作者:邓通,金色财经

加密法案史迎新篇。美国新罕布什尔州之举是「终此一家,别无其他」,还是「火之燎原,不可向迩」?

5 月 6 日,美国新罕布什尔州州长凯利·阿约特签署了该州立法机构通过的法案,成为美国第一个允许其政府投资比特币等加密货币的州。受此消息影响,加密市场普涨,BTC 甚至有望再次尝试 10 万美元大关。

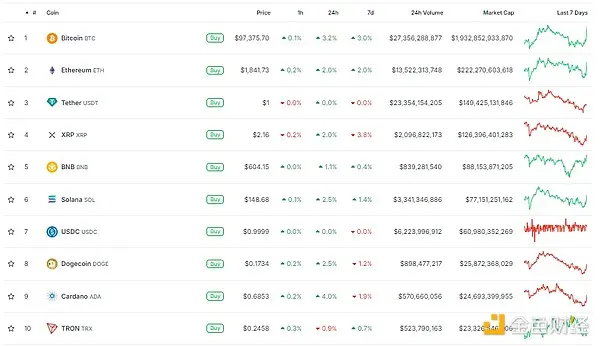

截至发稿,BTC 报 97340.70 美元,24 小时涨幅 3.2%。整个加密市场也迎来普涨。

新罕布什尔州的法案与特朗普签署的行政令有何不同?美国其他州的加密储备法案进程如何?哪些国家已经看到了 BTC 的价值,并大量持有?

新罕布什尔州州长阿约特开启加密法案史新篇

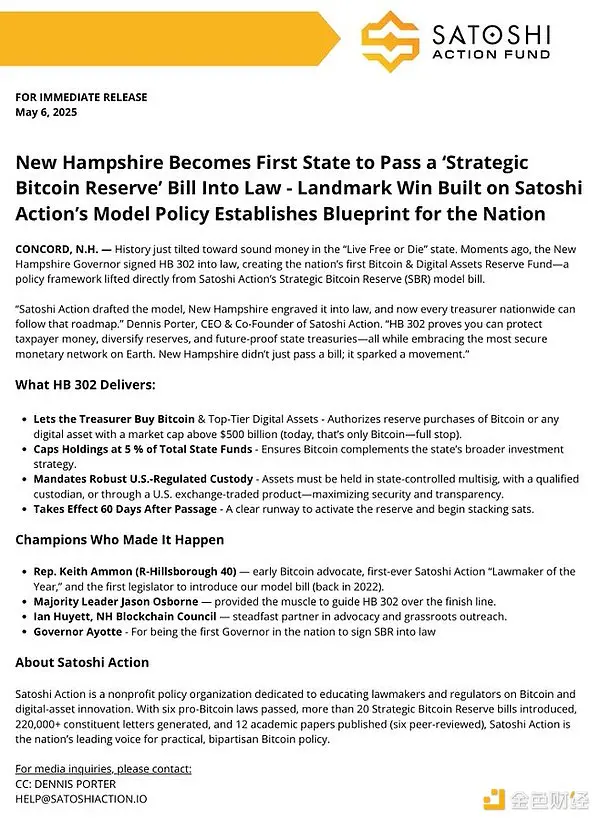

5 月 6 日,阿约特在社交媒体上发布公告,宣布新罕布什尔州将通过州参议院和众议院通过的一项法案,允许该州「投资加密货币和贵金属」。众议院第 302 号法案于今年 1 月在新罕布什尔州提出,该法案将允许该州财政部门使用资金投资市值超过 5000 亿美元的加密货币。

「『不自由,毋宁死』的州正在引领商业和数字资产的未来发展,」新罕布什尔州共和党人在 5 月 6 日的 X 帖子中表示。

随着该法案的签署,新罕布什尔州成为美国几个州中第一个考虑通过立法建立战略性比特币储备的州,其中包括一项与联邦政府合作的倡议。

新罕布什尔州的加密货币计划有哪些亮点?

HB 302 法案充满亮点:

- 允许财政部长购买比特币和顶级数字资产——授权储备购买市值超过 5000 亿美元的比特币或任何数字资产 ( 当前只有比特币 )。

- 基金总额的 5% 用于持有比特币——确保比特币补充该州更广泛的投资战略。

- 授权美国监管的稳健托管——资产必须由合格的托管人持有,或通过美国交易所交易产品,以最大化安全性和透明度,资产必须由国家控制的多元签名持有。

- 生效于通过 60 天后——一个清晰的路线图来激活储备计划。

追溯特朗普今年 3 月签署的战略比特币储备与数字资产储备库行政令,虽然这标志美国正式将比特币纳入国家战略资产体系。但从市场反应来看,加密行业对特朗普的行政令(仅限没收资产、不大规模购入)并不是十分满意:在消息公布前,BTC 一度飙升破 95000 美元,但政策一出即迎回落,至 84000 美元左右。

而本次新罕布什尔州则规定州财政部门可使用资金投资市值超过 5000 亿美元的加密货币。一时之间,比特币储备实现了从没收、不直接买入到可以直接用真金白银买入的巨变。

美国其他州的加密储备法案进程如何?

今年 3 月有报道指出,北卡罗来纳州可能会将公共资金的 10% 用于比特币,旨在建立战略储备并将加密货币作为其财务策略的一部分;亚利桑那州一项类似的法案于 4 月份在该州众议院获得通过,但于 5 月 2 日被州长凯蒂·霍布斯否决;佛罗里达州政府于 5 月 3 日撤回了两项加密货币储备法案的审议。

目前,业内人士正关注新罕布什尔州的立法是否会引发其他州的效仿。

Satoshi Action Fund(SAF)联合创始人 Dennis Porter 于 X 发文表示,今日,美国多个州通过战略比特币储备法案成为法律的可能性大幅增加。

各国政府持有多少比特币?

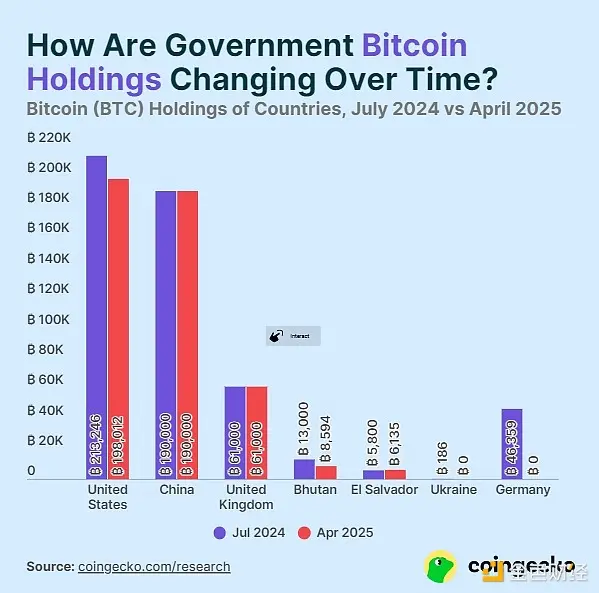

随着 BTC 不断刷新原有记录,越来越多国家正看到比特币的真正价值,并不断增加持有量。

据 Coingecko 统计数据,截至 2025 年 4 月,各国政府共持有超过 463,741 枚比特币,约占比特币总供应量的 2.3%。

排名前五的 BTC 持有大国分别是:美国、中国、英国、不丹、萨尔瓦多。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。