作者:Fairy,ChainCatcher

编辑:TB,ChainCatcher

互联网券商在“接币”,加密交易所也在“破圈”。

昨日,富途证券宣布推出比特币、以太坊和 USDT 充值服务,用户可将加密资产直接转入账户,打通币圈到股市的资金通道。而另一边,加密交易所也不再局限于圈内生态,布局支付场景,部分平台甚至将美股、黄金等传统资产纳入交易版图。

一边是券商打通加密入口,一边是交易所进行资源整合,拓展支付与合规通路。2025年,将是加密资产流通的新起点?

富途的加密野望

富途证券长期稳居香港股票类 App 下载榜首,全球注册用户超 2,500 万,客户资产高达 7,433 亿港元。如今,它正加速驶入加密资产的快车道。

早在 2023 年,富途就已开始布局加密赛道。旗下虚拟资产平台 PantherTrade 于当年 11 月向香港证监会提交了虚拟资产交易平台牌照申请。2024年 8 月 1 日,富途正式上线加密货币交易功能,开放 BTC 和 ETH 等现货交易对。

而在昨日,富途又进一步,开放比特币、以太坊与 USDT 的充值服务。合资格用户可将加密资产直接转入富途账户,自由切换港美股、ETF、基金、债券与虚拟资产等多元投资组合。

根据富途官网信息,目前 BTC 与 ETH 充值最低门槛分别为 0.0002 BTC 和 0.001 ETH,USDT 充值仅对专业投资者开放。有用户反馈称,富途的充值速度与主流交易所相当,体验流畅。

图源:富途官网

“券商接币”是趋势

富途并非孤例,传统券商加速拥抱加密资产已成全球性潮流。在香港市场,胜利证券迈步更早,2024 年 5 月开放用户通过 VictoryX APP 存取 USDT 和 USDC,并在今年提出以“虚拟资产全生态服务商”为未来三年发展核心。

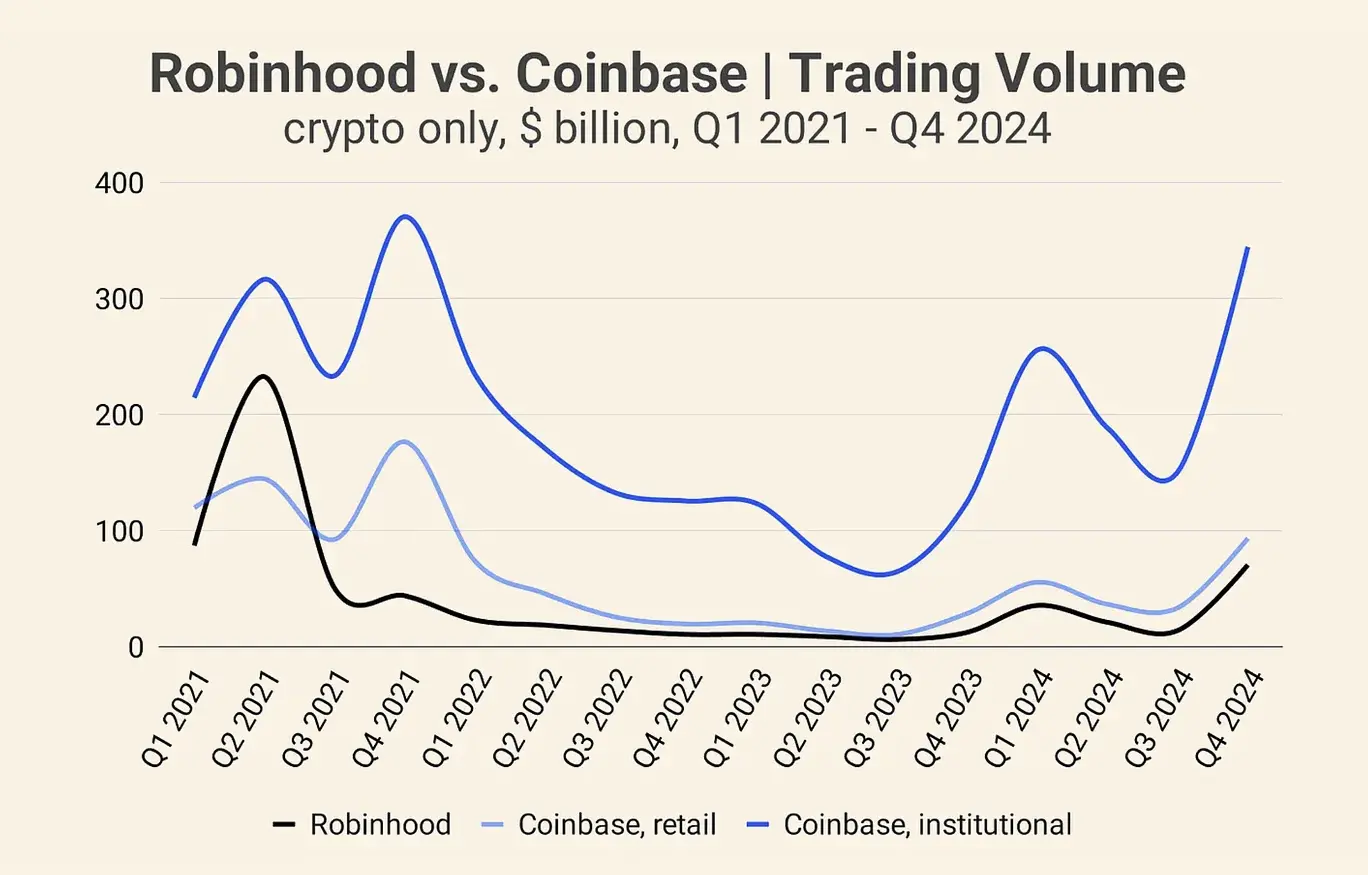

而在全球战场,美国券商 Robinhood 是最早“接币”的代表之一。2024 年,其加密交易量飙升至 1430 亿美元,同比激增 259%,逼近 Coinbase 零售交易量的三分之二。Robinhood 还不满足于此,通过收购 Bitstamp,计划 2025 年底在新加坡上线加密服务,加速抢滩亚太市场。

Coinbase 与Robinhood 加密交易量,图源:insights4.vc

入局者在加码,观望者在追赶。嘉信理财预计年内开放 BTC 与 ETH 现货交易,摩根士丹利旗下 E*Trade 也计划在 2026 年前推出加密服务。

加密平台“破圈”升级

不只是传统券商向加密资产靠拢,加密平台也在反向“破圈”,主动连接传统金融市场。

Bybit 近期透露将上线美股等传统资产交易功能,计划在年内实现平台内直接交易美股、股指、黄金、原油等产品,进一步拓展其资产覆盖范围。

与此同时,加密平台正加速打通支付与消费场景。OKX 推出“币圈余额宝”OKX Pay,让用户可将闲置资产转化为稳定收益工具;Bitget、Coinbase 等平台已推出加密卡,OKX 与Kraken 的加密卡也在筹备中,数字资产正以支付的方式无缝接入线上线下消费生活。

围绕“加密卡”的布局由点到面,交易所此举不仅拓展了加密资产的应用边界,也在强化平台生态闭环、提升用户黏性,并成为新的业务增长曲线。

从加密资产起步,到连接全球主流投资品种与支付渠道,加密平台的边界正在重塑。加密 KOL Rocky 断言:“未来只有两类交易所,一类是融合了 RWA的综合型平台,另一类,是还在坚守纯加密资产阵地的传统交易所。”

或许下一代交易所的模样正在重新定义。

币股互通已成必然趋势

币股互通趋势加速,既带来机会,也带来挑战。未来,加密项目将与全球资本市场正面竞争流动性与关注度。与此同时,更多投资者可能开始用美股、港股的视角评估加密资产,低质量代币将被加速淘汰,推动市场向优质标的倾斜。稳定币采用率将持续上升,加密市场迈向主流金融体系。

全球视角下,监管框架日益明晰,合规门槛抬升,为传统券商与主流加密平台提供了稳健发展的路径;另一方面,上市、并购与跨界整合正变得常态化,传统金融资本与加密基础设施的融合正重塑市场格局。

加密资产正穿越生态孤岛,迈向更广阔的流通与应用场景。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。