中心化交易所(CEX)正面临前所未有的行业变局。一方面,行业内部面临多重挑战,如上币效应减弱、安全事件频发、信任危机加剧和链上竞争等问题;另一方面,Hyperliquid等DEX凭借技术创新持续蚕食市场份额。在这一关键转折点,华语用户作为CEX核心客群,其行为偏好将直接影响行业格局演变。

ChainCatcher联合RootData近日发起了「2025年中心化交易所华语用户调研」,在10多天内收集到了715份有效问卷,本报告将解析这些趋势背后的用户诉求,为行业参与者提供决策参考。(可点击此链接下载PDF版本)

核心数据要点:

- Binance和OKX是受访者使用频率最高、托管资金最多的CEX,但也是近一年用户减少使用率最高的平台。

- “积极上市优质资产”是受访者最喜欢的上币风格,但同时也有少数受访者对于交易所的上币机制失去了信心。

- CEX Web3钱包市场呈现极高集中度,近九成受访者将Web3钱包服务锁定于Binance和OKX。其中Binance以56.5%的使用率占据领先地位,OKX以33.1%的占比位于第二。

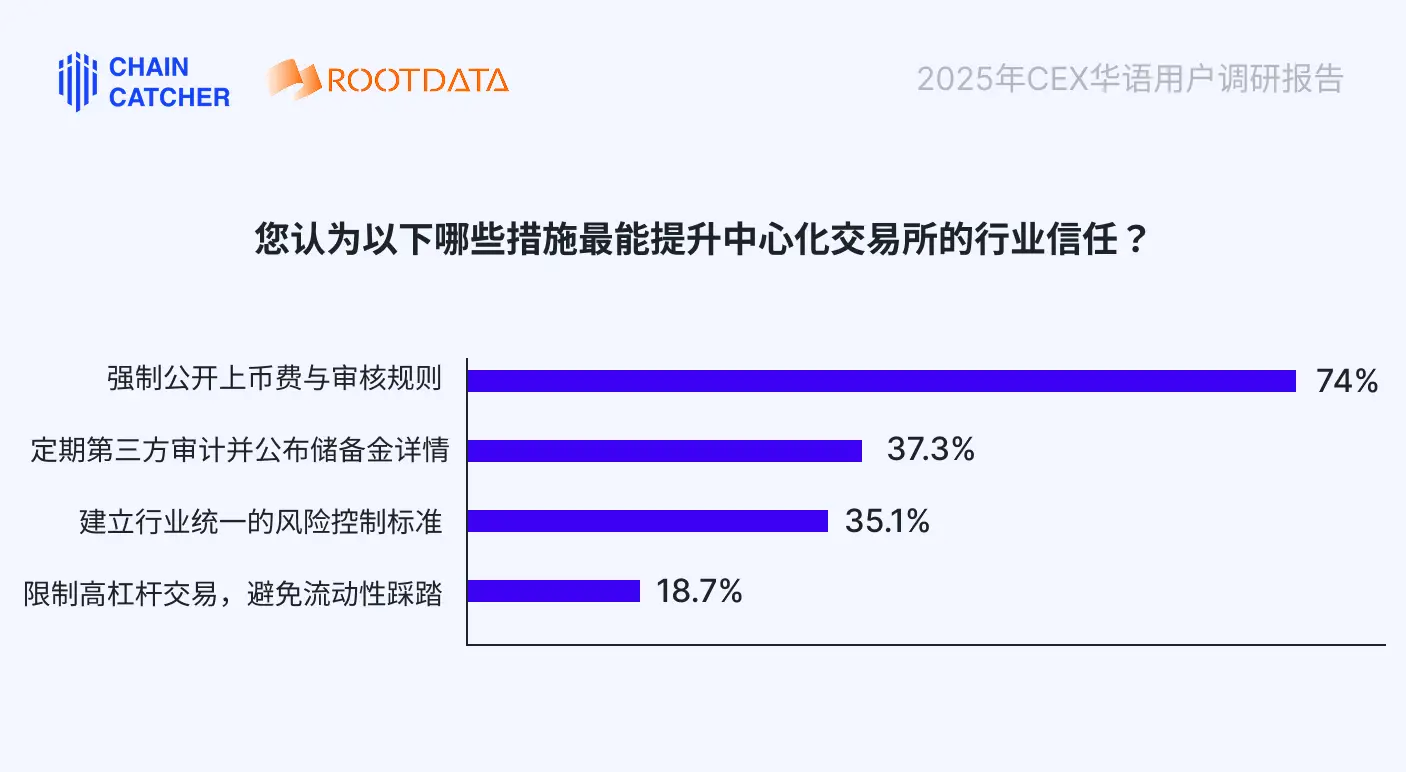

- 中心化交易所出入金问题最突出,上币机制遭质疑。59.3%受访者遭遇出入金问题,63.9%因上币问题(破发、内幕交易)弃用交易所;74%的受访者要求上币流程透明。

- 大部分受访者近一年使用中心化交易所的频次、投入资金金额都在增加,且整体盈利面显著扩大。约54.4%的受访者表示本周期在CEX投资交易中盈利超过上一个周期,仅8.7%的受访者亏损幅度扩大。

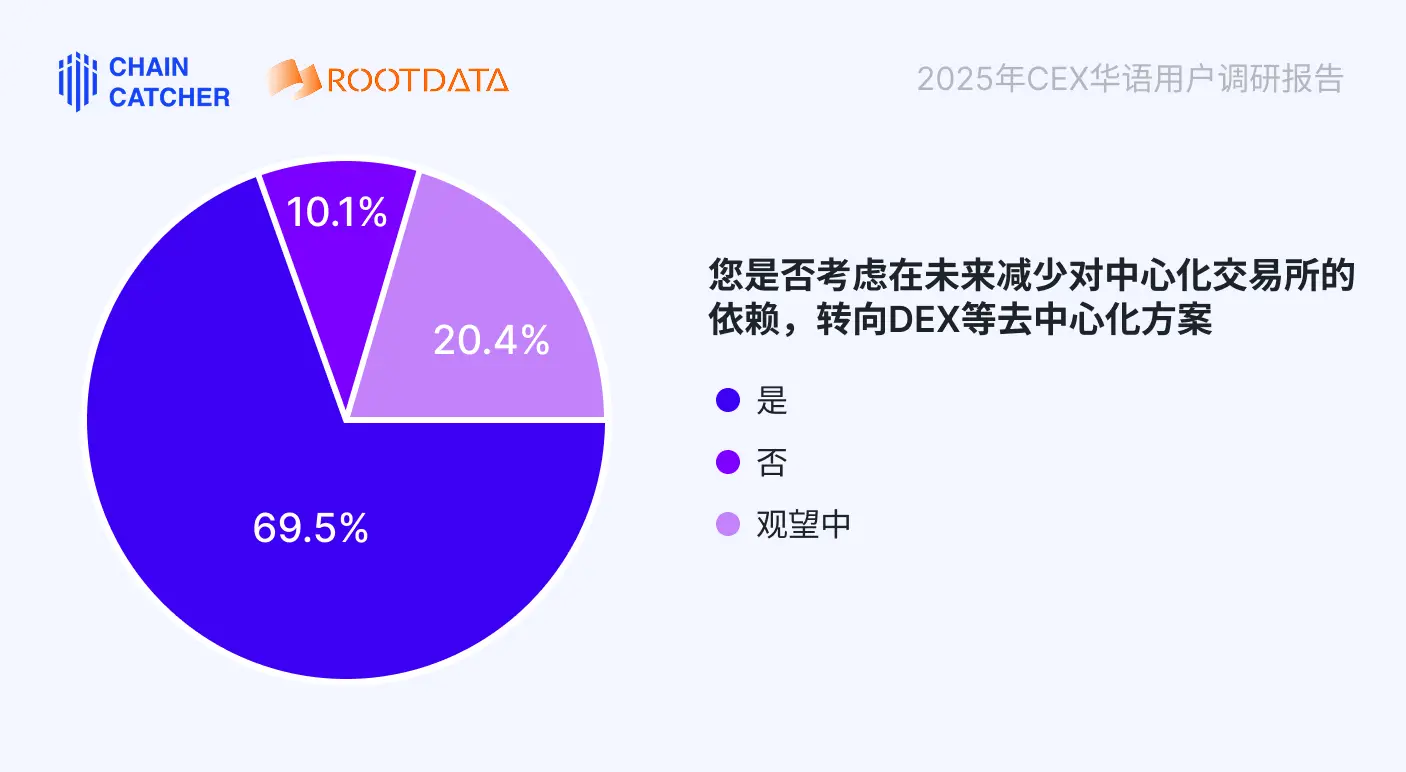

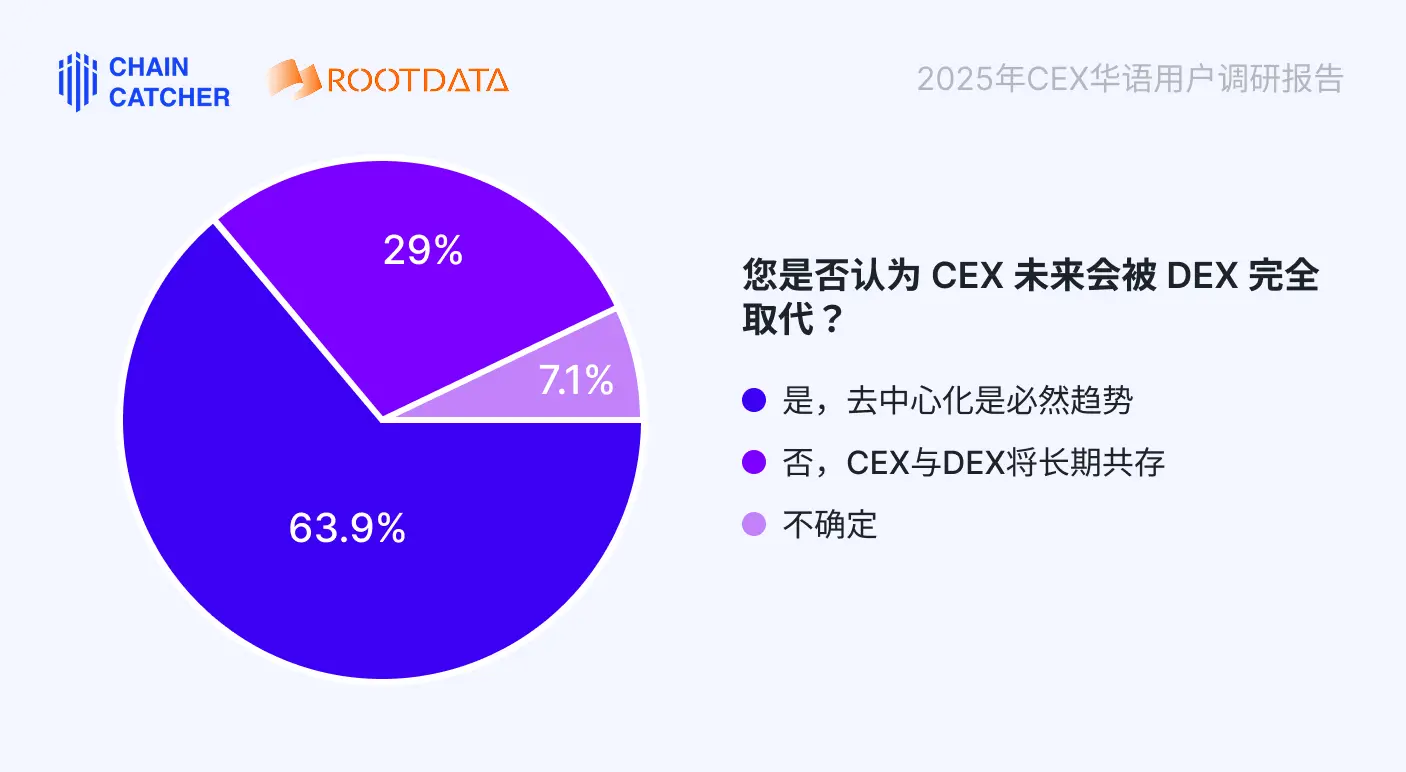

- 69.5%的受访者考虑转向DEX等去中心化方案,63.9%的受访者认为DEX将完全取代CEX。但77.4%用户仍在CEX增加资产配置,反映短期依赖难改变。

一、调研人群概况

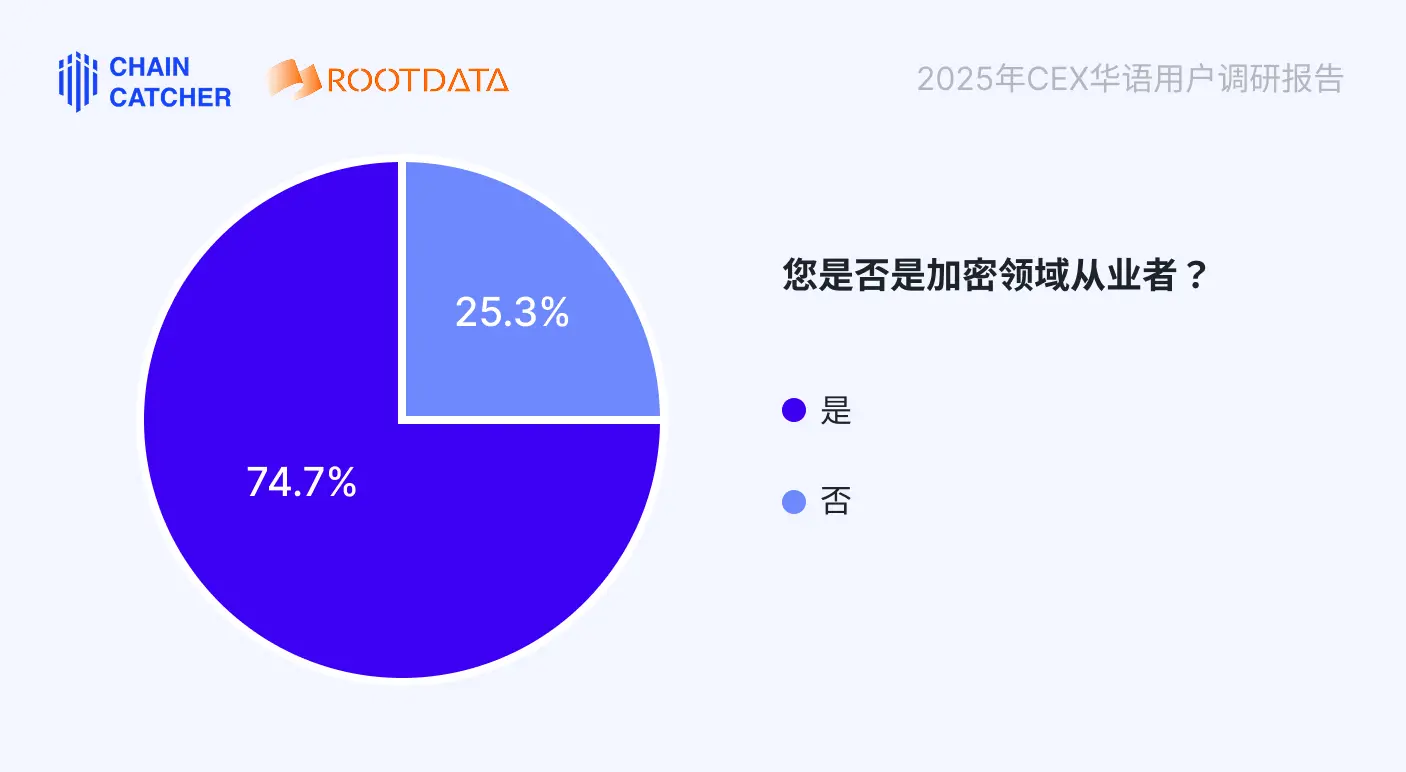

受访者大部分为加密领域从业者:几乎3/4的受访者是加密领域从业者,1/4的受访者为非加密从业者。

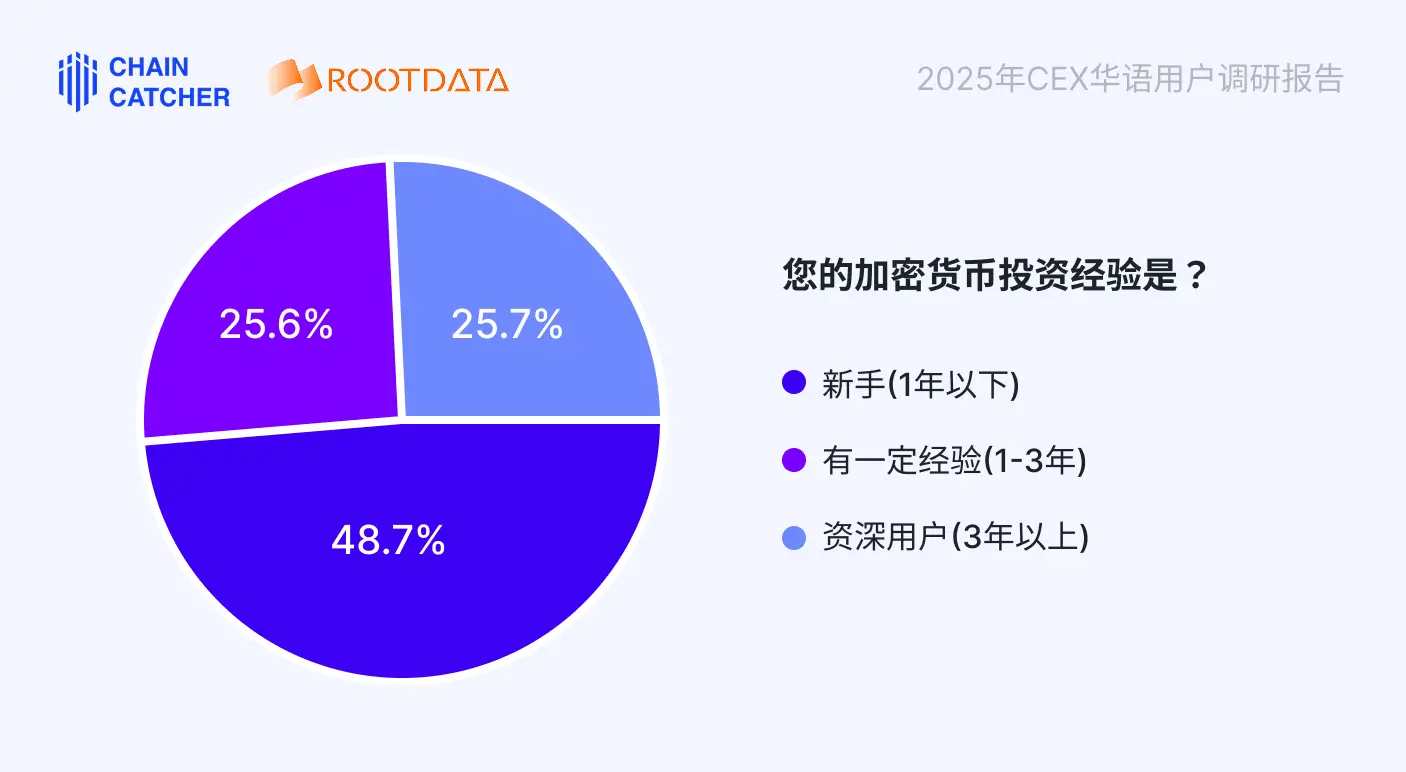

受访者主要是加密投资新手和有一定经验的投资者:投资经验不足1年的新手占比达到了48.7%;有1-3年投资经验以及3年以上的资深用户则分别占比达到了25.6%、25.7%。

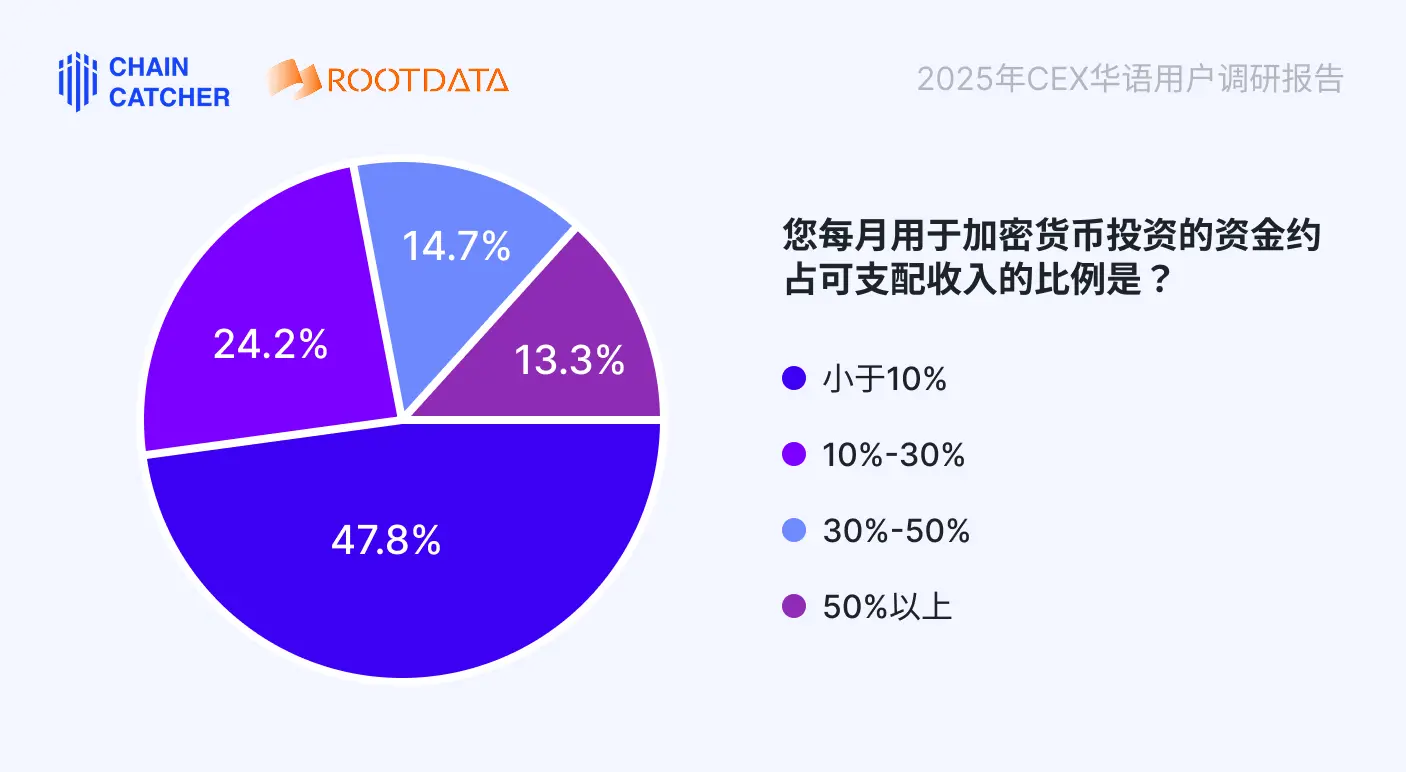

受访者对加密投资保持较为谨慎态度。每月加密投资占收入比小于10%的受访者近一半;占比10%-30%的受访者为24.2%;占比30%-50%的受访者为14.7%;仍有13.3%的受访者较为激进,将月收入的一半及以上资金用于投资加密货币。

CEX 华语用户使用偏好

1、高频使用的CEX

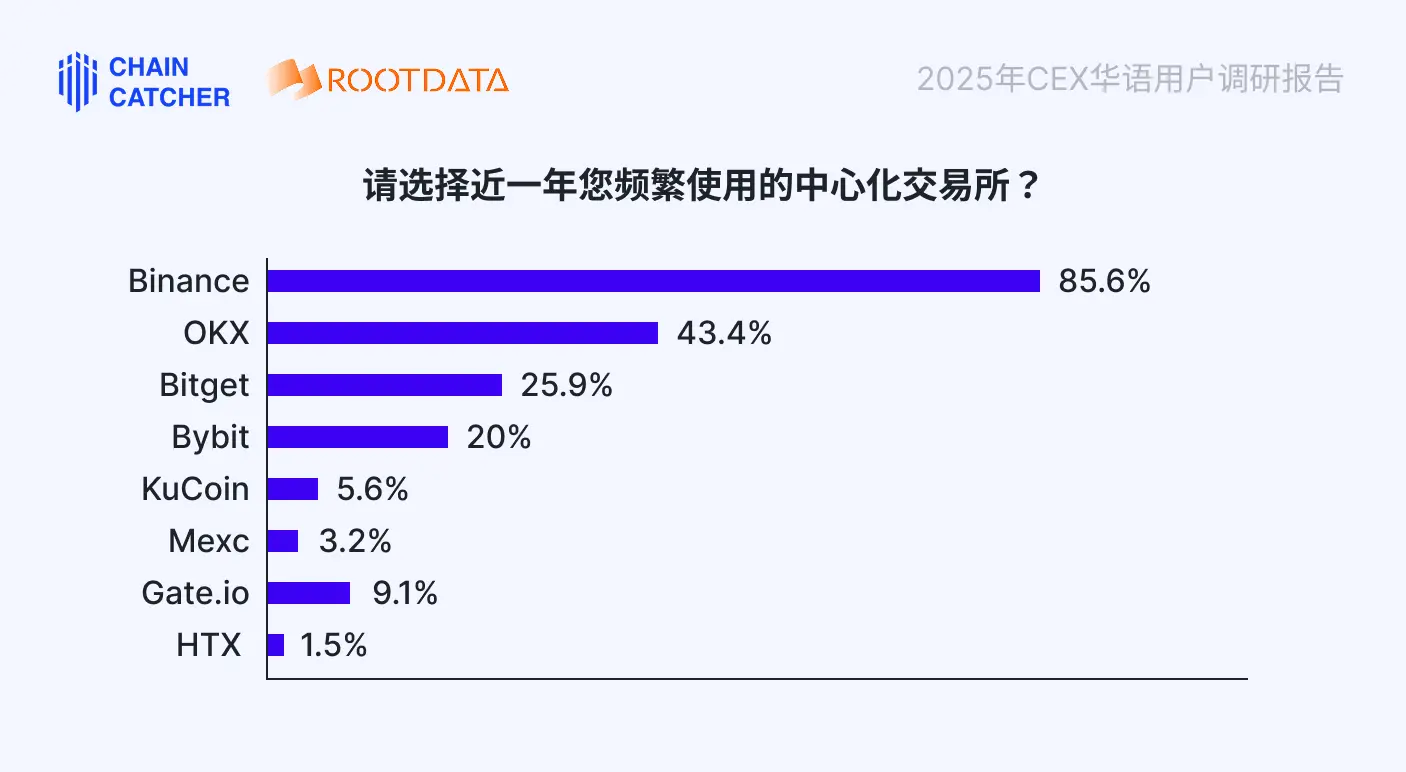

本次问卷调研让受访者最多选择3个近一年频繁使用的中心化交易所。

结果显示,Binance、OKX、Bitget为是受访者使用最频繁的中心化交易所前三名。

Binance被85.6%的受访者选择,远超其他平台,较第二名的OKX(43.4%)高出近一倍,反映用户选择明显向头部平台聚集,马太效应加剧。

Bitget(25.9%)和Bybit(20%)则组成第三阵营,一定程度说明了第二梯队竞争激烈,格局难定。

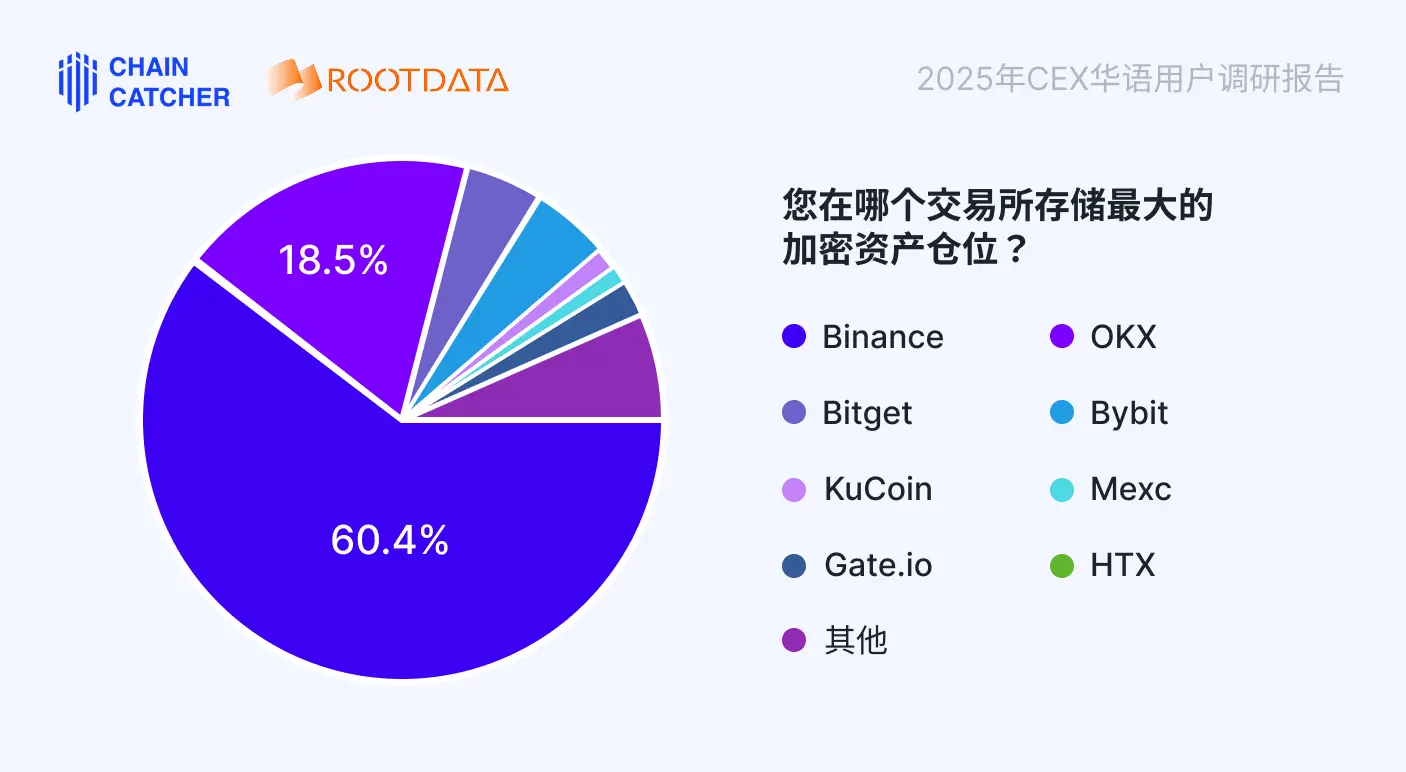

2、存储最大加密资产仓位的CEX

除使用频次外,受访者的最大加密资产仓位存放位置,同样说明了中心化交易所受用户信任的情况。

从调研结果来看,Binance仍然为最多受访者选择的存储最大加密资产仓位的中心化交易所,有超过60%的受访者选择将最多的加密资产存放在Binance。

有18.5%的受访者将最大加密资产仓位放在OKX,显著低于43.4%的使用频率。可能一定程度上说明,用户倾向将其作为"交易通道"而非"资产仓库"。

除了Binance 和OKX 之外,其他交易所的市场份额非常分散且占比较低。Bitget 和 Bybit 作为排名第三、第四的交易所,分别只有 4.8%的受访者选择将其作为放置最大加密资产仓位的 CEX。

这反映出在加密资产存储市场中,Binance 和 OKX 已经占据了绝大部分市场份额,其他交易所想要突破并吸引更多用户存储资产面临不小挑战。

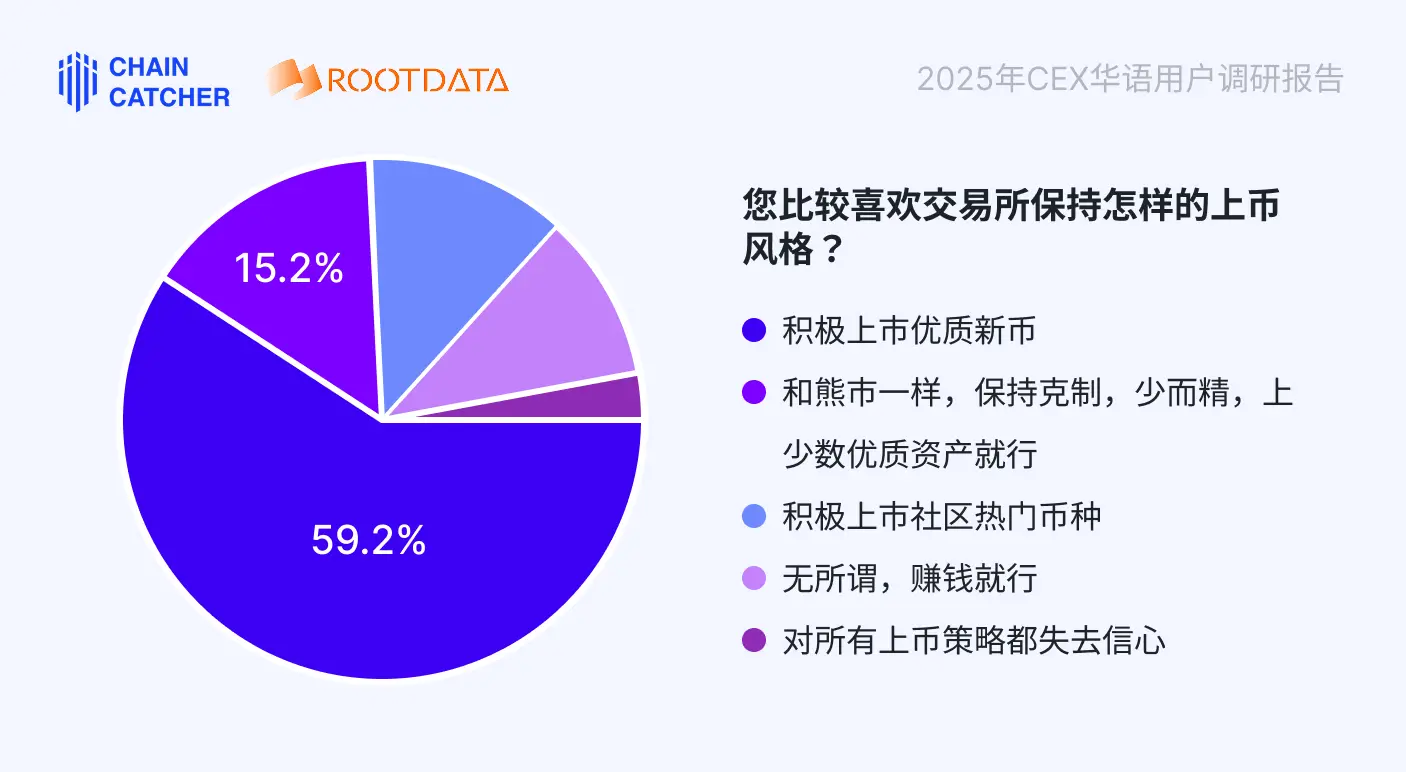

3、上币风格偏好

这轮周期下,因中心化交易所的上币效应减弱,交易所采取什么样的上币风格也是市场常讨论的焦点。

从调研结果来看,59.2%的受访者喜欢积极上市优质新币的上币风格。这反映了加密货币市场仍处于创新驱动阶段,用户对新兴资产仍有较高期待。

15.2%的受访者则喜欢更为克制的上币风格:希望做到少而精,有所筛选的上少数优质资产。这反映了部分用户注重长期价值投资。

12.4%的受访者则喜欢积极上市社区热门币种的上币风格。这轮周期,meme币的火爆再次验证了社区情绪的力量,社区的热度也是用户和交易所必须参考的方向。

此外还有10.2%的受访者对于上币风格并不太关心,更在意的是赚钱效应;还有2.9%的受访者对于交易所的上币失去了信心。这反映了过往交易所上币破发率高、内幕交易丑闻等问题,确实让部分用户受到困扰。

中心化交易所或需要在动态平衡中寻找定位——既要满足多数用户对“新资产”的渴求,又要通过筛选机制建立信任,同时灵活响应社区文化的变化。

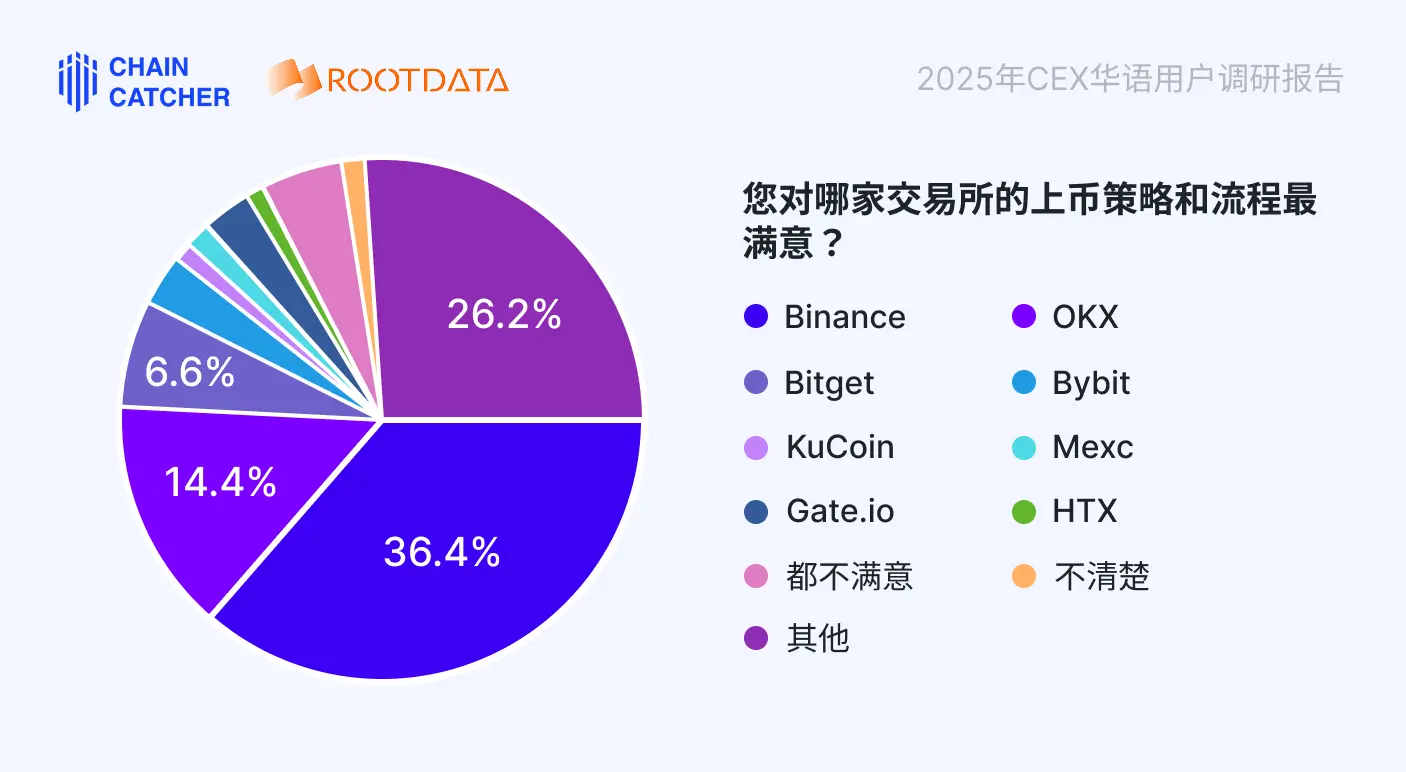

4、CEX上币策略及流程满意度情况

Binance以36.4%的占比仍居第一,但领先优势缩小。Binance在本轮周期多次因上币问题(如内幕交易质疑、部分新币高破发率)引发争议,但其在项目筛选能力、流动性和全球资源方面仍具优势,使其成为受访者最满意的交易所。

不过,相较于其在高频使用率、资产托管等维度的统治级表现,用户对其上币策略的满意度仍有明显差距,说明审核透明度、项目质量把控等环节亟待优化。

KuCoin则以26.2%的占比紧随Binance之后,成为上币策略及流程满意度排名第二的平台。根据Klein Labs报告统计,2024年KuCoin全年上币数量达297个,远高于Binance(60个)和OKX(64个),但显著低于上币最激进的Gate.io(629个)。这种"适度积极"的上币策略以及社区投票上币机制,吸引了部分注重参与感的投资者群体。OKX则以14.4%的占比排在第三位。

整体来看,中心化交易所仍面临上币挑战。超过5%的用户对所有交易所的上币策略及流程表示不满,多位用户留言批评交易所上币后砸盘现象。

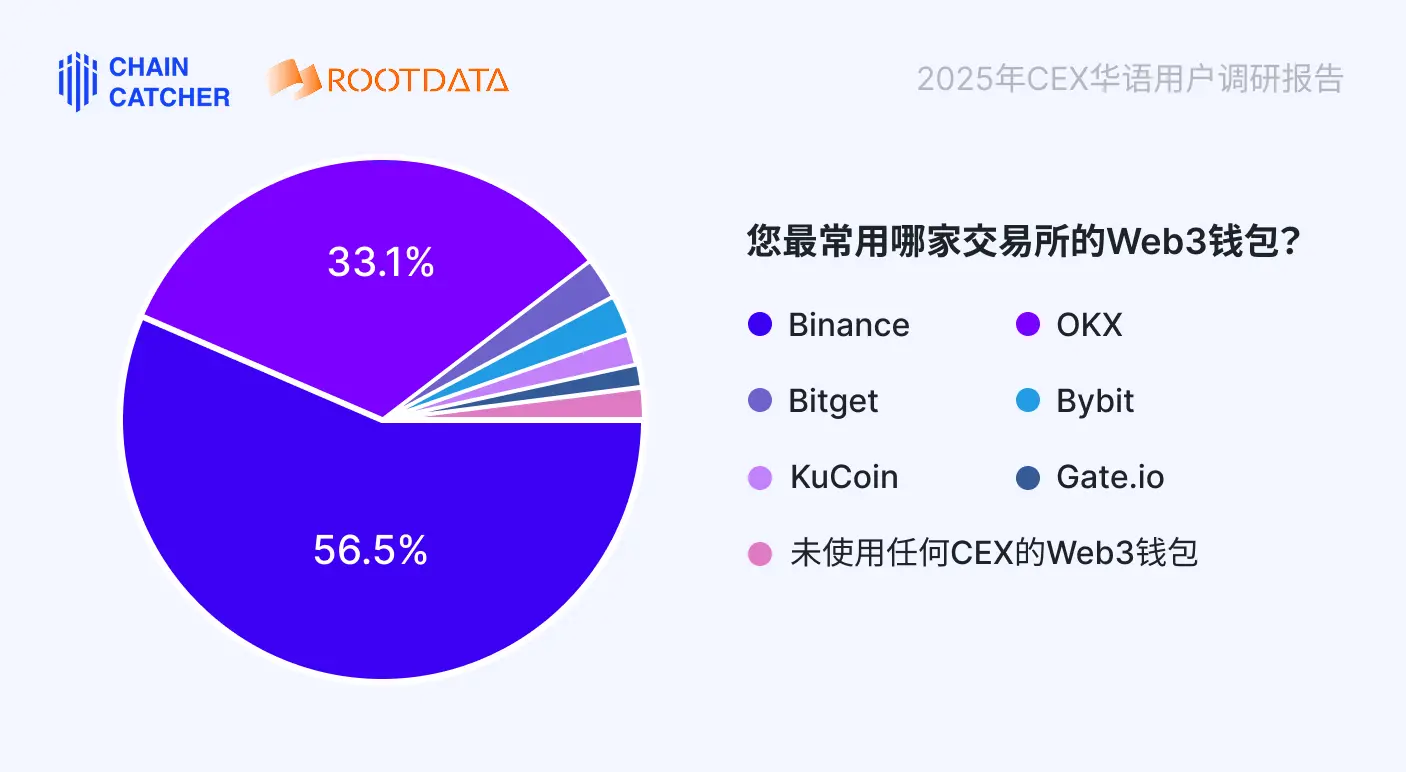

5、CEX Web3钱包服务的受欢迎情况

根据调研数据显示,在中心化交易所提供的Web3钱包服务中,Binance以56.5%的使用率占据领先地位,其领先优势可能主要得益于Binance Alpha计划的持续导流。

OKX以33.1%的占比位于第二,在Web3钱包具有先发优势的OKX或受到暂停服务及Binance Alpha的冲击影响。

整体来看,Binance和OKX合计被90%的受访者选择,形成明显的双寡头格局,而其他交易所的Web3钱包使用率均不足3%。此外,仍有2%的受访者表示完全不使用任何中心化交易所的Web3钱包。(备注:调研结束后,Bybit宣布关闭大部分Web3钱包服务)

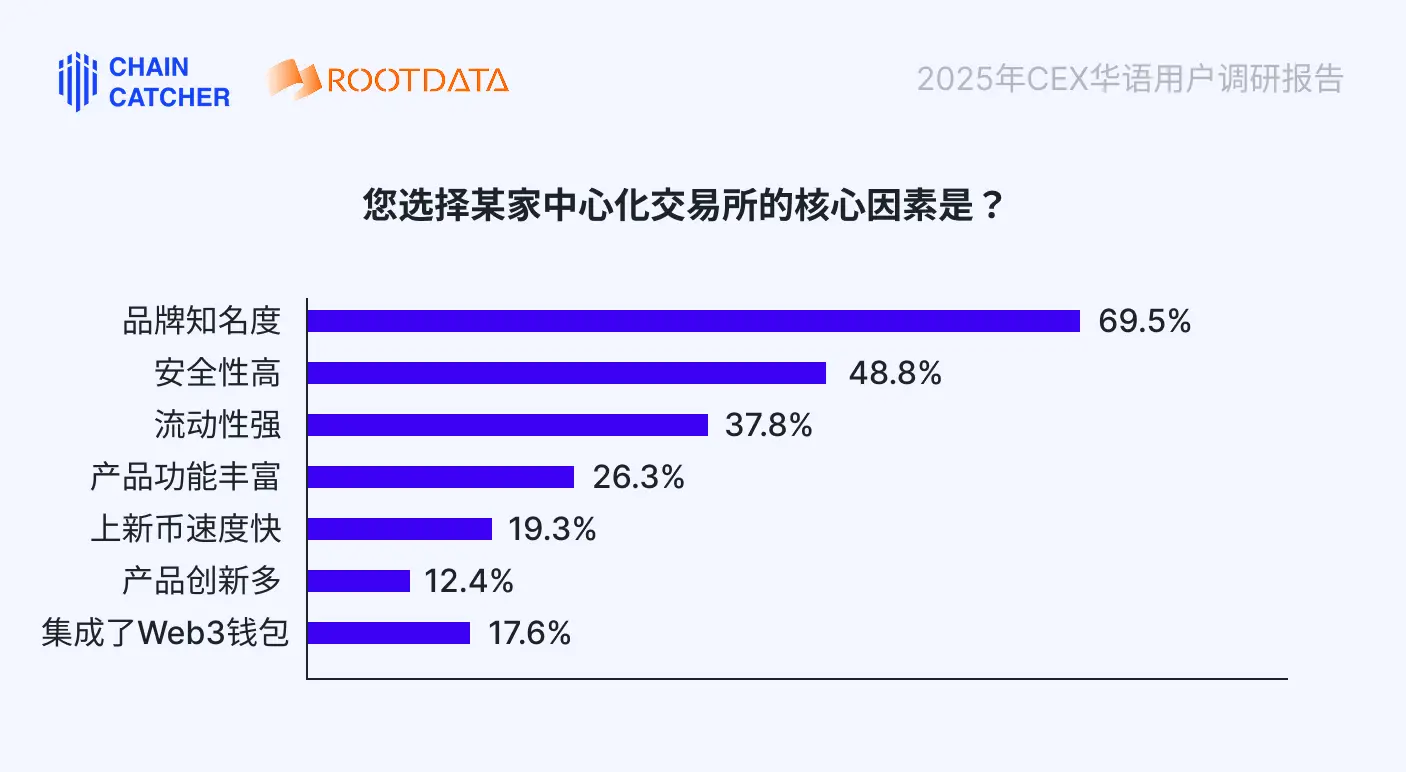

6、选择某家CEX的核心因素

受访者在挑选中心化交易所,最看重什么哪些因素?本次问卷也进行了详细的调查。

从调研结果来看,品牌效应占据绝对主导。69.5%的受访者将“品牌知名度”列为首要考量,反映出行业马太效应加剧,头部交易所凭借先发优势和规模效应形成认知壁垒。

而48.8%用户强调“安全性”,37.8%注重“流动性”,这两大刚需指标共同构成了交易所的生存底线。

26.3%用户关注“产品功能丰富度”,体现成熟投资者对衍生品、理财等综合服务的需求。

19.3%偏好“上新币速度”,反映一级市场参与需求。而17.6%的用户将“集成Web3钱包”纳入考量,这一相对新兴的选项已超越部分传统指标,预示着CEX与DeFi的融合正在重塑行业标准。

此外,在受访者的留言中可以看到,是否有较多的空投等福利活动、平台币的赋能以及U卡的使用体验,也是受访者选择中心化交易所的参考选项。

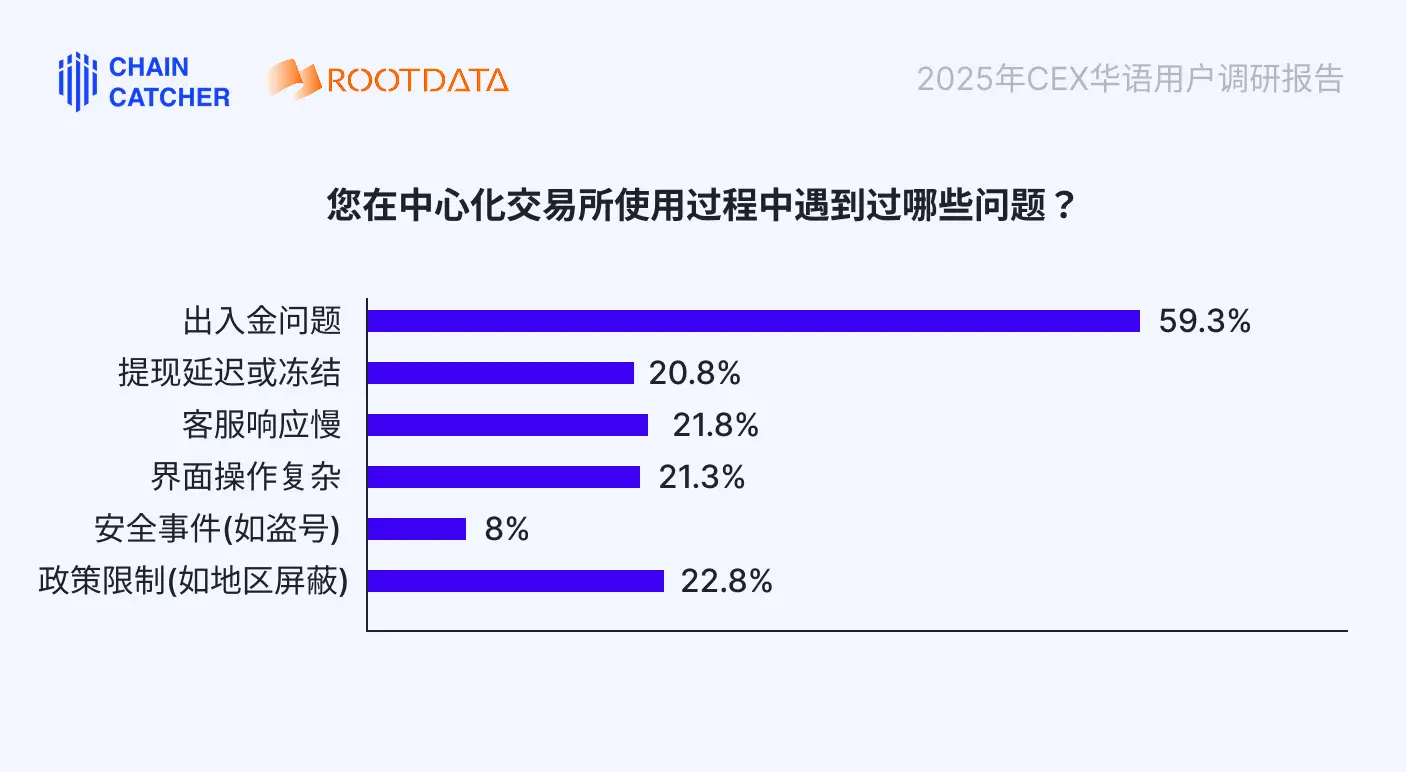

7、CEX 用户痛点分析

出入金问题成为最大痛点。59.3%的用户遭遇过出入金问题,远高于其他问题类型,反映传统金融与加密生态的衔接仍存在系统性障碍。

运营与服务问题也集中显现。提现延迟/冻结(20.8%)和客服响应慢(21.8%)合计影响超40%用户,暴露出部分交易所在资金处理效率和客户服务体系的不足。

22.8%的用户受政策限制影响(如地区屏蔽、KYC升级等),政策合规挑战日益显著。

此外还有21.3%的受访者认为界面操作复杂,这也反映了当前中心化交易平台在用户体验设计上仍存在较大改进空间。

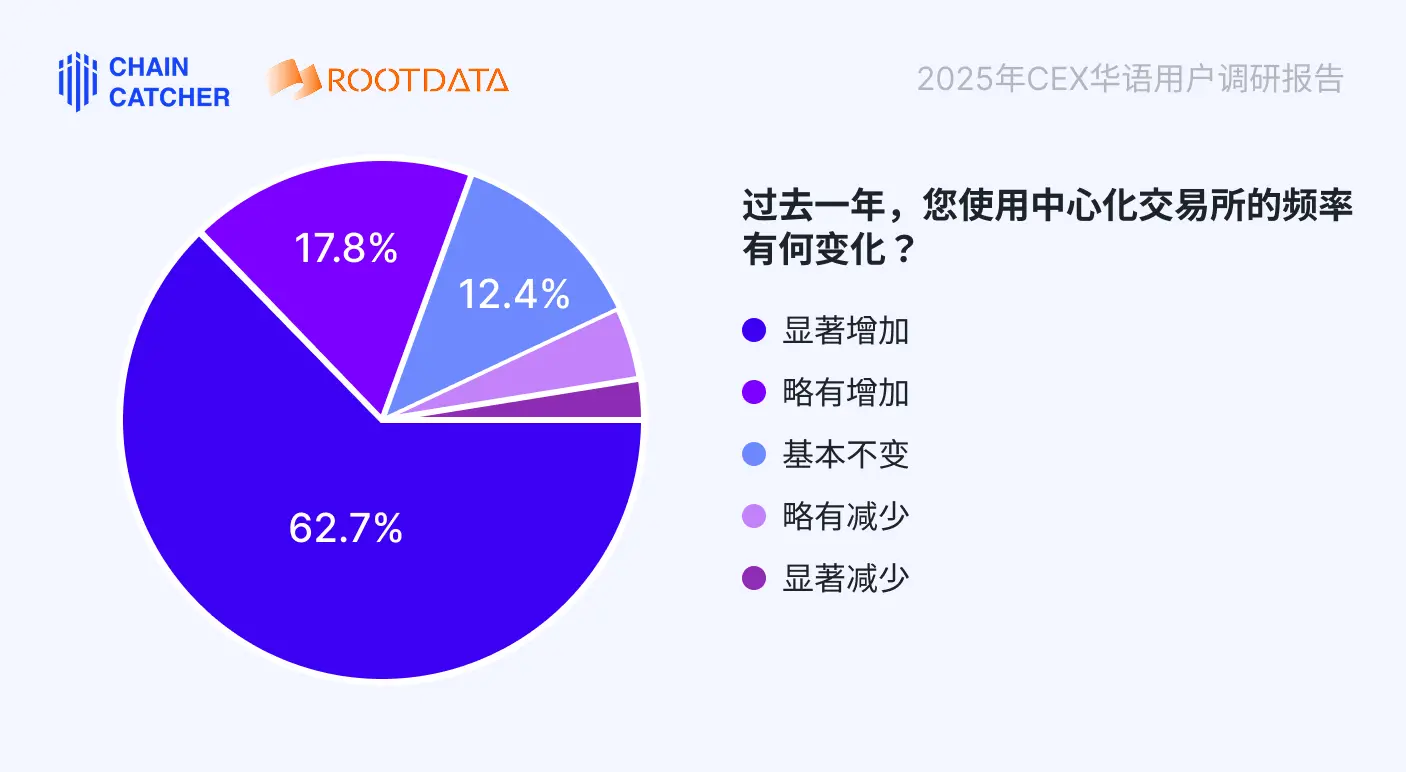

三、近一年CEX华语用户使用趋势变化

1、使用频次变化

问卷调查了用户近一年使用CEX的频次变化。

80.5%的用户(62.7%显著增加,17.8%略有增加)表示过去一年使用CEX的频率上升,表明CEX在华语用户中的黏性依然较强。这可能与市场行情波动、加密资产投资热潮以及头部CEX不断推出新功能(如Web3钱包、理财产品等)有关。

12.4%的用户表示使用频率基本不变,反映出部分用户已形成稳定的交易习惯。而仅有7.1%的用户(略有减少4.6%,显著减少2.5%)减少了CEX使用频率,这可能与安全事件或DEX的吸引力增强有关。

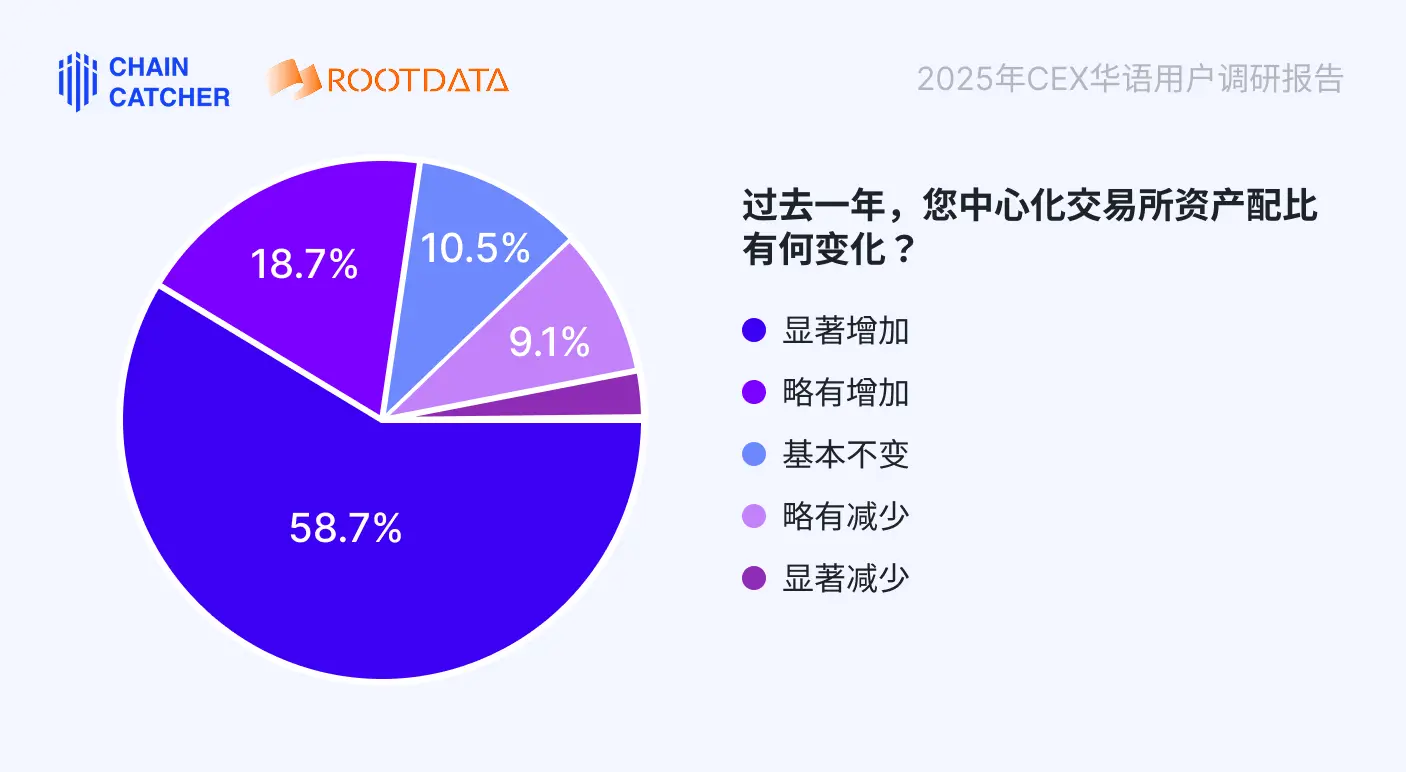

2、资产投入变化

结果显示,77.4%的用户(58.7%显著增加,18.7%略有增加)在CEX增加了加密资产配置,其中,超过半数受访者在过去一年显著增加资产配置,仅12%的受访者减少资产配置(9.1%略有减少,2.9%显著减少)。

整体反映了随着比特币持续新高,加密市场行情回暖,用户对于加密资产的投资需求也在增加,而CEX仍然是用户们最重要的加密货币投资交易入口。

3、资产增值趋势

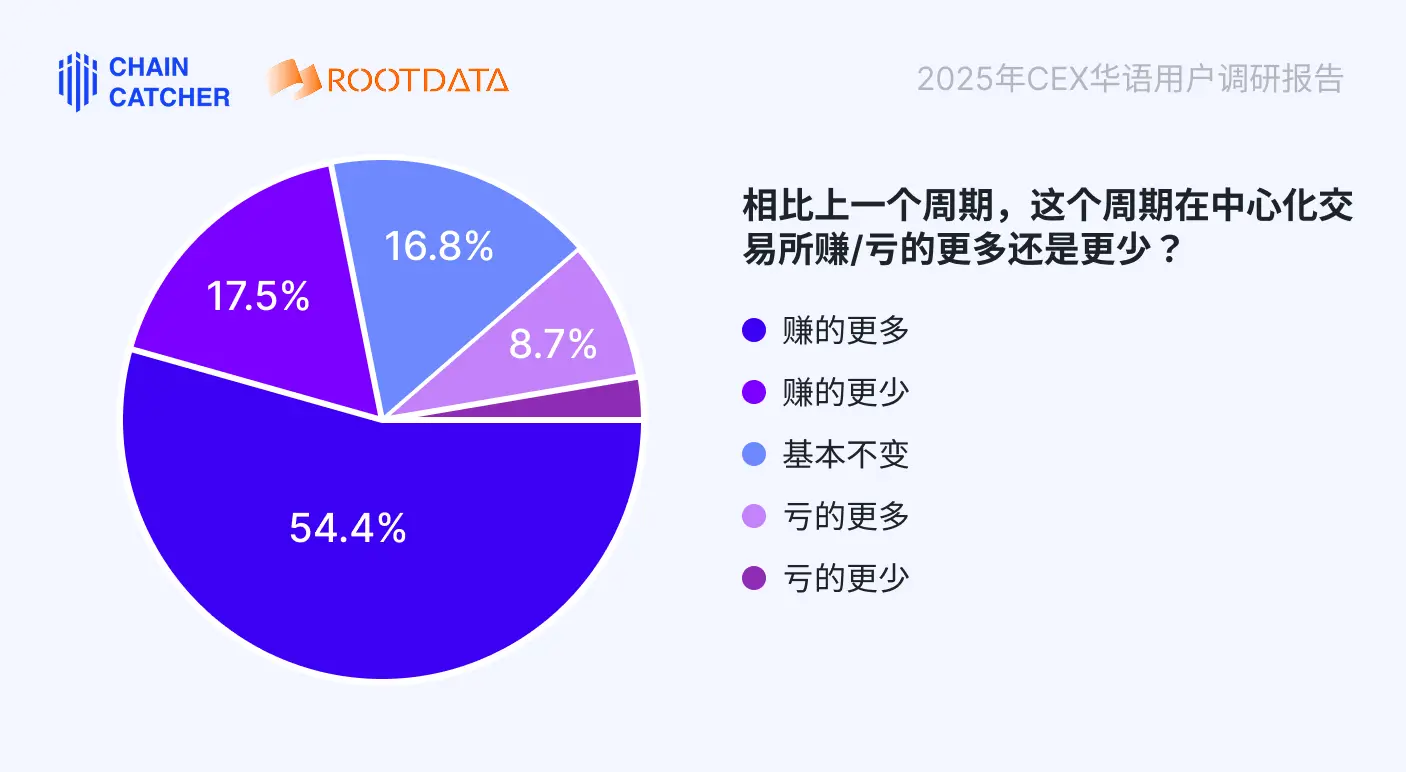

我们在问卷询问了受访者,“相比上一个周期(2022年初~2023年底),这个周期(2024年初至今)在中心化交易所赚/亏的更多还是更少?”

结果显示,整体盈利面显著扩大,约54.4%的用户表示本周期在CEX投资交易中盈利超过上个周期,仅8.7%的用户亏损幅度扩大。

4、显著减少使用的CEX及原因分析

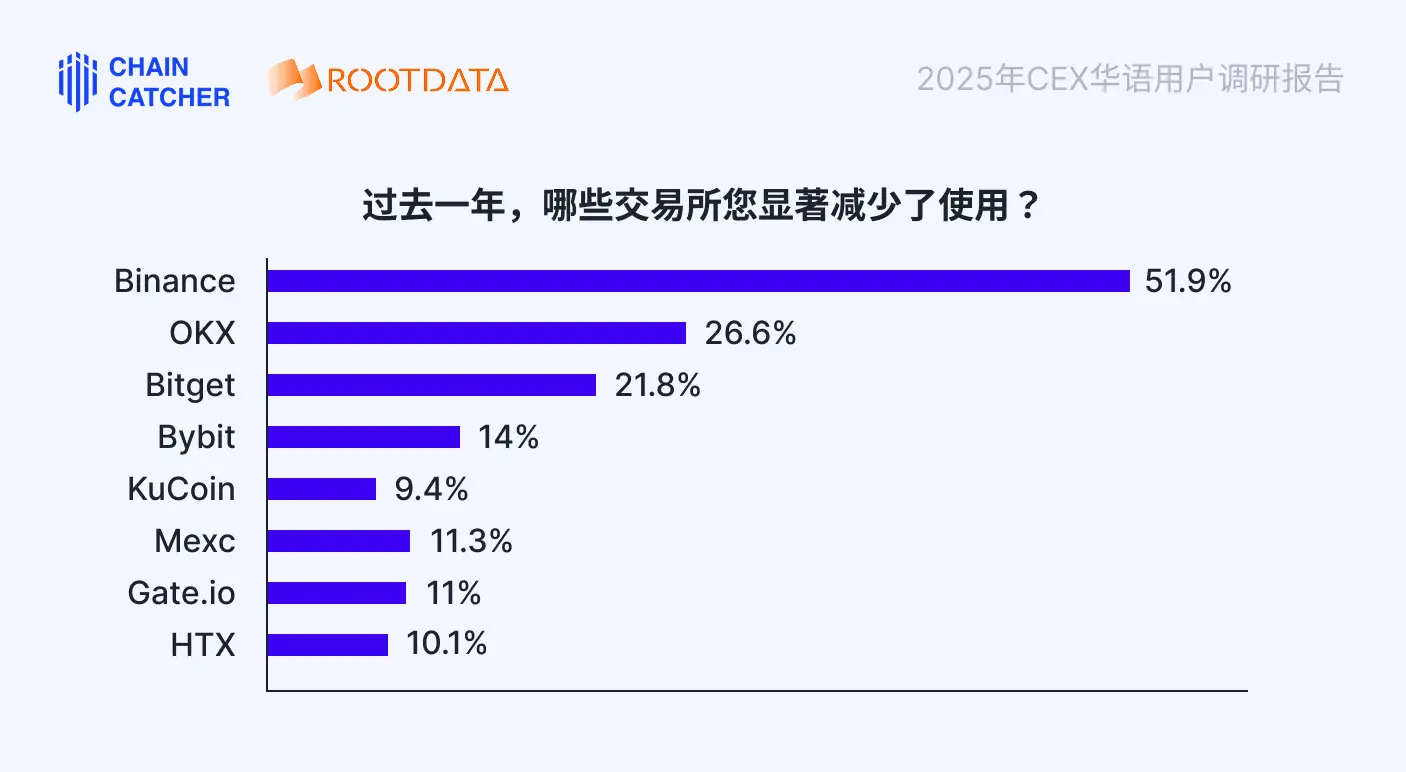

Binance以51.9%的占比成为受访者减少使用最多的交易所,可能受上币效应减弱、监管合规等因素影响,而OKX以26.6%的占比紧随其后。

Binance、OKX作为受访者最高频使用,资产托管金额最大的交易所,仍然可能面临较大的用户流失率。

5、弃用某家CEX的原因分析

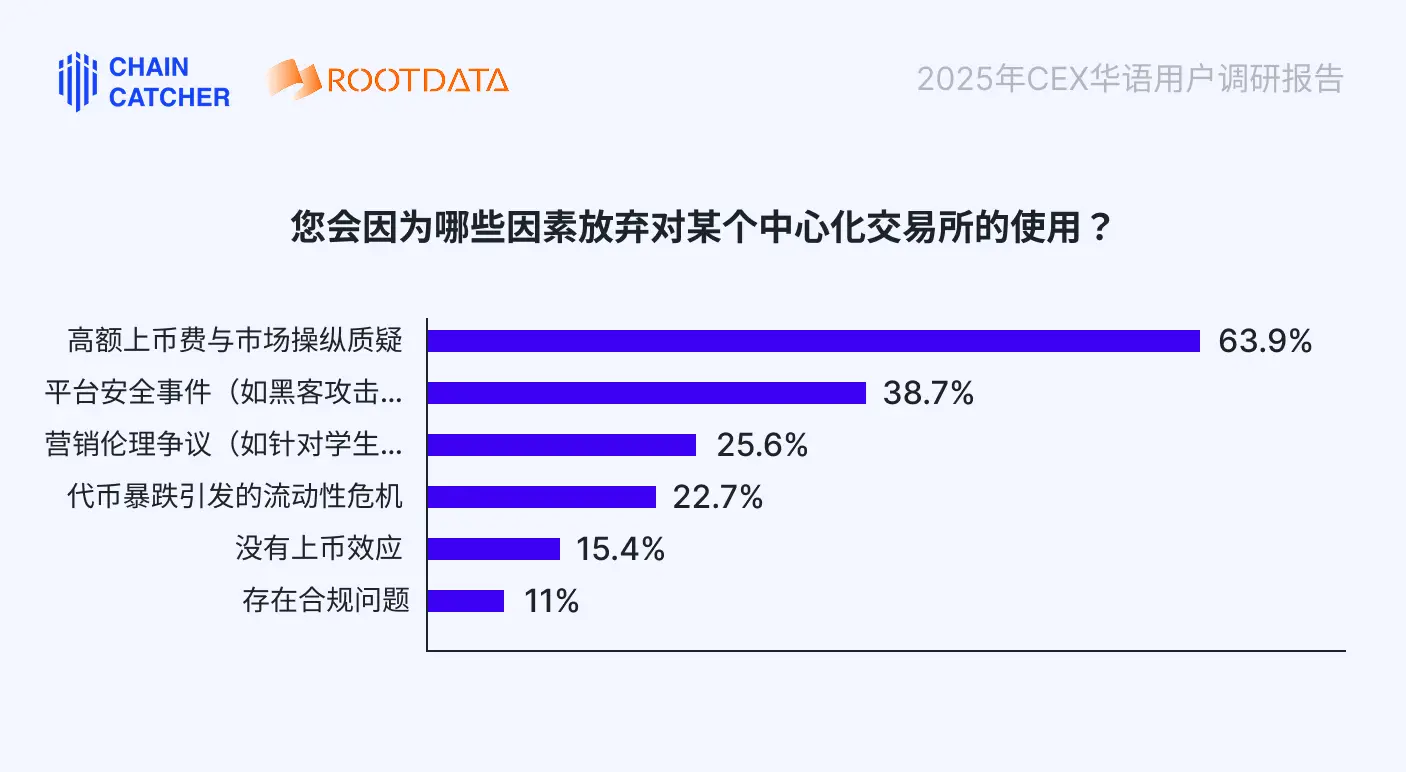

调研受访者弃用某家中心化交易所的原因显示,上币机制带来的负面最大。

63.9%的用户因上币问题弃用CEX,占比最高,反映出用户对上币机制的不满尤为集中。高额上币费可能增加项目方成本,间接推高代币价格,而市场操纵质疑则进一步动摇了用户对平台公平性的信任。此外,15.4%的用户还会因“没有上币效应”弃用CEX,这表明CEX亟需优化上币机制以重建用户信心。

38.7%的用户因平台安全事件弃用CEX,显示安全问题仍是用户最关注的痛点之一。今年Bybit的15亿美元盗窃案再次为加密CEX用户及行业敲响了警钟。

而25.6%的用户因营销伦理争议弃用CEX,表明这类问题不仅损害平台声誉,也可能引发用户对平台整体运营诚信的质疑。

22.7%的用户因代币暴跌引发的流动性危机弃用CEX,反映出部分平台在市场波动下的流动性管理能力不足。

而11%的用户因合规问题弃用CEX,显示部分平台在监管合规性方面存在短板。随着全球加密监管趋严,用户也担心资产安全受到影响。CEX需积极适应监管要求,提升合规水平以降低用户顾虑。

6、减少对CEX整体使用的潜在因素分析

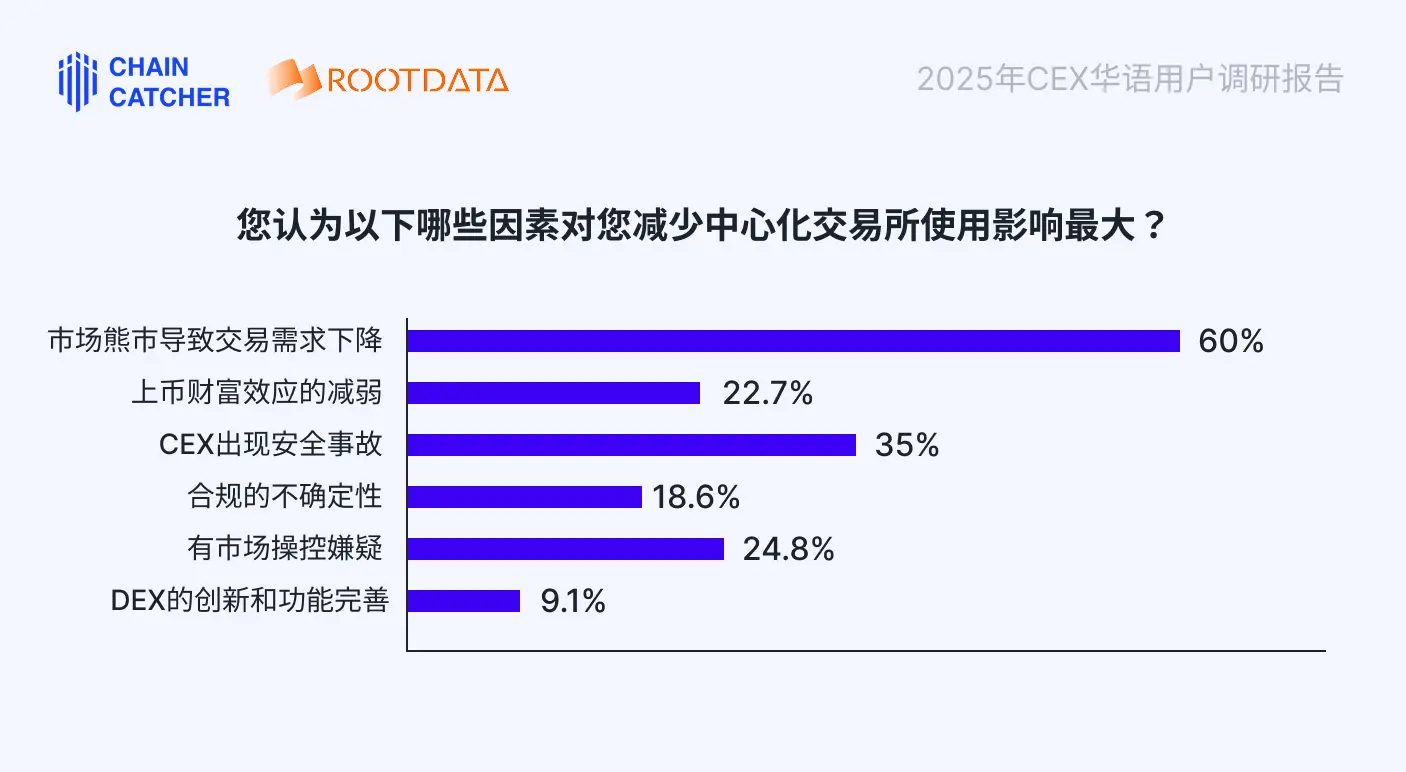

调研受访者会因哪些因素减少对中心化交易所的使用,结果显示,60%的用户因市场熊市减少CEX使用,占比最高,反映出宏观市场环境对用户行为的直接影响。

35%的用户因安全事故减少CEX使用,显示安全仍是CEX的核心痛点。

24.8%的用户因市场操纵嫌疑减少使用,反映出用户对CEX交易公平性的质疑。

22.7%的用户因上币财富效应减弱减少使用,反映了CEX若无法通过优质项目吸引用户,可能导致用户流失。此外合规问题、DEX的创新都对CEX吸引用户使用过程中带来了挑战。

四、华语用户对 CEX 未来发展预期

1、是否考虑用去中心化方案替代CEX

69.5%的受访者表示会考虑用DEX等更去中心化方案替代CEX,占比显著,这反映出用户对CEX的信任危机加剧,以及DEX的崛起对于CEX带来的竞争压力。

但10.1%的受访者仍表示在观望中,这表明了部分用户可能对CEX的品牌仍有较强依赖,对DEX等所谓的去中心化方案的成熟度也持怀疑态度。

2、对CEX和DEX未来格局判断

对于“CEX是否未来会被DEX完全取代?”这一问题,63.9%的受访者认为DEX会完全取代CEX,反映了去中心化金融(DeFi)的理念在加密货币社区中具有较强的吸引力,以及DEX在用户体验上逐渐缩小与CEX的差距。

接近30%的受访者认为CEX和DEX会长期共存,表明一部分人对CEX的持续存在持乐观态度。CEX的优势在于交易速度快、用户体验友好、流动性高、支持法币交易等,尤其对新手用户和机构投资者更具吸引力。少部分受访者持观望态度,可能因为他们对区块链技术、市场监管、DEX技术成熟度(如交易效率、gas费用问题)或CEX的迭代能力存在不确定性。这反映了加密市场的复杂性和未来发展的多变性。

3、针对CEX提升信任度,受访者最期待的改进措施分析

上币过程的透明性仍然最受关注。超过74%的受访者认为需要进一步公开上币流程,这也反映用户普遍认为CEX的上币流程不够公开,可能存在“暗箱操作”或利益输送的疑虑。

而超过37%的受访者关注CEX的资产储备透明度,反映了对平台资金安全性的担忧。FTX等破产事件对于部分用户带来的阴影可能仍未消散

此外,超过35%的受访者希望CEX建立行业统一的风控标准,或表明当前CEX的风控措施参差不齐,可能导致系统性风险;超18%的受访者则希望限制高杠杆交易。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。