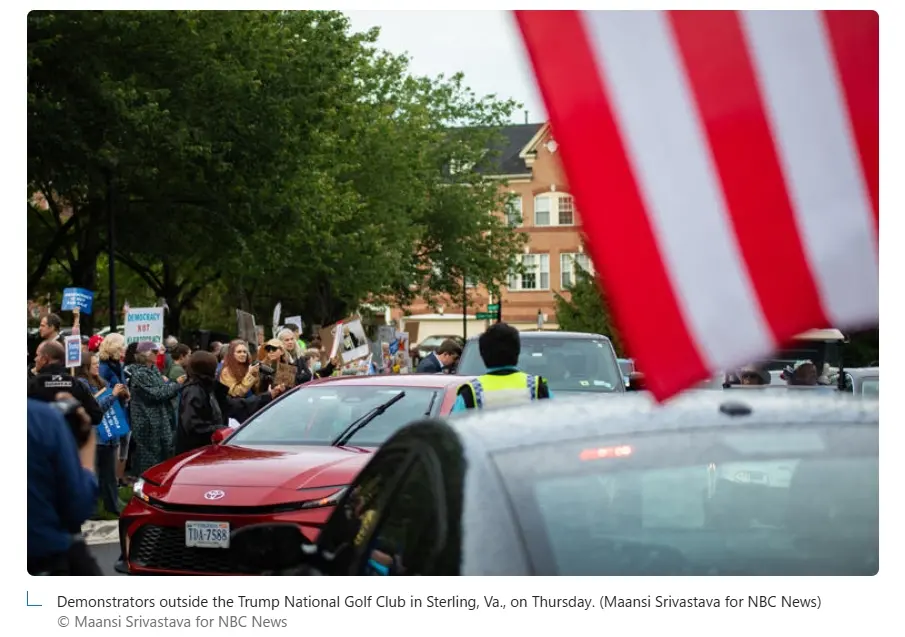

On May 22, 2025, outside the Trump National Golf Club in Sterling, Virginia, protesters held up signs reading "Crypto Corruption," while inside, 220 "whales" holding millions of dollars worth of Trump tokens (TRUMP) awaited dinner with the former president. At the same time, the price of the TRUMP token experienced an absurd rollercoaster: at 5 PM Beijing time on the 22nd, the price violently surged from $14 to $16, only to drop back to $14 by 4 AM on the 23rd, before the dinner had even started. Behind this farce, an ultimate game regarding "market signals" and "real events" was unfolding—does fact change the market, or does the market fabricate facts?

1. Trump Dinner: A Perfect Experiment of "Expectation Overdraft"

1.1. The "FOMO Frenzy" on the Eve of the Dinner

According to on-chain data, within 48 hours of the dinner announcement, the trading volume of the TRUMP token surged by 300%, with the 220 "whales" having an average holding cost of $1.78 million, while the token price once skyrocketed by 50%. Ironically, by the time the dinner officially began on the evening of the 22nd (U.S. time), the price had already retreated— the market had already completed its harvest in the "expectation narrative."

Key Logic Chain

Signal propagation > Fact occurrence: The price peak occurred during the news diffusion period (May 22, Beijing time), rather than at the time of the event (evening of May 22, U.S. time).

Liquidity trap: Although the daily trading volume of TRUMP exceeded $3.8 billion, the spot depth was less than $5 million, allowing the market maker to control the market with just $20 million.

1.2. The "Self-Fulfilling Prophecy" of Political Narrative

The Trump team tied token holdings to political resources (such as White House tour rights), essentially securitizing "social capital." This model relies on continuous hot topic stimulation; once the narrative stagnates, the price collapses—just as the TRUMP token fell again after Democratic lawmakers proposed to ban "crypto corruption" on May 23.

2. Do You Still Remember the ETF Approval: The "Information Arbitrage War" Behind the SEC Website Crash

The 2024 ETF frenzy: Delays, congestion, and expectation gaps: When the SEC website briefly crashed due to ETF approval news, the market had already priced in the information 24 hours in advance through "internal leaks," allowing institutions to sell off on the good news.

Market Rules

Buy expectations, sell facts: When the probability of ETF approval rose to 90%, the price increase had already overdrafted 80%.

Excessive profits from information asymmetry: Bloomberg analysts predicted approval progress through regulatory documents, while retail investors were stuck in a "FOMO chasing - panic selling" cycle.

3. The "Narrative Economics" of the Crypto Market: Who is Creating Signals?

3.1. The "Trinity" of Market Makers, Media, and Algorithms

Market maker control: 80% of TRUMP token chips are controlled by the Trump camp, allowing for precise creation of selling pressure during unlocking events.

Media amplifiers: "Breaking news" from institutions like Cointelegraph and Bloomberg often become tools for price manipulation, such as panic triggered by "SEC delays ETF approval."

Algorithmic resonance: Social platforms amplify FOMO sentiment through recommendation algorithms, forming a "self-reinforcing trend."

3.2. The Shift from "Fact-Driven" to "Signal-Driven"

When market fluctuations no longer rely on tangible progress but rather on "pricing possibilities," signals become facts. For example:

Trump's tweet: A single statement like "America will become the crypto capital" can cause SOL to rise by 70% in a day.

Conclusion: The "Truman Show" of the Crypto Market

In this virtual theater constructed by expectations, signals, and algorithms, real events are merely a footnote to the narrative. When Trump raises his glass at the dinner, the market has already turned to the next hot topic—perhaps a tweet from the SEC or an ambiguous policy draft. The only certainty for investors is the uncertainty itself.

Disclaimer: This article does not constitute investment advice; the market carries risks, and decisions should be made cautiously.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。