截止4月15日,火币HTX在2025年共上线了47个项目,覆盖当下多个热门赛道。从2024年下半年开始,火币HTX一直主打“孙哥严选”,即每个上线的新资产孙哥都会亲自把关,那普通投资者是不是也能从中发现行业趋势和财富密码呢?

2025至今,MEME依然是主战场

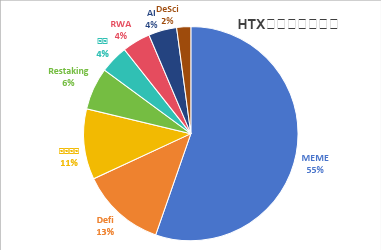

从下图能清楚的看到,目前市场上较热的赛道火币HTX均有覆盖,大体可以分为7个赛道,分别是MEME、Defi、基础设施(L1/L2)、Restaking、游戏、RWA、AI、DeSci。其中MEME的占比达到了55%,随后是DeFi的13%,基础实施的11%,RWA和AI分别占比4%。

(数据截止2025.4.15)

2025年MEME项目呈现显著分化态势,头部项目平均生命周期缩短至14天,较2024年缩短40%。这种急速轮动背后,反映了批量发射平台(如Pump.fun V3)导致供给过剩、杠杆化MEME farming工具普及加速资金周转、将NFT持有量纳入代币分发权重的新模式。

过去几个月,市场的资金还是以短线炒作MEME为主,热度同样在MEME币上,火币HTX上线的币种也基本能满足用户炒作MEME的需求。平台上币思路清晰,既有适合短线操作的MEME资产,也有适合长线布局的RWA和AI等赛道资产。由于今年BTC走势不佳,所以不可避免了选择大量适合短线的MEME类代币。

DeFi、Restaking赛道展现增值潜力

MEME的上新量虽然大,但提供的机会窗口却非常短。与之前十倍百倍MEME的时期不同,目前为止,2025年还没有诞生涨势较好的MEME,这与发射速度和频率增加,分散了市场资金有关。而火币HTX精选的DeFi和Restaking资产却提供了不错的财富机会。

(STO上线火币HTX至今走势)

StakeStone是一个去中心化的全链流动性基础设施协议,属于Restaking赛道。2月11日上线火币HTX,随后一路上涨,最高达到3倍收益。

(PLUME上线火币HTX至今走势)

Plume Network 是首个专为 RWAFi 打造的全栈 L1 RWA 链与生态系统,属于RWA赛道。1月21日上线火币HTX后走势很稳,一直在震荡上扬,最高收益也超过了3倍。

(BUZZ上线火币HTX至今走势)

而MEME类的项目则以高开低走居多,往往行情不会超过两周,随后便进入长期的低位。

(2025年以来BTC走势)

今年以来,BTC走势以回调为主,直到近几周才有所反弹,所以新资产提供的机会也会比其他周期要少。在此背景下,火币HTX仍然提供了多个涨势不错的新资产。

新资产操作思路分享

MEME类资产二八分化非常明显,大部分MEME最后都要归零,仅有极少数百里挑一可能会有10倍以上的涨幅。所以MEME操作要么尽可能多参与去赌10倍以上的概率,要么炒短线热度,赚点儿就走。

而除MEME以外的则可以长期布局,关注火币HTX的上新资产以及所布局的赛道,从中选择自己看好的标的。交易所的嗅觉一定是超过普通散户的,何况火币HTX上新是孙哥亲自把关,几乎所有可能爆发和有长期潜力的赛道,火币HTX均有覆盖。

随着火币HTX在2025年持续上新优质新资产,孙哥亲自“严选”机制也让火币HTX形成强烈的财富效应。对投资者而言,“炒新币,上火币”正成为其挖掘早期潜力资产的投资习惯。无论是StakeStone、Plume这样的长线潜力项目,还是短期高热度的MEME爆款,投资者都能在火币HTX上第一时间把握先机,捕获优质资产。

加密市场已进入专业机构主导的新周期,普通投资者可通过交易所的布局逻辑,构建新的投资框架,方能在波动中捕获趋势性收益。在不确定性中,火币HTX的“上新逻辑”或许就是散户穿越牛熊的灯塔。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。