作者:Paolo@胜利证券合伙人,Andy@VDX资深研究员

TL;DR

市场空间:稳定币市场依托交易和支付两大核心刚需场景,未来或有数十倍增长空间。稳定币是各加密赛道中最先被纳入合规和监管的赛道,合规化、机构化、主流化是长期趋势。未来稳定币用户甚至可能超过BTC持仓用户,成为加密最大的Killer App。

Circle的优势和壁垒:1)合规先发及正统性:受益于合规红利,有望作为“体制内稳定币”承载链上美元扩张战略;2)开放基建及生态网络:USDC具备多链支持、跨链协议、且与各种交易所和DeFi深度集成,并与支付机构合作成为跨境支付和链上结算的中枢;3)机构级信任及主流资金接入:资产安全透明、定期发布审计报告、是目前唯一被广泛接受为“机构级稳定币”的产品。

Circle的风险与挑战:1)收入结构高度依赖美债生息,利率敏感且周期性强,美元降息周期下收入增长承压;2)渠道依赖度高,当前收入约60%分给Coinbase和Binance等渠道。未来能否拓展其他收入源(如交易佣金等)、提升渠道议价能力是其增长的关键点。

竞争对比:USDT与USDC的竞争本质是黑白美元在不同市场与场景的竞争。Tether是“印钞机”,Circle是“窄银行”。USDT依托于交易所流动性支柱、OTC场外兑换、灰色支付,而USDC则聚焦于合规跨境支付、企业清算、DeFi、RWA资产底层货币。两者在不同场景下形成平行共生关系。

投资分析:作为稳定币法案出台后首家上市的合规稳定币龙头,Circle的IPO受益于高昂的市场情绪。但对比其2024年17亿美金收入、1.6亿美金净利润,当前市场近50倍的PE估值已进行了较为乐观的定价,需警惕高估值下的获利盘集中兑现。长期来看,稳定币赛道潜在增长空间巨大,Circle凭借其合规先发、生态网络构建、主流机构资金接入优势,有望进一步巩固其领先地位,建议关注其长期发展。

引子|从灰色套利到制度接管:稳定币迎来分水岭

Circle上市,标志稳定币第一次进入全球资本市场的主舞台。从被视为"赌场筹码"的USDT,到今天代表"合规数字美元"的USDC登陆美股,这不仅是商业的转折,更是金融秩序重构的前哨战。合规稳定币不再是链上的流通工具,而是美元对全球进行"去银行化、去地理化"扩张的战略代理人。

2025年,美国、香港等国稳定币监管陆续落地,Tether与Circle代表的“灰产美元”与“白名单美元”正式分化。Circle的上市,不仅是加密产业的一次资本化事件,更是美元全球化的又一次结构升级,是合规美元完成金融主权输出链上化的起点。

市场规模|稳定币作为全球流动性的新锚点

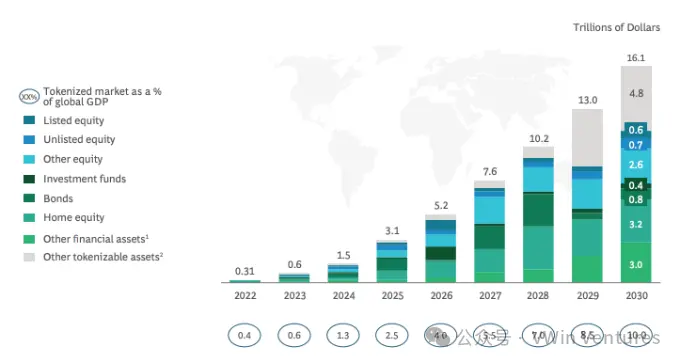

根据Citigroup等机构预测,2030年全球稳定币总市值将在1.6万亿—3.7万亿美元之间,增量主要集中于跨境支付、链上金融与RWA三大领域。

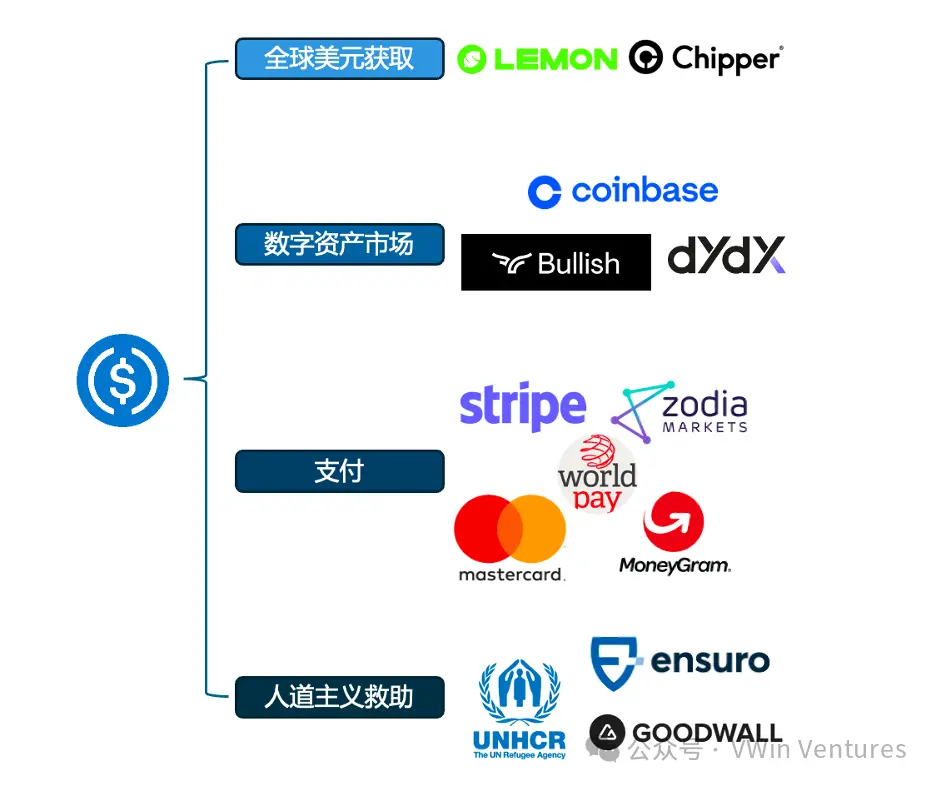

跨境支付将成为核心驱动场景。稳定币平均清算成本比传统SWIFT路径降低90%以上,T+0结算效率对中东、拉美、东南亚等高摩擦区尤具吸引力。

RWA连接链上与现实资产。稳定币作为链上资金端、RWA作为资产端,两者双生关系构成增长飞轮。Circle与BlackRock合作推出的USDC Treasury Fund即是典型试点:稳定币作为清算与参与通证,同时提供收益接入与资产包装。

虚拟资产原生场景作为持续基础流动性载体。链上借贷、衍生品、结构化收益协议持续吸纳稳定币做抵押,形成底层“美元流动性池”。

稳定币将不再只是币圈资金的中转通道,而逐步变为Web3原生操作系统中的“美元流动内核”。

竞争格局|Circle正在经历链上原生场景与围合规新玩家双重赛跑

Circle当前面临一场双重竞速:一方面是与Tether等链上原生玩家在流动性覆盖与使用弹性上的比拼,另一方面则是与传统金融巨头如PayPal、JPMorgan等在稳定币制度输出权上的竞争

Circle核心竞争优势:

合规先发及正统性:受益于合规红利,有望作为“体制内稳定币”承载链上美元扩张战略。 开放基建及生态网络:USDC具备多链支持、跨链协议、且与各种交易所和DeFi深度集成,并与支付机构合作成为跨境支付和链上结算的中枢。 机构及信任及主流资金接入:资产安全透明、定期发布审计报告、是目前唯一被广泛接受为“机构级稳定币”的产品。

政策落地抬高市场准入门槛,将加速清退非合规玩家

尽管Circle难以在灰色市场从流动性规模上战胜USDT,但它正从制度层面构建不可替代性并承接USDT的合规市场份额:

若美欧加速监管,USDT在合规场景中的市占率预计将从25%下降至10%,释放约216亿美元市场空间;

Circle可望承接其中约60%,对应130亿美元增量。

USDT“合规化”的可能性极低,未来可能维持灰色通道角色,与美方达成“非正式协议”,继续作为美元全球外溢的黑色触手。

Circle合规牌照壁垒领先优势相对有限,多位玩家已加速追赶(Paypal等)。

合规发行到应用的合规过渡领先优势仍在,JPM、Fidelity等自铸稳定币目前还在内部封闭体系。

资本市场流量红利也将随合规加密公司上市潮被稀释,早期生态主导权存在被稀释风险。

Circle的合规支付场景能否守住?

原有稳定币三巨头各自最核心优势:USDT深入灰黑色场景、拥有自下而上的多级承兑分销网络;USDC拥有合规银行与机构通道;DAI抗审查无法被冻结。

其中USDC的合规通道壁垒最容易受到冲击。银行发行的稳定币,借助传统银行账户体系与合规通道部署大规模场景,Circle(e.g. USDC在特定场景属于USDT的衍生品,跨境贸易中用户真实使用USDT但终端on/off ramp会从USDT换成USDC借助其合规法币通道)

Circle目前合作渠道能否有强绑定关系,还是得持续烧钱补贴仍然存疑。

Circle与传统金融机构的竞争

短期内,Circle 凭借合规先发、链上原生生态、开放协议能力,在“开放型全球链上清算网络中拥有压倒性优势

中长期,传统金融玩家若入场,其流量、用户账户、出入金体系将成为最大威胁,尤其是在零售支付、封闭体系结算(如自家钱包)中,可能构成局部替代

胜负关键在于:谁能更快构建“合规 +可组合 +可接入” 的链上支付基础设施,并赢得机构信任。Circle 已跑在前面,但不能掉以轻心

核心在于网络效应,被双边广泛接入

银行稳定币在B2B贸易场景下可能形成流动性互认,但在链上生态中缺乏“中立性”,难以广泛调用;接入中立层USDC更可行

Circle的长期优势:

1) 合规+开放生态:Circle通过早期布局,成为合规稳定币领域的领头羊,并借助多链、跨链支付平台,突破了传统金融巨头的技术壁垒

2) DeFi和RWA集成:Circle在DeFi和RWA(资产代币化)领域的领先地位,使其能够拓展到传统金融未能覆盖的高增长领域。

传统金融的竞争优势:

1)传统支付网络和商户基础:传统金融巨头能够快速推广稳定币支付,尤其是在零售支付和B2B支付领域,借助其庞大的支付基础设施、商户网络和客户信任

2) 法币出入金和银行集成:传统金融稳定币在法币兑换和银行系统的整合中具有明显的竞争

RWA增量场景,USDC必须完成从“牌照稳定币”向“链上系统币”的升级

BCG预测至2030年全球RWA市场规模超16万亿美元,稳定币需要“资产锚定”来建立信任并拓展场景,RWA需要“链上资金”获取流动性,两者共同构成现实与链上世界连接的价值闭环

仅有合规与储备透明已非护城河,Circle要赢得链上支付与交易结算的主导权,绑定RWA增量新资产类别。否则其应用层将不断被侵蚀,估值天花板也将受到压制。

商业模式|利率敏感、渠道依赖,Circle需迈向多元增长曲线

当前Circle利润结构单一,利率敏感度高

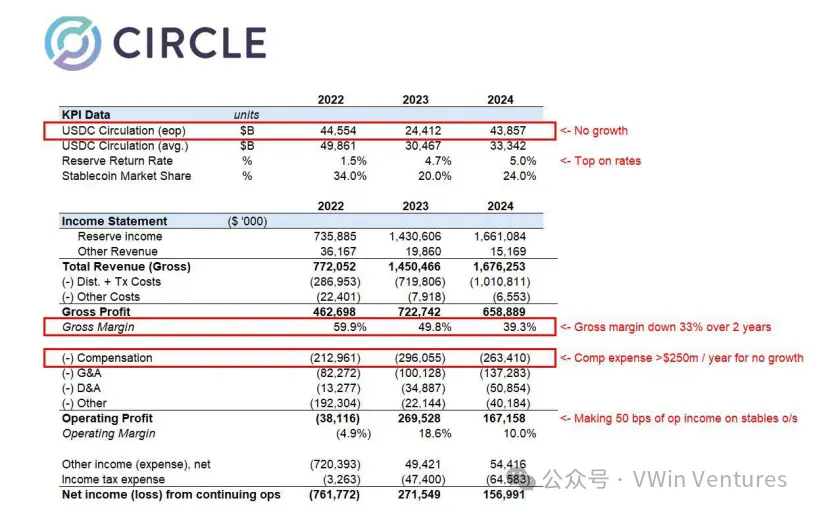

2024年收入约17亿美元,净利润1.6亿美元,99%来源于准备金利息;

假设美联储年度降息1%,基于2024年的AUM规模,收入或将减少约20%,对其利润形成巨大冲击;

渠道依赖程度高,Coinbase垄断变现效率

Coinbase拥有USDC平台独占权限,Circle重度依赖Coinbase推广网络;

2023年后,Coinbase成为USDC唯一发行合作方,其平台产生的利息收益归Coinbase;

非Coinbase渠道Circle也只能五五分成,2024年约10亿美元分销支出几乎全部流向Coinbase,Circle利差变现效率极低

核心转型方向:稳定币基础设施的可组合变现,拓展非利差收入

仅靠利息无法维持长期估值预期,未来需通过链上支付API、稳定币跨链通道、钱包账户等模块拓展收入场景,增加To B盈利能力

CCTP(跨链转移协议)构建USDC在不同链间的桥梁,使其具备成为“链上支付层”的基础。

Circle Mint与API产品已对接数十家平台,若能形成SDK级调用闭环,将形成To B商业闭环。

链上清结算与RWA联动(如与BlackRock、Securitize合作)是长期估值重构的核心场景。

财务与估值|黑白美元的对冲结构,合规之路难比利润率

财务状况

Circle IPO估值约81亿美元,PE约50倍,PS约5倍(根据2024年财报数据测算),单从利润率与现金流结构来看估值已实现较为乐观定价。

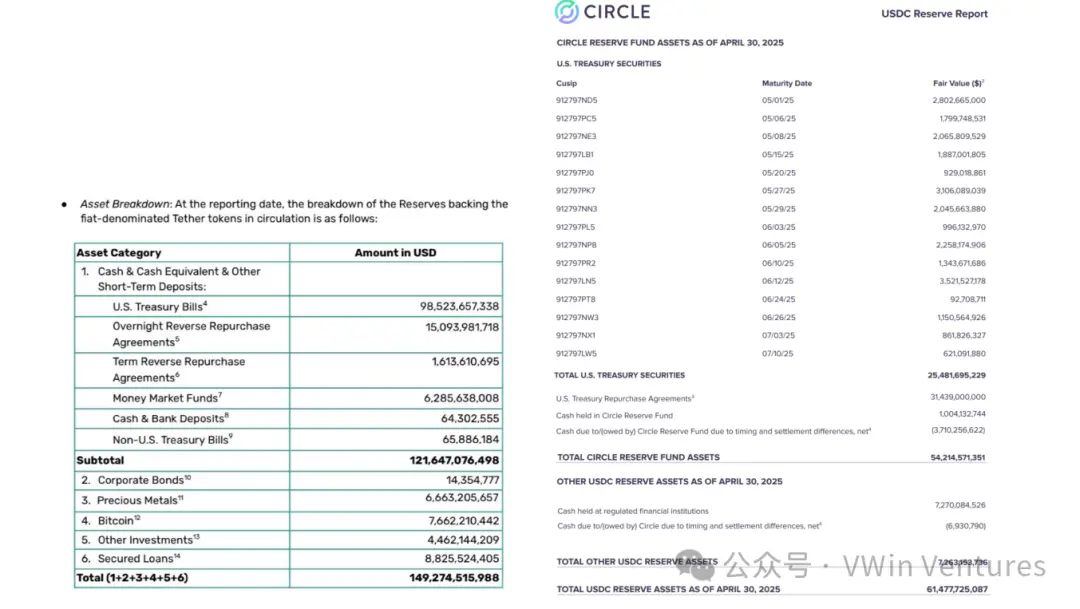

AUM回升至600亿美元,超越SVB危机前约400亿美元水平。

当前利率支撑盈利,毛利约6.6亿美元,运营费用偏高,员工成本2.6亿美元。

其与Tether对比如下:

Tether净利润超130亿美元,是Circle的80倍,AuM仅是Circle的2.5倍

净利润率极高:全直营、无渠道成本;员工仅百余人,合规成本低,是全球人均净利最高的公司

USDT储备资产结构更激进(85%美债,5%黄金,7%BTC),高风险也带来高收益

盈利结构差异:Tether是印钞机,Circle是窄银行

Tether运营成本极低,无需负担合规成本、不付渠道分润,直接全收利差;USDC在各环节被抽水

应用场景不同:灰产 vs 合规

Tether在灰色地带走得更远(绕开KYC,接触受制裁国家等),实现超强的盈利能力

Circle 高度合规,财务公开透明

USDC必须执行黑名单、KYC、AML等制度

拒绝进入部分高风险/不合规市场

盈利能力受合规成本压制(比如审计、合规支出)

合规利润率难以与非合规抗衡

但合规才能吸引主流、机构化资金

主流市场合规化趋势下,非合规生存空间越来越小;但同时在全球割裂的背景之下,自下而上真实/监管外需求增长大

合规才能创造资本市场价值与资本溢价

投资策略|短期情绪热度驱动估值已实现较乐观定价,存在情绪溢价交易机会;长期博取系统性估值重构

IPO阶段市场情绪高、资金拥挤,短期市场热度和对“合规稳定币龙头”叙事的认同或带来阶段性交易机会

但需关注估值回归的潜在波动,主要风险来自于利率回落带来的利差压缩,以及渠道议价能力尚未完全建立所可能暴露的收入敏感性

中长期关键看新业务拓展、渠道依赖是否下降、以及向全球支付网络嵌套的能力

投资者目前买的是合规牌照+链上支付网络未来的定价权,不是当期利润

是否重演Coinbase“高点上市”仍待观察,重点是其后两季能否交出链上支付落地进展与非利差收入增量数据

结语|稳定币法案开启合规时代,IPO只是星辰大海的序章?

稳定币市场正步入一个前所未有的爆发前夜:支付与交易的刚性需求为其提供了持续增长的燃料,合规、机构化与主流化的大势,正在将其塑造成链上金融最核心的基础设施。

Circle正处于这一趋势的核心交汇点。

合规正统性带来制度卡位优势,使其成为“体制内稳定币”的代表选项;

开放基建能力赋予其多链、可组合、可嵌套的技术架构,在支付、DeFi、跨链与RWA等场景中均可实现中立融入;

机构级信任结构令其得以成为传统机构合规接入加密世界的首选清结算资产。

但与此同时,Circle仍面临收入结构对利率的敏感性、渠道依赖度高等结构性挑战,是否能够在新业务拓展中摆脱周期约束、构建第二增长曲线,将决定其估值重构路径。

USDC与USDT之间的竞争,不再是单一维度的“市值之争”,而是代表黑白美元体系、不同清结算路径、监管兼容性的全栈竞争。

Circle的IPO并非一个终点,而是全球稳定币正式进入制度化赛道的起点。

真正被资本市场押注的,不是今天的收入,而是其在全球链上美元共识体系中能否扮演关键协议层的角色。当USDC成为“链上美元”的通用流通底层时,Circle的故事,才真正开始。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。