Don't be an NPC in the game, be a creator of a new civilization.

Author: msfew

Internet Addiction Teen → Esports Referee

I am msfew, a heavy internet addict. Since elementary school, I have continuously immersed myself in video games, playing League of Legends with classmates on a laptop that barely runs at 20 frames per second.

Whether during my undergraduate classes, while interning at Google as a programmer, or later joining ORA (ora.io, World Intelligent Network) as part of an AI startup, I never stopped dedicating several hours a day to gaming, even sacrificing sleep to play.

As my understanding of the gaming industry deepened, I recently realized the importance of becoming an "esports referee." After trying my hand at a few tournaments, I leveraged my narrative skills honed in the crypto industry and my multilingual advantages to secure a position as an executive referee for the top international event, the "Overwatch Global Championship."

I officiated in front of players and coaches from European and American teams, as well as millions of online and offline viewers at the Hangzhou Asian Games venue, ensuring the fairness and smooth execution of the event. (That's me looking at the camera in the picture)

(This article's main theme is the on-chain gaming assets. If you're interested in the esports referee part, you can skip to the end to see the related content.)

Version Abandonment: Blockchain Games

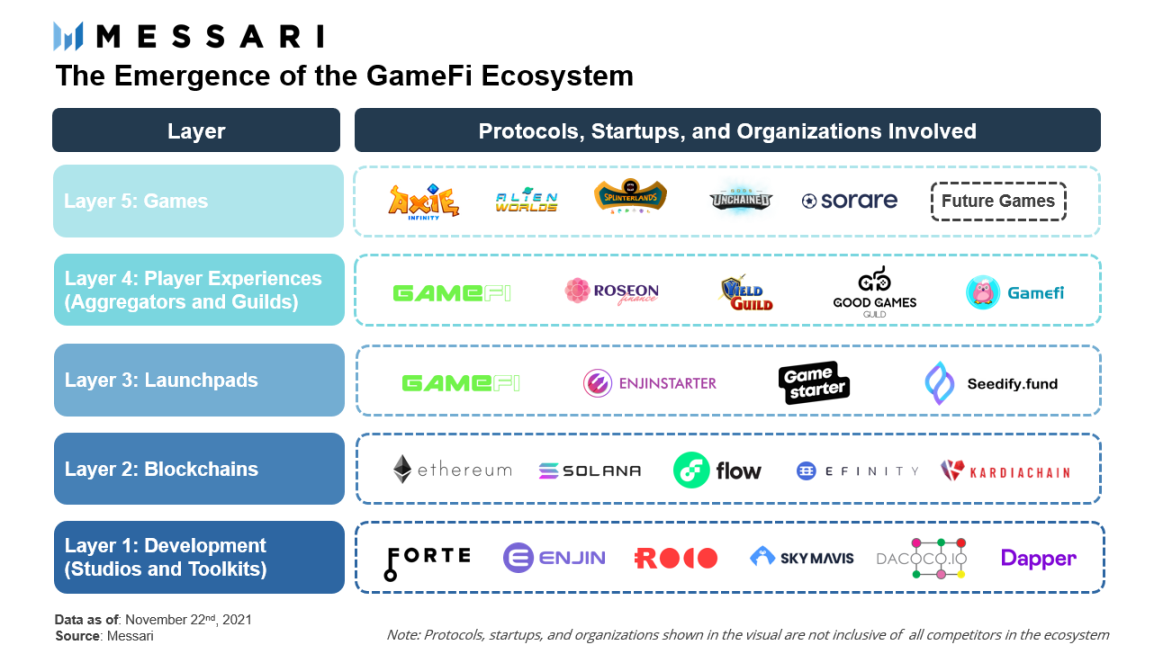

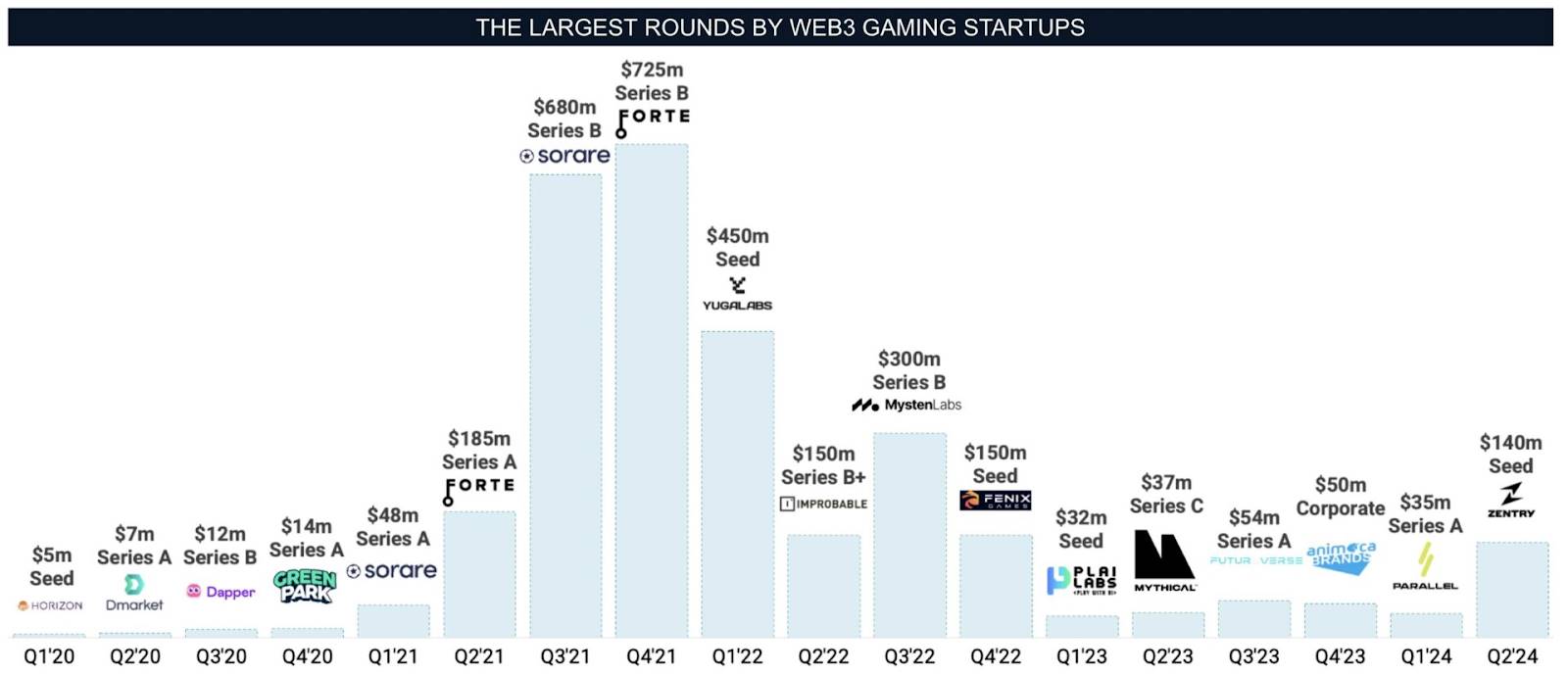

The years 2021 - 2022 marked the peak of blockchain games. It seems that after that, we haven't heard much about blockchain games, nor have we seen new giant blockchain game projects, only sporadic mentions of narratives like "full-chain games."

Many analytical posts have discussed why GameFi failed (for example, considering gameplay, or data metrics). Successful narratives and tracks each have their merits, but the reasons for failure are always the same: the narrative/product/new traffic cannot support the price ("debt issuance and conversion"). GameFi has always been about "Play-to-earn," "rural encirclement of cities," "new economic systems," and "new traffic entering the system," but it cannot create or keep up with new rhythms.

Capital began to vote with its feet, with less and less funding entering the GameFi space, leading to fewer people entering the field, and the overall quality of projects in the track deteriorating. Projects that previously raised large amounts of money could not deliver as originally expected, and the inflated narrative bubble burst, creating a vicious cycle.

Direction of Games + Blockchain?

How can we save blockchain games? I believe there are three main methods:

Tokenization: Abandon the creation of those poor-quality games, stop pretending, and directly attempt to combine existing games with blockchain.

Full-chain games: Still full-chain games, but not for the sake of making games, rather to drive the development of infrastructure through the demand for games.

Incorporate new technologies: For example, integrating AI into games to make them more enjoyable.

Tokenization of Game Assets

After this cycle of influence, now 100% of people in the crypto space are no longer averse to tokenizing anything. This cycle is not lacking in good narratives, so games have been neglected.

However, traditional Web2 games that truly have consensus have been overlooked. They are the real hot topics.

Games "built natively from Web3" inherently struggle to compete with traditional gaming giants (for example, a few years ago, when Riot released a shooting game, it garnered massive attention) or traditional channels. Or rather, these games themselves are unwilling to take the "difficult path." Of course, if a game has a crypto-native mechanism, then it is essentially selling the token as a product, and it is reasonable to consider tokens as products.

Instead of pondering how to "carve flowers on dog poop" (link), it is better to choose quality themes from the source.

Good Games Generate Good Assets

When it comes to the assets within popular games, they are excellent tokenization subjects for three reasons:

-

The speed of trend formation + the rarity and non-replicability of the event itself: Once a good game issues a token, it is a one-time event. There are only a few good games, and issuing one means one less.

Consensus range: Most people in the crypto market recognize high-quality games.

Financial strength of the audience: Players and traders are willing to spend big money on game-related on-chain assets.

Additionally, the attention mechanism of games differs from that of memes, each with its pros and cons. The dissemination mechanism of memes is quick and fades rapidly; very few memes survive for years, while the dissemination and attention for games are sustained, resembling an initial rapid phase followed by prolonged engagement.

Similar Mental Model:

- Game assets inherently possess a mental model similar to crypto assets. Taking CSGO as an example, Play-to-earn (box drops) + randomness (getting a rare item) + series and individual items (NFTs) are very similar. At the same time, traders tend to have a "gambler's mentality," understanding their speculative nature. Of course, many gamers do spend a lot of money just to buy items based on luxury logic.

Loser Business:

- A viewpoint that is often criticized is that in the future, one should invest in loser businesses, and gaming is a continuously growing loser business. More fresh blood will enter the system. One can avoid trading tokens, but if one doesn't play games, it really is quite strange.

Did people not know these truths before? Why are they being stated now? I believe it is mainly because times have changed; the infrastructure is ready (the trading platforms themselves, various "brokerages"), and the perception of tokens and on-chain assets is becoming increasingly accepted.

Having discussed the advantages, one issue is that game assets are limited by the upper limits of the games themselves (though this upper limit is quite high), and they cannot spread infinitely like pure memes (for example, while older generations may know Trump, they may resist understanding games). There are also regulatory and IP limitations.

Finally, we return to the initial point: in the gaming track, we should try to issue assets for good games/good assets, rather than creating garbage assets to issue. This is also a lesson learned from the previous cycles of AI and gaming (link) (everyone builds launchpads, launchpads create more garbage assets, which actually does not work).

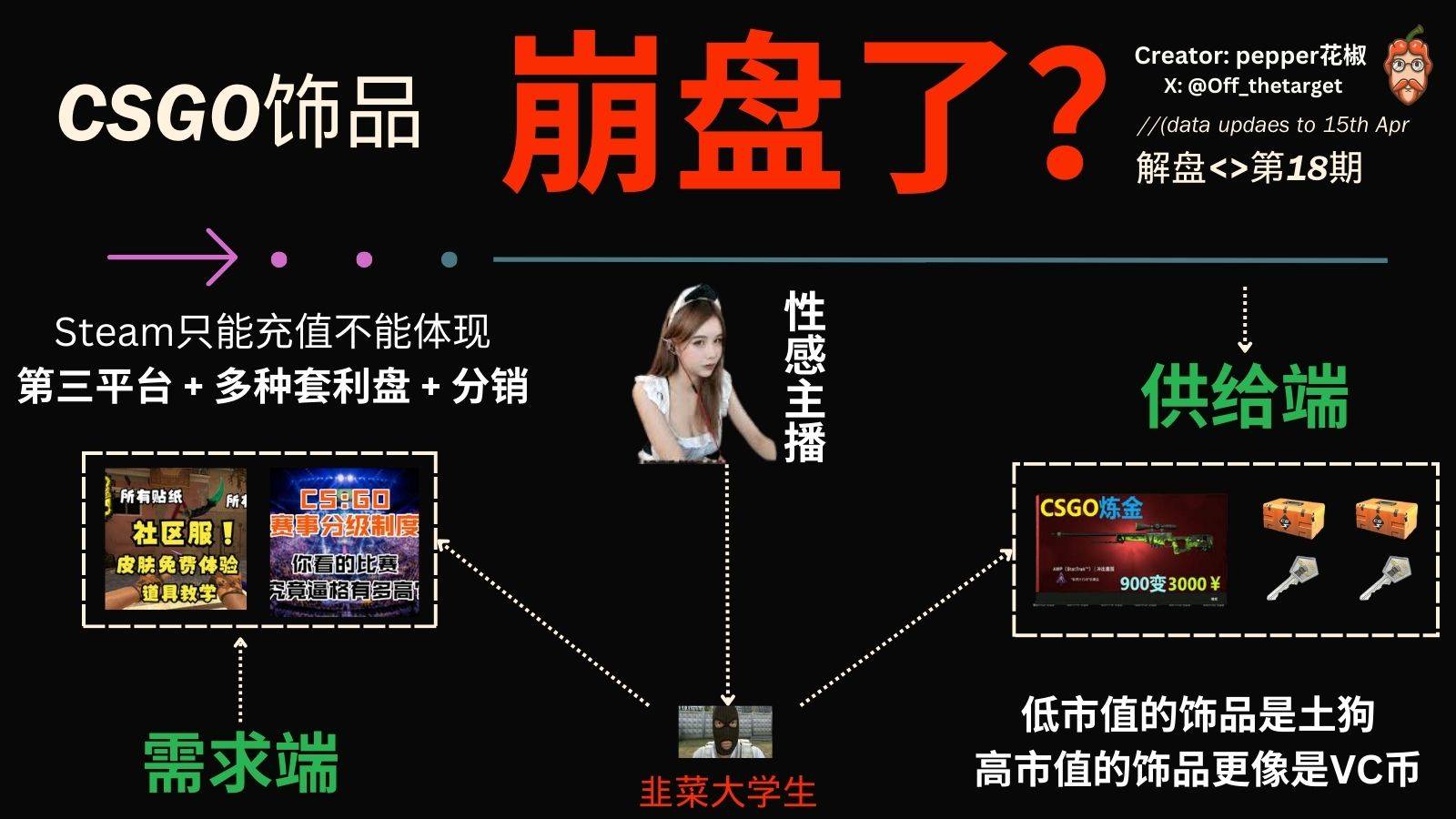

Taking CSGO Skins as an Example

CSGO skins are a typical example of game assets because their model is simple enough (much simpler than the previously popular Dream of the Red Chamber during the last GameFi cycle) and they are sufficiently popular.

Previously, off_thetarget, Gink5814, and I have all published content related to CSGO skins.

In simple terms, CSGO skins:

CSGO is a shooting game with many weapons (AK, M4, pistols, knives, gloves). The game's popularity is extremely high.

The default skin is ugly (compared to skins), and you can purchase weapon skins through opening cases or the secondary market.

Skins correspond to → weapon type (main weapon? knife? gloves?) → specific model (AK, M4, butterfly knife) → wear level and pattern; this aligns perfectly with the NFT track (PFP? U cards?) → specific series (Punks, BAYC) → corresponding small images.

Players have a strong motivation and demand for buying skins, and there are even official burn mechanisms like account bans from the gaming platform.

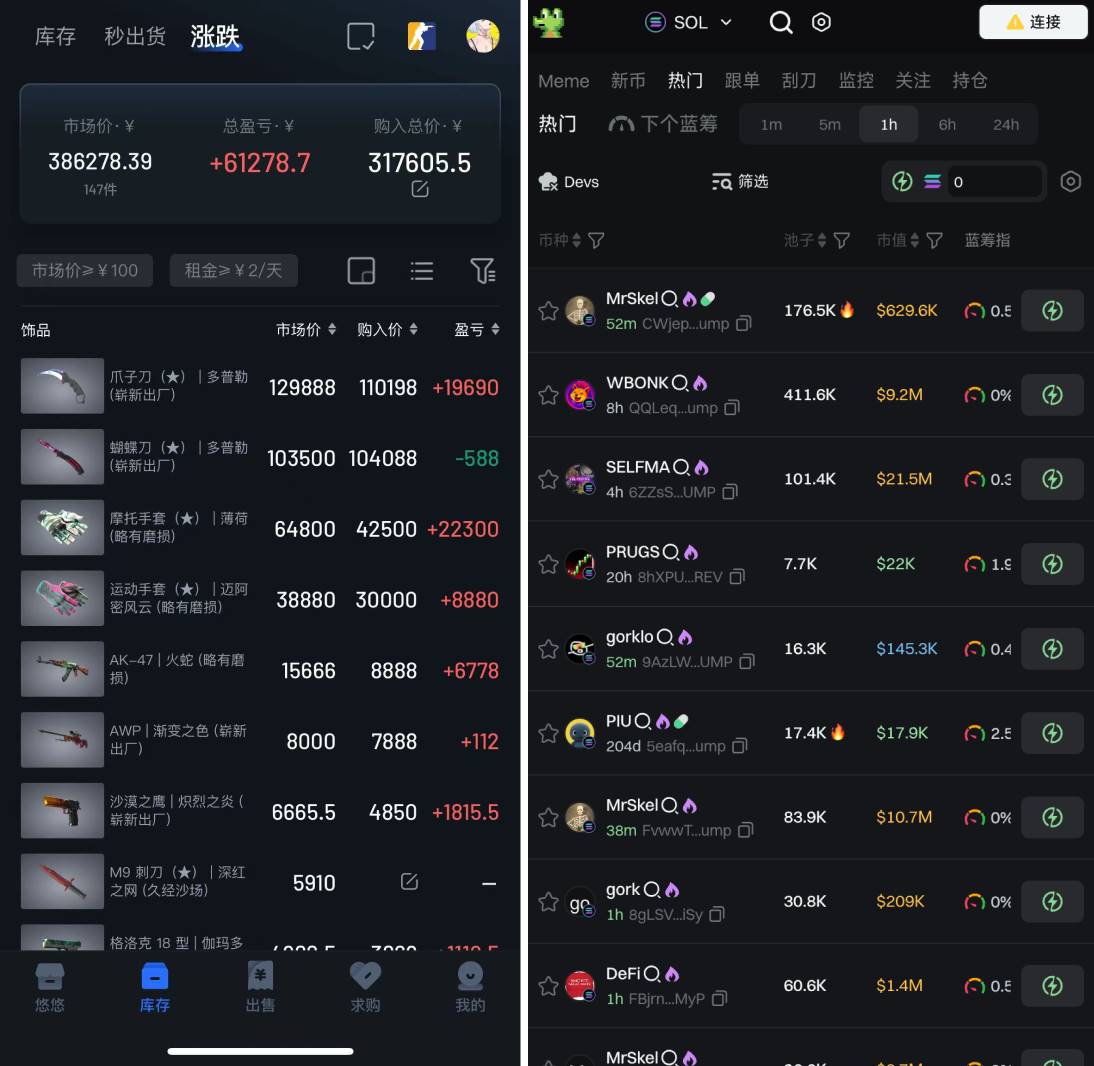

I believe the current risk of CSGO skins lies in the price running far ahead of the value. The actual traffic growth of the game is likely declining, but due to narratives like "being a landlord" and "skin flipping," it has attracted a lot of pure capital and speculative traffic:

Being a landlord means buying skins and then renting them out. If the skins continue to rise, that's great (however, there is still a risk of being bought out in default), but if they drop, the returns might not even be as good as a money market fund… So whether they rise or fall, good returns are not guaranteed.

Skin flipping seems to be about finding dumb money to serve as the exit liquidity for the entire system, letting them calculate exchange rate differences and buy cheap dollar cards, but the source of these cards and the 7-day lock-up mechanism make one worry about whether they will be the last ones left if a sudden crash occurs…

The dissemination is too aggressive, usually through QQ groups and WeChat groups, where a "teacher" gives the order, and everyone collectively raises the listing price…

Overall, CSGO perfectly fits our narrative of "popular Web2 games going on-chain." We have two directions to combine CSGO skins with blockchain and achieve "on-chain" game assets: 1) sell shovels; 2) CSGO on-chain fund.

1. Sell Shovels: Create CSGO Skin Trading Tools with Crypto Thinking

In any trading-related field, it is always selling water and shovels that can safely traverse bull and bear markets. Bloomberg, Uniswap, law firms, auditing companies… are all giants that stand firm, ignoring market conditions.

In crypto, assets and narratives change (ICO → VC coins → DeFi → GameFi → pure memes), trading methods also evolve (CEX → AMM → NFT → TG Bot → on-chain scanning terminals), but the demand for better, more comprehensive, and faster trading tools remains constant.

In terms of technical limitations, both crypto and CSGO skins have some strange restrictions:

Crypto: On-chain transactions must generally follow AMM trading methods, while off-chain there are regulatory restrictions.

CSGO skins: The trading mechanism has cooldown period restrictions, and trading platforms adopt a listing system similar to NFTs.

Although both are constrained, they have each created a decent trading experience. The development of trading tools in crypto has actually been faster, going through multiple iterations. For example, to solve the fragmentation issue of AMM, aggregators like 1inch emerged; to address the fragmentation of NFT platforms, platforms like Blur appeared; to resolve the separation of trading and wallets, DEX Wallets and TG Bots were developed…

Currently, the trading of CSGO skins has several features that can be improved:

"Chain Scanning Platform": Analysis of KOLs and professional players' holdings similar to crypto chain scanning platforms.

"Aggregator": An all-in-one brokerage platform for buying (view base prices across platforms) and selling (analyzing order volumes and prices across all platforms + avoiding overselling + considering exchange rates and lock-up).

"Exchange": A trading mechanism similar to AMM (not selling to buyers, but selling to the platform or pool), achieving true instant buying and selling.

"Derivatives": Leveraged trading, long and short positions, lending, and other financial instruments and derivatives.

As an industry rooted in trading and thriving on it, crypto has rich experience in creating trading tools under technical constraints, which I believe will be a significant advantage for CSGO skin trading platforms.

The strong never complain about the environment. If CSGO skins had more mature trading platforms and experiences, everyone's holdings would also be more diverse, and the volume and price would inevitably be healthier.

2. New Assets: On-chain ETF for CSGO Skins

The narrative of RWA and the interconnection of crypto stock platforms has recently gained traction. I believe the biggest issue with traditional assets going on-chain is their lack of appeal, as they are mid-tier assets that don't stand out:

Their yields are not as high as stablecoins, nor do they have the safety of stablecoins (if stablecoins and US Treasury RWA are not considered RWA).

The purchasing process is complex and requires KYC (not achieving the idealized RWA's ability to bypass geographical restrictions and the characteristics of geographical arbitrage).

Their appeal is lower than memes or other assets (few in the crypto space are interested in buying funds for corn or soybeans; these are basically garbage assets packaged on-chain to find exit liquidity).

Interestingly, CSGO skins have a unique aspect: index by category, such as skin index, default skin index, agent index, etc. They are naturally divided into clear categories based on their types and can also be further subdivided into specific weapon series. CSGO is an excellent asset that is RWA and appealing.

The advantages of creating a fund for CSGO skins are numerous:

Benefits of on-chain funds: The well-known general advantages of on-chain funds include open and transparent data and flows, low operational costs with just one contract, and unrestricted on-chain circulation.

Capturing the skin index: There is no need to take risks betting on individual items, but rather capturing the returns of the entire field. While CSGO skins have always had an index, it has not been tradable, leaving many people only able to observe without participating.

Introducing gaming traffic: The logic of mass adoption. Gamers may enter crypto through this index fund, leading to a good out-of-circle effect and ultimate ceiling.

Pricing consensus among young audiences: Young people, especially those in the crypto space, are not interested in many RWAs and won't take them on, but will chase after assets they care about. CSGO skins are an example. Young people play games every day and naturally have an inexplicable affinity for these items.

How can a CSGO skin fund be realized? A simple idea for a knife skin index fund:

The knife fund allocates 80% to various types of knives, while 20% can be used as stablecoins to earn yields.

The goal is to make everyone unaware of the existence of crypto; although it is an on-chain fund, it can still allow direct entry and exit with fiat currency.

If someone feels that merely capturing returns is not enough (many players buy skins purely for luxury logic), then holding a certain amount of fund shares would allow them to borrow skins from the fund's holdings for free; additionally, a certain proportion of the skin holdings can be rented out on the trading platform.

In case of needing to avoid regulation, we can use token standards like ERC-7641 RevShare Token to package it from the fund into a shareable revenue token, allowing for sharing the value growth of assets in the fund and rental income.

Other Directions

In addition to the major direction of asset tokenization, there are also two minor directions: full-chain games and the integration of AI.

For full-chain games, the meaning is not just putting games on-chain, but rather using applications to drive the development of underlying infrastructure. Just like in the GPU example, people simply want to play better and more realistic video games, which drives advancements in graphics, and the progress in graphics in turn promotes the development of GPUs, which then fosters advancements in cutting-edge technologies like AI. A recent example in crypto is the Crossy Fluffle mini-game created by MegaETH; the focus is not on the game itself but on encouraging stronger underlying infrastructure through the demand for these applications.

Regarding the integration of AI, AI can exist as a neutral agent, executing tasks completely objectively, which would perfectly execute tasks like the esports referee mentioned at the beginning; at the same time, AI can also serve as a generator of stories, infinite maps, and game assets…

Summary: GG, but no WP

This is why, after serving as a referee for international events, I am keen on the on-chain gaming assets and the combination of games and crypto.

It's not because games or assets going on-chain are currently popular, but because we may have finally figured out how to play the game.

GameFi has seen both wins and losses, but this time, the crypto world has reopened, and the strategies will be more mature, with asset models and understandings becoming more solid.

Don't be an NPC in the game; be a creator of a new civilization.

Insights from an Esports Referee

Here are some additional thoughts, unrelated to the main text, for entertainment purposes:

Esports referees are not like traditional sports referees; they generally do not make judgments on the outcome of matches. Their main role is to help players debug equipment or allocate resources.

The essence of an esports referee is actually that of a liaison on the field, facilitating communication internally (with players and coaches) and externally (between the main referee and the event production team).

Getting into esports refereeing or the esports scene is actually very simple; it's easier than leveling up in games. The challenge lies in securing individual match resources; once you have the first one, it becomes much easier.

There is a significant shortage of people who can speak English and Korean; those with translation skills are actually very rare.

Esports competitions must always be held offline, as players' geographical locations must be unified to ensure relative fairness.

Esports, like Web3, often takes place in the evening or even late at night, aligning better with the biological clocks of young people.

Esports will replace traditional sports; the new generation will increasingly choose to participate in and watch esports rather than traditional sports.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。