Recently, Robinhood, Kraken, and Bybit have officially announced their plans for tokenizing U.S. stocks, pushing RWA into a new phase of explosive growth.

Just last month, crypto payment company Alchemy Pay announced a partnership with RWA tokenization platform Backed, planning to launch the xStocks product on its Alchemy Pay RWA investment platform.

Alchemy Pay's xStocks product will initially feature 60 tokenized assets, including popular stocks like Circle, Apple, Tesla, Google, and SPY, allowing direct investment in U.S. stocks and ETF token assets using fiat currency. Alchemy Pay RWA is the first RWA platform to support direct fiat investment in tokenized assets.

As RWA experiences rapid growth, competition is becoming increasingly fierce. What competitive advantages does Alchemy Pay's RWA platform have? What are Alchemy Pay's ambitions in transitioning from crypto payments to RWA?

RWA Has Transitioned from Concept Experimentation to Scalable Adoption

The entry of industry giants and the gradual clarification of the regulatory environment are driving RWA to become one of the fastest-growing sectors in on-chain finance.

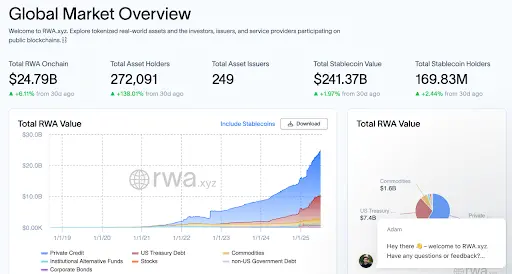

According to data from RWA.xyz, by July 2025, the total locked value (TVL) of the RWA market is expected to reach nearly $25 billion, a 188% increase from early 2024 (approximately $8.593 billion) and an 1100% increase from early 2022 (approximately $1.939 billion), demonstrating strong market momentum.

This wave of RWA has undergone a qualitative change compared to the previous two cycles.

On one hand, more industry giants are participating, moving RWA from concept experimentation to scalable adoption. Traditional financial giants like BlackRock, Franklin, JPMorgan, and WisdomTree have attempted fund/U.S. Treasury tokenization, followed by traditional payment giants like Visa and crypto giants like Tether expanding into tokenization platforms.

Recently, with Coinbase seeking approval from the U.S. SEC to provide stock tokenization trading services, Robinhood, Kraken, Bybit, and Alchemy Pay have successively launched U.S. stock tokenization products, further promoting the scalable adoption of RWA.

The Redstone report indicates that industry forecasts suggest that by 2030 to 2034, 10% to 30% of global assets may be tokenized.

On the other hand, the gradual clarification of the regulatory environment also supports the explosion of RWA. Switzerland, Hong Kong, Singapore, and other regions have established clear regulatory frameworks for tokenized assets. The upcoming "GENIUS Act" in the U.S. not only regulates stablecoins but also paves the way for the tokenization of various real-world financial assets.

Additionally, after multiple bull and bear cycles, DeFi has formed a complete underlying module, including DEX, lending, stablecoins, and asset management protocols, allowing RWA to release more liquidity value.

With the combined efforts of various parties, RWA is expected to continue its rapid growth in the coming years, becoming a key track for reshaping the financial sector.

What Advantages Does Alchemy Pay RWA Have?

The Alchemy Pay RWA investment platform is expected to officially launch in early August. Its first product is the xStocks product, which mainly includes 60 popular U.S. stocks and ETF tokenized assets such as Circle, Apple, Tesla, Google, and SPY. Alchemy Pay RWA is expected to collaborate with more RWA providers in the future to support various RWA assets such as real estate, funds, and U.S. Treasuries, as well as expand to more public chains.

Alchemy Pay's xStocks product allows users to invest in U.S. stocks around the clock, just like trading cryptocurrencies, without being restricted by traditional U.S. stock market opening hours. It also lowers the investment threshold, allowing non-U.S. investors to avoid the hassle of cross-border account opening and breaking geographical limitations. Meanwhile, since tokens can be subdivided, small amounts of capital can also participate in popular stock investments without needing to purchase whole shares, thus reducing the investment amount threshold.

Compared to other U.S. stock tokenization and RWA platforms, Alchemy Pay's biggest advantage may lie in its mature global crypto payment gateway, which can significantly lower the barriers for non-U.S. users to invest across regions and simplify user operations.

Alchemy Pay currently supports 173 countries, 50 fiat currencies, and over 300 payment channels, including mainstream payment methods like Visa, Mastercard, Apple Pay, Google Pay, and local payment methods like SEPA and PIX, enabling users to directly purchase RWA assets with fiat currency without complex cryptocurrency exchange processes. Alchemy Pay states that its RWA platform is the first to support one-click fiat investment in U.S. stock tokens and other RWA assets.

Based on its experience in providing crypto payment services to users in various regions, Alchemy Pay RWA is very user-friendly for beginners in terms of UI/UX design and operational processes.

Currently, the prototype of the Alchemy Pay RWA page has been launched, and its page design is very intuitive. Users can achieve "one-click purchase" through the dedicated portal "Buy Stocks," greatly simplifying the investment process, especially suitable for traditional investors who are not familiar with cryptocurrencies.

Alchemy Pay's RWA investment platform has also chosen the tokenization platform xStocks developed by Backed, similar to exchanges like Kraken and Bybit, as its underlying technology service provider. Each token of Alchemy Pay xStocks corresponds to one share of real stock, with Backed holding the physical stocks or ETFs as asset support.

Joining the ranks of early players in the xStocks camp alongside Kraken, Bybit, Solana, and Chainlink, Alchemy Pay not only ensures the security and regulatory compliance of assets through the compliance framework of xStocks, reducing investor risk, but also hopes to work with these leading industry projects to promote the establishment of RWA industry standards.

Alchemy Pay's Ambition: From Payment Gateway to Global Crypto Financial Center

In addition to the recent launch of the RWA platform, Alchemy Pay also plans to launch Alchemy Chain and issue stablecoins in Q4. Alchemy Chain will support frictionless conversion between global stablecoins like USDT and USDC and local stablecoins like EURC and MBRL, aggregating liquidity across chains and jurisdictions.

Since its establishment, Alchemy Pay has become one of the leading global crypto payment platforms, leveraging its payment infrastructure covering 173 countries and seamless "fiat-crypto" conversion capabilities.

Recently, from the launch of the Alchemy Pay RWA platform to the planned launch of the stablecoin public chain Alchemy Chain, it may showcase Alchemy Pay's strategic ambition to transition from a payment gateway to a global crypto financial center.

One can refer to the development path of Alipay. Alipay started with payments as an entry point, layering high-stickiness financial and lifestyle services, ultimately becoming a "financial super app" encompassing wealth management, credit, and insurance.

Alchemy Pay's advantage also lies in its global payment network. Similar to Alipay, it is penetrating more financial service areas through a three-step strategy of "payment + assets + infrastructure."

However, unlike traditional payment giants like Alipay, which operate within a centralized regulatory framework relying on local user scale and policy dividends, Alchemy Pay's breakthrough point lies in the decentralized global market, potentially offering a much larger market space in the future.

Through this strategic transformation, Alchemy Pay is expected to gradually evolve from a crypto payment solution to a global asset entry point and crypto financial center that serves global users and connects traditional and digital finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。