Author: Lawyer Liu Zhengyao

Introduction: The "New Scam" Dressed in Investment Clothing

Recently, the term "Xinkangjia" has been frequently mentioned across various social media platforms and investment groups. According to publicly available information online, Xinkangjia began its operations in 2023 under the guise of the "Dubai Gold Exchange China Branch," initially attracting investors with crude oil futures investments, and later with "big data investments," "foreign exchange investments," and "virtual currency investments." Participants became members by paying a threshold fee of 1000 USDT (Tether, a type of virtual currency, where 1 USDT can be exchanged for 1 USD), and the organization developed and expanded according to a so-called "militarized" structure, with different levels offering varying rebate ratios.

(The internal organizational structure and level rebate of Xinkangjia circulating online)

On June 26 of this year, the Xinkangjia platform completely closed its withdrawal channels, with reports suggesting that there are 2 million investors in the country, and the owner, Huang, and others absconded with around 18 billion. It is even alleged that the involved funds were mixed with virtual currency USDT and transferred away (which can be understood as money laundering "cleaning").

In fact, as early as April this year, the official Dubai Gold and Commodities Exchange (DGCX) issued a notice stating that DGCX has not established any affiliated institutions or partnerships in China.

As early as 2024, some departments in mainland China had already issued warnings about Xinkangjia, yet there are still comments under my videos questioning Lawyer Liu's judgment regarding the collapse of Xinkangjia. Some even feel that I am speaking too late, possibly because they can no longer withdraw their funds.

1. What Crimes Does the "Xinkangjia" Model Constitute?

Currently, no judicial or financial regulatory authorities have officially reported whether Xinkangjia constitutes a crime, but based on some materials circulating online, Lawyer Liu assesses that according to the model of Xinkangjia, it likely involves the crime of organizing and leading pyramid schemes or illegal fundraising (with the highest possibility being fundraising fraud).

There is also a practical issue from the perspective of judicial authorities: if classified as illegal fundraising, there will be a problem of needing to return the investment funds to the victims. The workload of statistics, contact, and return for around 2 million investors will be enormous. Additionally, if the investment was in USDT, should the return be in USDT or should the involved virtual currency be liquidated and returned in RMB?

If classified as pyramid scheme crimes, many issues would be "easily resolved": current judicial practice tends to recognize that there are no victims in pyramid scheme cases, and the funds involved need to be confiscated and returned to the national treasury. This not only fills the treasury but also saves considerable judicial resources, which is the scenario that judicial authorities most hope to see.

However, as lawyers, we must insist that the determination of what crime should be based on law, evidence, and facts. The following discussion is based on the assumption that the judicial authorities classify it as pyramid scheme crime.

2. Can Investors' Money Be Recovered in Pyramid Scheme Crimes?

This is the question most concerning to investors: Can I recover the money I invested?

Unfortunately, from the current judicial practice in mainland China, funds involved in pyramid scheme crimes rarely have the opportunity to be returned to investors. The main reasons are as follows:

(1) Involved funds are mostly treated as "illegal gains"

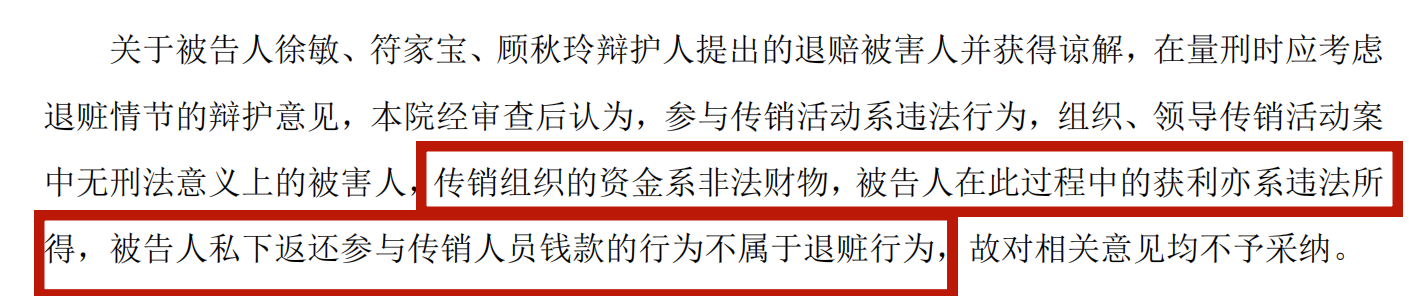

According to China's criminal law, criminal procedure law, and relevant judicial interpretations, as well as the practices in mainstream judicial practice, once an act is recognized as illegal or criminal, public security, prosecution, and courts usually regard the funds absorbed by the platform as "illegal gains" or "criminal tools," which are legally sealed, frozen, or confiscated, and ultimately forfeited to the national treasury. For example, in the judgment of the Huishan District Court in Wuxi City regarding the pyramid scheme crimes of Xu and others ((2020) Su 0206 Criminal Initial 561), it was pointed out:

(2) The law prioritizes the protection of social order

The primary task of judicial authorities in handling pyramid scheme cases is to combat crime and maintain financial order, as the crime of organizing and leading pyramid schemes is categorized under "disrupting market economic order." For a large number of participants in pyramid schemes, even if their initial intention was to invest, they inevitably played a role in "promoting" the platform's expansion, with some investors even profiting by recruiting others. Therefore, judicial authorities generally adopt a cautious attitude towards the so-called "returning funds to investors."

(3) Severe asset loss and difficulty in recovery

Many pyramid scheme platforms quickly transfer funds abroad or launder money through virtual currencies during their operations. By the time public security authorities initiate investigations, the assets involved are often minimal, making it difficult for investors to recover even if they win a lawsuit. In past major pyramid scheme cases like "Yunlianhui" and "Shanxinhui," billions of funds were confiscated by the courts, while investors had almost no chance of compensation. It can be anticipated that even if the "Xinkangjia" case reaches the judgment stage, the vast majority of funds will belong to the state.

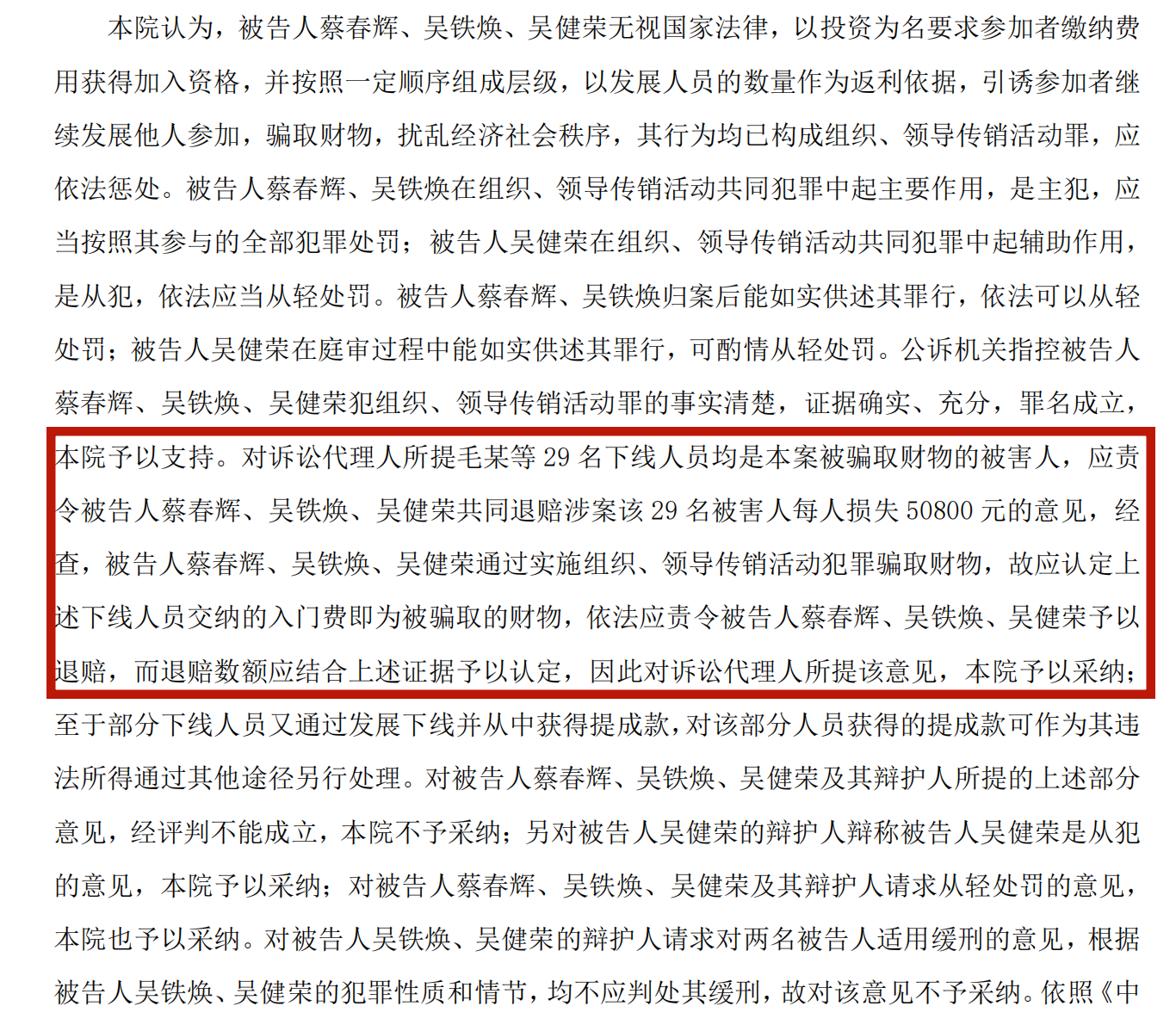

However, there are also cases in judicial practice where investors' funds have been returned. For example, in the pyramid scheme case of Cai and Wu ((2016) Yue 2072 Criminal Initial 1195), the court clearly stated that ordinary investors are victims of the pyramid scheme, and the corresponding property should be returned.

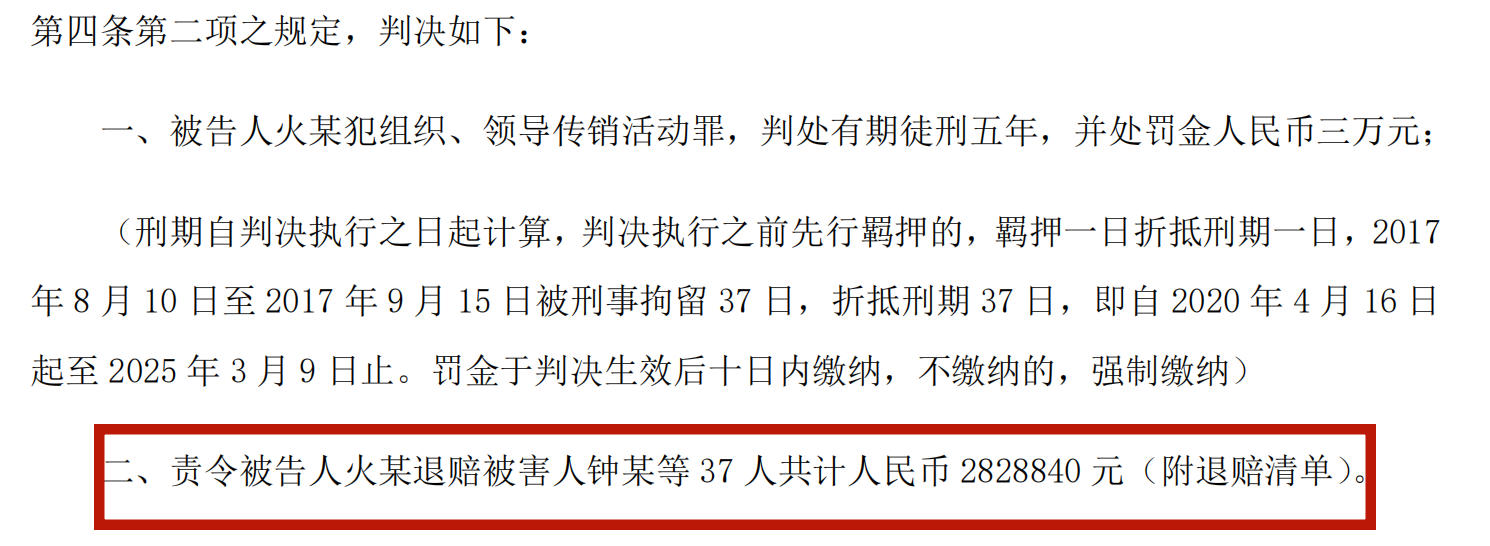

In the pyramid scheme case of Huo ((2020) Ning 0402 Criminal Initial 285), the court also ruled that Huo should return the investment funds of 37 victims.

Lawyer Liu needs to emphasize that even though these two cases exist where victims were compensated, it does not mean that the handling of new pyramid scheme cases should follow this precedent, as China is not a common law country, and current judicial practice still primarily focuses on confiscation.

3. What Other Legal Risks Are Involved in Investing in USDT?

The uniqueness of "Xinkangjia" lies in the fact that investors are all investing in USDT. Therefore, some participants may still harbor a sense of luck: "I invested in USDT, not RMB, and USDT is a virtual asset with property attributes; the law can protect me, right?" This understanding contains many misconceptions in the current judicial reality of mainland China.

(1) Virtual currencies do not possess legal compensation, and transactions are not protected

Since the announcement issued by the central bank and seven ministries in 2017 regarding the prevention of risks from token issuance and financing, mainland China has maintained a clear prohibition on virtual currency transactions. The "9.24 Notice" in 2021 reiterated that virtual currency-related activities are illegal financial activities, and no unit or individual may engage in such activities.

Therefore, whether investors purchase USDT, Bitcoin, or Ethereum, their investment behavior is not protected under the Chinese legal system. Even if losses occur or the platform runs away, the court is likely to reject their civil claims for compensation (thus, from this perspective, understanding the litigation agent system for victims in pyramid scheme cases may not be feasible, as many courts believe there are no victims in pyramid scheme cases).

(2) "Recognition of property attributes" does not equal "support for transactions"

Although some judicial rulings recognize that virtual currencies have certain "property attributes" and can be objects of theft, fraud, and other crimes, this only applies within the scope of criminal law. The purpose is to clarify that "virtual currencies can be stolen and can constitute objects of crime," not to say "they can be traded or invested legally." This distinction is crucial—acknowledging their existence does not mean allowing their circulation, nor does it mean protecting their investment.

(3) Involved virtual currency assets are still primarily handled through confiscation

Even if the assets involved are USDT or other virtual currencies, public security authorities will still freeze and seize them according to the law, and after conviction, they will be confiscated as illegal gains. If the "Xinkangjia" case is treated as a pyramid scheme case, the large amount of USDT assets absorbed by the platform that are seized by judicial authorities will ultimately be converted into legal currency and deposited into the national treasury, with investors rarely able to recover any funds.

Conclusion: Beware of Virtual Currency "Wealth Management" Traps and Protect Your Finances

The "Xinkangjia" case serves as a reminder that virtual currency wealth management projects disguised as "blockchain," "USDT," "mining machines," and "task platforms" are essentially old wine in new bottles, representing a Ponzi scheme. They masquerade as "financial innovation," but in essence, they are a combination of illegal fundraising, pyramid schemes, and fraud.

Currently, mainland China does not recognize the legal status of virtual currency investments and does not provide legal protection. This means that once an investment fails or a platform runs away, investors not only suffer significant losses but may also bear legal responsibilities for "participating in pyramid schemes" or "aiding money laundering," resulting in both financial loss and legal entanglements, which is highly unprofitable.

In the face of the temptation of virtual currencies and high returns, investors should maintain a clear mind:

- Reject promises of "guaranteed profits";

- Stay away from "recruiting others" and "rebate sharing" models;

- Do not easily trust "investment experts" or "financial teachers" online;

- Report any suspicious platforms to public security authorities as soon as possible.

The law cannot protect non-compliant speculative behavior; investment should not only aim for returns but also for safety. May every investor keep their eyes open and protect their finances, no longer paying for scams.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。