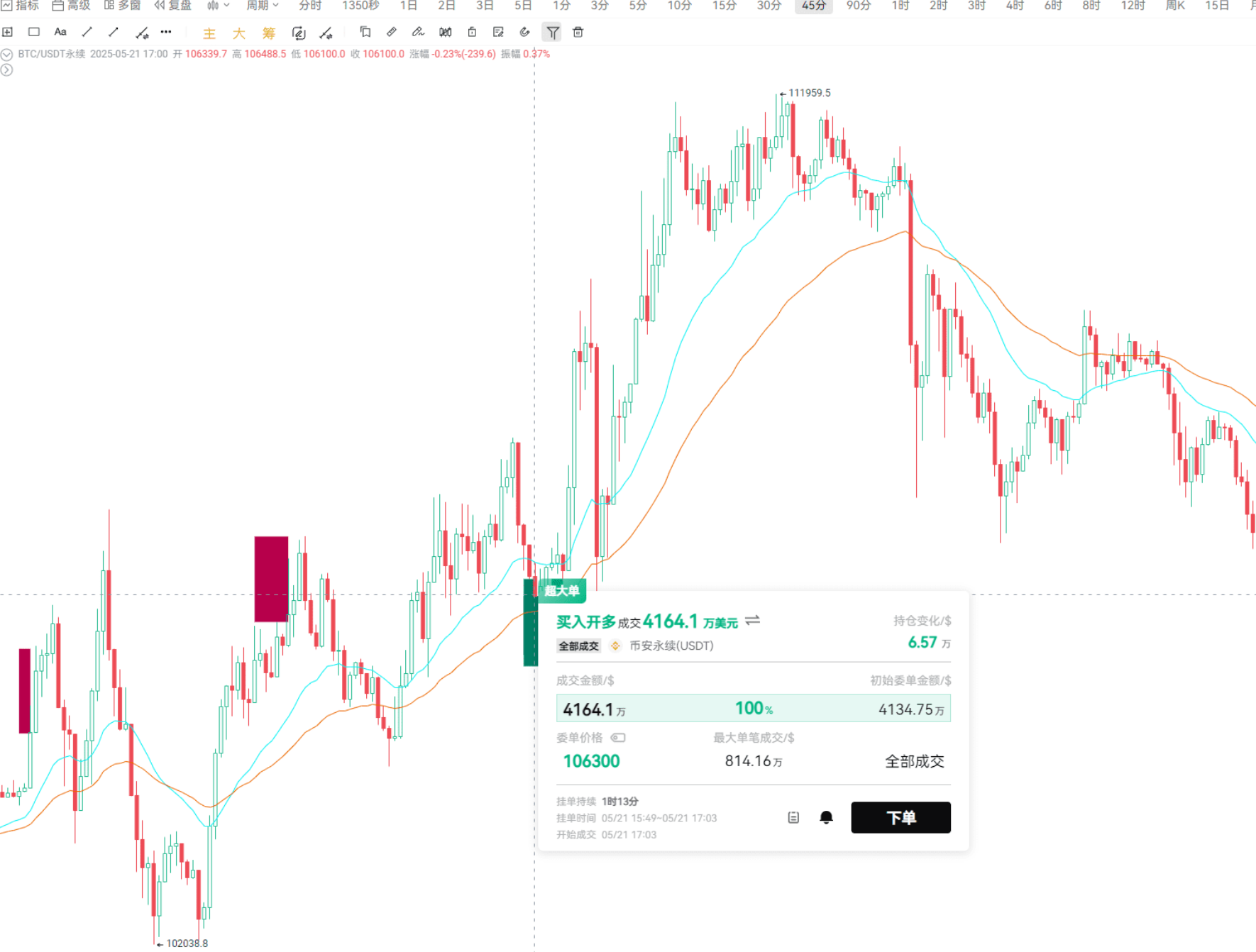

Hello everyone, on June 11th, friends in the live broadcast room may have noticed a strange phenomenon in the BTC market, which has been consolidating for the past two days—certain major funds frequently placing "hundred million dollar short-lived large orders." Just like the scene captured in the screenshot earlier: a sudden buy order of 100 million dollars appears on the order book, but after less than 10,000 dollars are executed, the order is quickly canceled. This kind of "loud thunder but little rain" operation is not normal market behavior, but a typical major player baiting tactic.

In just 24 hours yesterday, we captured four such abnormal orders. Behind these fleeting large orders, major players usually have three layers of calculations:

The first layer of calculation is psychological warfare. When you see a sudden buy order of 80 million dollars at three in the morning, what is your first reaction? Most retail investors instinctively think "big funds are about to bottom out," and rush to follow suit and go long. Little do they know, this could be a carefully laid bull trap by the major players—they don’t actually want to execute the order, but rather use this numerical fireworks to stimulate market sentiment. Similarly, a sudden large sell order can trigger panic selling. Just like last week's false breakdown of ETH, which was triggered by a few "phantom sell orders."

The second layer of calculation is market probing. These short-lived large orders act like the major players' sonar detection, specifically used to test the current market's real depth. A friend from a high-frequency quant team revealed that they often use this method to assess: if a 50 million dollar buy order is suddenly canceled, will the market support collapse? Will slippage exceed expectations? More cunningly, some major players will feint to the east and strike to the west—placing fake orders on Binance to create a smokescreen, while secretly completing real positions on OKX or Coinbase. It’s like a magician’s sleight of hand; while your attention is drawn to the left hand, the right hand has already completed the crucial action.

The third layer of calculation is behavioral chain deception. What is truly worth being cautious about is not the order numbers themselves, but the "order-cancellation-execution" behavior chain. For example: the major player first places a 100 million dollar buy order to create a bullish atmosphere, and once retail investors follow suit and push the price higher, they quietly sell at a higher level. The entire process is like a carefully choreographed drama, with that eye-catching "100 million" merely being a poster to attract you to buy a ticket to enter.

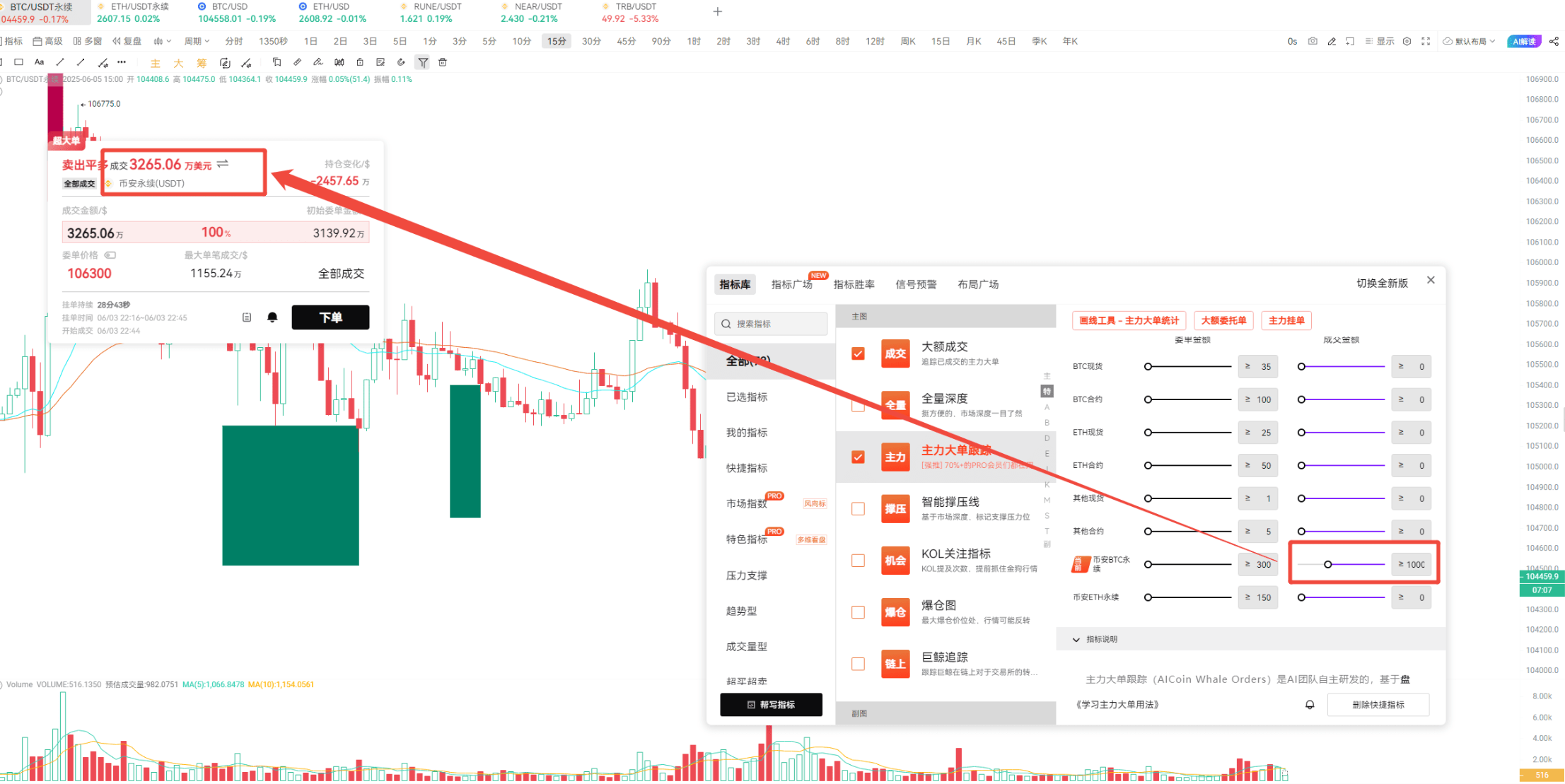

The solution lies in four key filters:

Execution Rate Filter—only focus on large orders with an execution rate exceeding 80% (Image 7), and directly ignore those "paper tigers" with less than 1% execution!

Time Funnel—set a 5-minute observation window to filter out fake orders that survive for less than 3 K-line periods.

Amount Threshold—in the BTC perpetual contract market, any so-called "large order" below 10 million dollars isn’t even worth a glance!

Behavior Verification—must see the major player executing a real transaction in the opposite direction immediately after canceling the order!

Speaking of practical tools, our community-developed "Major Player Behavior Tracker" has already helped many users avoid traps. This indicator scans in real-time: when large orders appear, is there accompanying on-chain capital flow? After cancellation, does a reverse position appear immediately? Just like last week's false breakout of BTC, the system issued a "major player baiting" alert 10 minutes in advance.

Lastly, here’s a warm-hearted benefit: friends who register for OKX through the exclusive AiCoin link can not only enjoy a 20% fee rebate, but the first 100 will also receive our smart thermos cup—this cup is like our AI risk control system, helping you maintain temperature in both hot and cold markets. Additionally, there are 10 free AI analysis opportunities to help you develop a discerning eye. https://www.okx.com/zh-hans/join/aicoin20

Remember, in this market where psychological games are played every second, the true winners always focus on the movements of major player wallets, not on those fleeting numerical illusions on the order book. In the next live broadcast, we will dissect "on-chain fingerprints during major player wash trading," so stay tuned!

This article only represents the author's personal views and does not represent the position or views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。