大家好呀。各位交易场上的战友们,这里是研究院,今天我要为大家揭开主力大单的神秘面纱。这些动辄千万美元级别的资金动向,就像市场写给我们的密电码,只要掌握解读方法,就能提前洞察趋势变化。让我们从最基础的"大单吸引法"开始讲起。

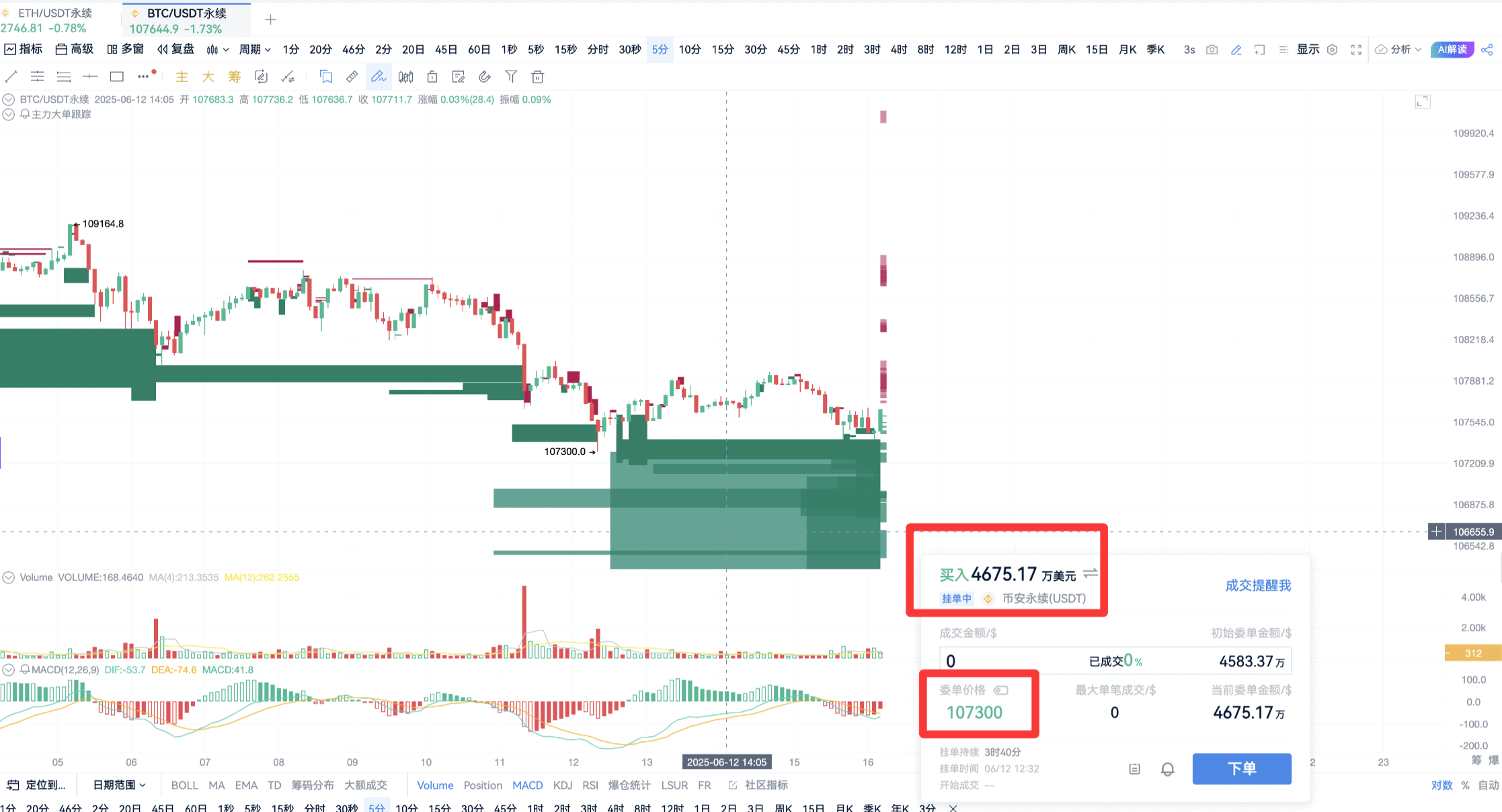

当你在现价上方发现一笔巨额卖单时,这实际上是主力在向你传递一个重要信号:他们认为价格会涨到这个位置,所以提前在此布下防线。按照这个逻辑,短线反而可以看涨。就像此刻BTC盘面上,4670美元位置出现的大单。

,这就是典型的"诱敌深入"战术。虽然整体趋势看涨,但主力很可能先让价格回踩107300美元附近,给没上车的朋友一个补票机会。

更令人振奋的是,在106500美元位置还挂着一笔5336万美元的超级买单。

这种量级的挂单就像在市场底部浇筑了一层钢筋混凝土,形成难以撼动的支撑。根据我们的实战统计,当出现这种级别的托底单时,价格有78%的概率会在触及后开启新一轮上涨。

不过ETH的盘面就略显单调,目前下方缺乏足够吸引力的买单。

但不必失望,现价上方没有明显的大额卖单压制,意味着上涨空间几乎不受限制。当前最大的阻力位在11万美元附近,而主力最新挂出的单更是指明了110200美元的上攻目标和106800美元的防守底线。

中场休息后,我们来探讨更进阶的"主力成交法"。这个方法的核心逻辑很简单:当主力真金白银成交大量多单时,他们就被迫要继续推高价格;反之,大额空单成交后往往会引发下跌。就像最近BTC在顶部区域连续出现的大额空单成交,直接导致价格走出一波下跌趋势。

最新数据显示,现价下方的三笔空单总值已达1.4亿美元,这种量级的筹码交换往往预示着趋势的延续。

将这两种方法结合使用,就能构建完整的交易策略:用大单吸引法预判关键位,用成交法确认趋势方向。比如现在BTC盘面,106500美元的多单托底就是绝佳的防守位,而上方若出现大额空单成交,就是短线离场的信号。

记住,市场永远是最好的老师。主力每挂出一笔大单,每成交一笔巨量,都是在向我们透露他们的作战计划。交易之路没有捷径,但掌握正确的方法,至少能让我们少走弯路。

本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。