黑石集团以太坊投资 + 资金流入激增:这对ETH意味着什么

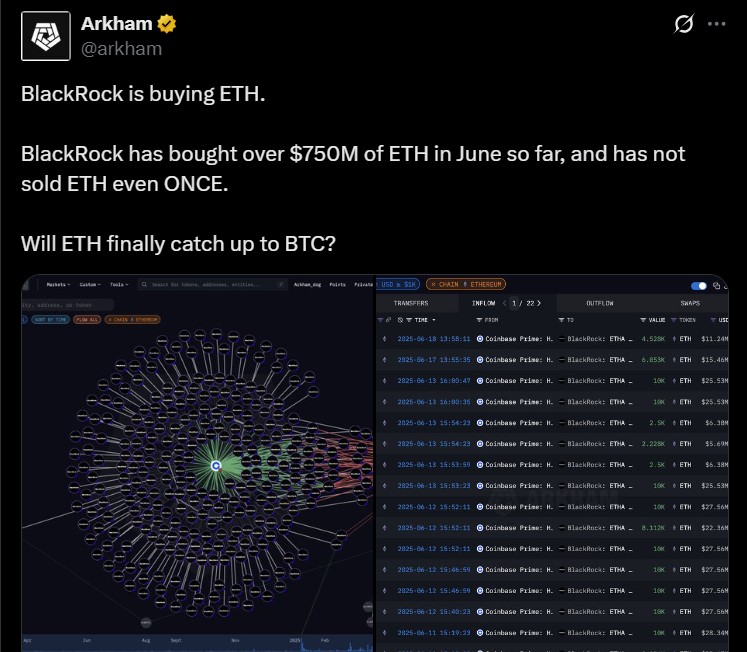

在六月,黑石集团的以太坊投资活动震惊了许多分析师。根据Arkham的链上数据,这家全球最大的资产管理公司已经购买了超过7.5亿美元的代币。更令人惊讶的是,自那时以来没有一枚代币被出售,即使以太坊今天的价格也崩溃了。

来源: Arkham Data X 账户

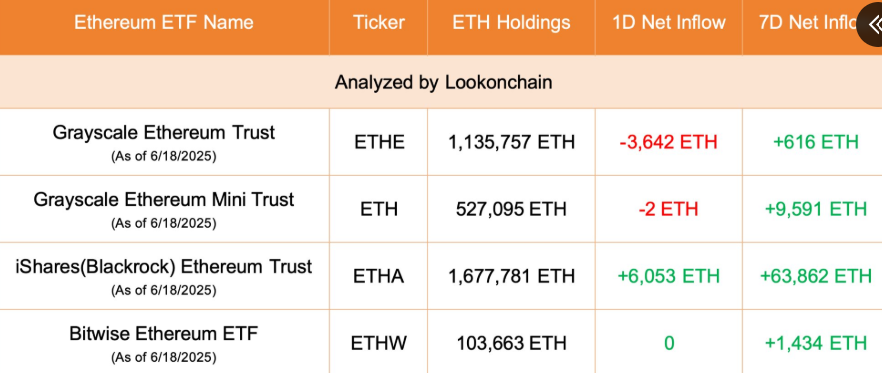

他们的加密货币专注基金目前持有约167万个代币,价值约42.3亿美元。根据Lookonchain的数据,今天的最新消息显示,ETF资金流入依然强劲,本周新增超过6000个代币,激发了市场日益增长的好奇心。

来源: Lookonchain X 官方账户

为什么以太坊今天下跌?面临强劲阻力

许多人在问:为什么今天会下跌,尽管需求上升,价格崩溃在图表上得到了反映。它仍然在接近2490美元的价格交易。交易者和分析师现在正在辩论ETH是否会保持支撑或突破。短期信号如RSI为46.85和负MACD直方图表明动能减弱。

目前,这个币必须保持在2450美元以上,否则可能会向2350美元回调,具体请参见TradingView图表。

来源: TradingView

许多交易者认为这个区间是真正的突破区。尽管它面临强劲的阻力,这也是下跌的原因之一,但如果它获得力量,突破2600美元可能为向下一个主要以太坊价格目标 2800–2900美元的反弹奠定基础。

像Alva这样的AI加密工具表明,当前市场的动向与其说是恐慌,不如说是“战术轮换”。这意味着资金在ETH与BTC之间转移,但两者仍然是长期策略的关键持有资产。

分析师表示长期$ETH价格预测依然乐观

展望未来3-6个月,许多人将ETH ETF更新和Layer-2的采用视为强烈的看涨信号。像Optimism、Base和zkSync这样的项目正在推动网络活动的增加。这些Layer-2的新闻趋势使得该币更具可扩展性,这是投资者所看重的。

ETH未来预测包括潜在收益高达3600美元,如果需求保持稳定,整体经济条件保持有利。但也存在风险:宏观变化可能会将ETH推回到2000美元,这将考验更低的支撑阻力区。

最后思考:大型加密货币激增是否即将到来?

现在,所有的目光都集中在黑石集团以太坊投资是否会激发一波新的买家。尽管以太坊价格崩溃已经反映出来,但强劲的基本面和ETF的支持为$ETH的下一次重大行动提供了坚实的基础。

作为一名加密分析师,我注意到,当黑石集团的加密新闻与低零售活动相吻合时,通常预示着一些重大事件即将发生。这些机构的举动不仅仅是数字——它们是安静的权力游戏。

因此,请关注阻力水平,并确保在投资任何加密货币之前进行自己的研究,因为加密市场高度波动,价格变化频繁。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。