6 月 20 日,以太坊创始人 Vitalik Buterin 转评了 ConsenSys 创始人 Joseph Lubin 的一篇推文,表示「以太坊一层(Ethereum L1)是世界账本」。

这也是 Vitalik 针对近期以太坊宏观叙事讨论的罕见表态。

众所周知,在区块链世界中,每一条公链基本都有设计定位,也往往奠定其技术架构与生态格调。

譬如以太坊,自诞生之日起,终极愿景就是构建「世界计算机」:一个可以运行任何智能合约、承载各种 Web3 应用逻辑的开放平台,Vitalik 也曾明确指出,以太坊不只是一个支付网络,更是一个通用的去中心化计算层。

那如今,从「世界计算机」到「世界账本」,究竟经历了怎样的叙事流变?

01、以太坊:世界计算机的初心

其实不止以太坊,就连最初明确提出「电子现金」(Electronic Cash)愿景的比特币,伴随着体量增长和市场演化,其支付定位也逐渐淡化,转向以价值存储为核心的「数字黄金」。

客观上来说,这种转变本身就是一种务实选择,毕竟 BTC 作为加密资产出圈破界的代表,已经实质性被纳入主流金融机构的资产负债表,逐步成为 TradFi 配置的核心资产之一。

而同样回顾以太坊的发展路径,我们会发现主线虽然没有经历宏大叙事的剧烈转变,但早已处于持续的动态演化之中:

2016 年开始的一轮轮市场周期演进,以太坊都作为所有智能合约平台的龙头,引领整个赛道诞生了大量链上用例,从 ERC20 到 DeFi,再到 NFT 与链游,每一轮热点都印证了「链上计算力」的魅力。

可以说,智能合约一直是其核心,因此 Vitalik 才多次强调,以太坊是一个去中心化应用平台,目标是承载各种 Web3 原生逻辑,而不仅仅是资产转账。但与此同时,我们也看到了现实中的矛盾。

最饱受诟病的自然就是曾经高 Gas 费、低 TPS 等性能问题,限制了真正复杂计算逻辑的大规模落地,也正是在这种背景下,从 2020 年开始,Rollup 技术逐步登堂入室,经过 5 年来的发展,以太坊也逐步确立了「L1+L2」的分层结构。

在这种架构下,尤其是过去两年来,越来越多迹象显示,以太坊正在显露出成为一个可信、稳定、主权级别的「世界账本」的迹象。

02、L1+L2 分工下的叙事重构

如果用一句话来概括这种分工,「以太坊主网主网负责安全与结算、L2 承接高频交互」应该恰如其分。

说白了,如今以太坊生态内部已经形成了一种清晰的分工模式,即主网负责提供安全和最终结算的基础设施保障,而 L2(如 Base、Arbitrum、Optimism 等)则承载起大部分高频交易和用户操作。

这样既提高了扩展性,也进一步强化了 ETH 的价值捕获逻辑,天然将以太坊主网推向一个「全球去中心化账本」的定位,L2 越多,越成功,生态越繁荣,以太坊主网作为统一大账本的价值越高。

毕竟所有 L2 网络都依赖它做「央行」级别的结算层。

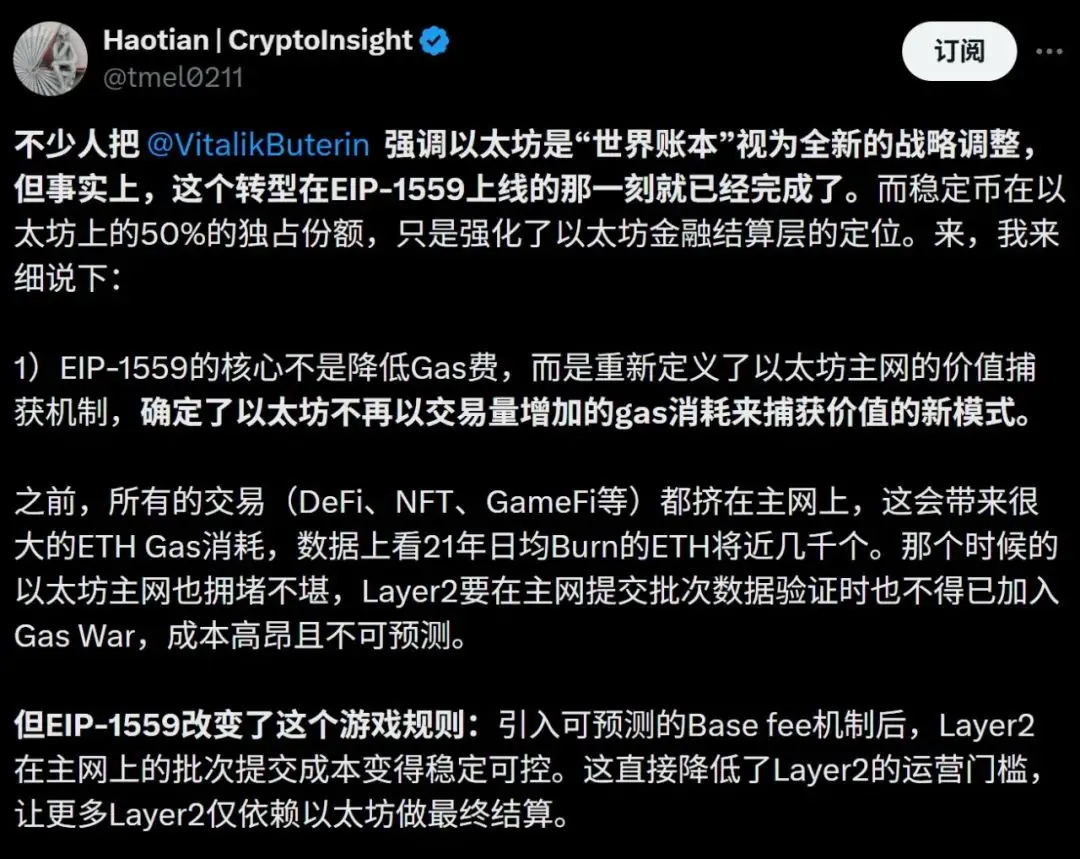

正如 Web3 研究员 Haotian 所言,EIP-1559 无疑是以太坊叙事转折的关键节点,它不仅引入了 Base Fee 和燃烧机制,更深层地重塑了以太坊的价值捕获方式,使得以太坊不再依赖主网上的大量交易所带来的 Gas 收入,而是转向依靠 L2 实现持续「纳税」。

换句话说,过去用户就是主网的直接客户,现在则变成了L2 各自代理运营,负责向用户提供服务、收取手续费,最终「上缴」费用,向主网换取结算权,这一机制设计很像历史上的「包税人制度」:

-

主网成为交易清结算的最终可信账本,类似央行;

-

L2 像商业银行,负责面向用户的高频服务;

-

而每笔 L2 交易回到主网验证时,都会烧掉 ETH,为账本的安全性付费;

可以说,以太坊没有放弃「世界计算机」的愿景,只不过 L1+L2 的分工架构与发展路径,正在引导它先成为「世界账本」。

03、「世界账本」的现实主义落地

另一个比较有意思的观察维度是,而每一轮 ETH 的价值爆发,其实都源于主网作为账本角色的「被用起来」。

像 2017 年 ERC20 浪潮是发行 Token 的清结算层,2020 年 DeFi Summer 则是智能合约组合下的资金结算平台,而近期这轮若因美股代币化、RWA 等金融资产上链再次爆发,以太坊也仍是那个可信账本。

因为对于 TradFi 来说,计算能力当然重要,但真正决定是否迁移上链的,始终是账本的「信任、最终性与安全性」——这是合规资产最核心的落脚点。

这也是为什么像 Robinhood 等平台纷纷选择基于 Arbitrum 等 L2 推出美股代币交易服务,背后不仅是对 Rollup 架构性能的认可,更重要的是,这些交易最终都将回归以太坊主网完成结算。

这也说明现有 L2 方案的性能、安全与合规能力,已足以承接传统金融核心资产的交易需求,某种意义上讲,这轮「美股上链」浪潮,实际强化了以太坊作为全球金融清结算基础设施的定位,进一步验证了其「世界账本」角色的可行性与现实需求。

这才是以太坊从「世界计算机」迈向「世界账本」的现实主义演进路径——它不再仅仅承诺未来的链上应用图景,而是被越来越多现实世界的主流资产选择作为结算终点。

从这个角度看,这类趋势不仅是对以太坊 L1 的价值确认,也会深刻重构 L2 的价值捕获逻辑,推动整个以太坊生态在技术与金融基础设施之间真正接轨。

一言以蔽之,那些真正能推动这条链走向亿级用户的叙事,不仅仅是以太坊可以做什么,更在于:

现实世界愿意用以太坊做什么。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。