Organized by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

U.S. Bitcoin Spot ETF Net Inflow of $920 Million

Last week, the U.S. Bitcoin spot ETFs saw a net inflow over four days, totaling $920 million, with total assets under management reaching $11.866 billion.

Four ETFs experienced net inflows last week, primarily from IBIT, FBTC, and ARKB, which saw inflows of $1.03 billion, $62.4 million, and $45.6 million, respectively.

Data Source: Farside Investors

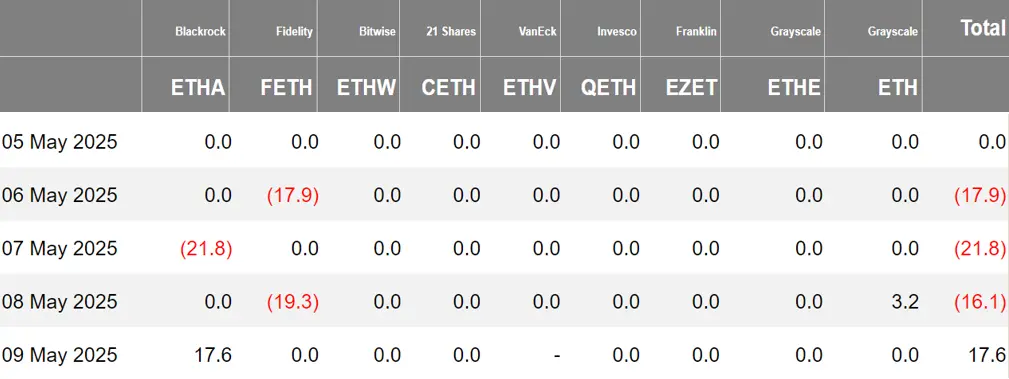

U.S. Ethereum Spot ETF Net Outflow of $38.2 Million

Last week, the U.S. Ethereum spot ETFs experienced a net outflow over three days, totaling $38.2 million, with total assets under management reaching $722 million.

The outflow was primarily from Fidelity's FETH, which saw a net outflow of $37.2 million. A total of six Ethereum spot ETFs had no capital movement.

Data Source: Farside Investors

Hong Kong Bitcoin Spot ETF Net Inflow of 23.71 Bitcoins

Last week, the Hong Kong Bitcoin spot ETFs saw a net inflow of 23.71 Bitcoins, with total assets under management reaching $42.9 million. The holdings of the issuer, Harvest Bitcoin, decreased to 302.19 Bitcoins, while Huaxia increased to 2,200 Bitcoins.

The Hong Kong Ethereum spot ETFs had no capital inflow, with total assets under management at $3.863 million.

Data Source: SoSoValue

Performance of Crypto Spot ETF Options

As of May 9, the nominal total trading volume of U.S. Bitcoin spot ETF options was $1.82 billion, with a nominal total long-short ratio of 2.27.

As of May 8, the nominal total open interest of U.S. Bitcoin spot ETF options reached $14.89 billion, with a nominal total long-short ratio of 9.10.

The market's short-term trading activity for Bitcoin spot ETF options has increased, with overall sentiment leaning bullish.

Additionally, the implied volatility was 50.33%.

Data Source: SoSoValue

Overview of Crypto ETF Developments Last Week

BlackRock Meets with U.S. SEC Crypto Working Group to Discuss Staking and Options for Crypto ETFs

According to The Block, representatives from BlackRock met with members of the U.S. SEC's crypto working group to discuss methods for addressing regulatory issues related to crypto assets, including staking and options for cryptocurrency exchange-traded funds.

Documents indicate that the meeting discussed "considerations for promoting ETPs with staking capabilities" and parameters for determining crypto ETF options positions and exercise limits, including liquidity thresholds. Additionally, BlackRock discussed specific standards for approving crypto ETFs.

Tidal Financial Group Plans to Launch Two Bitcoin and Gold Hedge ETFs

According to Bloomberg, Tidal Financial Group's Battleshares brand has submitted an application to the U.S. SEC to launch two Bitcoin and gold hedge ETFs. The products will allow investors to directly bet on the relative performance of the two asset classes through shorting securities, swap contracts, and options. Counterpoint Chief Strategist Dhaval Joshi believes that Bitcoin will gradually erode gold's market share, and the long BTC/short gold combination has more potential in the long run.

This year, gold has reached new highs due to safe-haven demand, while Bitcoin fell in sync with risk assets during the tariff turmoil in April but has recently rebounded strongly with the advancement of U.S. digital finance policies. Spectra FX President Brent Donnelly pointed out that Bitcoin remains highly correlated with the Nasdaq 100 index, while gold reflects "shorting the U.S." sentiment. Data shows that this year, the top four gold ETFs have attracted over $14 billion, while leading Bitcoin ETFs have received $8 billion in inflows.

Harvest Portfolios to List Two Bitcoin ETFs on Cboe Canada

Cboe Canada, a subsidiary of the Chicago Mercantile Exchange, announced the listing of two Bitcoin exchange-traded funds from asset management company Harvest Portfolios: Harvest Bitcoin Enhanced Income ETF (HBIX) and Harvest Bitcoin Leaders Enhanced Income ETF (HBTE). Both Bitcoin ETFs reportedly employ an actively managed covered call strategy and utilize moderate leverage.

BlackRock's Bitcoin Spot ETF Year-to-Date Inflows Surpass the World's Largest Gold ETF

According to CoinDesk, despite Bitcoin's year-to-date increase of 3.8% being far less than gold's 29% surge, BlackRock's spot Bitcoin ETF (IBIT) has still seen net inflows of $6.96 billion, ranking sixth in the U.S. ETF inflow chart, surpassing the world's largest gold ETF (GLD) at $6.5 billion. This phenomenon indicates institutional investors' continued optimism about the long-term value of cryptocurrencies.

Gold has benefited from geopolitical tensions and inflation concerns, reaching $3,384 per ounce, while Bitcoin has fallen over 10% from its historical high in January. Analysts point out that the continued inflow during periods of price weakness confirms Bitcoin's asset allocation value as "digital gold," and it is expected that the scale of BTC ETFs will reach three times that of gold ETFs within 3-5 years.

Korean Presidential Candidate Promises to Approve Bitcoin ETFs

According to the Korea Economic Daily (KED), Lee Jae-myung, the leader of the Democratic Party of Korea, has become the latest presidential candidate to promise to approve spot cryptocurrency exchange-traded funds (ETFs) and other crypto-friendly measures if elected. Lee announced his cryptocurrency commitment on May 6 as part of a broader initiative to provide more investment opportunities for young people, who are a primary target demographic in the upcoming June 3 election.

KED quoted Lee in Korean: "I will create a safe investment environment for young people to [accumulate] assets and plan for the future." He also promised to legalize spot cryptocurrency ETFs, reduce trading fees, and implement more consumer protection measures.

Defiance Launches Four ETFs Tracking Long and Short Positions in Bitcoin, Ethereum, and Gold

According to filings submitted by Defiance ETFs, LLC to the U.S. Securities and Exchange Commission (SEC), the firm has applied for four new exchange-traded funds, including:

- Bitcoin vs. Ethereum ETF: Long BTC, Short ETH;

- Ethereum vs. Bitcoin ETF: Short BTC, Long ETH;

- Bitcoin vs. Gold ETF: Long BTC, Short Gold;

- Gold vs. Bitcoin ETF: Short BTC, Long Gold.

Each fund reportedly tracks the leveraged performance of one asset relative to another through derivatives and employs an actively managed approach, seeking total returns through synthetic exposure to the underlying assets. These funds do not hold spot assets but instead establish leveraged exposure using a combination of futures contracts, swaps, options, and U.S.-listed ETFs or exchange-traded products (ETPs).

Bitwise Has Submitted a Listing Application for a Spot NEAR ETF to the U.S. SEC

According to Cointelegraph, digital asset management company Bitwise has submitted a listing application for a spot NEAR ETF to the U.S. Securities and Exchange Commission, adding a new contender to the growing list of alternative coins vying for regulatory approval.

Bitwise's registration statement for the Bitwise Near ETF, dated May 6, indicates that the ETF will track the price movements of the NEAR token through traditional brokers, net of fees. Bitwise has designated Coinbase Custody as the custodian for the Bitwise NEAR ETF. The management fee, stock ticker, and listing exchange for the Bitwise NEAR ETF have yet to be determined.

U.S. SEC Delays Decision on Litecoin Spot ETF Application Submitted by Canary Capital

According to former Fox Business reporter Eleanor Terrett, the U.S. Securities and Exchange Commission (SEC) has delayed its decision on the Litecoin (LTC) spot ETF application submitted by Canary Capital and has initiated a public comment period to assess whether the ETF meets regulatory requirements to prevent fraud and manipulation. The deadline for comments is May 26 (May 27, Beijing time), and the deadline for responses is June 9 (June 10, Beijing time).

This delay aligns with Bloomberg analyst James Seyffart's prediction yesterday that "it is highly likely they will choose to postpone making a final decision rather than directly approving or rejecting it."

VanEck On-Chain Economy ETF (NODE) to Officially Launch on May 14

Market News: VanEck Submits S-1 Filing for BNB ETF

Views and Analysis on Crypto ETFs

Bloomberg's senior ETF analyst Eric Balchunas posted on platform X, stating that many criticized VanEck's submission of the BNB ETF application yesterday.

However, knowing some of Zhao Changpeng's statements from last week reveals that he is advising multiple governments on establishing cryptocurrency reserves and has suggested including BNB in those reserves. This may be the reason Jan VanEck took notice and acted. Again, this is just a hypothetical thought, but the logic is very clear.

Bloomberg's senior ETF analyst Eric Balchunas stated on social media, "IBIT attracted another $500 million yesterday, marking 15 consecutive days of inflows, currently ranking sixth in annual inflows, surpassing GLD.

Considering that IBIT has only risen 4% while GLD is in a historically strong performance period, attracting more inflows under these circumstances is a very good signal for the long-term outlook and strengthens our confidence in the prediction that Bitcoin ETF assets under management will reach three times that of gold ETFs in 3-5 years."

QCP Capital released a market analysis indicating that last Friday's macro data provided a detailed snapshot of the U.S. economy, with non-farm payrolls increasing by 177,000, exceeding the expected 133,000, and the unemployment rate remaining stable at 4.2%. However, behind the strong data, economists continue to warn that the full economic impact of recent tariff increases has yet to be seen, and the market remains cautiously optimistic.

Meanwhile, the market generally expects the Federal Reserve to maintain interest rates at this week's policy meeting. Despite recording a historic high loss in the first quarter, Strategy has doubled its financing target to $84 billion, with this loss attributed to the adoption of new digital asset fair value accounting standards, highlighting the company's firm belief in its long-term Bitcoin strategy. At the same time, the steady inflows into spot Bitcoin ETFs indicate that institutional demand remains, reinforcing the growing role of this asset in diversified portfolios.

Bloomberg senior ETF analyst James Seyffart analyzed and stated, "A decision on Canary Capital's Litecoin ETF application will be made before Monday, May 5 (which may be postponed). The SEC has pre-approved and delayed many applications, but not this time. If any asset has a chance of being approved early, in my view, it is Litecoin. I personally think the likelihood of a delay is higher, but it is definitely worth watching."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。