特朗普与鲍威尔的斗争引发了关于FOMC会议前美联储降息的辩论

在一个重大的政治转折中,总统表示美国联邦储备委员会主席杰罗姆·鲍威尔应该立即辞职。这为持续多年的特朗普与鲍威尔的斗争增添了更多火药味,这场斗争围绕着美国的利率政策展开。

为什么特朗普推动鲍威尔辞职?

总统表示,他将利率维持得过高,这正在伤害经济。他认为,在如此高的利率下,政府甚至无法妥善再融资其债务,而他对此心知肚明。

他在推特上补充道,联邦住房金融局的负责人也表示国会应该调查他的行为。

总统明确表示,他希望将利率降至1%。他甚至给美联储主席写了一封手写信,并在社交媒体上发布,称美国因紧缩的货币政策而损失“数千亿”。在他看来,他正在忽视现实并拒绝采取行动。

特朗普与鲍威尔的利率斗争

这场特朗普与鲍威尔的斗争由来已久。甚至在特朗普上任之前,他就警告说国家已经没有钱了。成为总统后,他与美联储主席多次发生冲突,称他反应迟缓,并表示管理美联储是“最简单的工作之一”。

最近,在6月18日的FOMC会议上,美联储再次决定维持利率不变,保持在4.25%到4.5%之间。华尔街的许多人希望降息,但主席坚决反对。

他认为关税的不确定性不允许他立即降息。事实上,他并没有屈服于压力,而是在网上分享了一张冷静的狐獴的表情包,以表明他并不担心。

鲍威尔会被替换吗?

总统不仅仅是在抱怨。在幕后,他正在寻求在2026年任期结束之前替换主席。

他已经在与可能的接替人选进行交谈,如凯文·沃什、凯文·哈塞特和克里斯托弗·沃勒。

如果他真的替换鲍威尔,这可能会导致利率处理方式的重大变化。

许多专家担心这可能会损害美联储的独立性。

中央银行的决策不应基于政治,而应通过信息来做出。

然而,随着总统的意愿得以实现,这种情况可能会改变美联储未来的功能。

这对加密货币的影响?

特朗普与鲍威尔的斗争也可能动摇加密货币市场。如果特朗普的策略带来降息,那么比特币和其他加密货币可能会受益。较低的利率往往会导致更多资金投资于波动性资产,如加密货币。

目前,投资者预计他们可能会在今年下半年降息。然而,如果他不得不辞职,并被一个支持快速降息的人替代,那么加密货币价格可能会飙升。

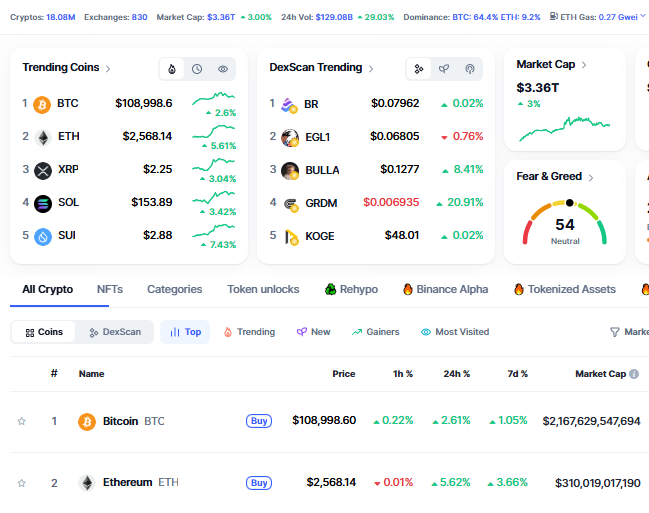

另一方面,当前关税的不确定性可能会让投资者在短期内感到紧张。现在,加密货币市场的市值为3.36万亿美元,在过去24小时内增长了3.00%。比特币的交易价格为108,998美元,过去一天增长了2.61%,而以太坊的交易价格为2568美元,过去一天增长了5.62%。

所有目光都集中在7月30日的美联储会议上

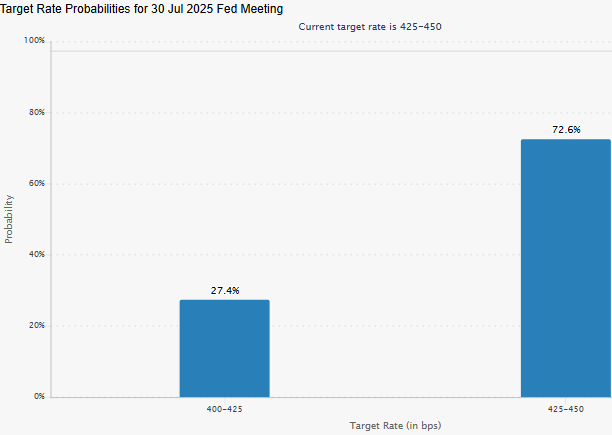

特朗普与鲍威尔斗争的下一个重大时刻是即将到来的 7月30日的FOMC会议。届时,美联储可能会决定是否最终降息或维持高利率。根据美联储观察工具,只有25.8%的人投票认为美联储会降息。

许多交易者希望看到降息的迹象。如果 美联储降息,这可能会平息市场并推动加密货币。但如果美联储再次维持不变,来自总统的压力可能会进一步加大,进一步加剧特朗普与鲍威尔的斗争。

最终思考

特朗普与鲍威尔的斗争不仅仅是一场政治戏剧,它是关于金钱、权力和经济未来的重大冲突。其影响可能在未来几个月内波及利率和加密货币市场价格等各个方面。

另请阅读: Hrum 今日报价 2025年7月3日:奖励150个代币

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。