Bitcoin to Hit New All Time High: Support from Institutional Investors

The crypto currency world is buzzing with excitement. There is a discussion going on that Bitcoin might soon reach a new all-time high. Several signals are pointing in that direction, specifically with strong support from big corporate organizations and investors.

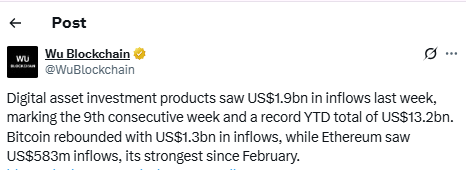

Institutional Demand Keeps Rising

Last week, crypto investment products experienced an inflow of $1.9 billion. Out of which $1.3 billion went into Bitcoin-focused exchange-traded products (ETPs). It marks this as the ninth week of steady growth. These ETPs assist investors get exposure to this digital asset through traditional markets.

Source: Wu Blockchain

In the United States, spot ETFs now hold assets worth over $156 billion. This depicts that huge investors trust this digital asset as a long-term investment.

Metaplanet and Strategy Are Leading the Charge

Japanese tech firm Metaplanet is making headlines. It recently bought 1,088 units of the asset on June 1. Metaplanet holdings pushing its total to 10,000 Bitcoin . The company isn’t stopping there. It plans to raise ¥770.9 billion (about $5.4 billion) through a special method that allows it to sell shares at a premium price. This move aims to boost its digital holdings to 210,000 by the end of 2027.

On the other hand, Michael Saylor’s firm Strategy already holds 582,000 units, worth over $61 billion. It uses a smart method called dollar-cost averaging, buying in small chunks over time. Just last week, it added 1,045 units for around $110 million. Previously the firm has also launched stock offerings to raise funds for more purchases, already gathering over $3 billion for the latest purchase.

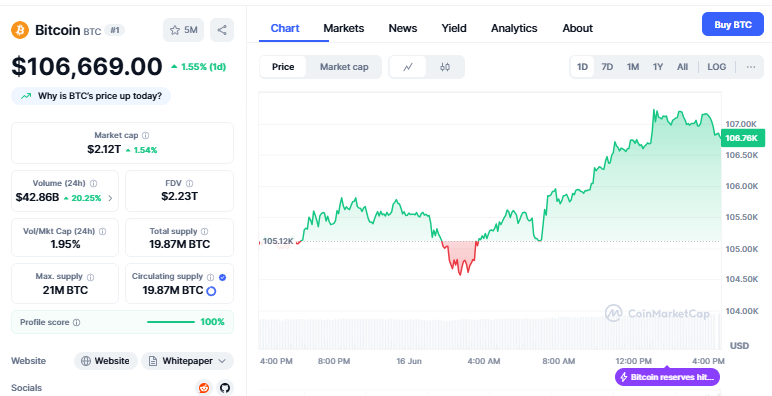

Bitcoin as a Safe Haven

When tensions rose between Israel and Iran, many altcoins dropped. But the leading digital coin held firm around $107K. Investors are now considering it as a new age gold, a hedge against their money during unstable times. It dropped by 4% but recovered in no time from $102000 to $107000. It is currently trading at $106,669 with an increase of 1.55% within the last 24 hours.The trading volume has also increased by 20.26%.

Source: CoinMarketCap

The Fear and Greed Index, which measures market mood, sits at 61. That means investors feel hopeful but cautious. More and more, big firms and everyday users are looking at this asset as a smart place to store value.

Corporate BTC Adoption Grows

It’s not just investment firms. Big companies are joining in too. There are reports that Trump Media got the SEC approval and might add $2.3B worth of Bitcoin through DRW.

VanEck’s Matthew Sigel has also warned these firms to be careful when raising money by offering new shares. If done the wrong way, it can reduce the value of what current investors own. Still, the fact that so many companies are thinking about adding this asset shows strong belief in its future.

Final Thoughts

From record-breaking inflows to growing company support, all signs suggest that BTC could soon break its past records. While no one can predict the future for sure, the current trend is clear, more people are buying, holding, and believing. The industry is looking forward to the upcoming FOMC meeting that might fluctuate the prices too. Whether it’s for growth or safety, Bitcoin is once again becoming the star of the financial world.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。