创新 PayFi 协议 PolyFlow 在近期成功举办了一场聚焦“美国稳定币法案” 的 Special Asia AMA。

在比特币突破历史新高11万美元的背景下,加密行业正加速融入传统金融体系,而美国稳定币法案(简称“GENIUS法案”)的推进,更是被视为全球金融体系变革的关键一步。

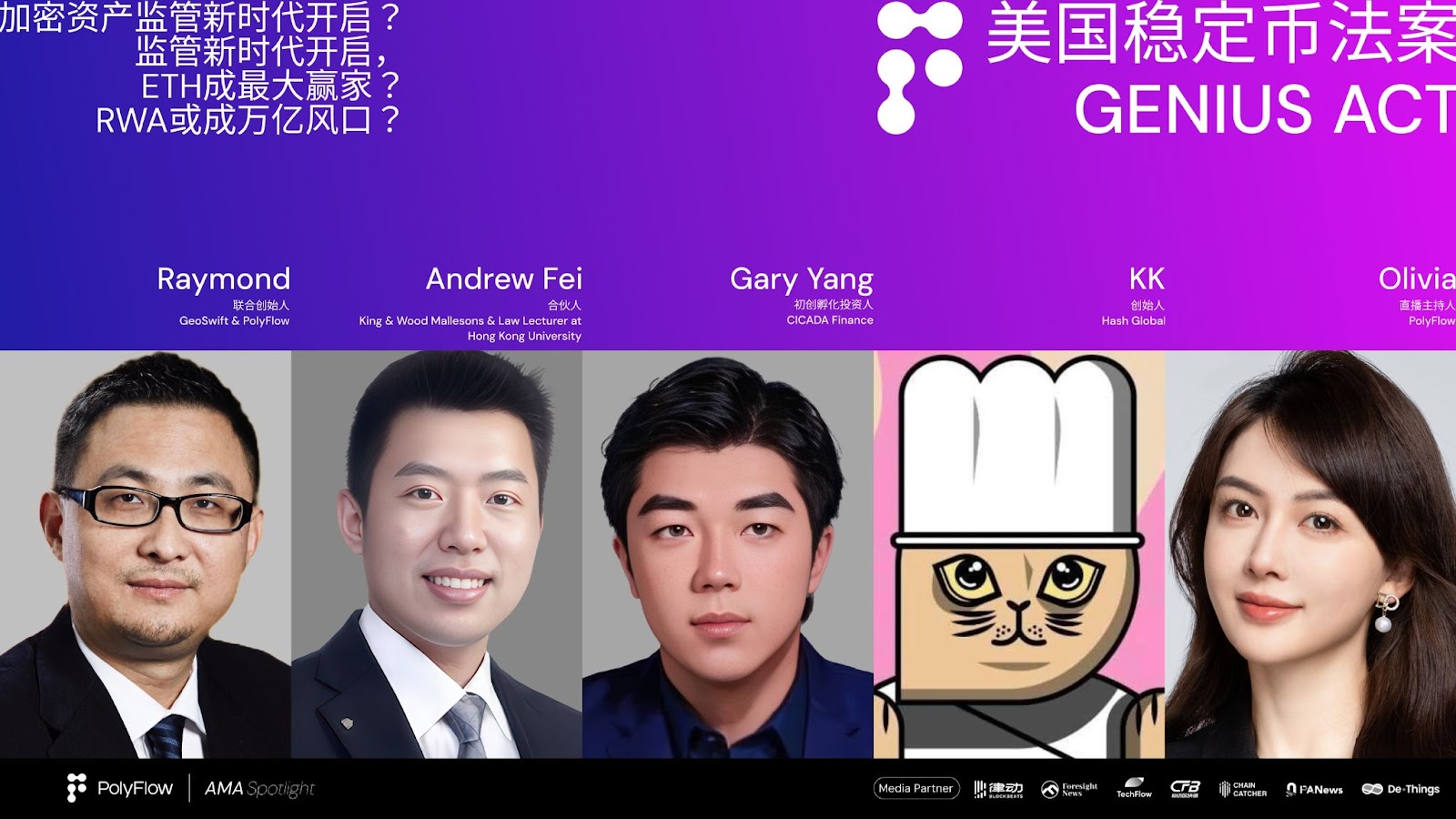

这场AMA汇聚了四位来自不同领域的行业先锋,共同探讨法案的深层影响与未来机遇。

Meet the Speakers:四位行业领航者

Raymond

跨境支付公司GeoSwift创始人、PolyFlow 联合创始人、加密行业早期信仰者。Raymond 早在2011年涉足比特币投资,也是 Ripple 的早期投资人,亲历加密市场从0到万亿规模的演变,深耕跨境支付与稳定币实践。

Andrew

香港金杜律师事务所合伙人、美国执业律师、香港大学法学院兼职教授,主要从事包括数字资产、结构性融资、银团贷款、金融监管、资本市场和资产证券化等法务事务,并并深度参与美国与亚洲金融政策研究。

Gary

CICADA Finance投资人、传统VC/PE转型加密的资深实践者。Gary 拥有15年投资经验,推动资产管理从传统模式向链上协议化转型,专注DeFi与RWA赛道。

KK

Hash Global创始人、加密领域早期投资人。聚焦稳定币与支付赛道,主导投资超80个Web3项目,推动技术与商业场景结合。

一、美国稳定币Genius法案简介

Andrew律师首先介绍了Genius法案的基本情况。

该法案旨在建立一个全面的美国法律和监管框架,以支持稳定币的发展和广泛应用。稳定币作为加密资产市场和传统金融市场之间的桥梁,具有稳定的价值和灵活性,并可按一对一比例兑换成法定货币。然而,由于其与传统金融体系的紧密关系,全球各国政府和监管机构都担心稳定币市场可能带来的负面影响。因此,该法案有望被纳入监管范围内,并在美国参议院的投票后,有望被送到美国总统那里签署成为法律。

Genius法案的关键要点

稳定币的定义与特性:Genius法案定义支付稳定币为价值锚定国家法定货币的数字资产,用于支付和结算。稳定币具有稳定的价值,适合作为Web3领域的支付工具,且是加密资产市场与传统金融市场的桥梁。其储备资产包括银行存款和政府债券等。

监管框架:法案建立了联邦和州双层监管框架。发行规模不超过100亿美元的发行主体可选择遵守州监管框架,其他发行人需遵守联邦监管制度。联邦层面的主要监管机构包括美联储、货币监理署和联邦存款保险公司。

牌照制度:法案确保稳定币发行人主动申请牌照,规定除持牌发行人外,其他人士不得在美国发行支付稳定币。数字资产服务提供商不得向美国人士提供或出售非持牌稳定币。符合条件的外国稳定币发行人可豁免,但需向美国政府登记。

会计与财务要求:美国本地持牌稳定币发行人发行的稳定币在会计上可被视为现金,可用于衍生品交易保证金和银行间结算。持牌发行人必须维持100%的合格储备资产,并每月公布储备资产规模和组成,经会计师审查。CEO和CFO需确认信息准确性。发行规模超过500亿美元的发行人需编制年度财务报告并审计。

合规与风险管理:法案对发行人提出业务活动限制、资本金流动性、风险管理、反洗钱和合规等要求,需遵守美国经济制裁、反洗钱、反恐怖主义融资和KYC等法律。所有稳定币发行人都需具备技术能力遵守美国政府的合法指令。

简单总结下来,Genius法案的提出,反映了美国政府对稳定币发展的重视和支持。通过建立全面的法律和监管框架,该法案旨在确保稳定币的稳定性和安全性,同时促进其在金融领域的广泛应用。这不仅有助于推动加密资产市场的发展,也为传统金融市场带来了新的机遇和挑战。随着法案的推进和实施,稳定币有望在全球金融体系中发挥更重要的作用。

二、稳定币的历史由来

Raymond 作为行业最早期的一批参与者,从历史的角度,回顾了稳定币产生的原因以及稳定币如何从早期发展至今。美国稳定币法案的核心价值在于增强市场信心,推动行业共识,这正是加密货币从无到有、快速发展的根本动力。

稳定币的发展历程

稳定币的发展历程可以分为几个阶段。2010年,有人首次用比特币购买披萨,标志着加密货币能够作为商品的价值尺度用于支付商品的对价,这一事件具有标志性意义。早在2013年,市场上已经出现了许多加密货币的支付方式,如当时加拿大温哥华出现了可以用比特币取现的ATM机,同年日本东京也有商家接受比特币支付。然而,比特币价格波动大,限制了其作为支付工具的使用,更多被视为投资工具。

为了解决这一问题,一些人开始尝试发行稳定币。稳定币1.0时代,出现了如USDT、USDC等与法币1:1锚定的稳定币。这些稳定币通过美元或其他等价资产进行抵押,以确保其稳定性。随后,稳定币2.0时代出现,人们开始尝试用比特币或以太坊等加密资产作为抵押发行稳定币。这一时期,抵押比率不再是1:1,而是1.2或1.15:1,以覆盖加密资产的价格波动。

进一步发展,出现了算法稳定币,如Luna和UST。这些稳定币通过自身发行的数字资产作为抵押,但这种模式存在风险,因为其底层逻辑脆弱,容易受到市场冲击。这些事件表明,稳定币的核心在于其锚定资产的稳定性。

美国稳定币法案的核心要点

美国稳定币法案的核心在于明确稳定币的定义和发行要求。法案规定,稳定币必须以法币1:1的比例发行,确保其稳定性。这一规定有助于澄清市场上对稳定币的误解,明确稳定币的定义。许多项目方曾试图以客户资金作为抵押发行稳定币,但这并不符合稳定币的真正定义。稳定币必须以自有资产作为抵押,而非客户资金。

从整个行业的角度来看,美国稳定币法案对整个行业的最大贡献在于增强了市场的信心和对未来发展的期望。这种信心的建立,源于越来越多的人对稳定币价值的共识。正如黄金因其被广泛认可的价值而成为有价物体,稳定币也因共识而逐渐被市场接受。这种共识推动了稳定币市场的快速增长,从几乎为零发展到如今的3万亿至4万亿美元规模。

三、稳定币政策驱动因素的多维剖析

Gary 从一个一线金融从业者的角度,亲临美国市场一线,给出了对于美元稳定币政策的本质剖析。

美元扩表,以增强美元全球影响力

美国此次稳定币政策的核心目标之一,是让各国基于美元资产和美债发行美元稳定币。这背后实则关联着一个大规模扩表的策略。与以往美联储直接发行货币扩表不同,此次是将铸币发行权赋予其他主体,这也就意味着美联储实质上放弃了一部分M2铸币发行权。那么,美国为何要做出这样的选择呢?其根本目的还是为了扩表,进而增强美元的全球影响力。

然而,这一举措也引发了诸多疑问。既然目的是扩表和提升影响力,为何又要放弃发行权,甚至可能随之失去的结算权呢?当下,SWIFT结算占比呈下降趋势,按理说美国应加强控制,可为何此时却进一步放开呢?比如,若日本金融厅发行了满足Genius法案基础需求的USDJ,在日本本国货币循环中既能满足市场需求,又能像稳定币那样超发、增发。美国通过此次法案,为其他国家发行稳定币留出空间,允许在国外发行并进一步推广,看似是放弃了铸币和结算的潜在权力。

美元控制力的式微与新趋势的冲击

美国在过去几年间,已然逐步丧失了对全球货币的掌控权,这是不争的事实。从2019年到2023年,美国超发货币高达40%,货币大幅贬值。为了收回超发部分,美国采取了提升利率、增加准备金率等多种手段,但收效甚微。全球多地开始脱离美国管制,构建自己的货币间结算系统,香港的M-bridge讨论日益频繁,便是例证。

过去5年,美元对全球的控制影响力快速下降,今年更是出现了美债危机、美元资产危机以及汇率危机。人们纷纷将目光转向瑞郎、新币和日元等货币。巴菲特在股东大会上被问及是否购买美元美债和美股资产时,虽鼓励大家购买,但自己却投资了900亿日债基金,这一举动无疑暗示了美元当前的风险。

造成美元控制力下降的原因主要有两条线索。其一,美国在过去20年,尤其是进入2019年之后,Covid 逐渐失控,2019年成了关键的触发点,导致美元全球控制力下滑。其二,新趋势的出现,美国已无法掌控。

过去4年,以crypto进行结算的比例大幅攀升。尼日利亚2.23亿人口中,超50%的人使用crypto结算,这些结算虽本质上是用USD,但与美国发行的美元无关,也不受FDIC等美国监管机构约束,这是一个不容忽视的趋势。目前,杰瑞、印度、巴西、班格拉大学等国家和地区在全球消费金融日常结算体系中的发展迅猛,呈现出指数级增长态势。

供应链金融领域同样如此。我曾投资的一家北美公司,流通市值达数百亿。2022年我建议其使用USDT结算,当时因违法不敢尝试,可到了2023年,其使用比例已达千分之五,2024年更是上升到5%。这表明,在中小微企业的贸易结算中,crypto结算比例迅速增大,而这些原本都是美国货币表外的资产。该公司预计,2025年基于自然增长,crypto结算比例将超过15%,这一趋势已然十分明显。

综合来看,无论是美元自身在传统金融体系中的问题,还是crypto发展引发的问题,都指向了一个事实:美元对全球的掌控力正在迅速下降。这也是Genius法案推出的背景基石,美国此时若不采取行动,美元影响力将持续下滑。

美国稳定币政策的深层逻辑与影响

今年,参议院大刀阔斧地推进这一政策,美国体制的灵活性和应变能力可见一斑。这看似是一种“将计就计,以退为进”的策略,美国实际上放弃了部分美元铸币权和结算权,将这一事务推向市场。政策推行后,美国金融机构只是起到“打样”作用,告诉日本、越南、中东等国家和地区,只要有美债美元资产,就可以1:1发行自己的美元稳定币。

美国虽不愿看到超发,但又不得不接受,因为这是扩表的基石。过去,美元基于黄金和储备以及美元信用,如今其他国家已进入以美元资产美债为基石的新阶段。此次政策的本质,是通过以退为进的方式,放弃美元绝对发行权,将美债换成黄金,让全球以此为锚定发行货币。

这是美国借鉴 Web3 Restaking 模式的经典做法。Restaking 模式的核心是将货币质押在某个资产上,衍生出影子货币并流通,围绕影子货币构建生态资产,crypto 过去两年的发展精髓就在于此,而美国政府和金融体系迅速学习并运用了这一精髓,有效解决了美元全球控制力下降的核心问题。

此次政策实施后,美国金融系统将经历一场“地震”。短期内,美元资产会剧烈波动,影响传统金融机构的资产发行和流通,但长期来看,将进一步推广美元价值。纽约金融界已炸锅,香港的证券机构也纷纷前往新加坡寻求合作机会,其中蕴含着众多新机会。

四、稳定币在金融领域的关键作用与市场影响

在了解了上述美国稳定币法案的介绍,背景以及驱动因素之后,我们一起来探讨Genius法案对后续市场的影响。

稳定币——法币美元的 RWA

Hash Global 的 KK,从一个投资人的视角来看本次稳定币法案,又会有什么不一样的见解呢?

在金融领域,稳定币是一个备受瞩目的显性赛道,大家期待已久。我们早在三年前就开始投资RWA交易所,与新加坡持牌机构沟通,但整个进程非常缓慢。我们一直认为,今年真正能在Web3市场脱颖而出的,主要是稳定币和货币市场基金。

稳定币之所以重要,是因为它被视为美元法币的Web3版本,其现实资产对应的就是美元。而货币市场基金则是链上资金真正需要的。稳定币法案的出台,我认为会加速进程,让链上的资金越来越多。只有链上有资金,才会有流动性,有了流动性,才会吸引优质资产上链。

年初,大家就预计美国和香港会相继通过稳定币法案。现在法案通过后,我们看到传统金融机构,包括全球最大的两个支付网络Visa和MasterCard,都在积极拥抱稳定币,以解决跨境支付和支付端的问题。他们也会将稳定币的力量用到实处。

我之前和一些朋友聊过,现在发行稳定币,有点像当初银行开始发行信用卡。每家银行都想做信用卡业务,因为它们可以在支付网络和结算网络中分得一杯羹,无论是作为发卡行还是收单机构。现在法规出台,大家都具备发行条件,既然能发,为什么不发呢?只要有场景、有用户,就能赚钱。这个过程会加速为Web3的链上金融世界带来资金。只有有了足够多的资金和各类机构,Web3市场才能真正发展起来。

稳定币传统金融体系的融合发展

同样,有着从事跨境支付行业20经验的 Raymond,也给我们带来了他看着 crypto 行业发展,或者说是稳定币, Web3支付逐渐走向主流的深刻观察。

在最近的多伦多Consensus大会上,我们明显感受到今年的会场与以往有很大不同,更多的人开始关注Web3支付赛道。这反映出支付领域已成为当前行业热点。作为从业人员,已经早已提前布局并与行业内人士进行了诸多有益的探讨。例如,我们在2022年作为传统支付公司,搭建了PolyFlow平台,积极参与开发Web3支付赛道。

过去,传统金融行业与Crypto行业之间存在明显矛盾和对立。传统金融对Crypto行业持保留态度,而Crypto行业从业者则追求自由,反感传统金融的严格监管。然而,随着行业不断发展,两者的互动和联系日益紧密,越来越多的市场需求促使双方坐下来探讨如何实现融合。

我们近期也在与行业巨头进行有益尝试。例如,前几个月我们与Ripple合作,探索在全球支付清算网络中实现瑞普的XRP、稳定币与各国法币之间的打通。像USDC的发行方,他们推出的CPN项目,从金融机构两个端点出发,探索如何从通过合规出入金搭建清算网络。同时,我们也看到各大交易所纷纷推出自己的支付工具,如OKX的Pay等。

在这一过程中,我们不仅要关注从业人员的努力,还要看到传统金融巨头如Visa等的积极参与。我们最近也与Visa签订了协议,探讨如何利用Visa通道实现跨境支付,并借助我们的全球支付网络。多年来加密行业所有的发展都指向一个核心问题:稳定币及区块链不仅仅是记账体系,更是实现资产有效转移的重要工具。

在合规合法的框架下,如何进一步推动这种有效转移,是我们所有从业人员正在努力的方向。我作为加拿大国家开发银行和中国人民银行的顾问,经常与监管部门和银行交流。我常问他们一个问题:是不是所有传统金融的资金都是干净的?答案显然是否定的。那么是不是所有外部流入的资金都是“脏钱”?答案同样是否定的。如果Crypto行业里流动的都是“脏钱”,这个行业不可能发展到今天,也不会吸引众多资产投资和聪明人加入。这说明行业满足了世界上很大一部分合法流动资产的痛点。

在这种思路下,我们再看美国和香港推出的稳定币法案,这些政策不仅增强了行业信心,还将促使大家开发更多真正解决实际问题的行业解决方案。这就是我的观点。

美国银行金融体系的巨大变革

Gary 对此看到的是一个巨大的机会,一个从传统金融到稳定币,再到加密金融的变革。

从本质上讲,传统金融系统在过去100多年的发展过程中制定了一系列规则,但有一些规则逐渐变得复杂且僵化,反而不利于金融的持续快速发展。而新兴的Crypto行业在过去16年中已经做了很多有益的探索,尤其是在支付和结算系统方面发展迅速。然而,由于缺乏有效规制,Crypto行业也出现了一些不合规甚至“不干净”的问题。

因此,当前的关键节点是通过合规法案来规范现行国家体系下的金融发展,结合灵活的金融资产,推动传统金融与新兴金融的融合。这不仅是必要的,而且已经逐渐成为行业发展的趋势。此次稳定币法案的推出,可以说是一个里程碑式的事件。这些变化超出了许多传统金融人士和新兴金融从业者的预期,过去一年的推进速度之快令人瞩目。

后续法案的实施,使得传统金融有机会与新兴金融接轨,银行和金融机构逐渐成为类似“公链”的存在,能够自主发行货币和基于货币的资产。这一转变实际上已经酝酿了很长时间,如今终于迎来了关键节点。从某种意义上讲,银行和金融机构在合规的基础上,开始搭建自己的资产和生息体系,将传统资产转移到区块链上,实现公开透明、可记录、可追溯的交易。这不仅是技术的进步,更是金融模式的重大变革。高盛、花旗等银行在过去5年中,为了确保记账的透明性和真实性,已经受到美联储和FDIC等监管机构的要求,采用区块链技术进行记录。

此次变化之后,银行与区块链生态的融合将更加紧密。银行自己发行稳定币,开发自己的资产和生态系统,这将极大地推动传统金融与新兴金融的联通。未来一个月内,美国金融系统下的各类资产管理机构和职能系统都将发生巨变,大家将迅速调整策略,看谁能在这场变革中脱颖而出。

除了香港颁布的稳定币法案和相关执行条例外,全球其他地区如日本、新加坡和迪拜也将迅速响应,出台类似的稳定币立法。谁能最快对接这些法案并整合自己的金融系统,谁就能在未来的竞争中占据优势。通过影子货币的方式快速激活生态系统,将带来巨大的历史机遇。因此,将这一变革称为“Genius”也不为过。

关于 PolyFlow

PolyFlow 是首个模块化 PayFi 基础设施,致力于连接现实资产(RWA)与去中心化金融(DeFi)。作为 PayFi 网络基础设施层,PolyFlow 将传统支付、加密支付与 DeFi 融为一体,去中心化处理真实支付场景。PolyFlow 提供打造 PayFi 场景所需的基础设施,确保合规、安全及现实资产无缝对接,助力构建新一代金融范式与行业标准。

了解更多:X|Telegram|Medium| DAPP| 官网

媒体联络:media@polyflow.tech

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。