作者:momo,ChainCatcher

Hyperliquid遭遇信任危机后,Perp DEX的战争再次打响了。

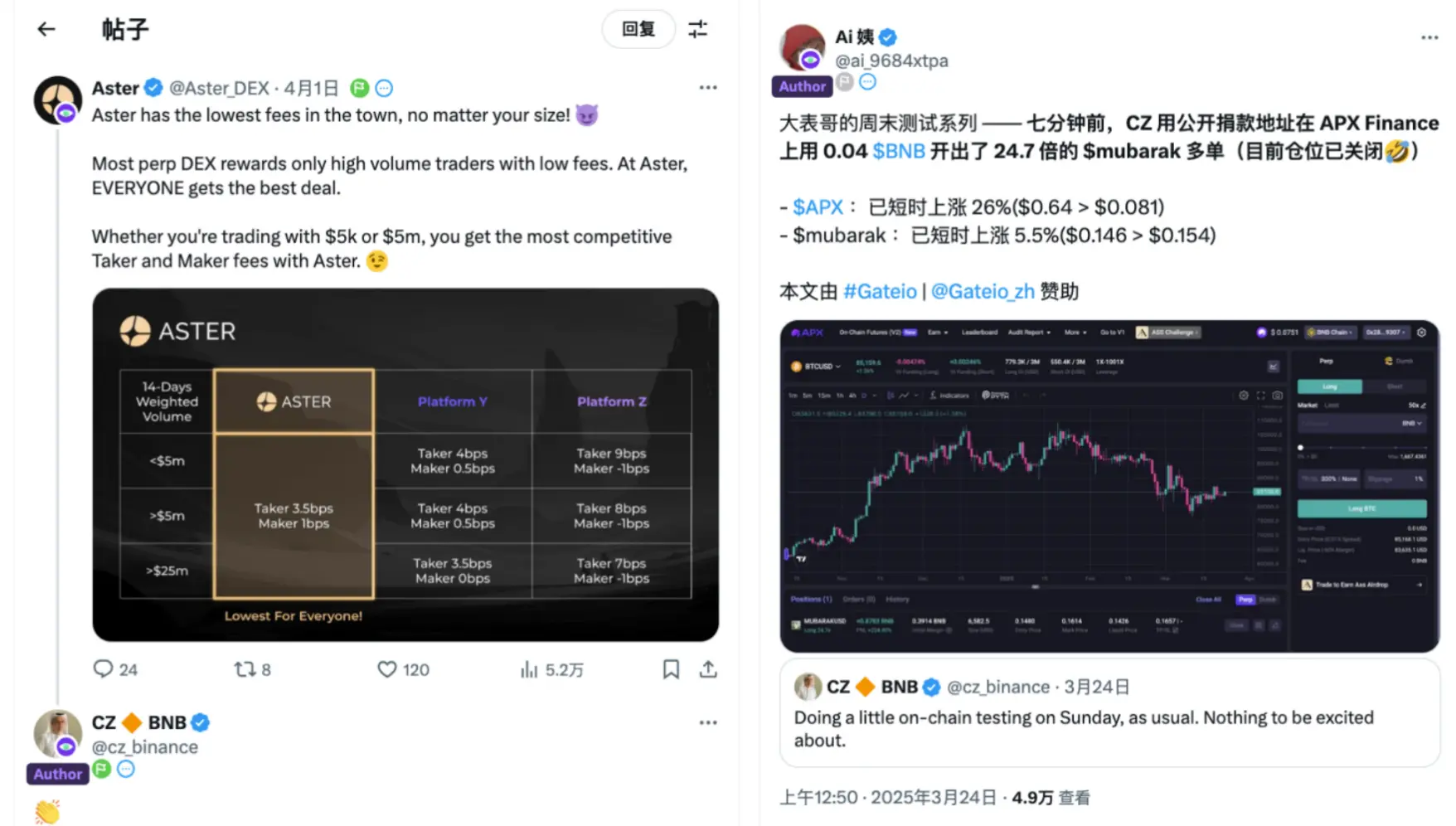

一些CEX也开始在明牌扶持自家生态的Perp DEX。近期,CZ就多次在推特上和Aster互动。

BNB Chain链上一直缺代表性的DEX,在Perp DEX混战之际,CZ顺势下场“奶”自己的“亲儿子”也是用意明显。Aster是YZi Labs(原Binance Labs)独家投资和孵化项目,也是BNB链上龙头Perp DEX。

Aster的前身是多资产流动性协议Astherus和老牌衍生品交易所APX Finance 。Astherus和APX Finance这两个项目不仅都获得了YZi Labs 的投资。Astherus还曾是YZi Labs第七季孵化项目。去年12月,Astherus与APX Finance宣布进行战略合并,并于近期将平台品牌名更名为Aster。

在Perp DEX热潮下,背靠币安这颗大树,Aster近日也发力明显。伴随着品牌更名,Aster整个产品定位和产品页面进行了大更新,并重启交易积分计划等激励计划,吸引用户参与使用。

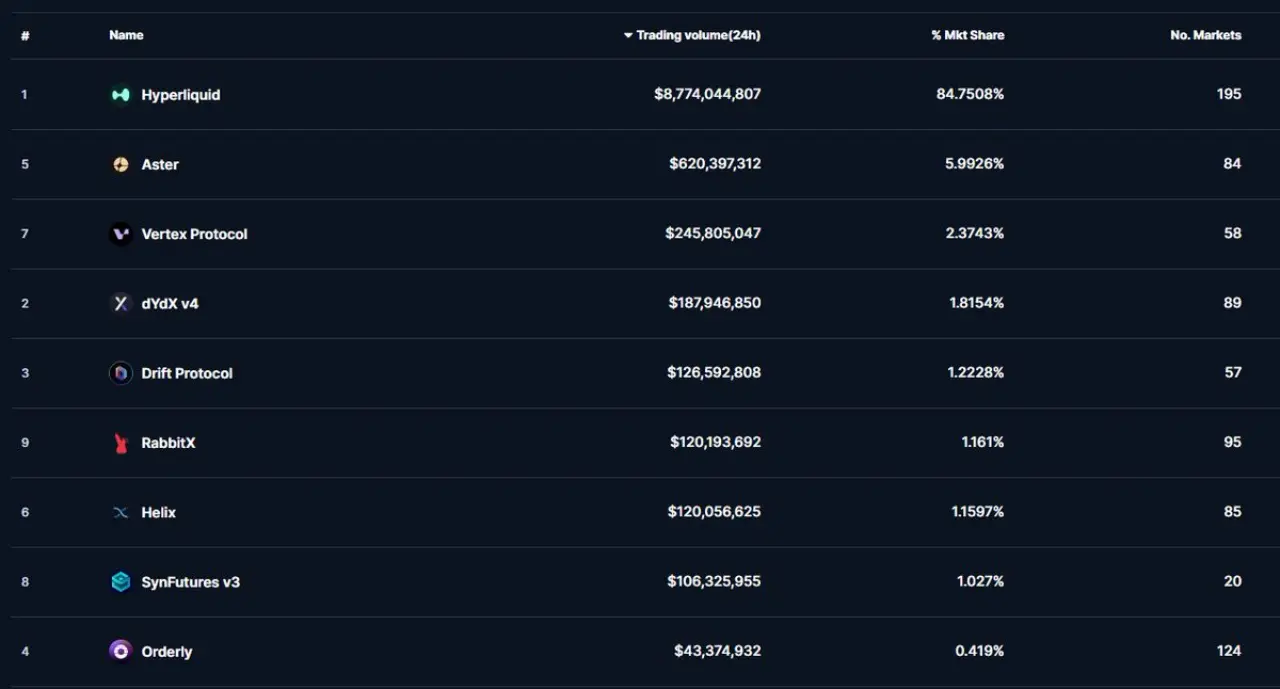

近日,Aster的Perp DEX排名一度攀升至第二,紧跟Hperliquid其后。

随着新老玩家涌入,Perp DEX赛道越来越热闹了,链上衍生品市场格局预计将被重塑。

品牌更名,Aster 转向 “Perp DEX”

Aster的前身Astherus和APX Finance最早都是BNB Chain上的明星项目。今年CZ在尝试链上DEX期间,就多次使用和点名这两个项目。

比如CZ发推提到使用了Astherus 的DEX,今年3月,链上分析师Ai姨还监测到,CZ在 APX Finance 使用 BNB 做多mubarak。

Astherus去年才成立,可以说是BNB Chain上的一匹黑马,去年7月入选了YZi Labs的第七季孵化计划,11月又拿到了YZi Labs的独家投资。Astherus上线仅半年TVL超 1.6亿美元,目前则达到了3亿美元,增长很快。

Astherus定位于一个多资产流动性中心,致力最大程度提高加密资产的实际收益。它推出了多个创新产品,如多元策略收益产品AstherusEarn和永续合约DEX AstherusEX。

在AstherusEarn上,用户可以质押BTC、BNB等主流资产赚取收益,还可以将获得LST资产在质押或用于衍生品交易赚取其它DeFi收益。

通过与CeFi机构合作,Astherus利用AI主动收益策略池从加密市场和传统金融领域获得收入,为用户带来可观的真实收益。

AstherusEX则不仅支持BTC等主流资产的衍生品交易,还支持LST(流动性质押代币)和LRT(流动性收益代币)等资产的质押和交易。

此外,Astherus的收益稳定币USDF也为用户开启了DeFi第二收益曲线。

而APX Finance更为老牌,曾是BNB Chain上最大的去中心化衍生品协议。它的业务主要是提供基于流动性提供者(LP)的链上永续合约交易,支持BNB Chain、Arbitrum、opBNB 和 Base多链网络。APX Finance 的特点是,可以为用户提供高达 1001 倍的杠杆、零滑点和较低的费用。

除了获得YZi Labs,APX Finance 与 Binance Web3 Wallet 也多次合作。

基于对去中心化衍生品市场的看好,Astherus 和APX Finance宣布合并成为Aster后,业务重心也大调整,转向了Perp DEX。

产品升级,双模式重塑 Perp DEX

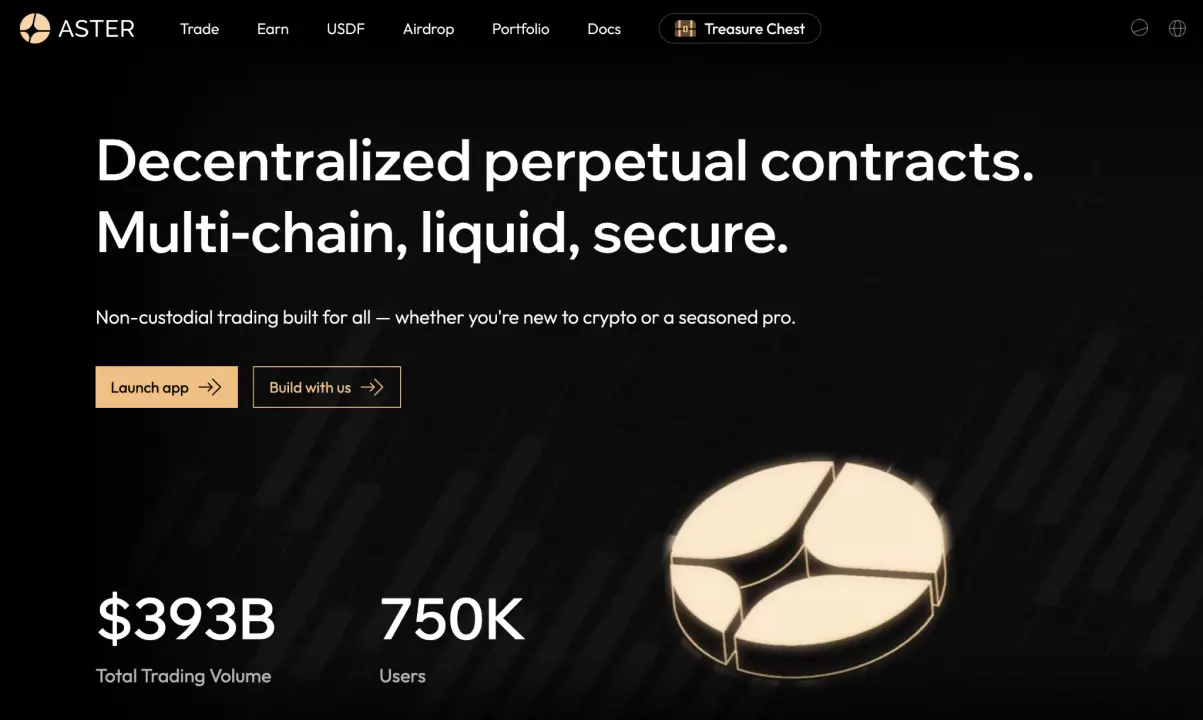

从最新的官网来看,Aster整个UI/UX进行了大更新。Aster定位于多链的、高流动性的且安全的去中心化的永续合约。

Aster已部署在BNB Chain、Arbitrum、Solana、Ehereum等多家主流公链上。

而从功能上来看,用于永续合约交易的“Trade”功能为首推。此外,Aster还是保留了质押多元收益产品“Earn”和收益性稳定币USDF。

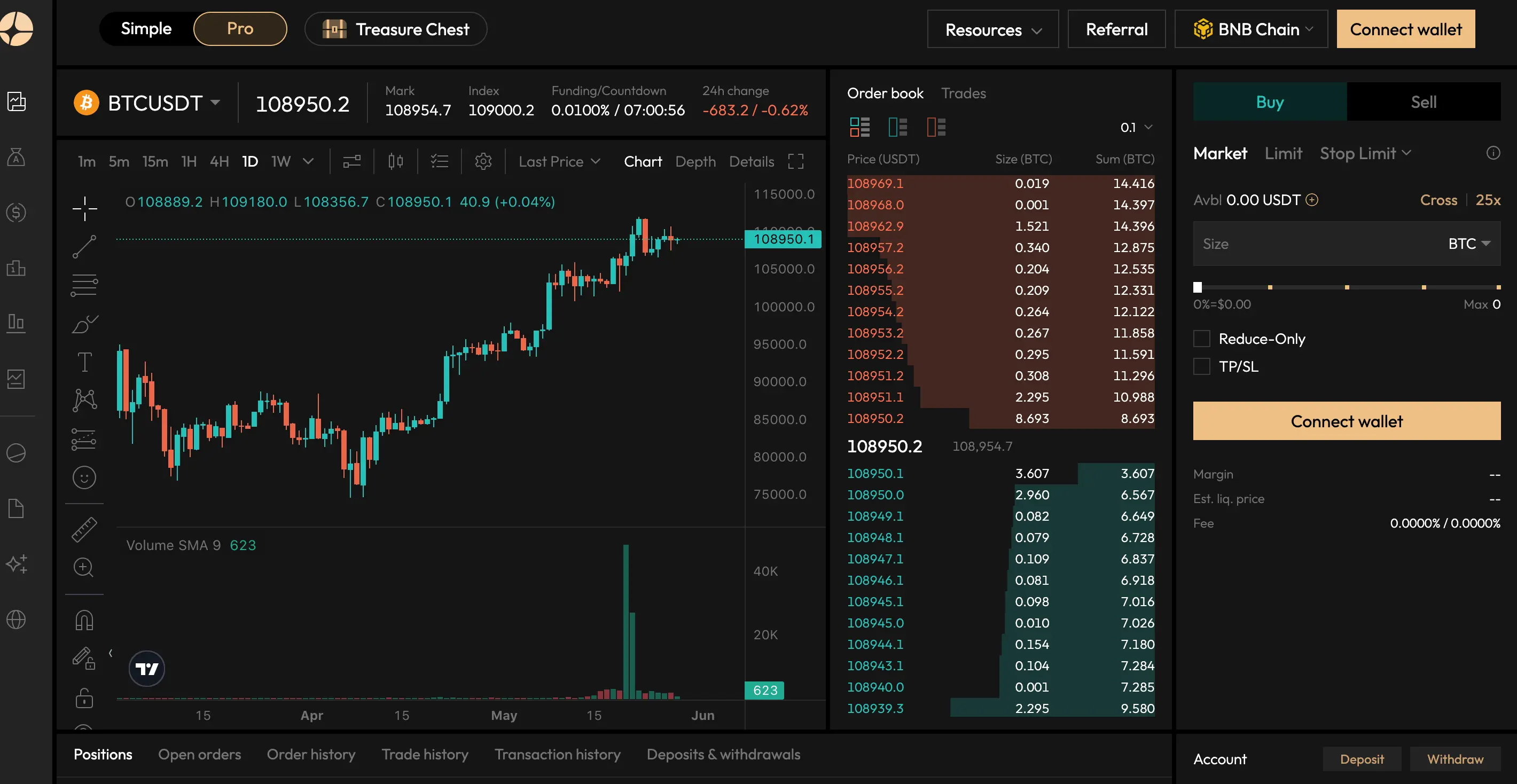

在合约上,Aster引入Simple与Pro两种交易模式:

Simple模式适合新手,简单易上手。该模式依托ALP资金池保障流动性,支持主流资产及热门Meme币的超40个交易对;最高1001x杠杆可实现零滑点开仓、免开仓费。同时,Simple模式中推出了更简易的猜涨跌产品“dumb”,进一步降低了交易门槛。

Pro模式则面向进阶的交易者。它采用订单簿机制,支持网格交易等更多专业的交易功能。用户可在 BNB Chain、Arbitrum等多条链上享受深度流动性与超低手续费(maker 0.01% / taker 0.035%)。该模式不仅提供了低成本且快速的交易体验,并确保用户资金自主管理与无需KYC。

双模式设计既保留了去中心化交易的自主性优势,又通过差异化功能设置,为各类用户提供了更精准的交易体验。

Aster表示,其目标是打造一个兼具深度流动性、低手续费与丝滑交易体验的专业合约平台,挑战甚至超越Hyperliquid的地位。

要赶超 Hyperliquid,Aster 凭什么?

Hyperliquid作为这轮周期的黑马,虽然遭遇了信任危机,但仍然具备不可轻视的实力。Aster想要赶超Hyperliquid ,有可能吗?

先从Perp DEX整个赛道的空间潜力看,在这轮周期中,Hyperliquid的确为Perp DEX赛道带来了更多市场关注,但Perp DEX的整体升温,也源自市场的需求。

相比于中心化交易所,Perp DEX有更好的上币效应。此外随着Layer2和多链生态的发展,Perp DEX在交易速度和用户体验上有了显著提升。

CoinGecko报告显示,2024年十大去中心化永续合约交易所的总交易量达到了1.5万亿美元,是2023年总量的两倍以上。

不过,尽管去中心化永续合约升温明显,但仍处在发展早期。2024年十大去中心化永续合约交易所的总交易量,仅为十大中心化永续合约交易所的总交易量的2%,这意味着Perp DEX渗透率还较低,有庞大的增长空间。

去中心化衍生品市场格局未定,新老玩家们还需要从产品性能、体验、社区等多个维度创新和优化来获取用户心智。

从产品层面来看,Aster又有何优势?

一是全网最低手续费。Aster的Taker费率仅为0.03%,Maker费率低至0.01%,低于Hyperliquid调整后的0.045%Taker费率(2025年4月30日起)。此外,Aster推出VIP等级机制,交易量越大,手续费越低,为高频和大额交易者提供显著的成本优势。低费率成为吸引用户的关键竞争力,尤其在高频交易场景下,成本节约尤为明显。

二是深度流动性。Aster与币安等顶级中心化交易所的做市商合作,构建了强大的流动性池,其买卖价差已接近币安水平。

三是产品多元化。Aster的Simple和Pro模式覆盖新手与专业交易者,满足了不同用户的多元需求。

此外,Aster的Perp DEX一开始就拥有流动性和用户基础。Aster 合并前的收益型产品积累了近3.5亿美元的流动性。

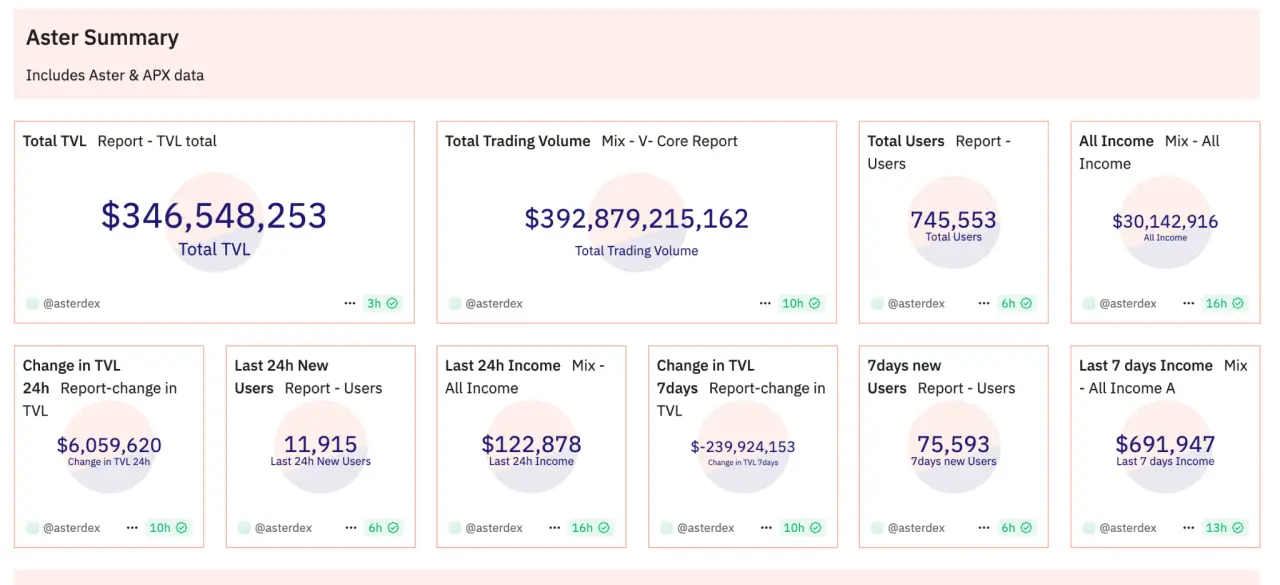

近日,Aster的Perp DEX也有爆发之势。据Defillama数据,Aster排名基本稳定在前五,一度攀升至第二名,紧跟Hyperliquid其后。据Dune面板统计,Aster总交易量即将突破4000亿美元,总用户数约75万,每日交易用户近1.2万,其平台的交易活跃度在持续攀升。

而从长期来看,Aster也在拓展生态产品、产品体验等层面应对竞争。从路线图上来看,它即将推出专用的Layer1,区块链浏览器、手机app等提升用户体验和去中心化程度,吸引更多合约用户。

在生态层面,Aster预计会享受到BNB Chain生态扶持红利。Hyperliquid的崛起后,各家公链尤其是CEX公链都也会扶持其自家生态的DEX来抗衡。

Solana生态有Raydium、Jupiter等多个现象级DEX,而BNB Chain似乎缺少一个类似量级的选手。Perp DEX 升温后,BNB Chain扶持自家投资的Aster,也是顺理成章。

在空投预期下,用户有哪些参与机会?

Perp DEX热潮下,Aster作为YZi Labs投资的代表选手,也是撸毛党们近期参与的热门项目。

Aster最近重启的交易积分计划,或预示着TGE在即。

从官方文档来看,用户激励机制目前处于Stage 1:Spectra 阶段。其积分体系分为Au 积分和Rh积分两类,积分可作为未来获得AST 空投的分配凭证。

获取Au积分上,用户通过铸造并持有Aster Earn相关资产(如 ALP、USDF、LP Token)获得。

而获取Rh 积分,用户主要是通过使用Aster Pro模式交易永续合约获得:

- 通过在Pro模式交易获得Rh 积分,可用于兑换未来的 $AST空投奖励,为活跃的平台支持者和交易者提供持续激励。

- 用户邀请好友并组建战队,可共同享受最高 1.2 倍Rh Points 加成。

- 平台最近每2周都有推出5万美金的交易活动奖励用户,在积分的基础上,额外给交易的奖金。

对于早期参与者,Aster也通过调整交易费率和返佣计划等给予支持。如Aster近期推出的VIP等级计划,用户交易量越大,预计费率越低;而即将推出的邀请返佣阶梯计划,同样是被推荐人交易量越大,推荐人返佣比例越高。

结语

总的来说,Aster作为Binance生态的一部分,具有强大的生态支持和较低的手续费等优势,有望在去中心化永续合约市场中占据一席之地。然而,要取代Hyperliquid,Aster需要在品牌认知度、技术成熟度和市场接受度等方面持续发力。

随着Perp DEX市场的不断升温,竞争将愈发激烈,Aster和Hyperliquid的竞争也将推动整个行业的发展。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。