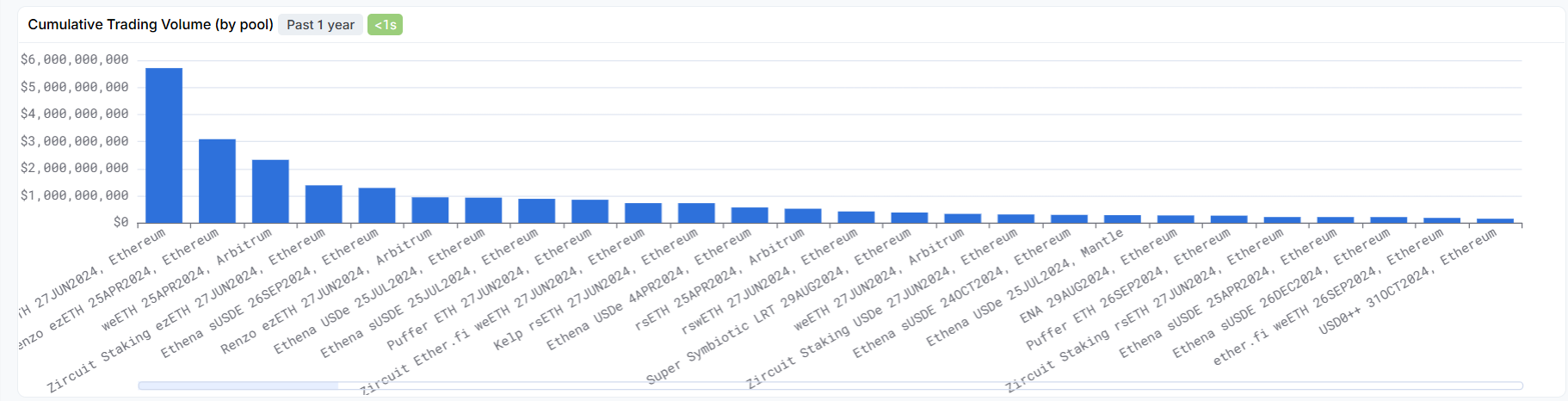

From the trading volume, it can be seen that the peak TVL of Pendle, which supports billions of dollars, is backed by the endless emergence of ETH staking/re-staking/liquid staking protocols and the top-tier project Ethena.

What is Pendle? How does it work?

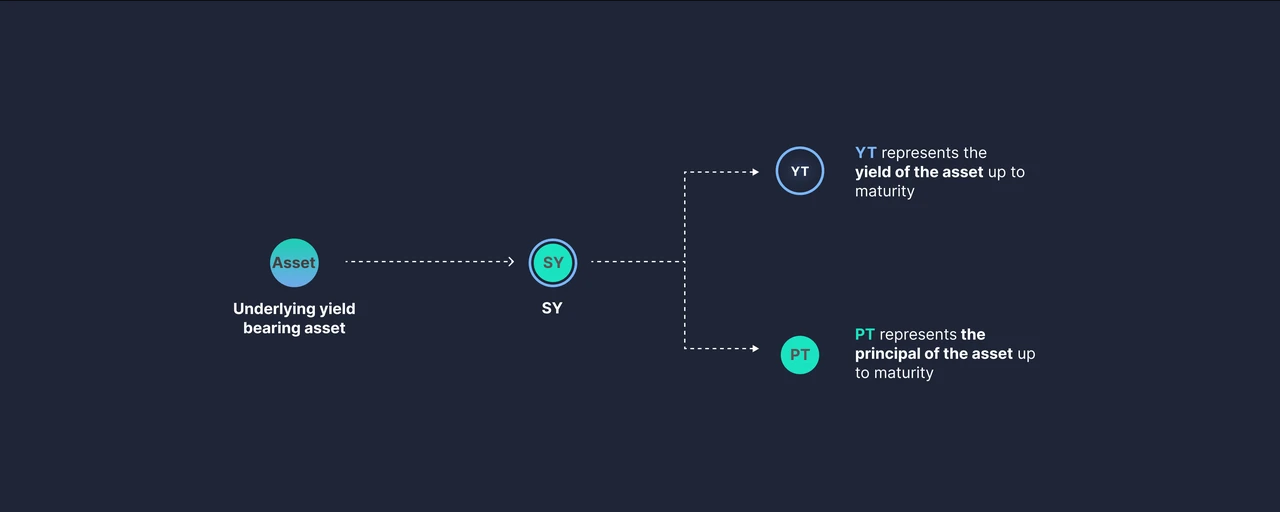

The core idea of Pendle is to tokenize the future yields of income-generating assets, allowing them to be freely traded in the secondary market. Specifically, Pendle splits income-generating assets (such as stETH) into:

Principal Token (PT): Represents ownership of the underlying asset, and users holding PT can redeem an equivalent amount of the underlying asset at maturity.

Yield Token (YT): Represents the expected yield generated over a future period, allowing users holding YT to access these yields in advance.

Illustration of asset splitting

Users in the Pendle protocol can exchange their income-generating asset SY for PT + YT, providing them with many options:

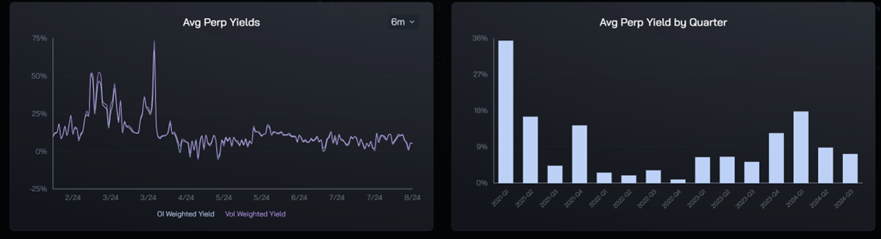

If a user believes that the annualized yield will decline, for example, after staking ETH in the Ethena protocol and minting USDe, and based on the current market conditions, the native income of USDe (the funding rate income from shorting contracts) continues to decline, they can choose to sell the YT asset, effectively cashing out the income early. At the end of the year, the user can buy back the YT asset, pair it with the PT asset, and redeem it for the SY asset;

The chart shows the USDe yield from the Ethena protocol, which has been at a low point (APY < 5%) since May.

If a user believes that the annualized yield will rise, they can buy YT assets, as YT assets will appreciate in value. Since YT assets represent yield, they are cheaper than the principal. For example, among 100 aUSDC, the YT asset is worth 5 dollars. This means that the user can amplify their yield by 20 times; or in other words, the user is leveraging USDC by 20 times.

If a user believes that the yield will remain stable, they can provide liquidity to the pool, offering liquidity for users buying and selling PT and YT assets. In this case, the user can earn additional trading fees while still receiving their original yield.

This approach is not uncommon in traditional finance; it merely splits the interest of income-generating assets and the base currency, then uses derivatives to amplify returns/hedge risks.

However, upon examining the trading volume of various pairs in the Pendle protocol, I discovered some issues.

Source: app.sentio.xyz/share/lv18u9fyu1b558xf?from="-2M"&to="now"

From the trading volume, it can be seen that the peak TVL of Pendle, which supports billions of dollars, is backed by the endless emergence of ETH staking/re-staking/liquid staking protocols and the top-tier project Ethena. This represents the greatest efforts and best results made by project parties on the supply side of ETH.

However, to this day, no rational investor/speculator can deny that the staking boom brought about by the Shanghai upgrade in 2023 and the earlier merge in 2022 did not create the wealth effect that people imagined. The native design of the Pendle protocol fundamentally filters out projects that are more likely to create wealth effects (such as the former op, arb, and aptos) by only allowing the splitting of income-generating assets.

In the first half of 2024, when everyone believes it is the beginning of a bull market, Pendle's TVL began to soar. From less than 400 million dollars at the end of January, it quickly climbed to nearly 5 billion dollars by the end of April. Behind this rapid increase in TVL are the activities of the first phase of ETHENA deposits and airdrops, as well as the launch of various re-staking projects like ethfi, renzo, and puffer. However, without exception, these projects provided relatively generous returns to users participating in staking in the short term, but after the tokens were listed, users quickly realized that the narrative of re-staking was not recognized by the market; meanwhile, the synthetic dollar assets of Ethena also lacked application pathways, and the funding rates of the contracts they relied on for survival continued to decline. All of this ultimately led to the collapse of the overall narrative and the value of ETH.

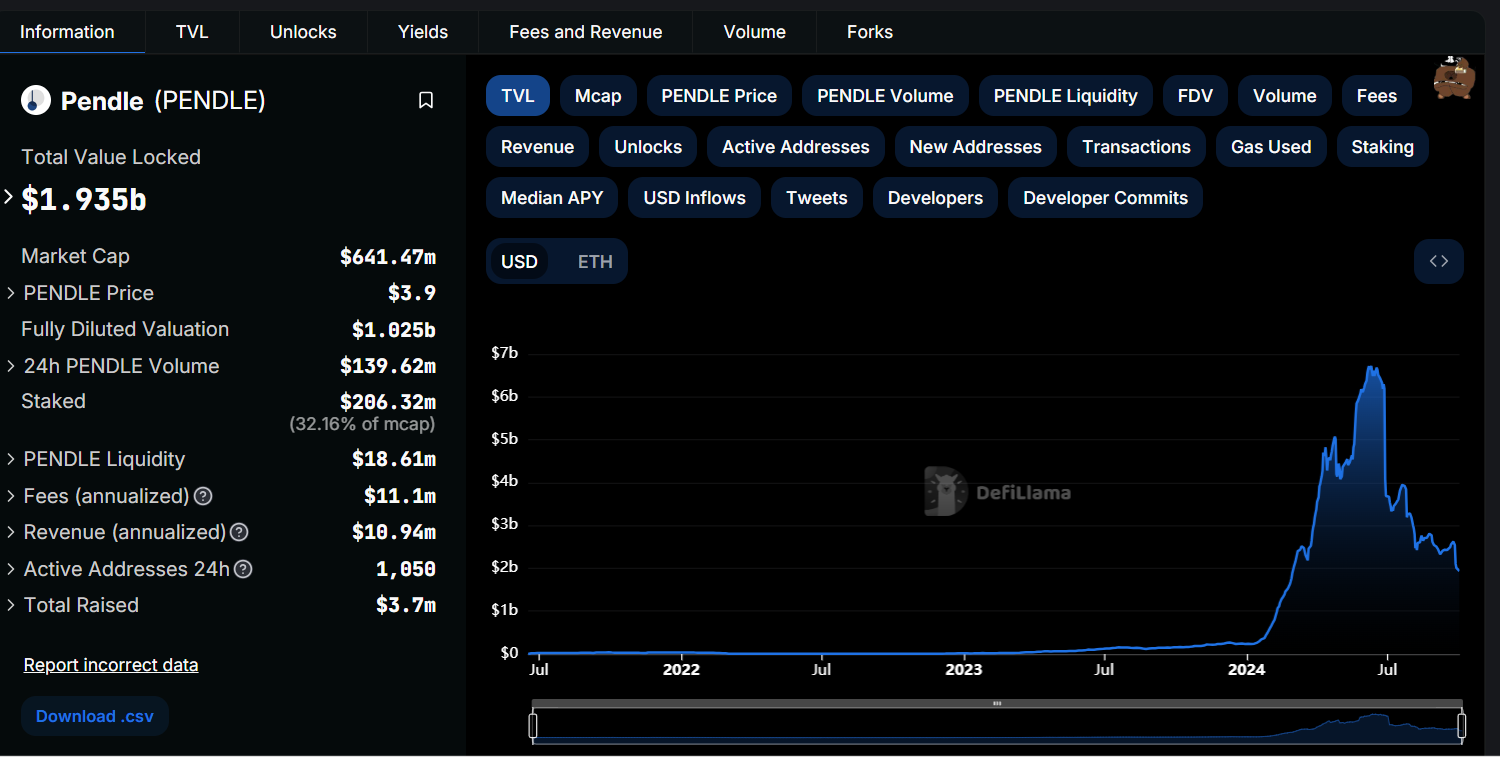

The chart shows the historical changes in Pendle's TVL, based on DefiLlama data.

I do not deny that the Pendle protocol represents a significant innovation in the underlying logic of the DeFi field, even though its predecessor is a derivative that has long existed in traditional finance. However, the underlying logic of splitting income-generating assets to achieve more stable or higher returns will remain a market necessity for a considerable period.

But for Pendle's token, its current TVL of less than 2 billion dollars supports its market value of over 600 million dollars and more than 1 billion dollars in TVL; and in the foreseeable future, its TVL will continue to decline.

The tokenomics of Pendle itself relies on the new LP pools formed by the income-generating assets after being split by the protocol.

VePENDLE is Pendle's governance token. Staking PENDLE will yield VePENDLE, and holding VePENDLE allows participation in Pendle's governance and voting, as well as sharing in the income of the Pendle protocol. The income earned by VePENDLE holders includes: interest collected from YT (approximately 3%) and rewards from maturing PT (excess income generated from PT that has not been redeemed in time after maturity), forming the basic APY of VePENDLE; VePENDLE voters also have the right to receive 80% of the swap fees from the voting pool; depositing VePENDLE into the LP pool to provide liquidity will earn PENDLE rewards in the LP pool, further increasing returns, potentially boosting returns by up to 250%. The VePENDLE obtained from staking PENDLE will unlock linearly over a period (up to two years). Ways to acquire PENDLE include: depositing LST or native asset tokens into the selected PT's LP pool to earn rewards, or depositing VePENDLE into the LP pool to provide liquidity and earn rewards.

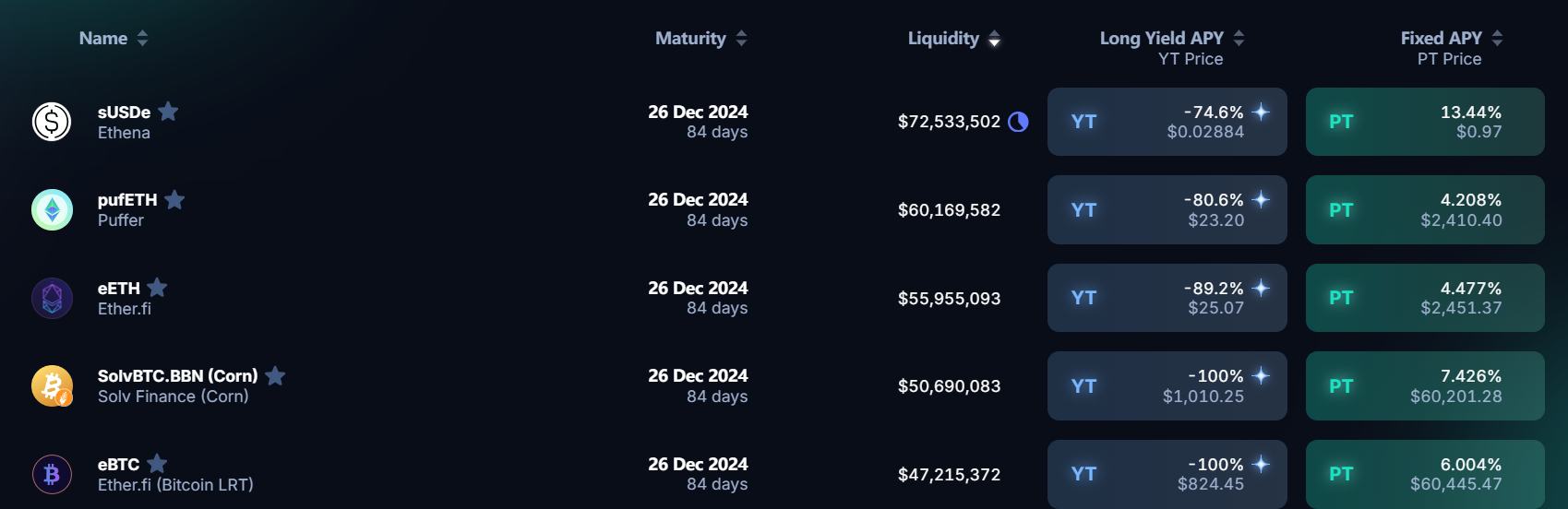

Imagine, when YT assets (yield tokens) have a long-term annualized return of negative numbers, and PT assets have a long-term annualized return of less than 10% or even 5%; at the same time, the original projects of income-generating assets are heading towards the heaviest LIST moment—when the yield transforms from a direct number into real tokens in users' hands, how many people will still invest in Pendle's protocol to earn the pitiful annualized returns?

The chart shows the trading pairs of Pendle (sorted by liquidity) at the time of writing.

Let me conclude with a quote from Wagner in "The Ring of the Nibelung."

The young queen does not yet know that all the gifts fate bestows have already been secretly priced.

Reference

app.sentio.xyz/share/lv18u9fyu1b558xf?from="-2M"&to="now"

PENDLE: Seriously Undervalued New DeFi Leader - News - odaily

Pendle Project Research Sharing - News - odaily

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。