撰文:岳小鱼

引言:

Web3行业发展太快了,每天都有新事物出现。因此,很多日常思考值得被记录下来。

这些思考会实时更新在推特账号中,并定期汇总发布在微信公众号。

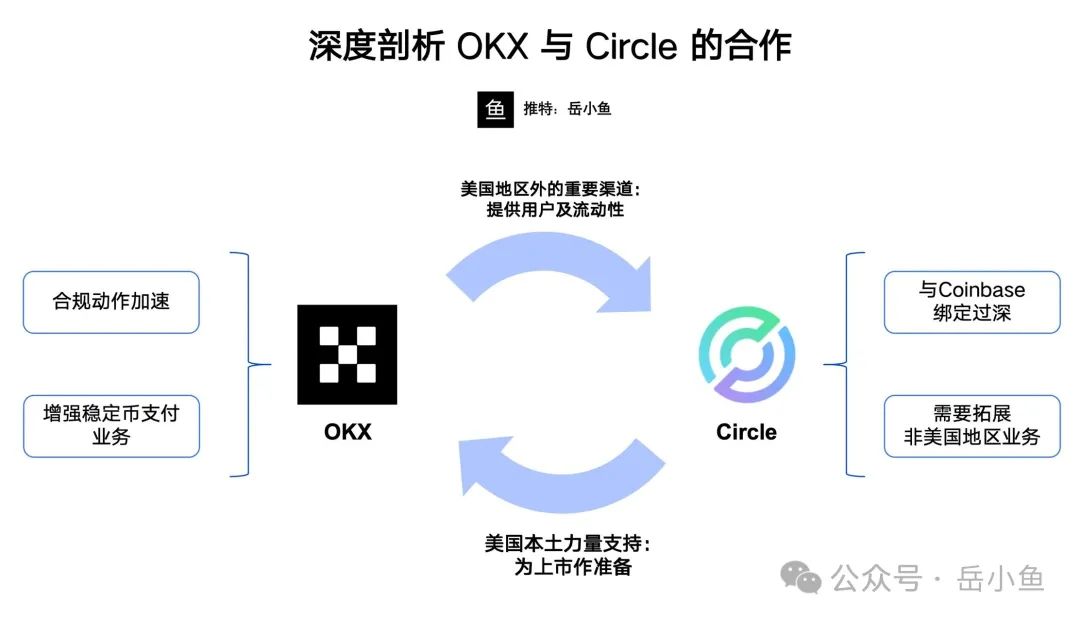

很多人其实并没有看懂OKX与Circle建立合作这次大事件,其背后透露出了很多信息。

首先,OKX与Circle为什么会达成合作呢?

想搞清楚为什么会有这次合作,要先了解两者各自的当下处境。

1、先看下OKX目前是什么情况:

对于OKX,最近有传言会在美国上市,而且也能看到其合规动作一直在加速。

前有停掉DEX的服务进行合规整改,现有清退网贷等不合规的用户和资金。

种种动作也表明了OKX的合规之路正在越走越远,终点就是在美股上市。

此时,OKX需要一个美国本土重量级的合作伙伴,为其上市之路提供更强的支撑。

另一方面,也有稳定币支付业务上的考量,之前OKX专门做了OKX Pay,继续往上游的稳定币发行商拓展,则非常有价值。

OKX能够与Circle合作,也是为了占据稳定币支付的重要生态位,在整个支付流程中获得了更大的利润空间。

2、再看下Circle目前的情况:

Circle已经在美国上市,一时之间似乎风头无两,但是其存在着一个非常大的潜在隐患:与Coinbase绑定过深。

这就从USDC的发展史讲起了:

USDC最早由Circle和Coinbase的合资公司Center发行,两家公司五五分享股权和控制权。

2023年下半年,Center关闭,所有控制权转移给Circle,由其全权负责USDC运营。

但是根据Circle招股书披露的协议,Coinbase仍持有USDC盈利的50%,并根据平台上USDC持有比例获得额外分红。

去年Circle盈利约16亿美元,约10亿支付给了Coinbase。

这两家公司其实还有一个非常重要的协议:若Circle无法分红给Coinbase或遇监管问题,Coinbase有权接管USDC成为发行方。

因此,虽然USDC现由Circle全权运营,但Coinbase仍扮演着重要角色。

这就解释了为何Circle与Coinbase现在绑定如此紧密。

3、回到稳定币业务本身

稳定币业务最关键的是流动性。

许多稳定币发行方都是交易所,因为交易所是天然渠道。

没有流通性,稳定币几乎不可能成功。

最开始时,Circle与Coinbase合作解决了最大痛点:发行之后立即获得了流通性、用户和交易对。

作为美国最大交易所,Coinbase给USDC带来巨大流量和品牌可信度。

而现在,Circle需要解决与Coinbase绑定过深的潜在问题。

如今,Circle找到了美国之外第二家能够提供用户和流动性的交易所,也就是OKX。

有人可能会问:为什么不是币安呢?

主要还是币安没有那么需要USDC。

Circle上市前,币安并不知道Circle付了10亿的推广费,币安只收到了6000万,但给了Coinbase9亿。

那币安为什么要帮Circle推广USDC呢?所以可以看到,币安现在站队了川普家族的USD1。

相比之下,币安之外的第二大交易所OKX更需要Circle。

4、总结一下

总之,OKX和Circle本次合作,可以说是各取所需:

OKX成为Circle首家非美国合规交易所的合作伙伴,为其上市之路带来了非常强的合规力量和美国本土力量支持,也增强了其稳定币支付业务。

对于Circle而言,OKX是一个美国之外很好的渠道方,与OKX的合作可以减轻Coinbase的限制,同时拓展了新的用户和流动性。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。