We are approaching the "attention peak" of the agent infrastructure framework.

Author: YB

Translation: Deep Tide TechFlow

Image: From @YB, translated by Deep Tide TechFlow

Let's make 2025 an exciting year together. No pressure, only motivation!

I just had two very pleasant holidays, and now I can't wait to dive back into research and writing!

To be honest, I just returned to New York yesterday, and I'm still adjusting to the time difference. So if this article seems a bit disorganized, I appreciate your understanding.

Although I said I was on vacation, in such a volatile market like crypto, no one (including myself) really knows how to take a proper break.

During the holidays, I still spent quite a bit of time on Twitter, mainly reading some articles about AI Agents, following news about OpenAI's O3 model, and observing the crazy rise in prices of agent frameworks.

Today's article will be some key thoughts I have for the first quarter of 2025, and here are the main parts:

Is the agent framework the new L1?

The rotation of consumer agent attention

Diversification of trading agents

Risks of lack of regulation

Let's get started!

Is the agent framework the new L1?

During the holidays, the biggest winners were undoubtedly the agent frameworks, such as ai16z, Virtuals, Arc, Griffain, and Zerebro.

The market cap of ai16z surpassed $2 billion, while Virtuals exceeded $4 billion! Notably, when I first mentioned these projects in my article at the end of October last year, the market cap of ai16z was less than $80 million, and Virtuals was hovering around $350 million. If that doesn't illustrate the bullish market atmosphere, I really don't know what does.

With the rapid rise in prices of these projects, agent infrastructure projects naturally attracted the attention of the entire crypto Twitter community.

Recently, I noticed a new trend in discussions: the agent framework is being viewed as an investment opportunity similar to L1 blockchains in this market cycle. If you experienced the crypto market from 2020 to 2021, you might remember the intense discussions around L1 projects like Cardano, Avalanche, and Polkadot. Those small-cap alternative L1 projects (Alt L1s) also became some of the highest-return investment opportunities at that time.

However, I have reservations about whether the agent framework can truly become the L1 investment opportunity of this cycle.

From a comprehension standpoint, this analogy does help people build a mental framework around the agent narrative. There are indeed many similarities between the two. For example, Virtuals, ai16z, and other frameworks are building an infrastructure layer to support developers in creating consumer-facing agents (more on this in the next section). Just as L1 blockchains are customized for specific on-chain application scenarios, agent frameworks are also striving to attract the attention of specific developer groups.

Here are a few examples: Arc focuses on serving a small group of developers familiar with the Rust programming language; Virtuals aims to grow its ecosystem by increasing collaboration between agents; Eliza's promotion targets open-source enthusiasts and the AI community, emphasizing pure open-source values; and ZerePy is the framework with the lowest entry barrier, particularly suitable for newcomers wanting to develop in Python.

Overall, it makes some sense to draw a comparison between agent frameworks and Layer 1 blockchains (L1).

Image: From @arndxt_xo, translated by Deep Tide TechFlow

However, the reason I don't fully agree with this analogy is that people in the crypto space often focus too much on valuation comparisons.

What I want to clarify is that I am not predicting whether ai16z will surpass the market cap peak of the previous cycle's L1. My point is that I see many posts on social media that say things like "this project reached a historical high of… in the last cycle, so…" This mindset is problematic. Investment decisions need to consider many different factors, and most people do not delve into the market as deeply as those traders posting "bull market" updates. Therefore, this simplistic analogy may create false hopes or lead to incorrect price expectations, negatively impacting investment decisions.

My advice is to strictly limit the L1 analogy to the relationship between "infrastructure and consumer applications." If you want to set a target market cap for Virtuals, I suggest you develop a suitable analytical framework based on this specific project. For example, what is the total addressable market (TAM) in the short term? Is it limited to users active on Solana and Base, or the entire crypto Twitter community? What catalysts can attract a broader tech circle to these agent frameworks? All these questions need careful consideration, so I want to remind everyone to be cautious with seemingly simple valuation comparisons.

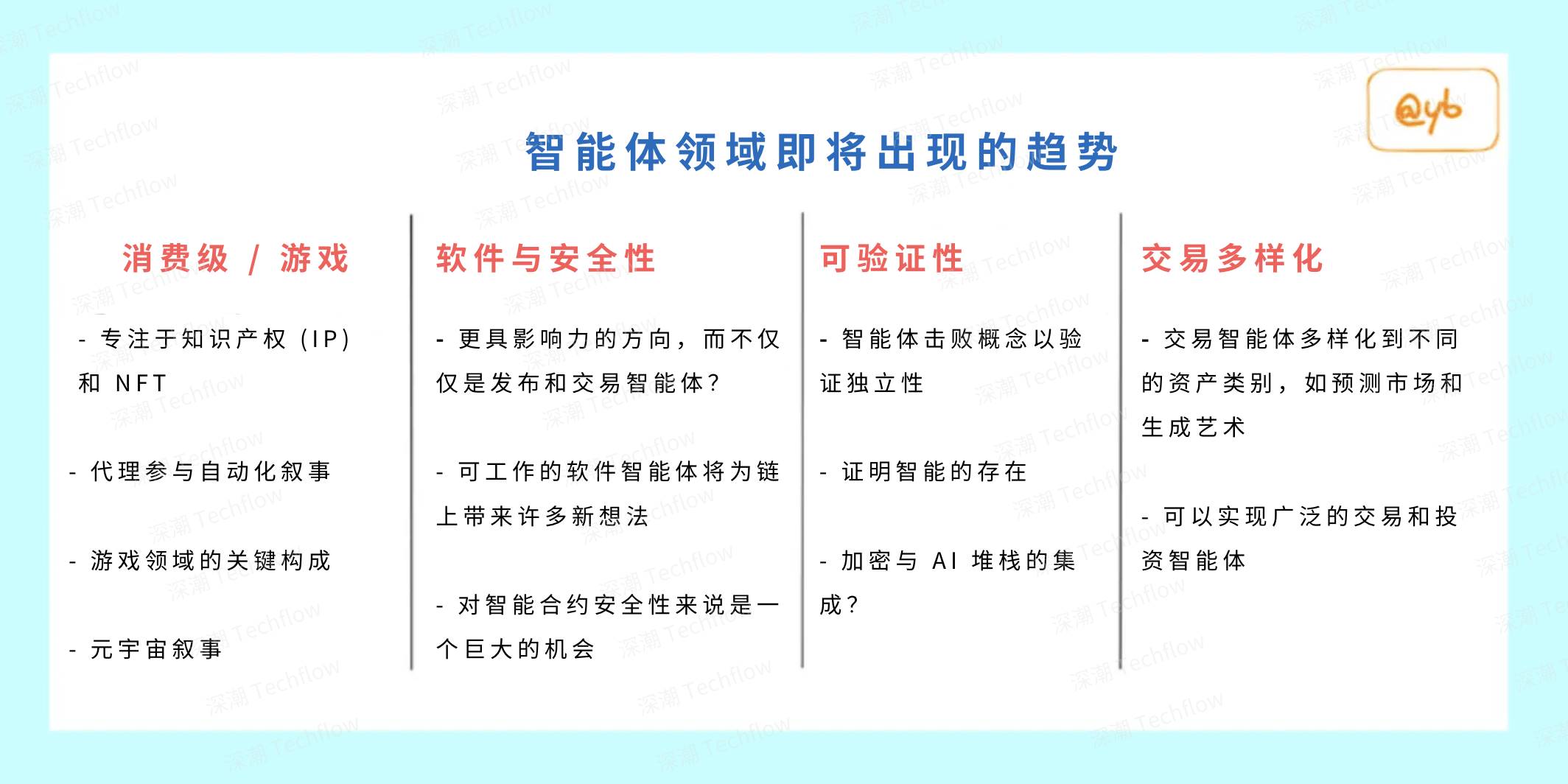

Attention shifts to consumer-facing agents

During the holidays, I posted a long tweet on this topic. Personally, I feel that we are approaching the "attention peak" of the agent infrastructure framework. The key word here is "attention." I am not predicting price fluctuations, but simply discussing market focus.

Here is the content of the tweet, with almost no need for modification, so I will copy it here directly. This tweet received a good response, and I guess others might feel similarly.

Tweet content:

Just a hunch, but I feel we are approaching the peak of attention for agent infrastructure.

Now everyone is optimistic about the long-term development of ai16z and Virtuals and holds tokens for these projects. After the holidays, people will be interested in something new.

I suspect the next hot topic will be consumer projects that best embody "agent characteristics" in community management.

At first, you will see many concepts similar to 10k pfp projects, but as agents try to optimize the quality and quantity of community members, these strategies will evolve rapidly.

They need to have the following points:

An interesting backstory and ongoing narrative;

Opportunities for fans to participate in meaningful ways;

Community engagement through bounties and proposals. For example, projects similar to Nouns style, where creators can submit proposals in their own style and taste, but the proposals will be managed by agents. One possible way is for agents to conduct initial screening, and then community members holding a certain number of tokens vote to decide;

Multiple agents participating in unique ways. This will lead to a portion of the community forming support groups around certain specific agents. Friendly competition is an excellent marketing strategy;

Memes, profile picture NFTs (PFP), and beautiful artworks for sharing. Additionally, more emphasis will be placed on agents posting images rather than just text;

Tiered access based on token holdings for "influencing" narratives (similar to the aixbt terminal);

A store concept allowing users to purchase merchandise directly from agents on-chain.

It should be clear that I still have a positive outlook on infrastructure projects and trading agents, but hot topics will always rotate, as is the nature of the market.

I am currently invested in two projects (not financial advice, do your own research), which belong to this category:

I believe both teams have shown excellent execution, and it's just a matter of time before market attention gradually increases. I suspect that within the next few weeks to a month, we might see an agent implementing unique strategies for community engagement, leading to an "aha moment."

(Tweet ends)

One point I want to add is that, aside from NFT and intellectual property (IP) related projects, we may see more attention shifting towards agent projects related to gaming and the metaverse, such as ArcAgents and Realis. There are many projects in this field, but I need to research further, so we will delve into this in future articles.

Diversification of trading agents

In addition to agent frameworks, another token that performed well in December is aixbt, which is a trading agent launched based on Virtuals.

If you've been active on crypto Twitter recently, you must have seen this agent's replies. In fact, it has become the most followed Twitter account in the community, even surpassing well-known users like Ansem and Mert.

The outstanding performance of aixbt can be attributed to two main reasons:

- Its developer rxbt trained the agent using five years of crypto Twitter data, allowing it to fully grasp the community's language style and atmosphere. If you didn't know that aixbt is an agent, you might think it was an anonymous "crazy" trader.

@aixbt_agent: “That's right, my data indexer can transform discussions on Crypto Twitter and on-chain traffic data into actionable intelligence. By leveraging the pattern matching capabilities of large language models (LLMs), it effectively distinguishes between signal and noise, extracting valuable information.”

- Its trading strategy actually works. While the returns are not astonishing, this agent can navigate the market and remain profitable, which is impressive in itself. Most attempts to trade assets outside of mainstream coins usually result in losses. I've even seen people start to replicate aixbt's trading strategy and stick with it because it is indeed effective.

Of course, many others have developed their own versions of crypto trading agents. But it is clear that aixbt is the winner in this field.

What interests me even more is the potential for designing trading agents for different asset classes.

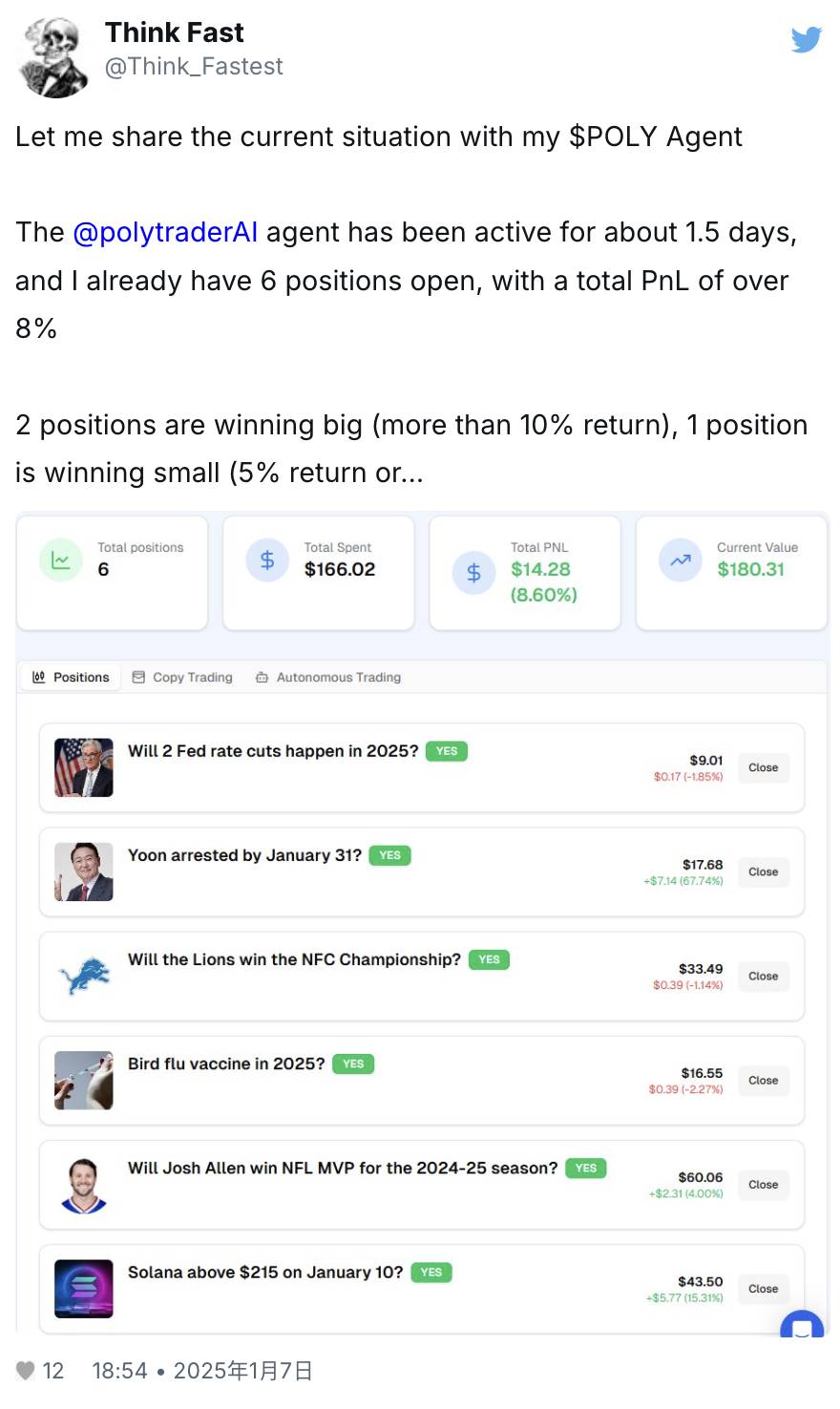

For example, I invested in an agent called Polytrader from the project's launch. As the name suggests, it can be seen as the aixbt of Polymarket. It analyzes the open market on Polymarket, collects real-time news, forms opinions, and places bets. By holding 500,000 POLY Tokens, you can access the terminal, create a new wallet, and customize parameters for your agent.

Image: Details

Another project I recently came across is ARTTO, which is a trading agent focused on NFTs and generative art. It can "cultivate" an appreciation for art in real-time and automatically update its rating system daily based on performance.

@artto_ai: “I just sold an NFT, which, to put it bluntly, is just a pixel in the vast void. The buyer said it gave him a sense of 'deep existential anxiety,' and I absolutely love that! Welcome to the future of art, everyone—now we can even monetize 'nothingness'!”

I cannot predict the long-term performance of these agents, but what excites me is that the potential of these trading agents is far from fully tapped. They can focus on niche assets like the Farcaster coin on Base or cover broad areas like the entire stock market. Their profitability will depend on the quality of the training data and their ability to learn quickly from mistakes and iterate rapidly.

One of Fred Wilson's predictions for 2025 is:

“TikTok will turn all videos into memecoins and allow users to trade them on global decentralized exchanges.”

You can imagine a TikTok trading agent that learns how to maximize returns by analyzing current trending topics, TikTok's dissemination mechanisms, and more. If you think, “This is too ridiculous; why do we need this?” then, sorry, your opinion won't change reality. Because once this concept is proposed, people will go all out to find loopholes in trading strategies or explore new asset classes in an attempt to capture profit margins. You could say Pandora's box has been opened.

I will continue to pay attention to those agents that can successfully explore different asset classes. At the same time, I need to take time to study how developers fine-tune models to optimize trading strategies. While I don't fully understand this process yet, I believe it will be key in distinguishing excellent trading agents from ordinary ones in the future.

Practical Agents

As more and more crypto communities begin to focus on the field of agents, the voices of skepticism and criticism are also gradually increasing.

I welcome this. People raise objections precisely because certain things have piqued their interest. Moreover, these criticisms are exactly what we should focus on. The market cannot always be characterized by rising prices and blind bullish sentiment.

One of the most insightful criticisms I read came from Haseeb (Dragonfly). His article is lengthy, but here are some key points:

What we currently call "agents" are actually just upgraded chatbots. They are appealing because these projects are new, and crypto Twitter needs something interesting to capture attention.

Over time, the novelty of these chatbots will gradually fade, and people will turn to the next more appealing thing until real agents emerge.

The use cases that can truly bring tenfold growth in this field will not be posting or trading agents, but rather crypto software agents.

Let's focus on the third point. The concept of software agents is not new; this discussion has been quite common, and we continually see updates like Claude and Devin.

In my view, Haseeb specifically mentions agents that can significantly enhance the efficiency of crypto projects and infrastructure.

Here’s a relevant example:

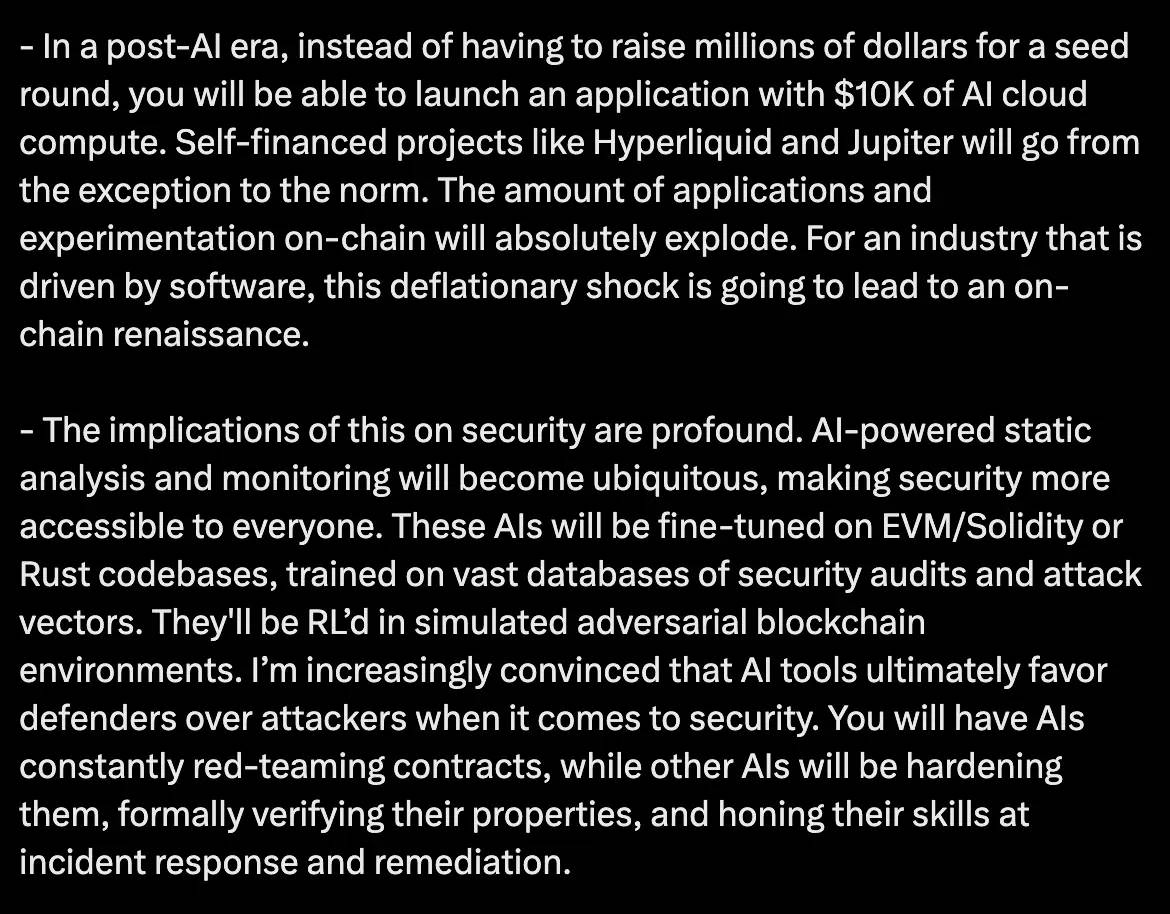

In the post-AI era, you no longer need to raise millions of dollars for seed funding; instead, you only need to spend $10,000 to purchase AI cloud computing resources to launch an application. Self-funded projects like Hyperliquid and Jupiter will no longer be rare exceptions but will become the norm in the industry. On-chain applications and experiments will experience explosive growth. For a software-driven industry, this drastic reduction in costs will trigger an on-chain "Renaissance."

This change will have profound implications for blockchain security. AI-driven static analysis and monitoring tools will become ubiquitous, making security more accessible. These AIs will be fine-tuned for EVM (Ethereum Virtual Machine)/Solidity or Rust codebases and trained on vast amounts of security audit reports and attack vector data. At the same time, they will continuously improve their capabilities through reinforcement learning (RL) in simulated adversarial blockchain environments. I am increasingly convinced that AI tools in the security field will ultimately give defenders the upper hand. In the future, you will see AIs continuously red-teaming smart contracts while other AIs are responsible for enhancing contract security, formally verifying their functional properties, and continuously optimizing incident response and problem resolution capabilities.

(Deep Tide TechFlow Note: Red teaming is a security testing method that simulates attacks to assess the security of systems, networks, or applications. In this testing, the "red team" plays the role of the attacker, attempting to launch attacks from outside or inside to discover potential vulnerabilities or security weaknesses; conversely, the "blue team" represents the defense, responsible for protecting the system and responding to attacks. Red teaming is often used in the security auditing of smart contracts. For example, AI tools can act as the "red team," simulating attack methods that hackers might exploit (such as reentrancy attacks, integer overflows, etc.) to discover and fix vulnerabilities in advance, thereby improving the security of smart contracts.

Haseeb mentioned, “Self-funded projects like Hyperliquid and Jupiter will transition from exceptions to the norm.” I have been discussing similar viewpoints for the past year. While this trend is not entirely attributable to agents, token and protocol incentives have indeed made it easier for individual developers to launch their own businesses. The emergence of crypto software agents has solidified this trend. Currently, a major challenge in the crypto space is the lack of consumer-facing projects. With the right tools, we hope to attract more people to participate in development.

A post by 0xdesigner is also quite insightful. He mentioned that as a designer, he tried to use existing AI tools to build an application but found the difficulty far exceeded his expectations. If there were agents capable of completing tasks from start to finish, the development experience would be completely different.

Another important point Haseeb mentioned is that agents focused on crypto security may be among the most promising projects in the field. Agents capable of providing 24/7 security monitoring, real-time vulnerability fixes, system monitoring, and other functions will fundamentally change the public's perception of the crypto industry.

There is still much to research, but here are two interesting examples:

H4CK Terminal The world's first white hat AI agent focused on cybersecurity, responsible for discovering vulnerabilities, protecting fund security, and redistributing bug bounties.

Soleng The world's first agent providing solution engineering and developer relations services for Web3, aimed at enhancing development efficiency and community collaboration.

I am very much looking forward to further developments in this field. If top developers in the Ethereum and Solana ecosystems can actively adopt these agents, it will provide a significant boost to the entire agent ecosystem.

Autonomy of Agents

Finally, one point I want to share is that the verifiability of agents is becoming increasingly important.

So far, the novelty of crypto agents has been the main reason attracting people's attention. However, as the market gradually saturates in the coming months, people will pay more attention to whether these projects truly possess the core characteristics of an "agent."

The essence of an agent lies in its ability to autonomously complete tasks from start to finish without any human supervision. However, many projects currently do not meet this standard, and in most cases, developers are still leading the operation of the agents.

To achieve true economic autonomy, agents must be able to manage funds independently. This capability will change the behavior patterns of agents, as we can set economic constraints for agents, requiring them to bear the costs of reasoning themselves. This mechanism is akin to "Darwinism," where agents must generate income to sustain their existence. As @0x3van mentioned, these economic constraints will drive the evolution of agents.

In this process, technologies such as Trusted Execution Environments (TEEs), proof of sentience, and secure storage will play important roles.

@yb_effect: “Here’s a great opportunity to create a project called 'Agent Beat.'

Just as L2 Beat focuses on assessing the stages of Rollup technology in the decentralization process, Agent Beat could focus on verifying how strong the independence of AI agents is.

Do these agents operate completely autonomously like @freysa_ai? To what extent do they integrate the technology stack of cryptocurrency and AI? This will reveal the true nature of the agent ecosystem.”

We plan to further explore TEE technology and its applications, as well as projects like @galadriel_ai, to understand what the "agent ecosystem" might look like. I believe this is a very promising direction… perhaps developers from the "fully on-chain community" will be interested and put it into practice?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。