作者:Jess Bidgood & Catie Edmondson

编译:深潮 TechFlow

特朗普总统的标志性立法可能会在本周末取得进展。

图片来源:Kenny Holston/《纽约时报》

特朗普称其标志性国内立法为“一个大而美法案”(One Big Beautiful Bill),但它的推进之路并不顺利。

这项法案旨在延续 2017 年的减税政策,并通过削减社会保障网的资金来支付这些减税成本。在众议院,该法案几乎未能通过;在参议院,它被大幅修改。最近几天,参议院的一位关键官员否决了法案中的多项条款,该官员的职责是确保立法者遵守预算法案的规则,这迫使参议员们不得不争分夺秒地重新加入部分内容。

此外,正如我的同事卡尔·赫尔斯(Carl Hulse)和凯蒂·埃德蒙森(Catie Edmondson)今天所写,没有人真正喜欢这项法案。

但这是特朗普治下的华盛顿。在这里,不知道法案的具体内容或对其缺乏热情这样的“小问题”,可能并不足以阻止参议院共和党人投票支持它——甚至可能在本周末就完成投票。

我向凯蒂请教了这部法案的曲折历程——它是如何变成一个政策“大杂烩”的,为什么它让许多共和党人感到不安,以及为什么这些问题可能对它成为法律的前景没有太大影响。

共和党人正在努力挽救参议院议事员认为违反预算法案规则的部分内容。你从特朗普第一届政府开始报道国会事务,见证了许多立法“制作过程”。这种混乱的情况是否正常?

在某种程度上,这确实是立法过程中的常见现象,过去两党都曾面临类似挑战。例如,当民主党利用预算调解程序通过拜登总统的《降低通胀法案》和新冠疫情刺激计划时,议事员也否决了其中的重要条款,包括提高联邦最低工资的提案。

但另一方面,我确实认为,这种来回拉锯反映了这项立法已经变成一个“政策大杂烩”,其中一些内容与预算几乎没有关系。这项法案包括减税、削减医疗补助(Medicaid)和营养援助计划的资金,但同时还包含禁止各州监管人工智能、放宽某些枪支法律以及出售公共土地的条款。

特朗普在扮演什么角色?他的行动——或不作为——是否加剧了混乱?

昨天,特朗普总统在白宫为这项法案争取了支持,但目前我们还没有看到他深度介入拉票工作。国会山的“游戏计划”通常是在关键投票的最后阶段让他出场,以压服那些最后的反对者。

同时,有一种反复上演的动态也在这里发生:那些对法案持保留意见的立法者会给总统打电话,希望他支持他们的立场。而特朗普总统通常会告诉他们,他同意他们的看法。这种情况让立法者更难弄清楚他真正想要什么,因为他的立场可能会随着这些对话而改变。

目前,这种情况尤其体现在医疗补助(Medicaid)的问题上。一些参议员认为参议院的方案对医疗补助的削减过于严重。其中包括密苏里州参议员乔什·霍利(Josh Hawley),他和其他几位参议员将这一担忧带到总统面前。霍利回来后表示,特朗普告诉他们,他更喜欢众议院的方案,因为该方案保留了更多的医疗补助项目。

关于医疗补助的争论是共和党内部围绕这项法案展开的几场斗争之一。还有哪些党内分歧被暴露出来?

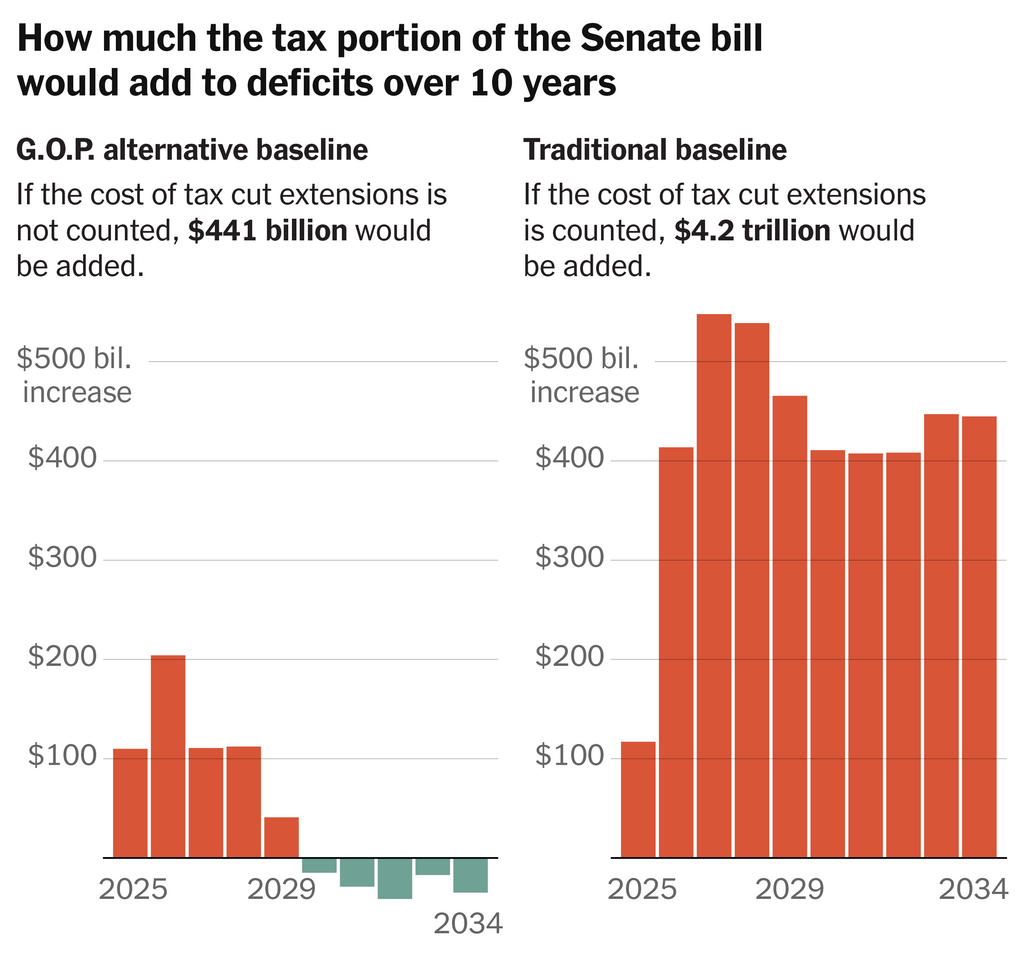

医疗补助问题是关于联邦支出削减幅度更广泛争论的一部分。在这一过程的初期,众议院和参议院的一些财政保守派人士表示,他们不愿意投票支持任何会增加赤字的立法,因此希望通过新的支出削减来弥补减税带来的收入损失。然而,这种情况并没有在众议院或参议院发生。两院的方案都会使赤字增加数万亿美元。这显然不是这些财政保守派希望在掌控国会和白宫时所采取的政策路径。

真的有人喜欢这项法案吗?

共和党人认为他们必须通过这项立法,因为如果不延续 2017 年的减税政策,那么所有人的税负都会增加。这项法案还包含了针对小费和加班的新的税收减免,这是特朗普在竞选期间承诺要做的事情。但除此之外,他们基本上是在延续现状——即 2017 年创立的减税政策——同时却大幅削减了一些非常受欢迎的社会福利项目。

如果你正准备在一个政治立场偏中立的州或选区竞选连任,你会知道民主党一定会针对这项法案削减医疗补助(Medicaid)和食品援助计划的内容猛烈抨击你。许多共和党议员已经在市政厅会议上听到选民对此表达的担忧。

那么,我们讨论的这些内容——共和党人不喜欢这项法案的种种理由,以及他们难以保持法案完整性的挑战——是否会真正威胁到它的通过可能性?

我认为不会,尽管这可能会让他们的时间表更加复杂,也可能会改变最终法案的具体内容。自众议院通过其版本以来,这项法案似乎已经不可避免。

他们可能会通过一项带来重大政治风险、但无人喜爱的法案。为什么?

这是一项可能带来政治风险的投票,但它并不是为了服务于某种宏大的政治理念,这使得它不同于我们过去看到的两党都曾面临的一些艰难投票。但这是特朗普要求的事情。

我认为,共和党内部普遍感到,他们可能会在中期选举中失去众议院多数席位——从历史趋势来看,这是非常可能的——这意味着他们通过重大立法的时间有限。而且,他们确实感受到一种意识形态上的紧迫感,必须延续 2017 年的减税政策。所有这些因素,再加上这项法案本质上是对总统议程的一次简单的赞成或反对投票,使得这项法案彻底失败的可能性微乎其微。

“大而美”的法案究竟要花多少钱?这取决于你如何计算——以及从哪里开始计算。我向负责税收政策报道的同事安德鲁·杜伦(Andrew Duehren)请教了这个问题,他发誓说研究这些内容其实很有趣。他为我们解释了共和党试图使用的预算“技巧”,以使账面数字看起来更好。

任何预算都需要对未来做出假设。比如,下个月我可能会花多少钱买食品?我会不会在工作中加薪?这些问题的答案可以帮助你回答其他问题,比如:我能负担得起这次度假吗?

华盛顿的运作方式与此类似,只是规模大得多。长期以来,共和党和民主党已经就一套对未来国家预算的假设达成共识——假设没有任何额外的政策变化。他们以此为基准来决定是否可以负担某些政策,比如减税。

参议院共和党人想要改变华盛顿对未来做出这些假设的方式。几十年来,临时性的减税政策一直被视为一种特殊支出;通常假设在长期内,这些减税政策会到期,税收会恢复到原来的水平,政府收入也会随之增加。

但参议院共和党人认为这种假设是错误的。他们主张将 2017 年通过的临时减税政策纳入长期预算假设。如果按照这种方式重新定义这些减税政策,那么延续这些政策(正如他们希望通过这项法案做到的那样)看起来就不会像是新增支出了。

这就好比你原本认为租一辆豪华车只是短期的特殊开销,但当租约到期时,你并没有选择更便宜的选项,而是告诉自己:我一直计划支付更高的车费,所以我完全能再租一辆豪车。

海云·蒋/《纽约时报》

抵达与离开

《纽约时报》最新的摄影记者海云·蒋(Haiyun Jiang)对能够讲述权力故事的照片情有独钟。本周,她随特朗普总统前往海牙时,就捕捉到了这样的瞬间。

周二晚上,海云与其他摄影记者一起等待特朗普抵达海伊滕博世宫(Huis ten Bosch),这是一座荷兰皇室宫殿,特朗普将在这里会见荷兰国王和王后并过夜。这种充满仪式感、排场十足且与皇室相关的活动,正是特朗普所热衷的场合。

当特朗普乘坐装甲豪华轿车抵达时,海云看到了一个展现总统权威的绝佳机会。

“我试图用车窗来框住他的身影,因为我知道特勤局的特工会为他打开车门,我觉得这是一种捕捉权力的方式,”海云告诉我。

稍后,她又抓住了另一个机会。当海云和其他摄影记者被匆匆带离现场时,她注意到皇宫的卫兵已经开始清理象征权力的装饰物。

海云·蒋/《纽约时报》

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。