scenario analyses, the valuation method can remain up-to-date, thus attracting traditional capital into the market.

Stock Tokenization Optimizes Trading Experience

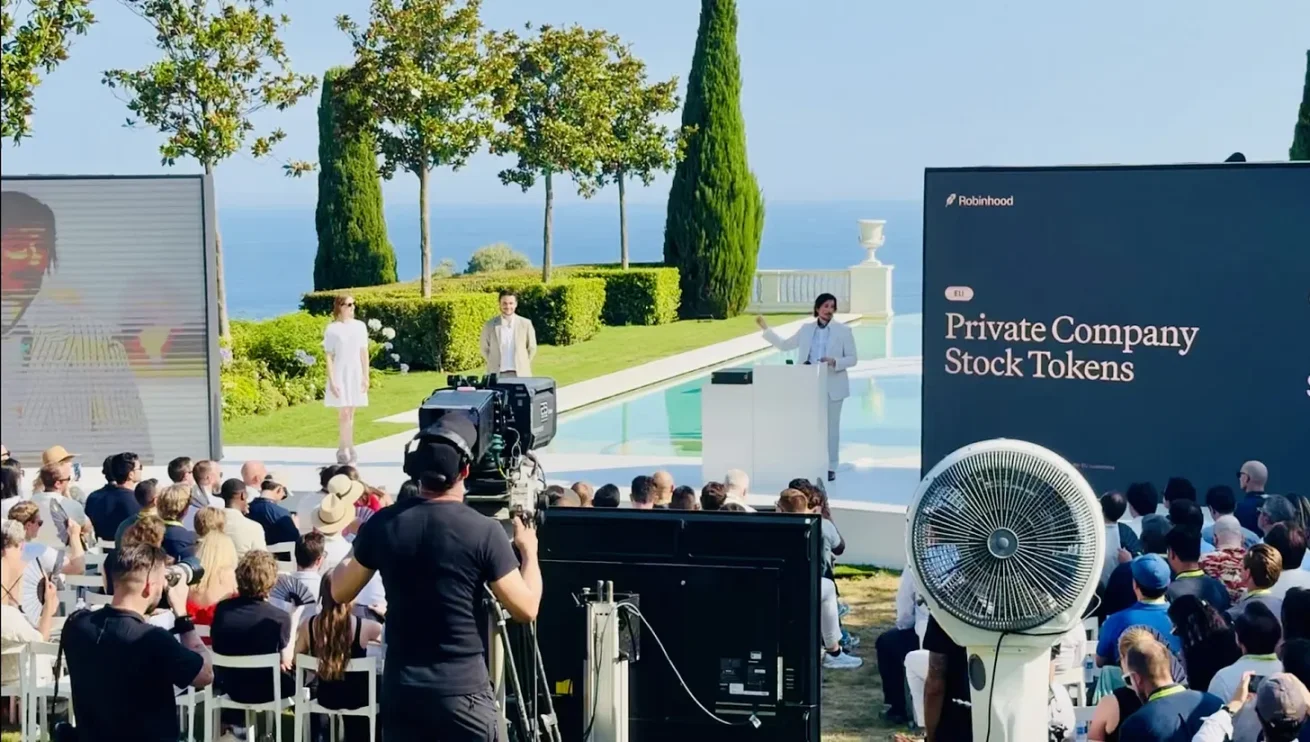

Pantera Capital supports the RWA (Real World Assets) tokenization space through its investment in Ondo Finance. Recently, we launched a $250 million fund in collaboration with Ondo to promote RWA development. With Robinhood announcing stock tokenization, this field is maturing rapidly.

Last week, Robinhood launched tokenized stocks on its platform, highlighting the core contradiction of this new financial technology: permissionless finance vs. permissioned finance, and the future role of DeFi.

Permissionless tokenized stocks allow anyone to trade on a public chain at any time, opening the U.S. capital markets to global investors, but they may also become breeding grounds for insider trading and manipulation. In contrast, the KYC-based permissioned model maintains market fairness but limits the core advantage of global access to tokenized stocks.

We believe that tokenized stocks will reshape DeFi. The mission of DeFi is to build open, programmable financial primitives, but it has primarily served crypto-native tokens until now. The introduction of tokenized stocks unlocks new use cases. The structure of tokenized stocks will determine the next wave of users and liquidity:

In the permissioned model, traditional institutions like Robinhood that have user relationships dominate the front end, while DeFi protocols can only compete for liquidity on the back end.

In the permissionless model, DeFi protocols can simultaneously control users and liquidity, creating a truly open global market.

Hyperliquid's HIP-3 upgrade perfectly exemplifies this vision: by configuring oracles, leverage, and funding parameters through staking protocol tokens, anyone can create perpetual contract markets for tokenized stocks. Robinhood and Coinbase have launched stock perpetual contracts in the EU, but their models remain more closed and less composable than DeFi. If they maintain an open track, DeFi will become the default venue for programmable borderless financial engineering.

Bitcoin Market Cap Surpasses Google

In 2025, Bitcoin will leap to a market cap of $2.128 trillion, becoming the fifth-largest asset globally, surpassing Google. Driven by institutional adoption, the approval of spot Bitcoin ETFs, and clear regulation, Bitcoin will break through $106,000. This milestone event proves that programmable currency has found a clear product-market fit.

Looking Ahead

As Dan Morehead said, cryptocurrency investments offer returns unmatched by traditional markets. This is precisely why traditional public markets and the crypto space are accelerating their financial and structural convergence:

Digital asset treasuries and crypto IPOs provide public markets with crypto financial exposure

Stablecoins and tokenization leverage crypto technology to optimize traditional market structures

In ten years, cryptocurrency will no longer be a niche market discussed by tech enthusiasts, but will become a core technology supporting everyday life.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。