In the U.S. market, Coinbase primarily focuses on spot trading, while Deribit, known for its derivatives, controls a significant portion of the cryptocurrency options trading volume.

Written by: Pzai, Foresight News

In recent years, compliant exchanges like Coinbase and Kraken have been competing in the derivatives trading space. On May 8, Coinbase announced a record-breaking acquisition of Deribit for $2.9 billion, surpassing Kraken's $1.5 billion acquisition of the derivatives platform NinjaTrader on March 20, making it the largest single acquisition in the cryptocurrency sector.

Recent financial reports from Coinbase show that its revenue for the first quarter of 2025 increased by 24% year-on-year but decreased by 10% quarter-on-quarter, falling short of market expectations ($2.105 billion). Net profit plummeted by 94% year-on-year to $66 million. Trading revenue in the first quarter dropped by 19% to $1.2 billion, with trading volume down by 10%. Following the announcement, Coinbase's stock price briefly rose by 6%. According to Benchmark's analysis, the acquisition will enhance the appeal of the Coinbase Prime platform and institutions, gradually gaining pricing power in cryptocurrency options. Will this acquisition lead to explosive growth in Coinbase's derivatives business and rescue long-term stock price expectations?

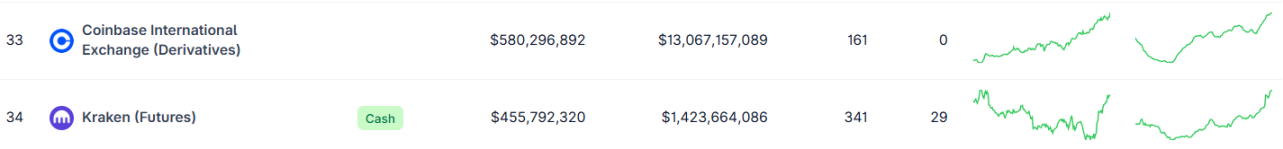

In the U.S. market, Coinbase primarily focuses on spot trading, while Deribit, known for its derivatives, controls a significant portion of the cryptocurrency options trading volume. According to CoinGecko data, in derivatives trading, Coinbase and Kraken rank only 33rd and 34th, respectively, making their depth and liquidity insufficiently attractive to traders.

As a professional derivatives trading platform, Deribit has a core user base that leans more towards professional traders and institutions, giving it a higher profile within that group compared to large user-scale exchanges like Binance and Coinbase. Data shows that its trading volume in 2024 is close to $1.2 trillion, with daily derivatives trading reaching $2.8 billion.

From a market structure perspective, derivatives trading has long become a pillar of the cryptocurrency industry. According to a Coinglass report, the global average daily trading volume of cryptocurrency derivatives reached $100 billion in 2024, far exceeding the trading volume of the spot market. Moreover, the market distribution among major exchanges shows significant differences. For example, Binance's daily trading volume reaches around $110 billion, far surpassing the total contract volume of Coinbase's international site. Therefore, Coinbase needs to find a platform to accommodate future demand for cryptocurrency derivatives trading.

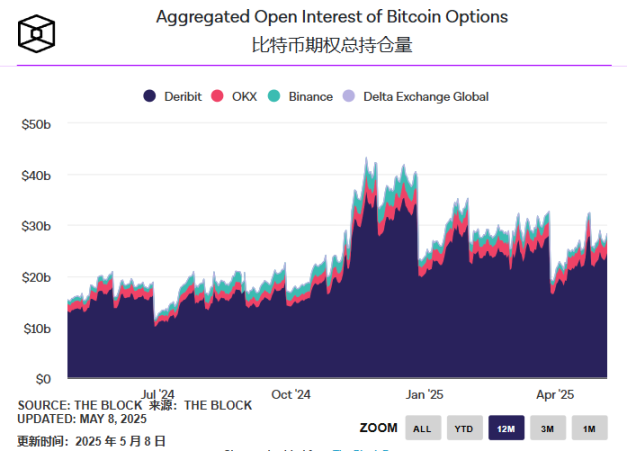

In terms of total open interest, Deribit consistently maintains an options scale in the tens of billions, accounting for over 90% of the overall market, and what Coinbase is eyeing is the financial benefits (hundreds of billions in options trading volume) and growth potential brought by a large number of options positions. Coinbase also stated that Deribit has a "stable profit record," with its adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) consistently showing positive growth trends, and it expects to further enhance profitability after the merger.

This acquisition deal includes $700 million in cash and 11 million shares of Coinbase common stock. Based on Deribit's estimated trading volume for 2024, its annual fee income is approximately $420 million (at a 0.035% fee rate), with the acquisition's price-to-sales ratio significantly lower than its peers (such as Robinhood's 15 times). Analysts expect that after integrating Deribit, Coinbase's average daily trading volume in derivatives will grow by 40%, diversifying trading revenue, with derivatives revenue potentially increasing to over 30% by 2026. From a long-term perspective, this deal offers substantial value for money.

In previous strategic acquisitions by Coinbase, it included Xapo (a wallet service provider, now Coinbase Custody), Tagomi (a brokerage, now Coinbase Prime), FairX (a compliant derivatives platform, transformed into Coinbase Derivatives), and One River Digital (now Coinbase asset management services). This acquisition also reflects that under the contraction of the spot market, the vast futures market can provide new growth points for Coinbase.

Additionally, Deribit's long-term reliance on options business has led competitors to attract users by offering high leverage, low fees, and diversified derivatives (such as structured products and leveraged tokens). Through Coinbase's acquisition and integration, its global user base (especially institutional clients through Coinbase Prime) can complement Deribit's professional derivatives capabilities.

Amid the temptation of such business scale growth, Coinbase has recently been aggressively "spending" on the user side. In the past two weeks, there has been a frenzy in the community about Coinbase offering $200 USDC to new derivatives customers, attracting a large number of users to the exchange. Due to the requirement for specific regional participation, this even led to a rush for address verification.

According to Bernstein analysts, as the industry moves towards a "one-stop" multi-asset platform, cryptocurrency exchanges and brokers are making "big moves" in mergers and acquisitions, and Coinbase is continuously expanding the business boundaries of compliant exchanges. With the entry of derivatives from compliant exchanges like Kraken and Coinbase, we can expect the cryptocurrency business lines in the European and U.S. markets to gradually improve, and the competition among various players is just beginning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。