作者:钟益,中国金融四十人论坛

近期,全球稳定币立法加速推进。5月20日,美国参议院通过《引导和建立美国稳定币国家创新法案》(《GENIUS Act》)的程序性投票。仅一天后,中国香港《稳定币条例草案》获特区立法会正式通过,并于5月30日正式生效,以在香港设立法定货币稳定币发行人的发牌制度。一时间,稳定币概念受到市场热捧。

事实上,CF40研究在年初就指出,“加密货币已今非昔比”。加密货币已经从过去的游离于主流金融体系之外的“洗钱工具”“投机工具”,转变为机构投资者大规模参与的、趋向主流化的新兴资产类别,成为全球金融生态中不可忽视的组成部分。随着加密货币市场发展,全球主要经济体对加密货币的监管,也从早期的重点关注投机和非法行为,逐步向更加全面和系统的多层次监管框架过渡。

稳定币作为传统金融和加密生态交叉融合的重要节点,是近年来全球加密货币监管的重要方向之一。近期全球立法动态,意味着其战略地位和市场规模还将不断攀升。而稳定币只是加密货币的其中一个类别,作为一个不断演进的创新领域,加密货币的概念和应用还在不断拓展的过程中。

重读本文,我们希望能够使读者了解加密货币的发展历程及潜在趋势,深化对加密货币的认识和研究。本文提示,加密货币主流化是技术创新、机构参与、监管演进和社会认知变化等多方面因素共同推动的。考虑到加密货币多维度的复杂性和市场快速发展、新概念层出不穷,当前我国亟需厘清加密货币的基本概念和运行机制,构建系统性的研究框架,为有效监管奠定基础。

* 本文作者系中国金融四十人研究院钟益,原文《加密货币已“今非昔比”》2025年1月5日首发于“CF40研究”小程序。登录“CF40研究”小程序,还可进一步了解《全球加密货币监管政策主要趋势》。本文版权归中国金融四十人研究院所有,未经书面许可,禁止任何形式的转载、复制或引用。受版面所限,参考文献略。

2009年,中本聪创造的比特币(BTC)开启了去中心化数字货币时代。这项基于区块链的创新虽在早期因匿名性等属性,与投机、非法活动挂钩而备受争议,但也展现出了革新金融体系的潜力。

2014年后,以太坊(Ethereum)引入智能合约,拓展了区块链应用边界,专业交易所的崛起完善了市场基础设施,首次代币发行(ICO)浪潮推动监管框架形成,泰达币(USDT)等稳定币的出现则为市场注入稳定性。

2020年,全球宽松货币政策促使机构投资者开始重新审视和布局加密货币市场,2024年1月比特币现货ETF的最终获批拓宽了加密货币的主流投资渠道。特别是,在特朗普当选美国总统后,其“让美国成为世界加密货币之都”、建立比特币储备的竞选主张,引发市场热烈反响,推动比特币价格飙升至10万美元以上,引起了全球范围内对加密货币的广泛关注和讨论。

如今,以比特币为代表的加密货币逐渐摆脱了早期“洗钱工具”“投机工具”的标签,其新型资产类别属性开始得到主流市场的认可,美联储主席鲍威尔将比特币比作“数字黄金”。

这些转变促使我们深入思考:在过去十余年间,加密货币究竟经历了怎样的蜕变?

加密货币基本情况介绍

(一)加密货币发展至今已衍生出至少三种不同特性的类型

加密货币(Cryptocurrency)是指仅以数字形式存在的货币,其利用加密技术确保交易安全。加密货币通常在去中心化的网络上运行,使用区块链技术作为交易的公共账本,根据发行人可分为央行数字货币(Central Bank Digital Currency,CBDC)和私人加密货币(Private Cryptocurrency)。

CBDC由中央银行发行和管理,是国家法定货币的数字形式,如由中国人民银行发行的数字人民币(DCEP)。私人加密货币由非政府机构发行,不受任何中央机构控制,本文主要聚焦私人加密货币的相关内容。

自2009年比特币诞生以来,目前已有成千上万种加密货币,并且可能每天都有新的加密货币出现。这些加密货币虽然都基于去中心化共识机制和分布式账本技术,但在具体实现上又存在一些差异。根据设计机制和功能,私人加密货币主要可分为三类:价值存储型加密货币(Store of Value Cryptocurrencies)、实用型代币(Utility Tokens)、稳定币(Stablecoin)。

需要说明的是,加密货币作为一个不断演进的创新领域,其概念和应用不断拓展,因此这些分类边界并非绝对。以USDT为例,它既是一种锚定美元的稳定币,同时作为以太坊网络上的代币,也具备实用型代币的特征。

第I类:价值存储型加密货币,典型代表是比特币、莱特币(LTC)等。这类加密货币虽然最初设计目标是实现点对点电子支付,但发展至今已经更多地承担了数字价值存储的功能。它们具有去中心化、无需信任(交易由整个网络验证而非依赖特定机构)、全球流通、匿名性等特点。

这种类型的加密货币通常有一个仅支持该用途的专用区块链,不支持智能合约和去中心化应用(DApps)。它们通常采用固定的供应上限来维持稀缺性,例如比特币的总量约2100万个、莱特币则限制在8400万个。其价格完全由市场供需决定,不与任何其他资产挂钩。

第II类:实用型代币,典型代表是以太币(ETH)、Solana(SOL)等。以太坊是首个支持智能合约的区块链平台,允许开发者在其网络上创建和部署去中心化应用程序(DApps)及数字资产。这种可编程的特性,极大地扩展了区块链技术的应用范围,更催生出了去中心化金融(DeFi)等创新应用场景。

代币(Tokens)是指在像以太坊这样的区块链平台上运行的任何加密资产。也就是说,代币不需要建立和维护自己的区块链网络,而是“寄生”在像以太坊这样的主链之上,发行和转移代币需要支付以太币作为手续费(Gas fee)。

根据实用型代币具体的功能,大致可以将其分为以下三类:

一是基础设施代币(Infrastructure Tokens)。这类实用型代币是支持智能合约的区块链平台的原生代币,主要用于维持网络运行和支付计算资源。

以太币是最具代表性的基础设施代币,其使用场景包括支付网络交易费用、为去中心化应用提供运行环境,以及通过质押机制参与网络验证以维护系统安全。

二是服务代币(Service Tokens)。服务代币是一类特殊的实用型代币,持有者可通过它获得特定网络服务的访问权限或执行相关操作。例如,Basic Attention Token (BAT)是基于以太坊ERC-20(以太坊网络上最常用的代币技术标准)的代币,其在Brave浏览器生态系统中使用,用于激励用户观看广告、支付广告费用以及打赏内容创作者等。

三是金融代币(Finance Tokens)。金融代币的应用场景广泛,包括去中心化借贷、交易、众筹等金融活动,持有者通常可以参与项目治理、分享平台收益。项目方通常会限制发行总量、设置锁仓期、采用多重签名等管理机制。币安币(BNB)是典型的代表,BNB的持有者可获得交易费用折扣。

第III类:稳定币,典型代表是USDT、USDC等。稳定币是一种旨在相对于某种特定资产或一篮子资产保持价值稳定的加密货币,其与比特币最大的区别是需要锚定别的资产,由发行机构根据市场需求增发或者销毁,主要可以分为以下四类。

一是与法定货币挂钩的稳定币,这是目前最受欢迎的稳定币类型,由法定货币(美元、欧元等)1:1储备支持,类似于货币局制度,例如与美元挂钩的USDT、USDC。

二是与商品挂钩的稳定币,与黄金、白银或其他有形商品等实物资产的价值挂钩。例如,PAX Gold是一种由黄金储备支持的稳定币,每个代币代表存储在安全金库中的一金衡盎司黄金。

三是加密货币支持的稳定币,如DAI、LUSD,这些稳定币通常使用超额抵押来减轻其基础资产的固有波动性。以DAI为例,用户需要抵押150美元价值的以太币来获得100美元价值的DAI(150%抵押率)。

四是算法稳定币,理论上可通过智能合约自动调节代币供需来维持价格稳定,而不依赖于抵押品,但现实中已有多个项目失败。Eichengreen(2018)指出的“算法中央银行”具有内在不稳定性,也在2022年Terra/LUNA崩溃事件中得到验证。

除了上述三种加密货币以外,区块链技术还有一些拓展性的应用。比如非同质化代币(Non-Fungible Token,NFT),其代表区块链上某个资产的数字凭证,每个NFT都具有独特的标识符,不可分割且无法相互替代。

NFT目前主要应用于数字艺术品交易(如数字画作、音乐、视频)、虚拟房地产(如元宇宙中的虚拟地块)、游戏道具(如游戏中的特殊装备和角色)以及数字收藏品(如运动赛事纪念品)等领域。

例如,2021年3月,数字艺术家Beeple的作品Everydays: The First 5000 Days以6934.6万美元(约合4.5亿元人民币)的价格在佳士得拍卖会上成交,成为NFT市场的标志性事件。

此外,还有一些基于加密货币的衍生资产,像是比特币期货、比特币期货ETF、比特币现货ETF等。

(二)加密货币市场已构建起独特的金融创新生态

第一,加密货币的市值和交易量在过去十年间经历了显著增长。

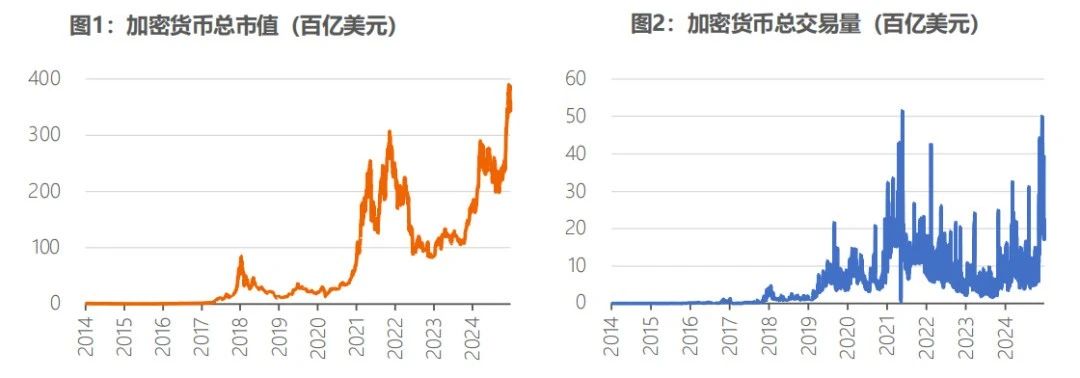

截至2024年12月28日,CoinGecko网站统计了全球范围内1200个加密货币交易所的16022种加密货币,全体加密货币的市值约为3.43万亿美元,过去24小时的交易量约为1653亿美元。

从相对规模来看,这一市值相当于美国股票市场总市值的5%、中国股票市场的35%。而在2014年初,全球加密货币总市值仅为106亿美元,十年间加密货币市场实现了超过300倍的增长。

数据来源:CoinGecko,截至2024年12月28日

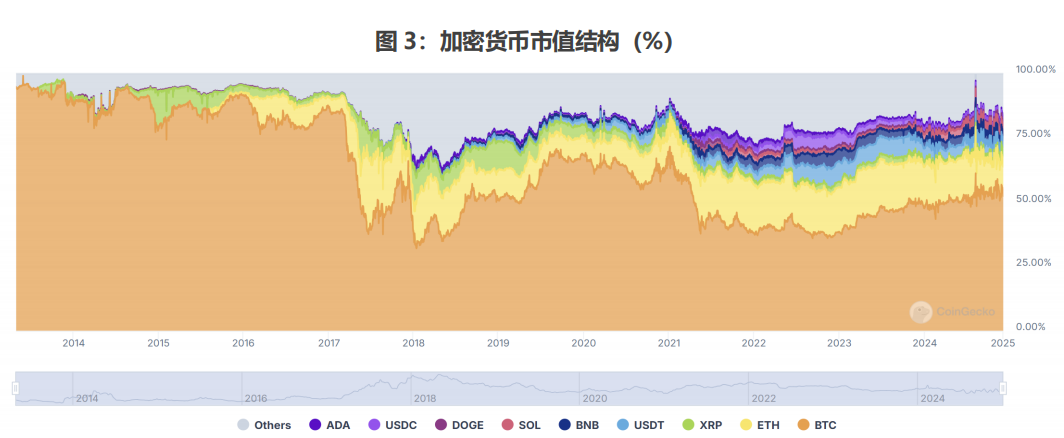

第二,加密货币多元化发展,比特币市值仍然占据主导地位。截至2024年12月28日,市值前三位的加密货币分别是比特币、以太币、USDT,分别为1.87万亿美元、4033亿美元、1386亿美元,占全体加密货币市值的比重分别约为54%、12%、4%。

过去十年,加密货币经历了从比特币单一主导到多元化发展的过程。2017年以前,比特币处于绝对主导地位,占全部加密货币市值的75%以上。2017-2018年,随着以太坊智能合约平台的兴起,以太币市值占比达到了约31%的峰值,比特币占比降至约33%的历史低点。

比特币市值此后经历反弹,在2020年回升至70%左右,目前维持在50%以上的水平,持续占据主导地位。此外,稳定币(USDT和USDC)的市场份额也从零上升至5%-7%,BNB、SOL等新兴加密货币也占据一定市场份额。

数据来源:CoinGecko,截至2024年12月28日

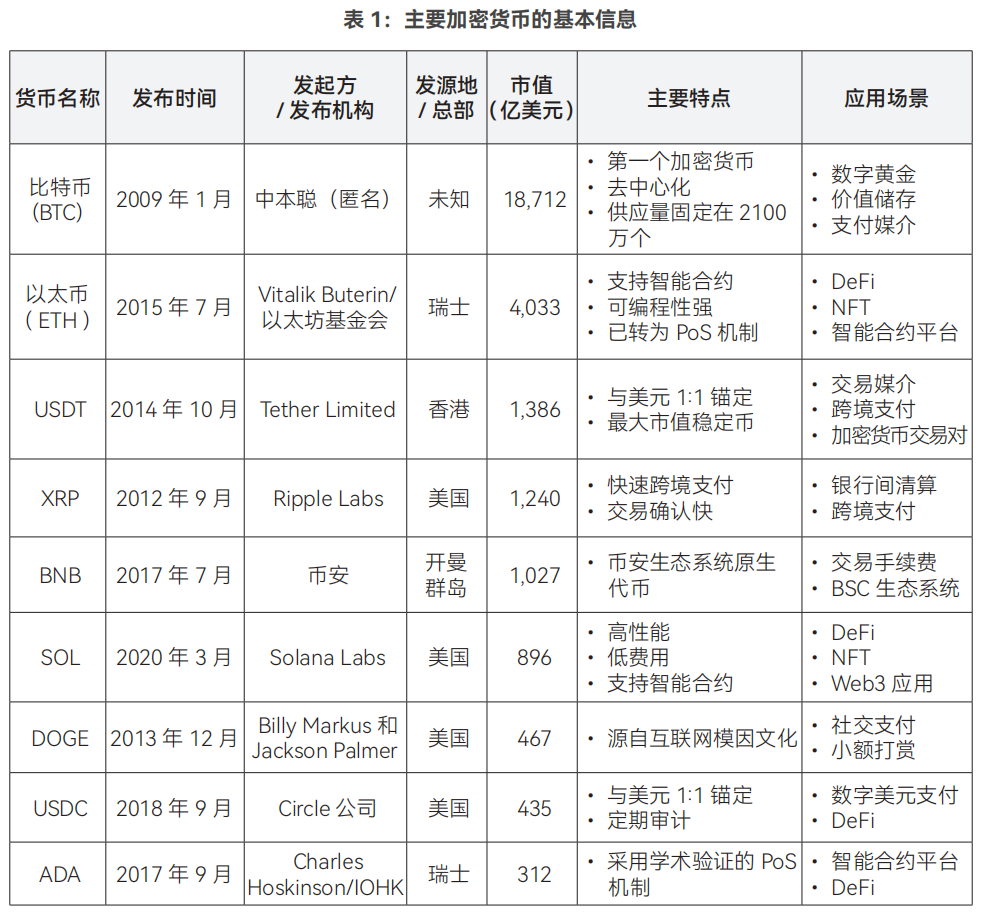

资料来源:CoinGecko,截至2024年12月28日,作者整理

第三,2022年以来稳定币的交易量开始在加密货币中占据主导地位。

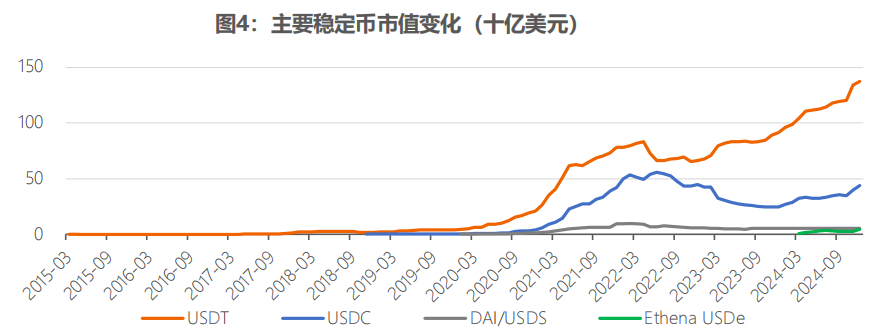

一是稳定币市值规模稳步提升。稳定币在2019年之前发展相对缓慢,2020年以后经历了爆发式增长。截至2024年12月,稳定币总市值达到2110亿美元,占全体加密货币市值的6.12%。

其中,USDT以1386亿美元的市值占据稳定币市场69%的主导地位,USDC则以425亿美元的市值位居第二,占比22%。两大稳定币合计占据超过90%的市场份额,呈现高度集中的格局(图4)。

数据来源:CoinMarketCap,截至2024年12月31日

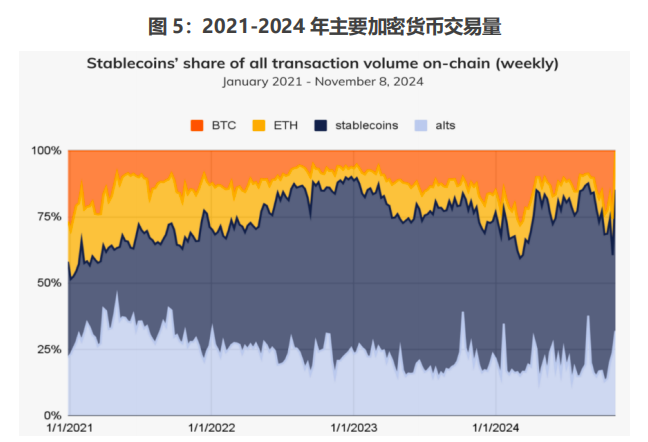

二是稳定币的应用场景正在逐步拓展。近几个月,稳定币以5%-7%的市值,承担了全体加密货币约三分之二的交易量(图5)。值得注意的是,这些交易可能主要体现为资产交易性质,而非日常消费支付。

资料来源:Chainalysis

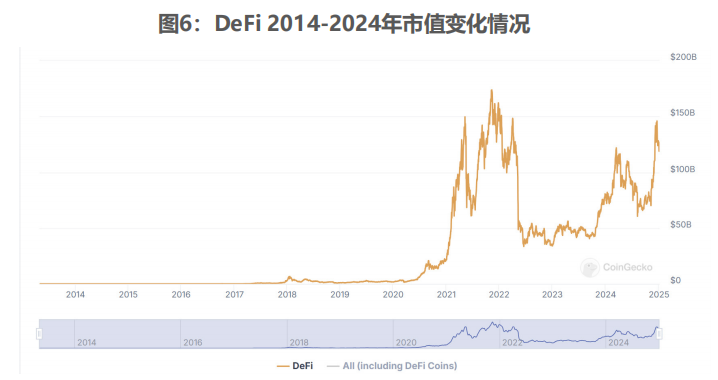

第四,非中心化金融(Decentralized Finance,DeFi)呈波动上升态势(图6)。DeFi提供了与传统金融体系类似的金融服务,同时实现了金融脱媒(表2)。截至2024年12月28日,DeFi市场市值达到1227亿美元,约占全体加密货币市值的3.6%。

资料来源:CoinGecko,截至2024年12月28日

早期(2017-2019年)DeFi应用相对简单,主要聚焦在借贷协议和稳定币;2020年,在“流动性挖矿”(Yield Farming)概念带动下,Uniswap等项目快速崛起;2021年左右,由于以太坊网络拥堵,部分项目开始向Solana等新兴高性能、低成本的公链迁移;2022年,Terra/LUNA生态崩溃导致DeFi市场市值大幅下跌,行业进入调整期,从2023年市场开始企稳回升。

资料来源:IMF,在原文基础上更新了示例

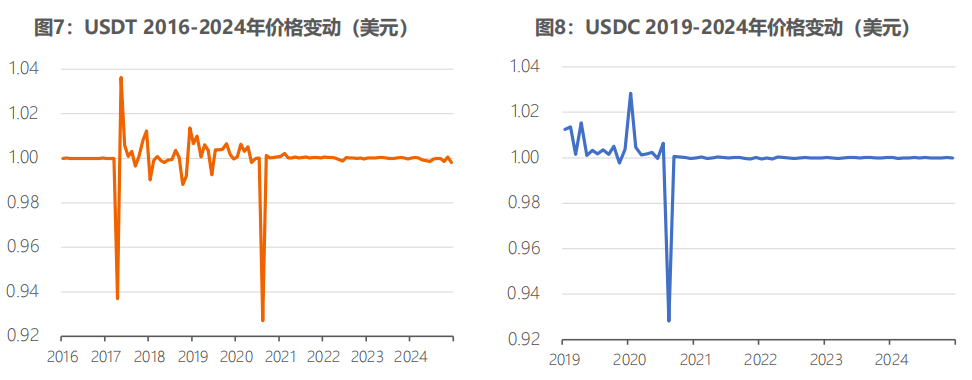

第五,加密货币的价格呈现出不一样的趋势。一是稳定币USDT、USDC的价格自2021年以来,已基本实现稳定在1美元左右的目标(图7、图8)。

数据来源:CoinMarketCap

两大稳定币在2021年前经历过多次价格波动:2017年开始,USDT的发行公司Tether因关联公司Bitfinex交易所的银行纠纷引发美元储备质疑,频遭法律调查;2020年,受新冠疫情影响,加密货币市场恐慌性抛售导致两币出现脱锚;2021年后,随着发行方加强储备透明度,以及市场机制的完善,价格基本稳定在1美元水平。

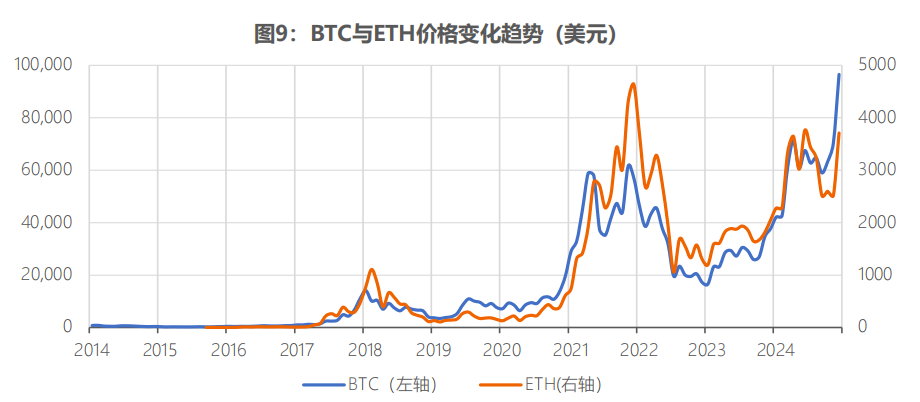

二是加密货币的价格走势具有较强的内在联动性(图9)。比特币和以太币的价格变动趋势高度相关,它们的涨跌往往会带动整个加密货币市场的走势。而且它们都受到全球货币政策环境、监管政策、重大行业事件冲击(如2022年FTX交易所破产)、通胀预期等多方面因素的共同影响。

数据来源:CoinGecko

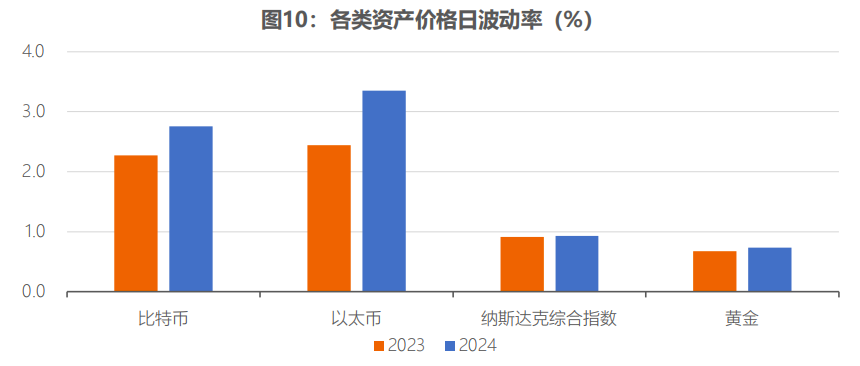

三是加密货币价格较传统金融资产的波动性更高(图10)。比较各类资产价格的日波动率情况来看:在2023年,比特币的日波动率为2.27%,是传统避险资产黄金(0.68%)的3.4倍,也是传统风险资产纳斯达克综合指数(0.91%)的2.5倍。而2024年,各类资产的波动性都有所上升且比特币变化幅度更显著,比特币的日波动率上升至2.76%,是黄金(0.74%)的3.7倍,也是纳斯达克综合指数(0.93%)的3.0倍。

数据来源:CoinGecko、WIND,作者计算

加密货币市场的发展轨迹

加密货币市场的发展轨迹由机构参与、监管演进、社会认知变化及技术创新等多方面因素共同塑造。

(一)发展初期(2009-2016年):技术发展方兴未艾,传统金融机构普遍持负面和观望态度,监管重点关注违法活动

2009年,比特币正式发行,最初主要在极客和密码学爱好者群体中传播,大家也仅将其看做一个技术实验。

2010年5月,美国程序员Laszlo Hanyecz用10000比特币购买了两个披萨(价值25美元,换算后每个比特币约为0.0025美元),成为了比特币的首个现实世界应用案例。

2010年至2013年,加密货币从早期实验逐渐走向大众视野。一是市场规模快速扩张。比特币的价格在2011年2月首次达到1美元,在2012年11月首次“减半”后持续上涨,次年4月达到100美元,11月首次突破1000美元。

二是技术创新不断涌现。2012年Peercoin(PPC)创新性地采用权益证明(Proof of Stake, PoS)共识机制,大幅降低能源消耗,后续如以太坊等区块链项目都采用了改进后的PoS机制。以太坊白皮书也在这一时期发布并提出智能合约概念。

三是支付类商业应用试探性起步。网页内容管理系统Wordpress在2012年11月宣布开始接受比特币支付,但三年后停止了这一支付选项,其创始人表示加密货币的使用率太小,认为加密货币的产生更多是出于哲学角度而非商用。2013年10月,加拿大首设比特币ATM机,办理加拿大元与比特币的兑换业务。

四是交易所等基础设施开始陆续建立。比特币诞生后,很长一段时间里并没有交易所,当时人们主要是在Bitcoin Talk论坛上交易比特币。2009年10月,新自由标准(New Liberty Standard)开始发布根据耗电量计算的比特币价格,首次报价是1美元兑1309.03个比特币。2010年7月,最早的主流交易平台Mt.Gox上线,当时承担了约70%的交易量,此后OKCoin、火币、Coinbase等加密货币交易所相继成立。

2014年至2016年,加密货币进入短暂调整期。一是技术安全问题引发广泛关注。2014年2月,当时全球最大的比特币交易所Mt.Gox因黑客攻击宣布破产,损失了超过85万枚比特币。比特币价格从2013年12月的1000美元以上的高点持续跌至2015年1月的200美元以下。

二是技术创新持续推进。一方面,2015年8月以太坊主网正式上线开启了智能合约时代。智能合约的诞生,让加密货币的应用不再局限于简单的转账工具,而是可以按照预设的规则自动运行,为后续的DeFi发展奠定了基础。另一方面,比特币在2016年7月迎来第二次减半,对于如何“扩容”(让网络承载更多交易)的技术讨论愈发激烈。

在发展初期,传统金融机构积极拥抱区块链新技术,但对加密货币普遍持观望、否定态度。机构倾向于将区块链技术与加密货币分开讨论,体现了拥抱技术、谨慎对待资产的态度。

摩根大通首席执行官Jamie Dimon称比特币是可怕的投资,贝莱德首席执行官Larry Fink在2017年称比特币是“洗钱工具”,代表了当时美国主流金融界的普遍看法。

但从2015年开始,这些传统金融机构开始关注和尝试应用区块链技术。2015年纳斯达克证券交易所推出基于区块链技术的私募股权交易平台Linq,支持企业向投资者私募发行“数字化”的股权。R3区块链联盟组织成立并吸引了包括摩根士丹利、高盛等全球约50家重要金融机构加入,各类基于区块链的创新项目也不断涌现。

美联储董事会委员Lael Brainard在2016年国际金融协会(IIF)组织的会议上表示,美联储已有一个300人的小组具体负责研究和跟进区块链技术,并紧跟市场的发展。

2013年至2016年,各国重点关注投机、反洗钱和反恐融资、交易安全等风险,并建立初步的监管框架。

美国重点关注投机、消费者保护等问题。金融犯罪执法网络(FinCEN)早在2013年就发布加密货币监管指南,将其定义为“一种支付媒介”,并要求交易所履行了解客户(KYC)尽职调查和注册为货币服务企业(MSB)。美国国税局(IRS)在2014年发布通知,将加密货币定义为财产(Property)而非货币(Currency),适用资本利得税规则;商品期货交易委员会(CFTC)将加密货币视为商品,根据《商品交易法》(CEA)对市场操纵和欺诈行为实施监管;纽约州于2015年推出BitLicense监管框架,要求企业必须获得许可证方可在州内运营。日本将加密货币认定为合法支付手段。

日本金融厅(FSA)于2016年5月在《支付服务法》中新增“数字货币”一章,正式承认其为合法支付手段,为数字货币交易所提供法律保障。作为配套规定,日本政府还于2017年3月24日公布《资金结算法施行令》,对资金转移和清算作了详尽规定。

欧洲方面,欧洲银行管理局(EBA)在2013年发布报告警示,比特币可能存在交易平台崩溃导致无法提现、黑客攻击、价格波动等风险。2016年,欧盟委员会开始提议将加密货币及其交易平台纳入反洗钱/反恐融资指令(AMLD4)的监管范围。经过两年的深入讨论,欧盟最终于2018年6月正式发布第五版反洗钱/反恐融资指令(AMLD5),首次将加密货币纳入监管体系。

(二)ICO泡沫时期(2017-2018年):ICO热潮推动加密货币发展,大量筹资和欺诈、骗局共生引发强监管

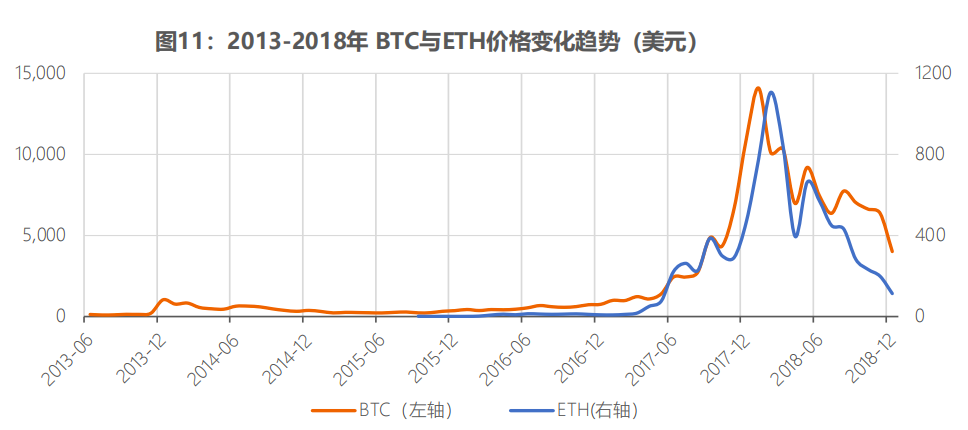

加密货币在2017-2018年有一段较短暂的牛市(图11),在2018年阶段性地达到了市值高峰,这一时期主要是由ICO热潮推动。

数据来源:CoinGecko

首次代币发行(Initial Coin Offering,ICO)是加密货币领域发展出的一种创新融资机制,其基本原理是项目方通过在区块链上发行新的加密货币,来募集流动性较好的加密货币(比特币、以太币)。

2013年Mastercoin首次尝试ICO,2014年以太坊ICO成功筹集1800万美元后引发广泛关注。以太坊作为主要ICO发行平台,其价格也随之上涨,加密货币逐渐引发媒体热议,“区块链”成为热词,吸引大量散户投资者入市。

但因缺乏监管、投机情绪高涨、技术漏洞等问题,ICO的泡沫最终在2018年破灭。早在2016年5月,基于以太坊的项目The DAO通过ICO筹集了约1.523亿美元,却因智能合约漏洞在一个月后遭黑客攻击,损失了约360万枚以太币。大量低质量项目的失败和欺诈行为频发,使ICO一度被视为“庞氏骗局”的代名词。

据美国网络安全公司CipherTrace统计,2018年因ICO退出骗局、伪造交易、黑客攻击和庞氏骗局导致的损失高达7.5亿美元。据俄罗斯加密货币和区块链协会(RACIB)统计,俄罗斯2017年共吸引了3亿美元的ICO资金,但是其中一半属于庞氏骗局。

各国加强对加密货币的重新审视和对ICO进行监管。中国央行等七部门在2017年4月联合发布公告,要求各类代币发行融资活动立即停止,并安排清退工作。2017年7月,美国证券交易委员会(SEC)发布声明,以The DAO项目为例强调ICO需加强合规管理。SEC明确部分ICO可能构成证券发行,必须遵守相关规定,并警告ICO存在诈骗、市场操纵等高风险,提醒投资者警惕高回报低风险的虚假承诺,尤其注意未注册或无牌运营的行为。此外,SEC还暂停了CIAO、First Bitcoin Capital等多项问题ICO交易。在项目质量和监管的双重压力下,这轮上涨最终以投机资金撤离和市场大幅回调告终。

截至此阶段,加密货币作为支付工具来看,使用频率不高且与非法活动挂钩。Athey et al.(2016)发现,截至2015年年中,比特币的活跃使用增长速度不快,也就是说真正经常使用比特币进行日常支付的用户并不多,大部分比特币被当作投资品持有。

Foley et al.(2019)研究发现,2009年1月到2017年4月,非法活动在比特币用户和交易活动中占很大比例,大约四分之一的用户(26%)和接近一半的比特币交易(46%)与非法活动相关;如果按交易金额计算,约五分之一(23%)的交易总额和约一半(49%)的比特币持有量与非法活动相关。

根据他们的估算,截至2017年4月,约有2700万的比特币市场参与者主要将比特币用于非法目的,他们合计持有70亿美元的比特币,每年进行约3700万笔交易,价值约760亿美元。

加密货币作为资产来看,其与传统金融资产相关性不大,主要受自身和市场不确定性驱动。Bianchi(2020)分析了14种主要加密货币在2016年4月至2017年9月之间的交易数据,发现加密货币的收益率与股市、债市等并无明显关联,加密货币的交易量主要是由历史价格走势和市场不确定性驱动。

2017年末,芝加哥期权交易所(CBOE)、芝加哥商品交易所集团(CME)相继推出了比特币期货合约,以美元现金结算,有助于提升比特币交易活跃度和实现价格发现功能。

(三)机构投资期(2019-2021年):在全球流动性泛滥背景下,部分机构投资者开始将加密货币纳入投资组合

事实上,早在2018年左右,机构投资者的态度就已经开始出现微妙变化。

富达(Fidelity)于2018年成立了子公司富达数字资产(Fidelity Digital Assets),开始筹备面向机构投资者的数字资产托管和交易服务。2019年,摩根大通推出加密数字货币摩根币(JPM Coin),用于客户之间支付交易的即时结算(不过,其首席执行官 Jamie Dimon到2024年仍在抨击比特币)。

机构投资者的态度发生根本性转变是从2020年开始,越来越多的传统金融机构开始对加密货币进行正面评价并开始进行战略布局。

第一,新冠疫情触发的全球量化宽松政策加剧了通胀担忧,促使机构投资者寻求新的对冲工具。比特币价格从2020年3月“黑色星期四”的3800美元暴跌点位逐步回升,并在2020年底突破20000美元。这一阶段,托管、交易、结算等机构级基础设施逐步完善,行业合规性和安全性有所提升,为后续机构投资者进入市场奠定了基础。

第二,机构投资者从此前的全面否定转向审慎参与,并持续加大参与深度。2020年5月,著名投资人Paul Tudor Jones宣布将比特币作为对冲通胀工具。贝莱德等投资巨头相继布局加密资产业务,贝莱德首席执行官Larry Fink对比特币的观点从2017年的“洗钱工具”转为“全球资产”;2021年3月,摩根士丹利成为首家为其高净值客户提供比特币基金投资渠道的大型美国银行,其拥有4万亿美元的客户资产,高盛紧随其后也宣布将为高净值客户提供加密货币投资选项。

支付巨头陆续接入加密生态,PayPal在2020年10月宣布支持用户购买、持有和销售加密货币,并在次年初将服务扩展至Venmo用户;数字支付公司Square不仅在其Cash App中支持加密货币业务,还购入5000万美元比特币作为储备资产;2021年3月,支付平台Visa宣布允许使用加密货币在其支付网络上结算交易。

以微策略公司(MicroStrategy)为代表的上市公司开始配置比特币,该公司在2020年8月首次购入2.5亿美元比特币后多次增持,并通过发行可转债、股票等方式为购买比特币融资,截至2024年12月15日其已经持有约43.9万枚比特币;特斯拉也在2021年初宣布购入15亿美元比特币。

第三,监管政策框架日趋清晰,助推加密行业主流化。2020年,美国货币监理署(OCC)发布指导意见,允许联邦银行和储蓄协会为加密资产提供托管服务。此举降低了个人用户保管数字资产的技术门槛与风险,同时也为传统金融机构拓展了新业务方向。预计全球四大银行BNY Mellon、State Street、摩根大通和花旗将在2025年开始提供加密资产托管服务,这些银行共同管理了超过12万亿美元的资产。

商品期货交易委员会(CFTC)将加密货币视作商品,负责审批新的加密货币衍生产品等。SEC对加密货币监管态度仍然严格,持续以“未注册证券”为由打击多个ICO项目,例如Telegram的TON项目被迫关停,并支付1850万美元和解。

此外,欧盟于2020年9月提出《加密资产市场监管法案》(Markets in Crypto-Assets, MiCA)草案,旨在为成员国建立统一的加密资产监管框架。

(四)结构性变革(2022年):重大风险事件引发加密货币市场深度调整

第一,市场创下历史新高后深度回调。比特币价格在机构配置和零售投资推动下,从2021年初的3万美元一路攀升至11月近6.8万美元的高点,以太币也突破4800美元。但在2022年,受美联储加息、Terra/LUNA崩塌和FTX交易所破产等因素影响,比特币最低跌至1.6万美元。

第二,风险爆发推动加密行业重新审视系统性风险管理。2022年5月,Terra LUNA生态系统发生崩塌,短短几天内,其原生代币LUNA从2022年4月初的119美元高位暴跌至接近零,同时其算法稳定币UST严重脱锚,导致整个生态系统市值蒸发超过400亿美元。这一事件暴露出算法稳定币过度依赖市场信心、缺乏充足外部储备支撑等根本性缺陷。

这次崩塌对加密货币市场造成了显著冲击,比特币和以太币等主流加密货币价格出现明显下跌,并引发了一系列连锁反应。知名的加密货币对冲基金Three Arrows Capital(3AC)因大量使用杠杆投资LUNA和其他加密货币而破产,其拖欠包括Voyager Digital、Genesis Trading等机构超过数十亿美元债务;中心化借贷平台Celsius在2022年6月冻结用户提现并宣布破产,披露的资产负债表缺口高达12亿美元;Voyager Digital也因3AC违约而申请破产保护。

这场危机在2022年11月达到顶点,当时全球第二大加密货币交易所FTX及其关联公司Alameda Research被曝存在严重财务问题,包括挪用客户资金、将自家发行的FTT代币作为主要贷款抵押物等。这些问题的曝光引发了市场恐慌,导致FTX在短短一周内从估值320亿美元跌至破产。

这些事件暴露了中心化机构在风险管理、资金隔离和公司治理等方面存在的缺陷,包括过度杠杆、期限错配、内部控制缺失等问题。

第三,市场动荡导致机构投资者参与加密货币市场出现分化。部分机构选择收缩业务,特斯拉在2022年二季度出售75%比特币持仓(约9.36亿美元),理由是需要保持流动性;多家银行在FTX事件后暂停或缩减加密货币相关服务。

另一方面,部分将加密货币视为长期战略布局的机构则继续投入。MicroStrategy在市场下跌期间继续增持比特币;富达数字资产在2022年10月底正式为机构客户提供以太币购买、出售和转账服务。

第四,技术基础持续夯实,关键技术升级按计划推进。2022年9月,以太坊成功完成“The Merge”升级,将其共识机制从工作量证明(PoW)过渡到权益证明(PoS)。这次升级使以太坊网络的能耗降低了超过99.9%,将区块生产从依赖能源密集型挖矿转变为基于质押的验证机制。完成升级后,以太坊验证者的数量和质押需求都在增加,反映了社区对权益证明(PoS)机制的信心。

以太坊的第二层扩容网络(Layer 2)取得明显进展,主要项目Arbitrum和Optimism通过在主网之上处理交易,降低了用户成本并提升了网络性能。此外,随着跨链桥安全性的提升、去中心化身份(DID)标准的确立以及零知识证明等隐私保护技术的发展,Web3基础设施逐步完善。

第五,行业事件冲击加快监管立法进程。日本早在2019年就开始讨论稳定币监管,2022年5月Terra/LUNA事件后,日本加快了立法进程,于2022年6月通过《资金结算法》修正案,对稳定币的发行、流通、赎回等环节进行全面规范。欧盟在2022年正式通过MiCA法案,这是全球首个综合性加密资产监管框架,涵盖发行标准、服务提供者规范和市场行为监管等。

(五)稳健发展时期(2023-2024年):市场企稳,监管框架基本成型,比特币现货ETF获批等拓宽参与加密市场渠道

第一,市场在经历重大风险事件后逐步复苏。2022年FTX破产等事件的负面影响逐渐消退,比特币价格从2022年末的1.6万美元稳步回升,并在2024年3月突破7万美元创新高。市场结构进一步优化,中心化交易所(CEX)透明度提升,为了恢复市场信任并满足监管要求,许多中心化交易所(如币安、Coinbase等)开始实施更透明的资产证明机制(Proof of Reserves),确保用户的资产得到妥善管理和验证;同时,去中心化交易所(如Uniswap、SushiSwap等)的发展也为市场提供了更多元化的交易选择。

第二,加密行业应用和基础设施持续发展,技术创新加速。以太坊的Layer2生态(如Polygon、Arbitrum、Optimism)不断壮大;NFT技术在品牌营销、游戏、艺术等领域的应用持续创新;区块链基础设施开始整合AI功能,如智能合约自动化和风险控制;比特币网络正尝试着从静态链向多功能生态系统转型;去中心化社交网络(DeSoc)等新型应用形态开始涌现;去中心化物理基础设施网络(DePIN)也在2024年跨越式发展,总市值突破400亿美元,同比增长132%。DePIN在电信、移动通信和能源等全球重要行业领域崭露头角,为这些传统行业的变革注入了新的活力与可能性。

第三,加密货币监管框架进一步完善,比特币正式进入主流投资领域。美国证券交易委员会(SEC)的立场经历了从严格限制到逐步接纳的转变——从2017年对ICO的严格监管,2019年比特币ETF申请被多次否决,到2021年批准比特币期货ETF,再到2024年1月初批准了包括贝莱德、富达在内的11家机构的比特币现货ETF申请,为机构投资者参与提供了合规通道。欧盟也在2023年起正式实施MiCA法案。中国香港也推出新的虚拟资产服务提供商(VASP)牌照制度并允许零售投资者交易ETF等产品。

第四,传统金融机构大范围入场,加密金融与传统金融加速融合。一是传统投资机构积极扩展加密货币投资渠道。2023年6月,贝莱德开始向SEC申请现货比特币ETF,其他大型金融机构也纷纷效仿,并最终在次年1月获得批准。根据Messari的报告,2024年加密货币游说影响力激增,行业加大推动有利法规的力度,总支出达到2亿美元,跻身前五大游说支出行业。

二是加密市场迎来机构投资的实质性突破。比特币ETF上市后表现强劲,资金持续流入,2024年比特币现货ETF市场总规模约1000亿美元。其中,贝莱德推出的比特币现货ETF(IBIT)创造了ETF市场新纪录,首月管理规模突破30亿美元,200天内攀升至400亿美元。

三是传统金融机构正在加密行业的实体资产通证化、稳定币等多个领域布局。Sky(原MakerDAO)和贝莱德等机构推出了链上货币市场基金;Ondo Finance的USDY(通证化国债基金)管理规模达4.4亿美元;机构正积极探索区块链在降低成本、提升透明度和支付效率等方面的应用潜力,PayPal在Solana平台上发行PYUSD稳定币。

四是机构投资者对加密货币普遍持乐观态度。根据富达对2023年机构投资者投资数字资产的调查,51%的受访机构表示目前已经对数字资产进行了投资,其核心逻辑是:如果数字资产未来真的成为更主流的价值储存手段,那市场空间会远超现在。黄金目前市值超过18.5万亿美元,而比特币的市值占黄金市值的比重已经从2020年的1.6%增长到2024年11月的近10%。

随着ETF等更多传统投资工具的出现,机构投资数字资产会变得更加便捷,比特币追赶的速度可能会进一步加快。根据普华永道2024年对对冲基金数字资产投资的调查,对冲基金普遍加大了对数字资产的配置,主要受监管透明度提升、新投资工具(特别是ETF)推出、投资者兴趣增长以及主流机构入场等驱动。

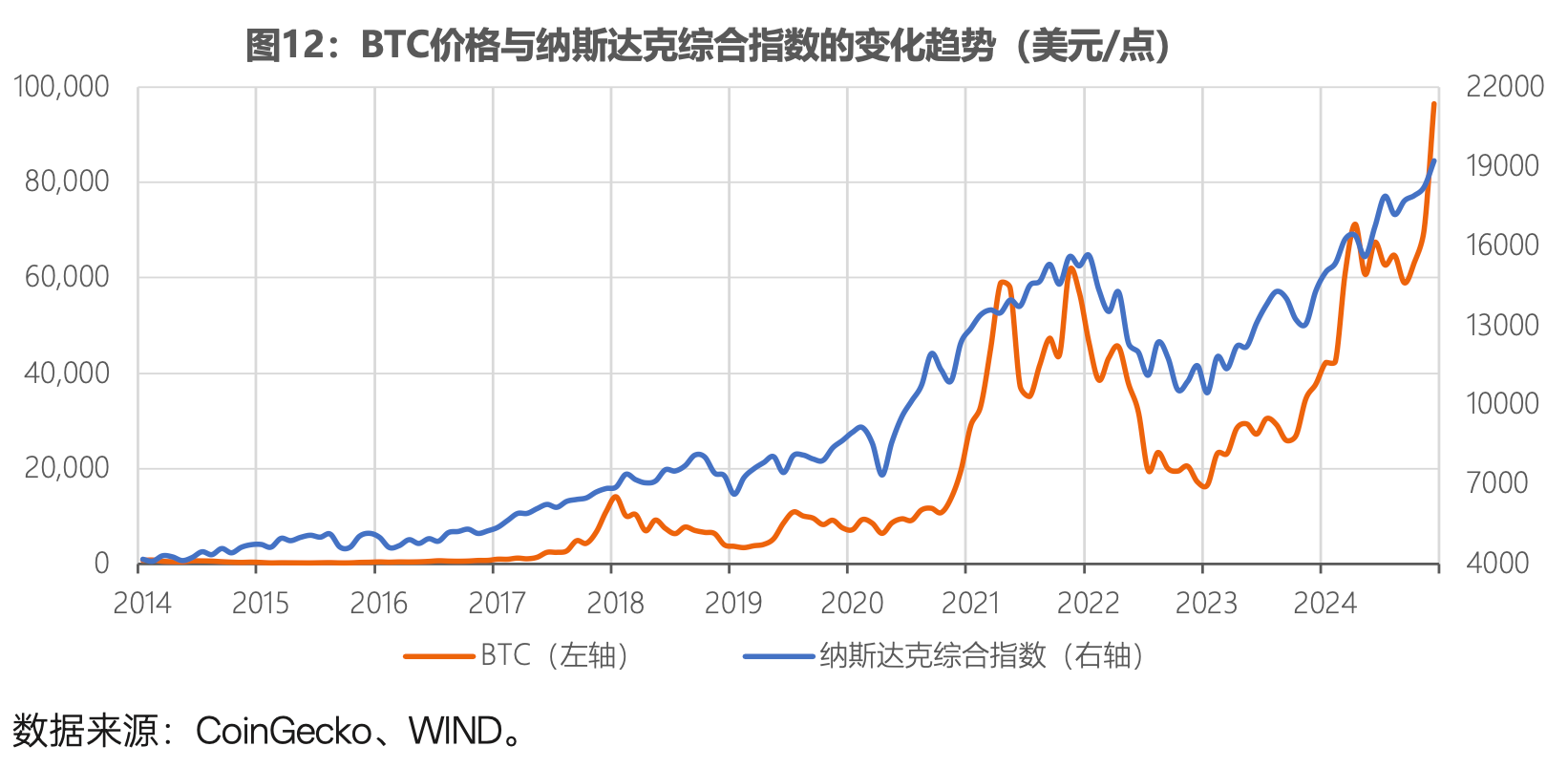

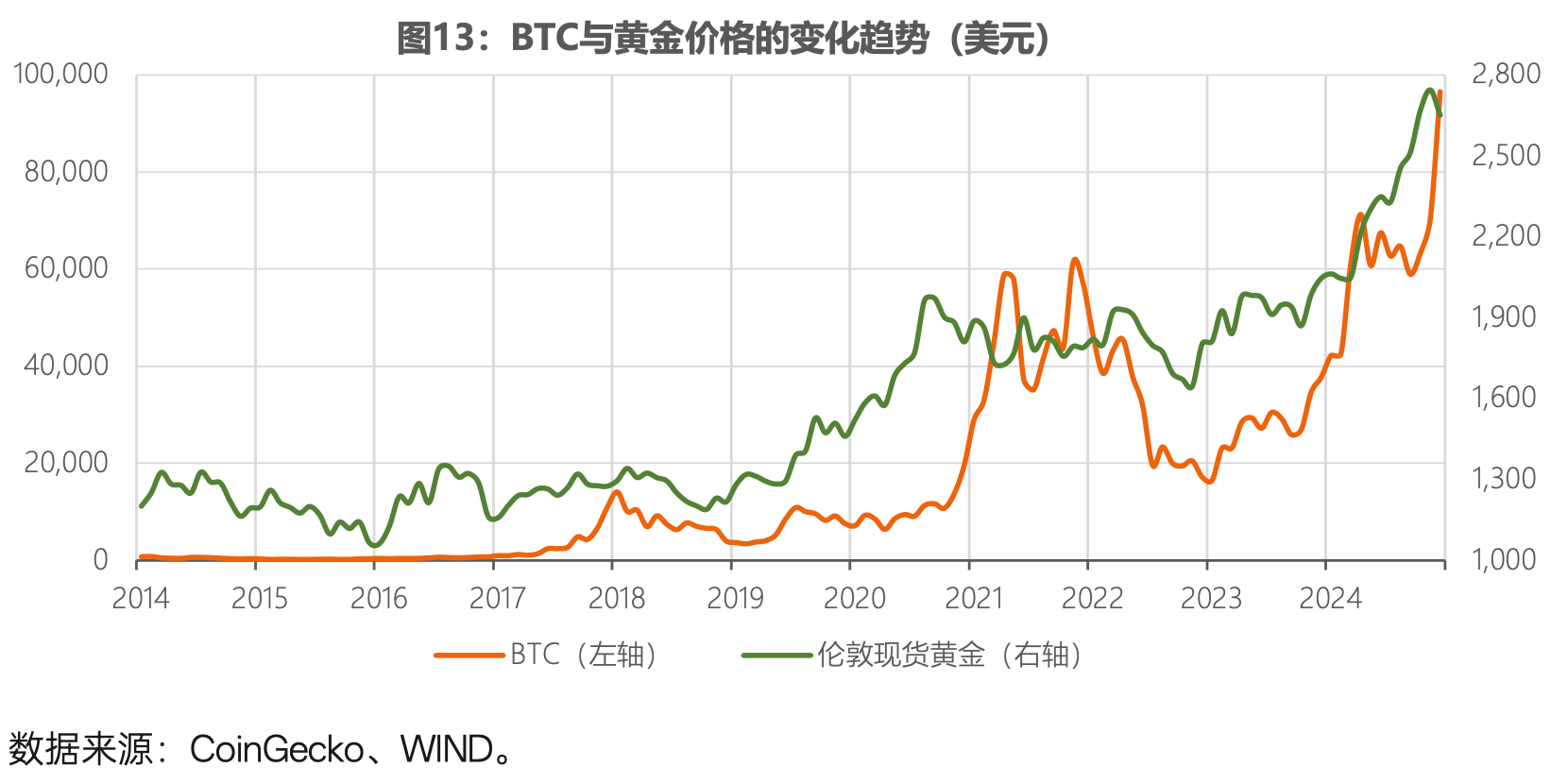

第五,比特币在特定情境下展现出与黄金类似的避险功能(图12、图13)。2020年以后,比特币价格、黄金价格和纳斯达克指数之间的关系经历了明显变化。新冠疫情初期(2020年3-4月),三者均在短暂下跌后反弹,但表现节奏和力度各异:纳斯达克在科技股带动下率先强势回升,黄金因避险需求稳步上涨,而比特币波动最为剧烈。随后在全球流动性宽松期(2020下半年至2021年初),比特币与纳斯达克呈现显著正相关性,显示其作为风险资产的特征,而黄金在2020年8-9月创下历史新高后走势分化,进入回调阶段。2021年通胀上行期间,这种分化进一步加剧,纳斯达克持续创新高,比特币经历两轮显著上涨,而黄金表现相对平淡。

2022年美联储启动加息周期后,纳斯达克与比特币均大幅下跌,尤其是FTX事件令比特币跌势加剧,而黄金因避险需求展现出较强的稳定性。2023年美国硅谷银行倒闭引发的区域银行危机期间,比特币和黄金表现出较强正相关性,均因避险需求上涨,而纳斯达克在短期波动后延续上涨趋势。这种演变或许表明,比特币由早期的与纳斯达克高度相关的风险资产特征,逐步开始在特定市场环境下展现出类似黄金的避险功能。

此前也有一些研究认为,比特币具有与黄金类似的风险对冲能力(Dyhrberg,2016)、可以用作通胀对冲工具(Blau et al.,2021;Choi and Shin,2022)。

这也反映在一些机构投资者的观点上,贝莱德在2023年10月、2024年9月都表达过类似的观点。其认为,比特币的长期回报驱动因素与传统资产类别有根本区别,在某些情况下甚至是相反的。全球投资者面临地缘政治紧张加剧、美国债务危机深化和政治环境动荡的挑战,比特币可能会被视为对这些财政、货币和地缘政治风险因素的独特对冲工具。美联储主席鲍威尔则在2024年12月公开表示,比特币“就像黄金一样,只是它是虚拟的、数字化的”。

结论与思考

加密货币市场正经历深刻变革。纵观其发展轨迹,加密货币已经从过去的一个游离于主流金融体系之外的“投机工具”,发展成为全球金融生态中不可忽视的组成部分。

这种转变既深刻又迅速,是由技术创新、机构参与、监管演进和社会认知变化等多方面因素所共同推动的。如今的加密货币市场已在多个关键维度呈现出全新面貌。

其一,加密货币已经从纯粹的新技术试验,变为颇具规模的一种资产类别。目前,加密货币的市值已经超过了3万亿美元,这相当于中国A股市值的三分之一,而十年前其规模才仅超过百亿美元,约十五年前加密货币(比特币)才首次面世。其中,比特币已从早期仅受技术爱好者关注的创新实验产品,跃升为全球第七大资产,其市值规模超越了传统避险资产白银以及能源巨头沙特阿美。

其二,加密货币已经从比特币绝对主导的单一格局发展成为加密生态体系,并且还在不断演进之中。一是加密货币的数量繁多。CoinGecko网站可统计到的加密货币就超过了1.6万种,加密货币交易所就有1200家。二是加密生态已构建起与传统金融体系相对应的基础设施(表2),可实现交易、借贷、投资等传统金融的核心功能。

三是加密货币的功能多元化。早期的比特币主要体现价值储存和支付手段等功能。随着2014-2015年以太坊及智能合约的出现,加密货币的应用范围得到更多拓展,不断衍生出去中心化金融(DeFi)、非同质化代币(NFT)、去中心化社交网络(DeSoc)、去中心化物理基础设施网络(DePIN)、支付金融(PayFi)等各式新型应用。稳定币则在试图应对加密货币价格过度波动的问题,并提高支付效率、降低支付成本。根据Visa和Castle Island Ventures的研究,截至2024年,稳定币的总流通供应量已经超过了1600亿美元,而这在四年前仅为数十亿美元。

其三,加密金融业务与传统金融业务存在越来越多交叉和融合的情况。最初比特币等加密货币的定位是独立于当前央行和银行体系的去中心化的系统,但目前部分加密货币业务与传统金融业务的界限并不明确。

这种融合趋势表现在各个方面:例如,与法定货币挂钩的稳定币就类似于货币局制度,加密货币价格由实际的美元、欧元等资产储备支持;2019年摩根大通推出加密数字货币摩根币用于客户间的结算支付;2020年开始,PayPal、Visa等支付巨头开始支持加密货币相关支付服务;美国从2020年允许银行为加密资产提供托管服务;贝莱德等机构推出了链上货币市场基金等。加密金融体系似乎从完全替代传统金融的“竞争者”,转变为与传统金融融合促进的“协作者”。

其四,加密货币市场开始从散户主导的投机市场,转变为机构投资者大规模参与的、趋向主流化的新兴资产类别。大型投资机构对加密货币的态度早期普遍是负面的,将其当作“洗钱工具”、“投机工具”。而随着比特币、以太币等价格攀升,全球量化宽松政策加剧了通胀担忧,促使机构投资者寻求新的对冲工具,从2020年下半年开始,贝莱德、富达等投资巨头相继布局加密资产业务,以微策略为代表的传统企业同样开始配置比特币。

贝莱德首席执行官 Larry Fink对加密货币态度的180度转变也是大型投资机构普遍观点转变的一个缩影。此后这些机构开始积极推动比特币等加密资产主流化,经过多次申请和被驳回,美国SEC在2024年1月才正式允许包括贝莱德在内11家机构开展比特币现货ETF,拓宽了投资者参与加密货币市场的途径。稳定的长期资金有助于降低市场波动性,使加密货币市场逐步走向成熟。

其五,对加密货币的监管从重点关注投机、非法行为,发展成为探索建立多层次的监管框架。早期监管重点关注投机和非法行为,而后逐步发展成为更加全面和系统的监管框架,涵盖稳定币支付、反洗钱/反恐怖融资以及跨境交易等多个维度。这一演进过程中,各国对加密货币的监管态度和属性认定也随市场发展不断调整。

美国作为全球金融中心,其监管态度的转变具有代表性。2013至2016年间,金融犯罪执法网络(FinCEN)、国税局(IRS)和商品期货交易委员会(CFTC)相继出台监管规则,主要针对投机风险和违法行为。2017年ICO热潮推动美国证监会(SEC)将加密货币纳入证券监管范畴,由此开启了监管机构与加密货币市场的深入博弈。从比特币现货ETF的批准历程来看,SEC的立场经历了从最初的严格审查和多次拒绝,逐步向更开放和接纳态度的转变。

由此,可得到以下方面的启示:

首先,需要更系统地构建对加密货币体系的认识和研究。加密货币不仅涉及金融学、密码学、区块链技术等多个专业领域,还与支付、交易、投资等现代金融体系核心功能密切相关。这种多维度的复杂性,加上市场的快速发展,新概念层出不穷,导致难以形成清晰统一的认知框架。因此,厘清加密货币的基本概念和运行机制,构建系统性的研究框架,是开展有效监管的重要基础。

其次,需要将加密货币视作可能影响金融稳定的一个重要变量。随着加密货币市场规模的快速提升和与传统金融业务的加速融合,政策制定者需要像评估传统金融市场因素一样考虑其可能对金融稳定造成的影响。尤其是对于稳定币,美联储前主席伯南克将其视为一种由金融资产支持的银行货币,并警告称如果监管不足,稳定币可能面临缺乏足够资产支持的风险,这种情况类似于银行挤兑,甚至可能引发金融危机。

第三,越来越多的国家倾向于建立监管规则和立法来管理加密货币。根据普华永道2023年对35个主要国家和地区的调查报告,样本中约90%的国家和地区已经开始建立加密货币监管的体系,涵盖了监管框架、反洗钱/反恐融资、旅行规则、稳定币支付使用等多个方面。大多数国家都至少已建立反洗钱/反恐融资框架,这是当前加密货币监管的重点领域。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。