Users are no longer satisfied with simple trading; instead, they seek to quickly capture on-chain trends and opportunities under the premise of safety and convenience.

Author: Nancy, PANews

On-chain is becoming a new battleground for traffic in CEX (Centralized Exchanges). Recently, innovative plays such as Binance Alpha and Bitget's on-chain trading have not only provided the public with convenient and efficient on-chain trading paths but have also pioneered a new paradigm for airdrop mechanisms, greatly stimulating market participation enthusiasm.

In fact, as infrastructure continues to improve, product ecosystems become increasingly rich, and on-chain assets experience explosive growth, on-chain trading is gradually becoming mainstream in the market. Especially with emerging narratives represented by MEME and AI Agents, which attract a large influx of new users into the on-chain world due to their wealth creation effects and strong community drive.

In this market trend, CEXs, including Bitget, have keenly captured the potential of the on-chain economy, attempting to bridge the gap between CeFi and DeFi with more user-friendly product forms. In addition to supporting users to trade on-chain assets directly on the CEX interface, Bitget is also injecting more liquidity into the on-chain economy through a series of innovative products and mechanisms, aiming to establish itself as a key hub connecting on-chain and off-chain, thereby consolidating its core market competitiveness.

CEXs Compete for On-Chain Heights: How Does Bitget Turn Interaction Barriers into Traffic Channels?

As more users and assets flood into the on-chain world, this area, once exclusive to geeks and early players, is rapidly becoming lively and complex. A diverse group of players, including airdrop hunters, DeFi farmers, MEME hunters, and stablecoin investors, collectively form an increasingly diverse ecosystem. They drive the continuous expansion of asset scales and promote the iterative development of on-chain infrastructure—such as smarter wallets, more efficient cross-chain bridges, more accurate oracles, and faster, cheaper Layer 2 solutions.

However, in this seemingly prosperous on-chain world, an undeniable reality is gradually emerging: the threshold for on-chain interaction remains high. Complex operational processes, information asymmetry, cumbersome Gas fee mechanisms, fragmented cross-chain experiences, and pervasive security risks all create "invisible walls" that block countless potential users. This is not only a technical issue but also a gap in user experience. How to achieve more efficient on-chain interaction while ensuring user safety and lowering operational thresholds has become a core proposition for the new round of Web3 innovation expansion.

At the same time, the on-chain world is moving towards a new stage of "high-density interaction," and CeFi is facing continuous impacts from the on-chain ecosystem. Users are no longer satisfied with simple trading; they seek to quickly capture on-chain trends and opportunities under the premise of safety and convenience, especially with the rise of the MEME craze.

Bitget's on-chain trading is becoming a new entry point for redefining the on-chain experience and a new lever for exchanges to enhance platform liquidity and attract market attention.

In the ongoing prosperity of the on-chain ecosystem, the wealth effect is becoming one of the key driving forces attracting users. Bitget's on-chain trading, with its high-frequency listing rhythm and quality asset screening capabilities, is rapidly building its unique advantages in the early project discovery and value capture fields.

According to Bitget's first publicly announced listing strategy, the listing process for its on-chain trading follows a three-step strategy of "intelligent capture and preliminary review + manual re-examination + online execution" (as shown in the figure below), emphasizing efficiency, safety, and trend balance. This not only helps the platform gain a first-mover advantage in the fiercely competitive on-chain ecosystem but also filters more reliable potential assets for users.

Since its launch on April 7, Bitget's on-chain trading has listed over 120 tokens in less than two months. In terms of type, it mainly features popular assets such as MEME and AI, aligning with the current focus and preferences of on-chain users. In terms of listing frequency, it averages at least two tokens listed per day, demonstrating its high sensitivity to market hotspots and rapid responsiveness to user needs.

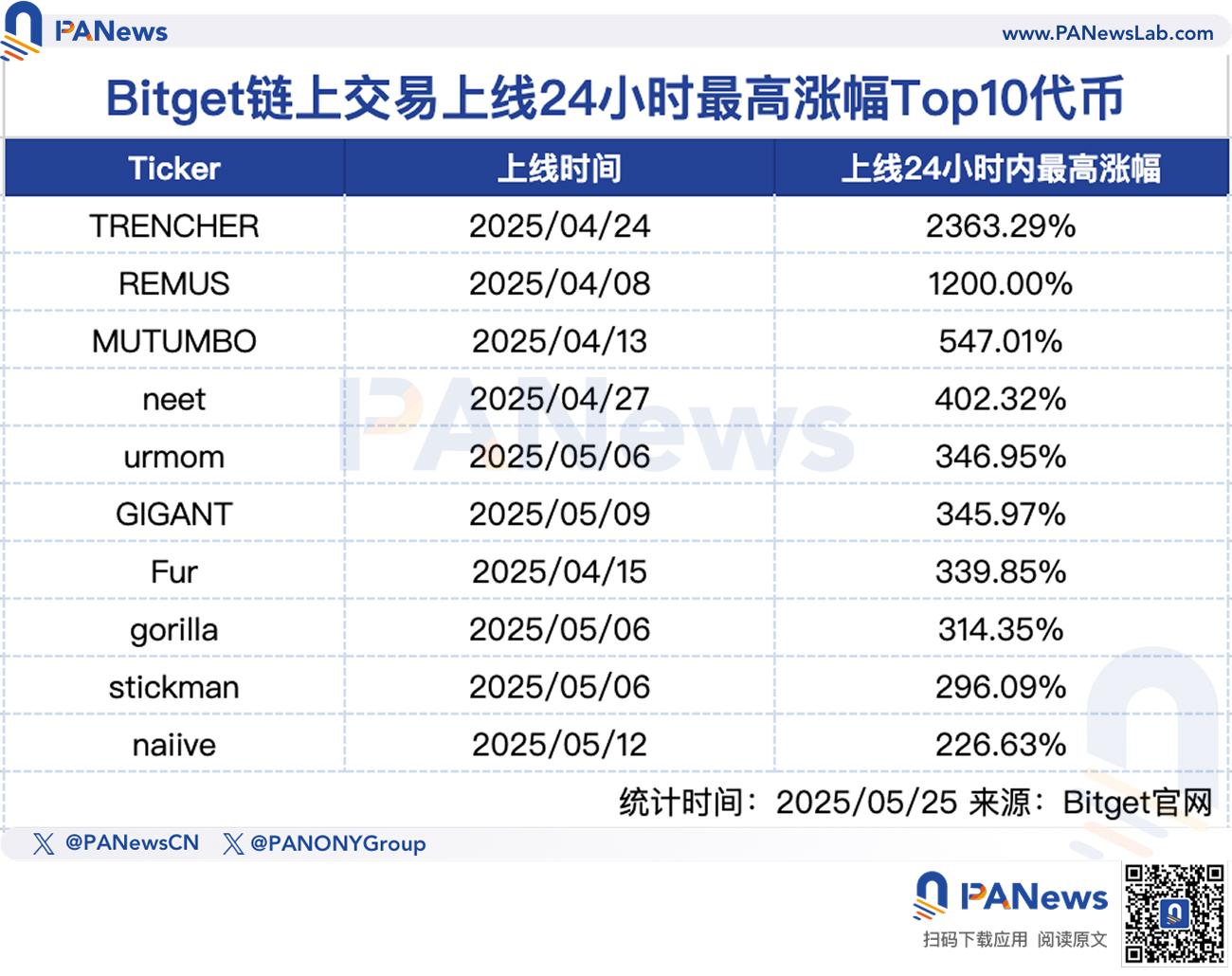

More intriguingly, several projects have shown highly attractive investment returns. According to PANews statistics, the top ten tokens with the highest price increases within 24 hours of being listed on Bitget's on-chain trading had an overall average increase of 638.25%, reflecting its strong market performance and capital attraction. Among them, TRENCHER, MUTUMBO, and REMUS achieved astonishing returns of several times or even dozens of times. These tokens are mostly early assets that have not yet landed on mainstream exchanges like Binance, further confirming Bitget's foresight and independent judgment in capturing early quality assets. From a time distribution perspective, Bitget's on-chain trading continues to produce "dark horse" projects, effectively attracting market attention and strengthening its brand influence in early asset discovery.

Moreover, the value of Bitget's on-chain trading is not only reflected in the early listings but also in its continuous empowerment of quality assets. So far, eight projects listed on Bitget's on-chain trading have been included in Binance Alpha, which not only reflects a time advantage but also showcases the platform's capabilities in project judgment, trend capture, and resource integration.

For example, Bitget's on-chain trading preemptively listed tokens such as FHE, gork, and AIOT, which were subsequently included in Binance Alpha, demonstrating its rapid capture of market trends and first-mover advantage, with an average maximum increase of 526% effectively broadening the platform's market exposure window. Additionally, the three major projects TROLL, gorilla, B2, and BANK achieved simultaneous coverage with Binance Alpha on the day of their listing, reflecting not only a coincidence of market sentiment and hotspots but also the efficient collaborative system established by Bitget between project screening mechanisms, listing rhythm control, and cutting-edge research trends. Furthermore, in terms of user experience, compared to Binance Alpha, Bitget's on-chain trading adopts a gas-free mechanism, significantly reducing users' operational costs while enhancing the trading experience, thereby stimulating user activity and forming a positive trading cycle.

The introduction of a points system has also become an important tool for exchanges to significantly enhance platform user stickiness, market activity, and resource dominance. From the perspective of Bitget's on-chain trading points system, it cleverly balances the earnings of ordinary users and high-frequency traders through low-threshold participation and a dual reward mechanism, taking into account fairness and incentives, providing diverse reward paths for both novice and experienced traders, showcasing efficient user incentives and platform growth strategies. Since its launch, Bitget has held two rounds of on-chain points challenges, each distributing 50,000 platform tokens (BGB) as airdrop rewards.

In summary, as on-chain interactions move towards a new stage of high density and high frequency, users' expectations for trading platforms have long surpassed the "tool" level, shifting towards a comprehensive consideration of experience, efficiency, and value capture capabilities. Bitget's on-chain trading not only builds a capture advantage for early quality assets through high-frequency listings and forward-looking screening but also breaks down "on-chain walls" through gas-free and points incentive mechanisms, significantly optimizing user experience and stimulating user activity.

Six Core Functions Restructuring On-Chain Trading Experience, Enjoying CEX-like Smoothness

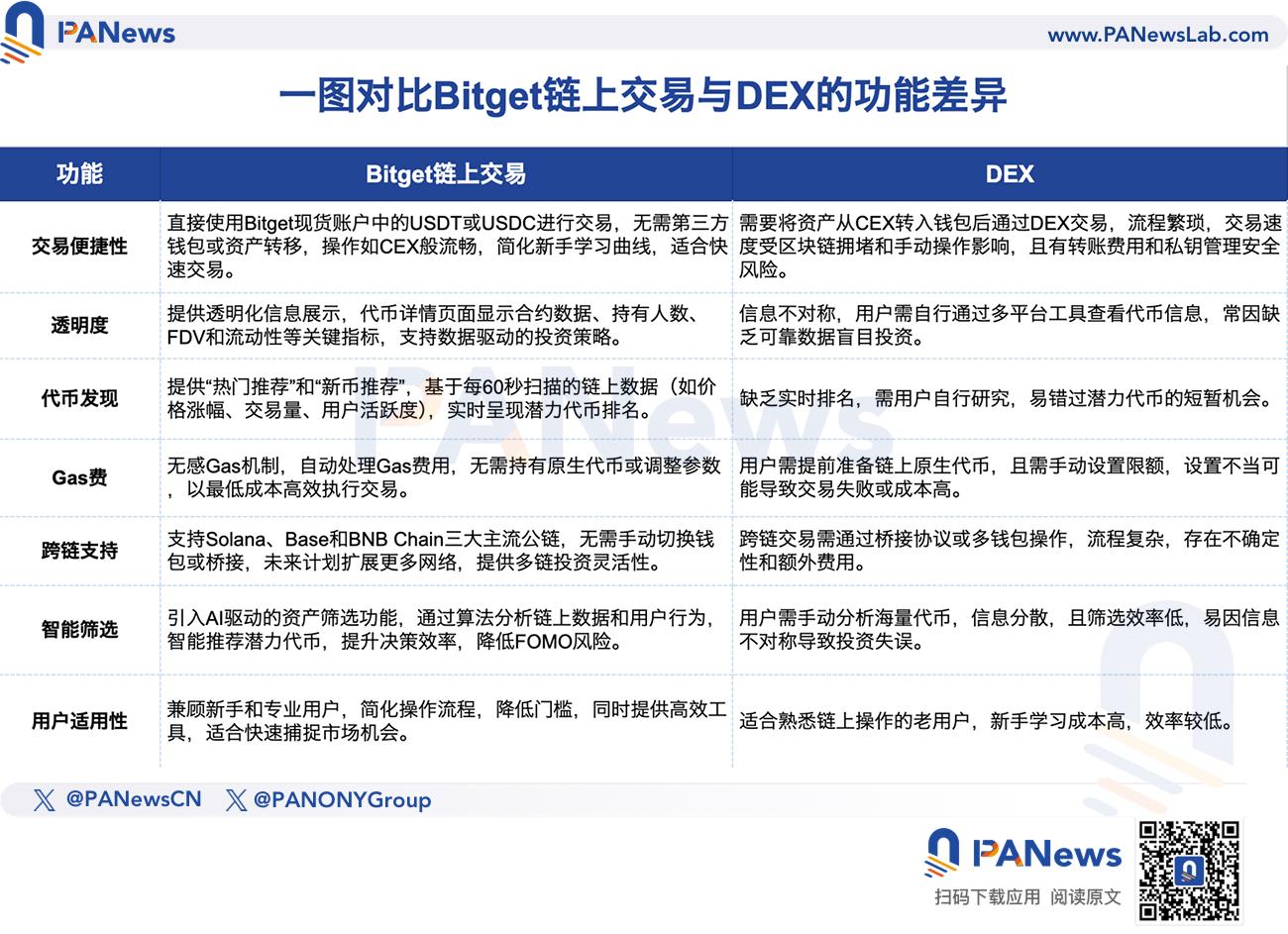

As a secret weapon bridging the gap between CeFi and the on-chain world, Bitget's on-chain trading is a one-stop tool that not only redefines the on-chain trading experience but also allows users to avoid repeatedly switching between CeFi and DeFi without bearing cumbersome processes and high learning costs.

Bitget's on-chain trading redefines the on-chain trading experience through six main core functions:

Instant On-Chain Trading: Users can directly use USDT or USDC in their spot accounts for on-chain asset trading without the need for wallet creation or private key management. This feature greatly reduces the learning curve for beginners while allowing professional users to quickly seize market opportunities.

Complete Transparency: By transparently displaying key indicators such as contract data, number of holders, FDV, and liquidity, it helps users establish data-driven investment strategies.

Real-Time Token Ranking: Through the "Hot Recommendations" and "New Token Recommendations" features, it presents users with the most promising token rankings based on real-time (scanning the blockchain every 60 seconds) on-chain data (such as price increases, trading volume, and user activity).

AI-Driven Screening Function: Introducing an AI-driven asset screening function that uses advanced algorithms to analyze massive on-chain data and user behavior models to intelligently screen potential tokens, aiding in the efficient discovery of quality assets, improving decision-making efficiency, and reducing emotional investment risks.

Cross-Chain Support: Supporting three major public chains—Solana, Base, and BNB Chain—users can capture multi-chain opportunities in one place without manual switching or bridging, with plans to expand to more networks in the future.

Gas-Free Mechanism: Automatically handling gas fees, users do not need to worry about configurations, allowing for efficient and low-cost transaction execution.

From asset discovery to transaction execution, from chain selection to fee settlement, Bitget's on-chain trading consistently focuses on user experience in its product logic. It not only meets the needs of speed and efficiency for on-chain veterans but is also particularly suitable for newcomers, allowing them to easily, efficiently, and safely navigate the on-chain ecosystem. By lowering usage thresholds and enhancing transaction convenience, Bitget's on-chain trading is injecting new users and liquidity into the on-chain ecosystem, helping to promote the popularization and prosperity of the entire on-chain world.

From Incentive Tools to Ecological Binding, Bitget Accelerates On-Chain Layout

"2025 will be a key year for CEXs to delve into DeFi. However, for many novice users, DeFi is still too complex, especially for those who have just purchased their first cryptocurrency on a mobile app. In this process, CEXs will become the gateway to the crypto world, serving millions of users. CEXs will not disappear; they will adapt to changes, and DeFi will become a core part of their adoption. Bitget is already moving in this direction, transforming from a centralized exchange into a comprehensive Web3 platform," Bitget CEO Gracy Chen has repeatedly emphasized in public that Web3 is one of Bitget's key business layout directions.

In addition to bridging on-chain trading channels, against the backdrop of the accelerating evolution of the on-chain world, Bitget is also building a panoramic ecosystem covering both CeFi and DeFi through a series of strategic product and mechanism upgrades. Prior to this, Bitget acquired and launched multi-chain wallet Bitget Wallet and on-chain earning products, as well as expanded the on-chain application scenarios of its platform token BGB, broadening users' paths to participate in the on-chain world and continuously deepening its on-chain ecosystem layout.

Among them, it is essential to mention the key upgrade to Bitget's platform token BGB's burn mechanism this year. This change not only injects more on-chain imagination into BGB itself but also signifies the evolutionary direction of the deflationary logic of platform tokens. In April of this year, Bitget announced that to enhance the compliance and transparency of the BGB and its burn plan, as well as to better empower the BGB ecosystem, extending its application scope from off-chain to on-chain and from the crypto field to real-world scenarios, the quarterly burn quantity of BGB will be linked to "on-chain Gas fees" based on a foundation of 30 million BGB. This new burn mechanism is based on the actual usage scenarios of BGB. This mechanism means that BGB is no longer just a platform incentive tool but a deflationary asset with real on-chain usage value, and its burn scale will directly reflect the actual usage of BGB in the on-chain ecosystem.

In fact, platform tokens are collectively entering the "post-value management era," where the competition is not just about whether to burn but about whether a sustainable, resilient deflationary mechanism and strong market influence can be constructed. The application of BGB is no longer limited to basic platform scenarios such as trading fee discounts, wealth management, and new listings, as well as real-world payments. This dynamic deflation, which links on-chain usage behavior with the burn mechanism, will further enhance its presence on-chain, thereby increasing the practicality and intrinsic demand for BGB, opening up new narrative space for its long-term value, and gradually becoming a "pass" and "value hub" connecting CeFi and the on-chain ecosystem.

It is foreseeable that the deep integration of platform tokens into the on-chain ecosystem is becoming a major trend. In fact, on-chain trading has inherent advantages such as openness and transparency, but it also faces challenges such as high technical thresholds, significant security risks, and unstable trading efficiency. CEXs, with their user base, liquidity advantages, and mature infrastructure, can improve the depth and price stability of on-chain trading, lower the usage threshold for users, while attracting traditional users into the Web3 ecosystem and providing exposure opportunities and liquidity support for on-chain projects, ultimately achieving interconnectivity between CeFi and DeFi in terms of liquidity and users.

Standing at the turning point of Web3 popularization, Bitget is user-centered, and by bridging the product loop between on-chain and off-chain, it not only innovates the trading experience but also constructs a sustainable growth logic for the on-chain value system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。