Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

Ethereum is undergoing a deep "transformation."

On one side, the foundation is laying off employees and cutting expenses, with an engineering focus becoming central; on the other side, there is a capital-intensive layout, acquiring public shell companies and bulk buying ETH, constructing an Ethereum version of "MicroStrategy."

The Foundation Begins to "Operate"

The Ethereum Foundation has begun to "perform surgery." Recently, the EF has faced two major criticisms from the community: first, frequent selling of tokens and lack of transparency in accounts; second, the team being "inactive" and inefficient. Now, the foundation is attempting to turn this situation around.

At the beginning of the year, the leadership of the Ethereum Foundation underwent a "major overhaul." However, just a couple of days ago, the foundation announced layoffs and directly renamed the "Protocol R&D" team to "Protocol," restructuring around three strategic goals: L1 scaling, blob scaling, and user experience optimization. Each direction has a clear leader and a stronger accountability mechanism has been introduced. In other words, EF will enter the "KPI" era, shifting from "talking vision" to "making products." (Related reading: 7 personnel adjustments, three new organizations, can Ethereum's "self-rescue" achieve rebirth?)

Bigger moves are happening at the financial level. Last night, the foundation updated its financial policy: annual expenditures cannot exceed 15% of treasury assets, and plans to compress this to 5% over the next five years. Whether to sell ETH will be based on the operational buffer period (currently set at 2.5 years) and the ratio of fiat currency reserves, adjusted dynamically each quarter, implemented through on-chain or fiat channels.

At the same time, the foundation has introduced the "Defipunk Standard" to evaluate projects, emphasizing principles such as open-source, self-custody, permissionless access, and privacy protection.

This transformation from structure to system is a signal of a deep transition. The Ethereum Foundation believes that 2025-2026 will be a critical phase for Ethereum, perhaps marking the beginning of Ethereum's efficiency engine restart.

SharpLink Enters the Scene, "Reform" Signals Emerge?

Ethereum is becoming a battleground for a new round of strategic capital. OGs are teaming up with U.S. shell companies to enter the market and attempt to connect with sovereign capital, and the funding landscape for ETH seems to be quietly becoming active.

The ETH version of "MicroStrategy" has begun to launch. On May 27, SharpLink Gaming announced the completion of a $425 million private placement and included ETH in its corporate treasury. Shortly after, on May 31, the company plans to raise another $1 billion to increase its holdings. However, the private placement involved established institutions like Consensys, ParaFi, Pantera Capital, and Galaxy Digital, which had heavily invested in Ethereum in earlier years, indicating that a strategic ETH initiative led by OGs and resonating with top players is emerging.

ETH version "MicroStrategy" collection

Meanwhile, Ethereum co-founder and Consensys CEO Joe Lubin stated that the company is in talks with a sovereign wealth fund and bank from a "major country" to explore building financial infrastructure on the Ethereum ecosystem. He hinted that these institutions may involve Ethereum's layer one and layer two infrastructure, signaling the release of sovereign capital.

On-site funds are also actively moving. Last night, a suspected Consensys-related address purchased $320 million worth of ETH from Galaxy Digital. It has currently staked $120 million worth of ETH through Liquid Collective, reflecting a long-term allocation intention.

Investment firm Trend Research has openly taken a long position on ETH, purchasing 8,846 ETH on May 27 for $23 million, with funds sourced from borrowing against staked ETH on Aave to buy more, indicating leveraged accumulation.

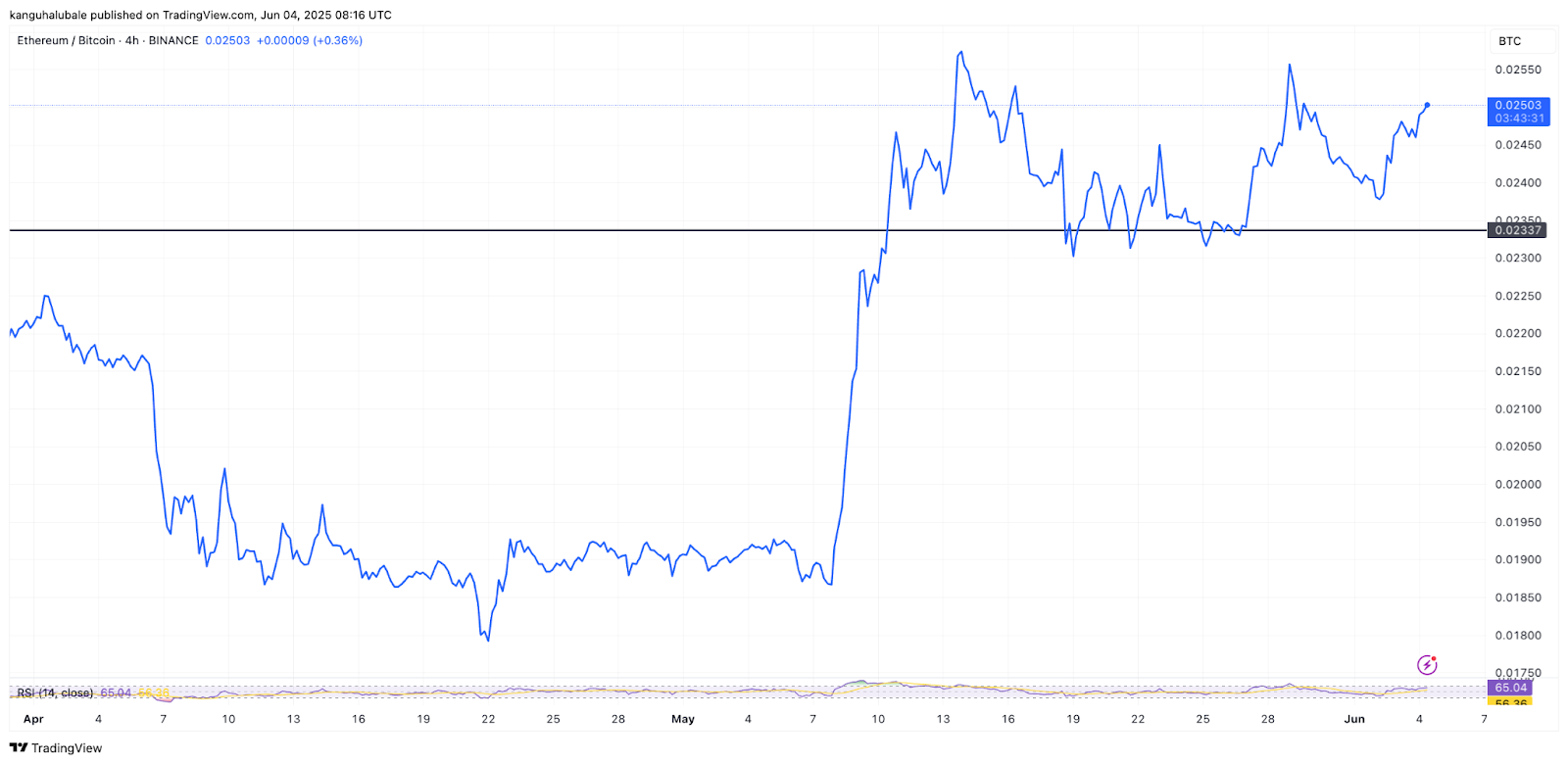

Additionally, the U.S. spot Ethereum ETF has recorded net inflows for 13 consecutive days, and the ETH/BTC ratio has risen about 30% over the past month, rebounding by as much as 48% from the multi-year low of 0.01766 set on April 22.

Optimistic Voices Resurface

In the current context, more and more investors, institutions, and analysts are beginning to reassess Ethereum's potential and resilience.

10x Research pointed out in its latest market analysis that ETH's performance has far exceeded expectations. "Although we anticipated a pullback a few days ago, the actual performance has proven to be much more resilient than expected. From a technical perspective, Ethereum is approaching the apex of a large triangular consolidation structure, and the eventual breakout direction could push the price towards $2,000 or $3,000."

Institutional investors are increasing their bets. LD Capital founder Jack Yi stated that Ethereum's oscillation cycle may be nearing its end, "We are basically fully invested," and has shifted strategy to ETH-based. He emphasized that as the Ethereum Foundation continues to optimize its growth strategy, the approval of ETFs, and macro factors such as M2 growth and interest rate cut expectations converge, the mid- to long-term logic of ETH and its ecosystem is becoming increasingly clear.

The warming sentiment is also reflected in the community. KOL Blue Fox stated, "I originally thought Ethereum would take 5-10 years to reach a cognitive breakthrough moment like BTC in this cycle, but now it seems that it might be completed in 2-3 years; the world's frequency is accelerating."

However, there are also confused voices. Community user @diamondhandjs expressed, "From some indicators, ETH is not performing well, but at the same time, OI continues to rise, as if something big is about to happen. Many third-party funds and bloggers on Twitter are bullish on ETH and have already bought in, but I have thought about it for a long time and still haven't grasped it."

Ethereum is striving to overcome its "midlife crisis."

The era driven by idealism and community faith may be coming to an end, as more pragmatic capital logic and institutional construction gradually take over the narrative. As a16z pointed out, the foundation model is struggling to adapt to the current pace of evolution; the crypto industry needs more efficient incentive mechanisms, clear accountability systems, and scalable structures.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。