撰文:Daniel Kuhn

编译:far,Centreless

国际清算银行表示,稳定币不是货币。

这家有时被称为「央行的央行」的机构在周二发布的一份报告中指出,与法币挂钩的数字资产未能通过使其成为货币体系支柱所需的「三项关键测试」:单一性、弹性以及完整性。

BIS 在其年度报告中审查下一代金融时表示:「稳定币等创新在未来货币体系中将扮演何种角色仍有待观察。但它们在衡量健全货币安排所应具备的三个理想特征时表现不佳,因此无法成为未来货币体系的支柱。」

据该报告作者称,稳定币确实具有一些优势——例如可编程性、伪匿名性以及「对新用户友好的接入方式」。此外,它们的「技术特性意味着它们可能提供更低的成本和更快的交易速度」,特别是在跨境支付方面。

然而,与央行发行的货币及商业银行和其他私营部门实体发行的工具相比,稳定币可能会通过削弱政府的货币主权(有时是通过「隐蔽美元化」)并助长犯罪活动而给全球金融体系带来风险,作者如是说。

尽管稳定币在加密生态系统进出通道中具有明确的角色,并且在通胀高企、存在资本管制或难以获得美元账户的国家中日益普及,但这些资产不应被视为现金对待。

三项关键测试

具体而言,由于其结构设计,稳定币未能通过弹性测试。以 Tether 发行的 USDT 为例,这种稳定币由「名义上等值的资产」支持,任何「额外的发行都需要持有者全额预付款」,这施加了「预先付现约束」。

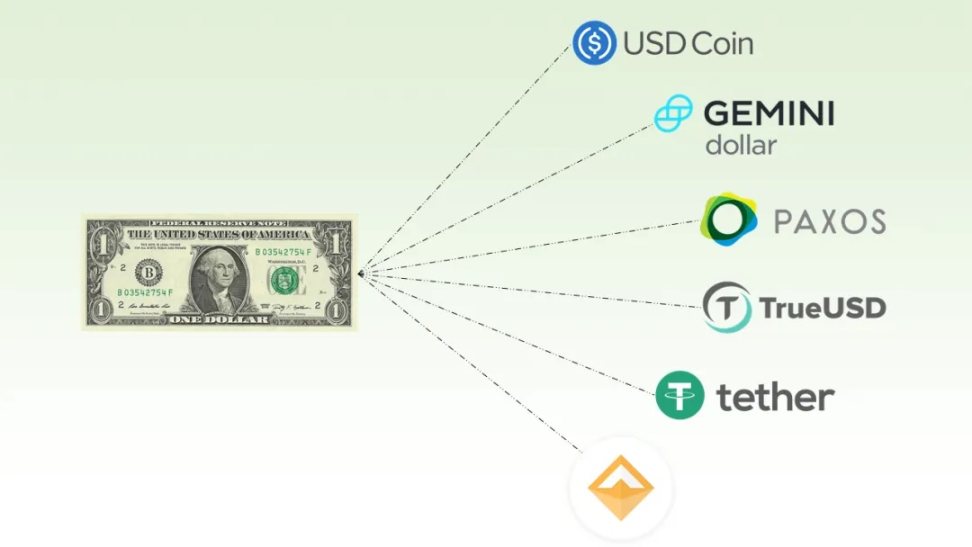

此外,与央行储备不同,稳定币并未满足货币的「单一性」要求——即货币可以由不同银行发行并被所有人无条件接受——因为它们通常由中心化实体发行,这些实体可能设定不同的标准,也不一定总是提供相同的结算保障。

作者写道:「稳定币的持有者会标注发行方的名字,就像 19 世纪美国自由银行时代流通的私人银行券一样。因此,稳定币经常以不同的汇率进行交易,破坏了货币的单一性。」

出于类似原因,稳定币在促进货币体系完整性方面也存在「重大缺陷」,因为并非所有发行方都会遵循标准化的了解你的客户(KYC)和反洗钱(AML)准则,也无法有效防范金融犯罪。

变革性的通证化

稳定币 USDC 的发行商 Circle 在 BIS 报告发布后,股价周二下跌超过 15%。此前一天,CRCL 股票曾创下 299 美元的历史新高,较其约 32 美元的首次公开发行价格上涨逾 600%。

尽管 BIS 表达了担忧,但该组织仍看好通证化的潜力,认为这是从跨境支付到证券市场等领域的「革命性创新」。

作者写道:「以央行储备金、商业银行货币和政府债券为核心的通证化平台,可以为下一代货币和金融体系奠定基础。」

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。