What is different about this "new card"?

Author: Fairy, ChainCatcher

Strategy has come up with new tricks again.

To continuously increase its Bitcoin position, MicroStrategy has been frequently "bloodletting" in recent years, financing through common stock, convertible bonds, and preferred stock, advancing on three fronts.

The bull market is not over, and the chips are doubled. Yesterday, Strategy announced the launch of a new preferred stock product, STRD, which is another chip on its Bitcoin-heavy path. What is different about this "new card"? What signals does its structural design, potential risks, and market game release?

STRD: High interest, but no guarantee of payment

STRD is the third type of preferred stock product launched by Strategy, intending to publicly issue 2.5 million shares, with the funds raised primarily used for Bitcoin acquisition and operational capital supplementation. STRD is essentially another structured expression of the BTC long strategy, continuing the framework of STRK and STRF, while making new designs in profit distribution and exit mechanisms.

Similar to its predecessors, the underlying asset behind STRD is still Bitcoin, but this time Strategy has adopted a more "defensive yet aggressive" structure: the annual coupon rate is 10%, but there is no obligation for mandatory payment, and interest does not accumulate.

Crypto KOL Phyrex succinctly interpreted: "The essence of STRD is to finance Strategy by lending money at an annual interest rate of 10%, but Strategy may not necessarily distribute the promised 10% annual interest. If it does not distribute, it will not make up for it in the future. In the explanation, Strategy promised to distribute on time, provided that the company's profits are favorable."

As for where this interest comes from, theoretically, Strategy has three possible payment paths:

Selling BTC holdings: If Strategy liquidates part of its Bitcoin holdings, it can obtain cash flow, but this will face capital gains tax and contradict its long-term holding strategy.

Continuous financing roll-over: It may raise money through reissuing debt or other tools to pay interest, which might be the approach Strategy currently prefers.

Corporate operating cash flow: If the company's other businesses are profitable, it may also be used to pay interest.

Although Strategy has the right not to pay interest, the cost of doing so would be extremely heavy. Once interest payments stop, the market price of STRD will inevitably come under pressure, investor confidence will be undermined, and future refinancing will face greater resistance. Therefore, the market generally believes that as long as the Bitcoin market performs steadily, Strategy is likely to choose to fulfill its obligations on time to maintain its market credibility and the sustainability of its capital chain.

"Three swords together": Strategy's multi-layered preferred stock

After discussing the characteristics of STRD, it is worth looking back at the three current preferred stock products of Strategy. STRK, STRF, and STRD each have their positioning in terms of liquidation priority, profit design, and risk structure, forming a key puzzle piece in Strategy's multi-layered capital structure. Below is a comparison table of the three products organized by Bitwise senior investment strategist Juan Leon (table content translated by ChainCatcher):

From the perspective of investor adaptation, STRK is more suitable for conservative configurations that pursue stable returns and have a lower risk appetite; STRF targets neutral investors who expect to lock in higher fixed returns but can accept certain credit risks; STRD focuses on aggressive funds with a high risk tolerance.

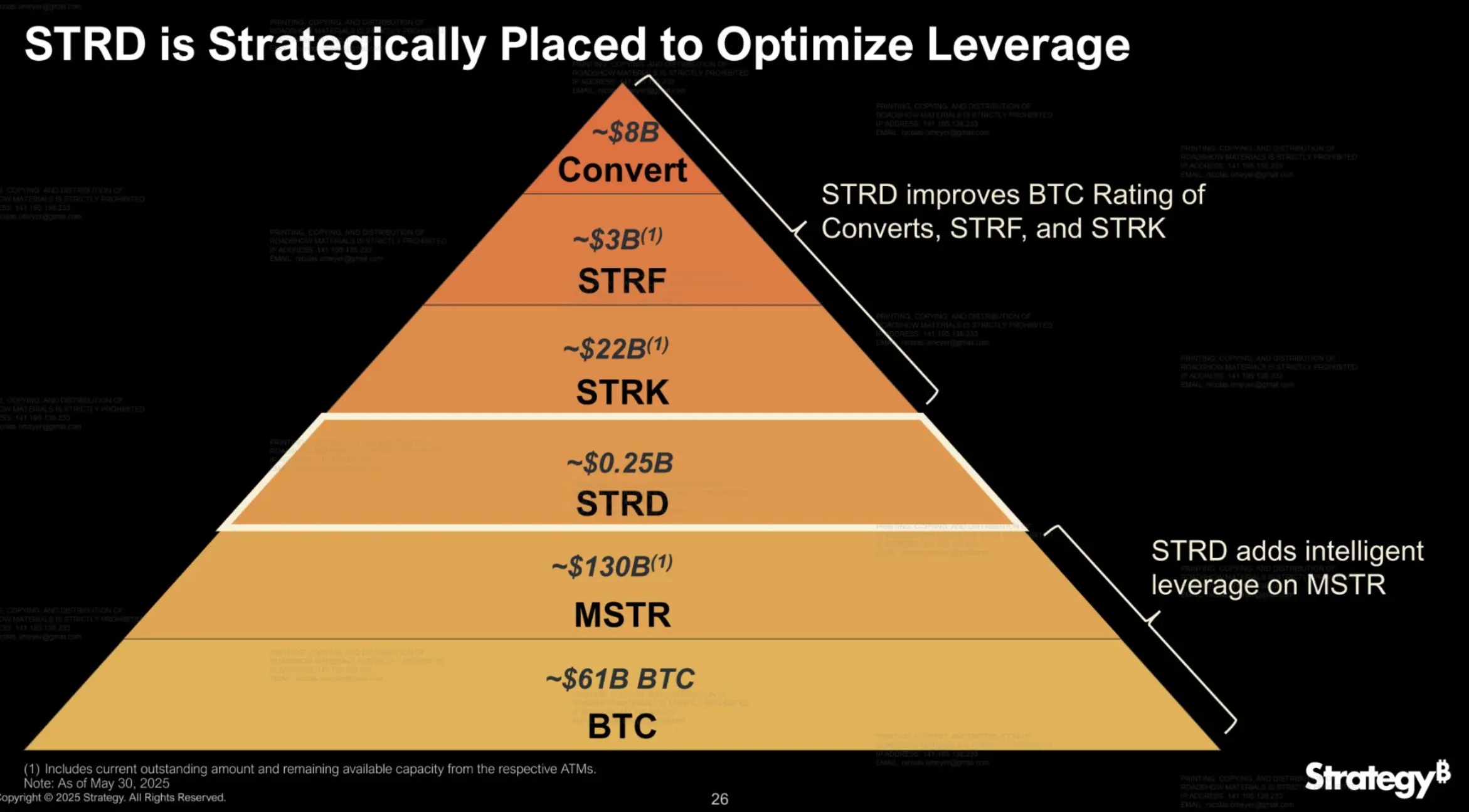

In addition to the product-level extension, the launch of STRD may also be a bet by Strategy on the capital structure's foundation. According to a chart shared by community member @DogCandles, STRD has a "low status" but a "big role," improving the credit support of upper-tier products and optimizing the overall capital structure.

The community is not convinced, and STRD has sparked controversy

The release of STRD is a carefully designed move by Strategy, but the community is not unanimously supportive. Many voices point to its "capital magic":

@chaojidigua: Jiang Taigong fishing, willing to take the bait.

@MemeSiguoyi: Don’t think the crypto circle can print money with air coins; we have our own way of printing money in stocks.

@Softelectrock: Ponzi nesting dolls.

Adam Livingston, author of "The Bitcoin Era," directly pointed out: STRD is essentially a BTC accumulation option disguised as a yield tool. When BTC rises sharply, Strategy redeems at face value; when BTC falls sharply, it simply does not pay interest. Investors are essentially paying for their belief in "the ultimate adoption of Bitcoin."

Meanwhile, Dylan LeClair, Bitcoin strategy director at Metaplanet, described it as a "genius design" from a structural perspective: "The issuance of STRD actually enhances the credit quality of STRF."

Regarding the future development path of Strategy, crypto KOL Phyrex made a bolder prediction: "It is possible that Strategy will consider some inventory Bitcoin plans, such as lending out BTC or participating in some quantitative trading to maintain cash flow. Strategy may eventually become a BTC-based bank."

Strategy's chips have been pushed to the center of the table. It wraps faith in structured products, conceals unilateral bets with risk-return models, and attracts market sentiment with "high interest."

This financial experiment based on faith is becoming increasingly complex and increasingly worthy of attention.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。