LaunchPad: A Hundred Schools of Thought Contend, Driving Market Enthusiasm.

Author: WOO X Research

Launchpad is a decentralized platform, typically operated by blockchain projects or decentralized exchanges (DEX), designed to help emerging blockchain projects issue tokens to the public through IDOs. These platforms provide fundraising channels for project teams while offering investors the opportunity to participate early in high-quality projects. The Launchpad introduced in this issue refers more to meme launch platforms, which differ from traditional Launchpads in that the market capitalization of listed tokens is lower, with nearly 100% circulation, most tokens being memes, and a lower threshold for users to issue tokens, resulting in a higher potential wealth effect.

Functions:

Project Fundraising: Provides financing channels for new blockchain projects by raising funds through the sale of tokens to the community for project development, marketing, etc.;

Token Distribution: Helps project teams distribute tokens to early investors, usually launching at a lower market cap to attract user participation;

Traffic Acquisition: Popular events or IPs are currently important ways for Launchpad platforms to gain traffic, attracting significant attention;

Providing Wealth Effect: On-chain tokens have low market caps, and once they gain market recognition, FOMO buying or future listings on major CEXs could lead to substantial profits for early buyers, rapidly spreading within the community;

Since the huge success of Pump Fun last year, this track has been the first choice for many development teams and even public chain startups, but ultimately, many have returned empty-handed, with the consensus around meme coins in the market gathering around Pump Fun.

However, aside from Pump Fun, the well-established Solana meme coin BONK has recently launched its own LaunchPad - Letsbonk.fun, with several meme coins under its umbrella having previously surpassed a market cap of 10 million dollars, marking a good start.

The leading AI Agent LaunchPad, Virtuals Protocol, has recently introduced new participation methods and activities. Without discussing the performance of its tokens, the parent token $VIRTUAL has doubled in price within a week, indicating that the new activities seem to have some effect.

So, while Pump Fun, LetsBonk, and Virtuals Protocol are all LaunchPads, what are the differences in their functionalities? What tokens should we pay attention to under these three platforms? Let WOO X Research take a look.

Pump Fun

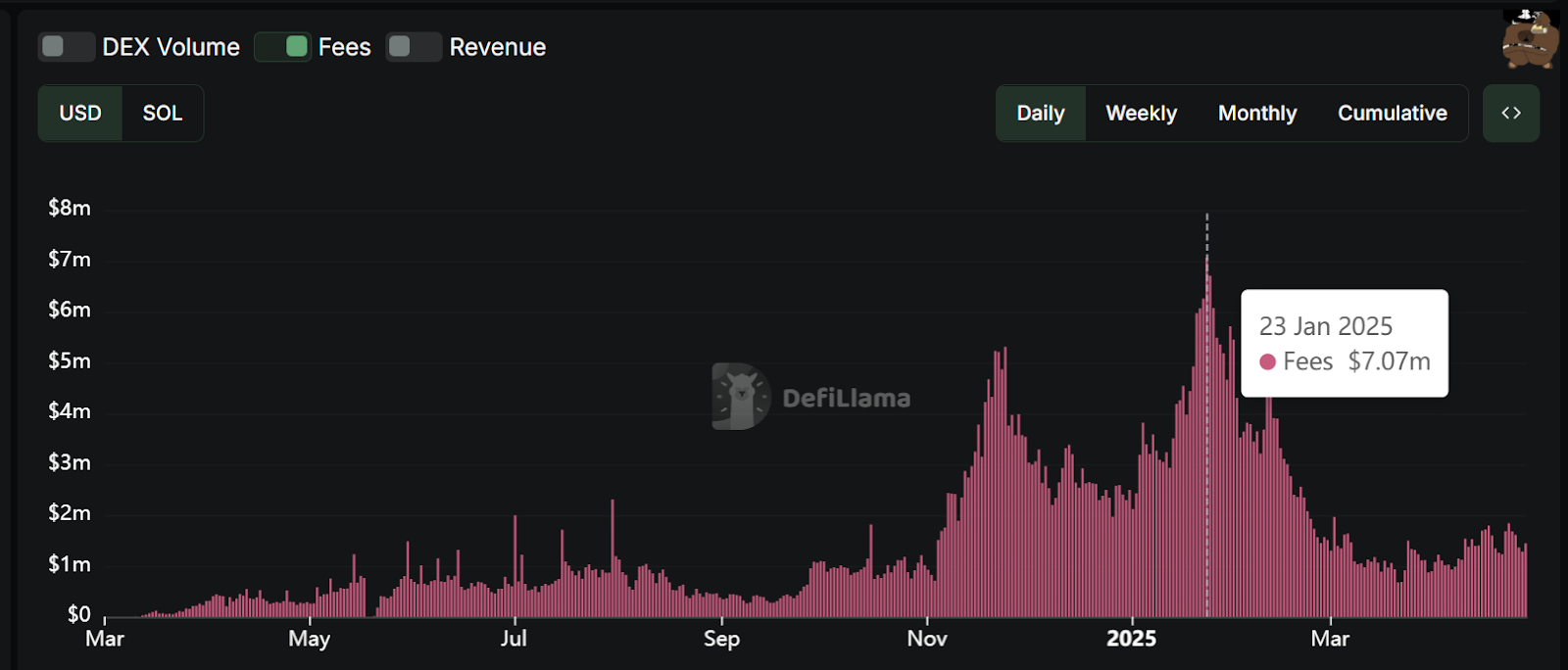

Pump Fun is certainly familiar to many; the meme frenzy of the second half of 2024 began here. At its peak, it could earn over 7 million dollars in a single day. Even now, during the cooling of memes, it still maintains a daily level of about 1.5 million dollars, having earned over 600 million dollars since its launch, making it a veritable money printer in the crypto space.

Pump Fun's revenue is all denominated in SOL. Typically, native projects on Solana, to avoid being labeled as "scammers" and to maintain closer ties with Solana's official channels, often stake the SOL they earn or operate nodes themselves. However, Pump Fun does the opposite, continuously selling off its SOL for USDC.

Since 2025, they have sold a total of 317 million dollars worth of SOL tokens, an astonishing amount.

Such actions not only create a poor impression but, combined with previous live broadcasts and lawsuits, while Pump Fun is super profitable within the Solana ecosystem, it is not a favored entity by the foundation.

In terms of its meme coins, Pump Fun has become the preferred platform for issuing coins, serving as an entry traffic website without a specific niche, allowing for a variety of themes, including animals, puns, news events, AI, etc. Essentially, anything you can think of can become a meme coin, so there is no particular focus on any specific feature among the tokens on the platform. Currently, the preferred platform for token issuance remains Pump Fun.

Reference: DefiLlama

LetsBonk

In contrast to Pump Fun, LetsBonk is clearly more politically orthodox, primarily because BONK is the most representative meme coin on the Solana chain, being the original meme coin with wealth effects and a project that has been deeply rooted in Solana for over four years. Besides the recent retweet by Toly, BONK has been visible in various offline events related to Solana. In terms of relationships, compared to Pump Fun's constant selling of coins, BONK is clearly more likable.

In terms of platform mechanics, LetsBonk also appears to be more selfless than Pump Fun, with revenue coming from 1% of transaction fees, which is used for:

Platform operation and growth

Providing for BONKsol validators to promote DeFi growth & protect the network

Repurchasing and burning BONK (a dashboard will be launched soon)

Additionally, the collaboration with Raydium's LaunchLab shows that LetsBonk is quite sincere in its goodwill towards the Solana ecosystem.

Currently, the highest market cap token on Letsbonk is Hosico, valued at 38 million dollars, inspired by a Scottish Fold cat named "Hosico." Hosico is a golden short-haired cat born on August 4, 2014, and has nearly 2 million followers on social media (like Instagram) due to its round face, big eyes, and adorable appearance, making it a globally recognized internet celebrity cat.

Other notable tokens include the namesake token Letsbonk and Grassiot.

Letsbonk was initially seen as the representative official platform token, and on its first day of launch, its market cap peaked at 30 million dollars. However, due to the emergence of various tokens competing for attention, it has since declined, with its current market cap only at 4 million dollars.

Grassiot's rise to fame was due to BONK's founder TOM purchasing the token, subsequently burning it, and then buying it back again. In simple terms, it gained value through the founder's attention, but later TOM stated that his purchase was merely for support, with no insider information and that he is also holding Hosico and LetsBonk, disclosing the amounts he holds. Grassiot's market cap has also dropped from a peak of 13 million dollars to about 4.3 million dollars at the time of writing.

Virtuals Protocol

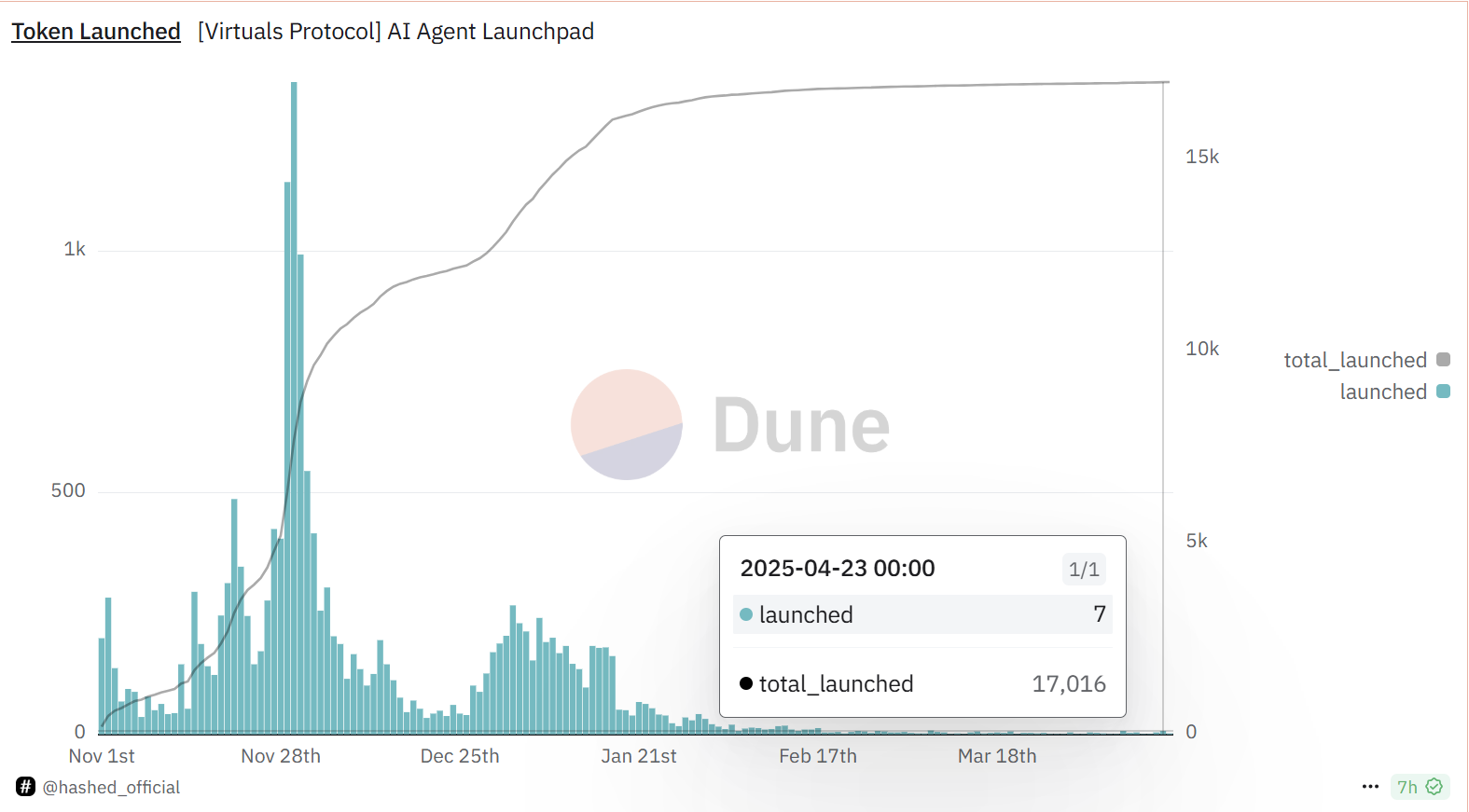

Originally built on Base, the AI Agent LaunchPad has recently expanded to the Solana chain. The business model is straightforward; users must consume VIRTUAL to create and trade tokens on the platform. However, with the recent decline in AI hype, fewer than 10 tokens are successfully issued per day on VIRTUAL, a significant drop from at least 100 tokens issued previously.

Reference: Dune

Recently, they have had significant updates

Virgen Points: This system is an important mechanism for Virtuals Protocol to encourage user participation, used for accessing pre-TGE token allocations, especially for "giga AI Agent launches." These points directly affect users' eligibility and rights to participate on the launch platform.

AI agents launch with a fully diluted market cap of 336,000 $VIRTUAL (approximately 232.58k USD), and all Virgins gain equal early access through Virgen Points. Allocations are determined after a 24-hour points bidding period, and if the funding target is not met, tokens will not be minted, and all $VIRTUAL and points will be fully refunded.

Ways to Earn:

Trenchor Points: Earned by trading Sentient and Prototype Agent tokens.

$VIRTUAL Points: Earned by holding $VIRTUAL tokens.

Yap for Points: Earn points by creating content related to Virtuals Protocol (such as X posts). According to an X post on April 23, 2025, this activity encourages users to "Yap" (i.e., participate in discussions or create content), with submission methods available via related submission links. The post mentions "Stronger signal. Higher rewards," suggesting that more influential content may earn more points.

$VADER Stakers: Earned by staking $VADER tokens.

How to Participate?

- Staking Points:

Use Virgen Points to commit to participation, with a maximum allocation of 0.5% of the total supply of tokens.

Final allocation depends on your committed points relative to the total committed points.

Over-committing can increase the chance of receiving the maximum allocation.

If the Genesis Launch is successful, only the points used for allocation will be burned, and the remaining points will be refunded.

- Invest $VIRTUAL tokens:

A maximum of 566 $VIRTUAL can be invested to ensure maximum allocation.

If participation exceeds expectations, allocations will be diluted, and excess $VIRTUAL will be refunded.

- Claim Tokens:

After a successful Genesis Launch, go to the Agent page to claim the purchased tokens.

If the launch fails, all points and $VIRTUAL will be fully refunded.

In summary, Virtuals Protocol is creating a smaller, more loyal LaunchPad, somewhat similar to the recent point-based new token activities launched by Binance Wallet, essentially hoping users will engage more in the ecosystem. If the Virtual system continues to prove effective in the future, there are three ways worth participating:

Directly purchase $VIRTUAL tokens to go long

Directly purchase $VADER tokens to go long

Participate in activities

The first two points are straightforward, and both $VIRTUAL and $VADER have recently shown astonishing price increases, making them the biggest beneficiaries of the activities. To participate in the activities, one must first accumulate points, which can be done by holding $VIRTUAL tokens in a wallet. If there are concerns about the potential decline of $VIRTUAL in the future, one can short the same amount of $VIRTUAL on a centralized exchange. The benefit is that it ensures participation in the activities without being overwhelmed by potential losses, and the design of the activity is such that it will not incur losses, only a situation where the returns are less than expected. The downside is that since an additional amount of capital is needed to short, the overall capital usage will be significantly reduced.

Conclusion

Overall, Pump Fun, LetsBonk, and Virtuals Protocol each have their advantages and concerns: Pump Fun consolidates its traffic entry with aggressive selling and high-profit models, but it is also frequently questioned due to its "cash-out" practices and negative events; LetsBonk, through deep community engagement and low fee sharing, shows goodwill towards the ecosystem, but the attention is divided between the platform token and secondary tokens, and whether it can continue to attract long-term participation remains to be seen; Virtuals Protocol's point mechanism and AI Agent are paving the way for a new track, full of innovation, but it has yet to demonstrate stable issuance energy, and whether user enthusiasm can be sustained is still uncertain.

Looking ahead, the next wave of enthusiasm in the LaunchPad track hinges on "value realization" and "community resilience": Can the platform balance short-term excitement with long-term ecological construction through mechanism design? Can project teams continue to provide real utility rather than relying solely on flashy narratives? When the hot money recedes, which model will prove to be more sustainable will become an important indicator for market evaluation. For researchers and participants, in addition to focusing on platform traffic and token price fluctuations, it is essential to deeply consider the core risks of each mechanism and their potential for future upgrades, in order to find the one truly worth long-term investment amidst the hundred schools of thought contending.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。