We are currently in a phase of market sentiment instability. Stay focused, pay attention to the data, and don't be influenced by market noise.

Author: Ignas | DeFi Research

Translation: Deep Tide TechFlow

To be honest, since mid-2023, I have been bullish, but recently my confidence has started to waver. This is actually a good sign, indicating that the market is recovering. I have also received more and more private messages from veterans in the cryptocurrency community expressing concerns about the market, especially the recent poor performance of ETH. This is another comical reversal signal. Looking back to March, the consensus in the market was to follow the typical 4-year cycle. It seemed too simple, and it turned out to be true! But how bad is the situation really? I want to step out of the Twitter bubble and personally examine the data. Therefore, here is a snapshot of some data points to help us understand where we are currently and prepare for the upcoming changes.

U.S. ISM Manufacturing Index

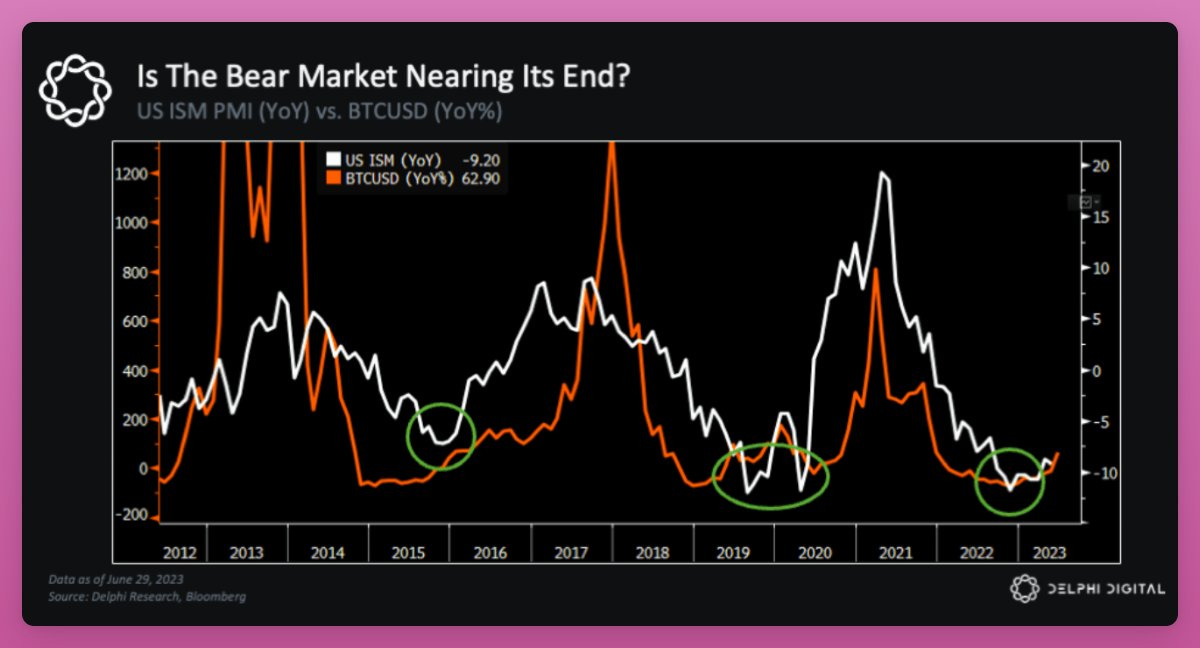

This may seem like a strange starting point, but let me explain. A year ago, I shared Delphi Digital's analysis of the catalysts for the upcoming bull market in a post. It makes sense to review previous predictions to draw important lessons.

In their analysis, Delphi detailed the "heavyweight" and "lightweight" narratives that would dominate the cycle.

The heavyweight narrative includes the Federal Reserve's liquidity cycle, wars, and new government policies. Delphi accurately predicted that Grayscale's victory in court would lead to the emergence of a BTC ETF, but they (and others) did not anticipate the rapid appearance of an ETH ETF.

They also successfully predicted the surge of SOL, the emergence of AI Token, and the dominance of memecoins. They deserve great respect for this.

But one thing they seemed to do better than others. Please take a look at the chart below.

They wrote: "The U.S. ISM is one of the best indicators for predicting asset price trends, and it looks like it is approaching the bottom of its two-year downtrend. The stock market has already begun to react to this…"

"What is surprising is how precisely ISM tracks the trajectory of previous cycles, including the timing of peaks and valleys. Every 3.5 years, it repeats like clockwork."

They correctly pointed out that ISM can predict the price of BTC. However, the biggest problem is that the U.S. ISM Manufacturing Index reversed its bullish trend in 2024 and started to decline.

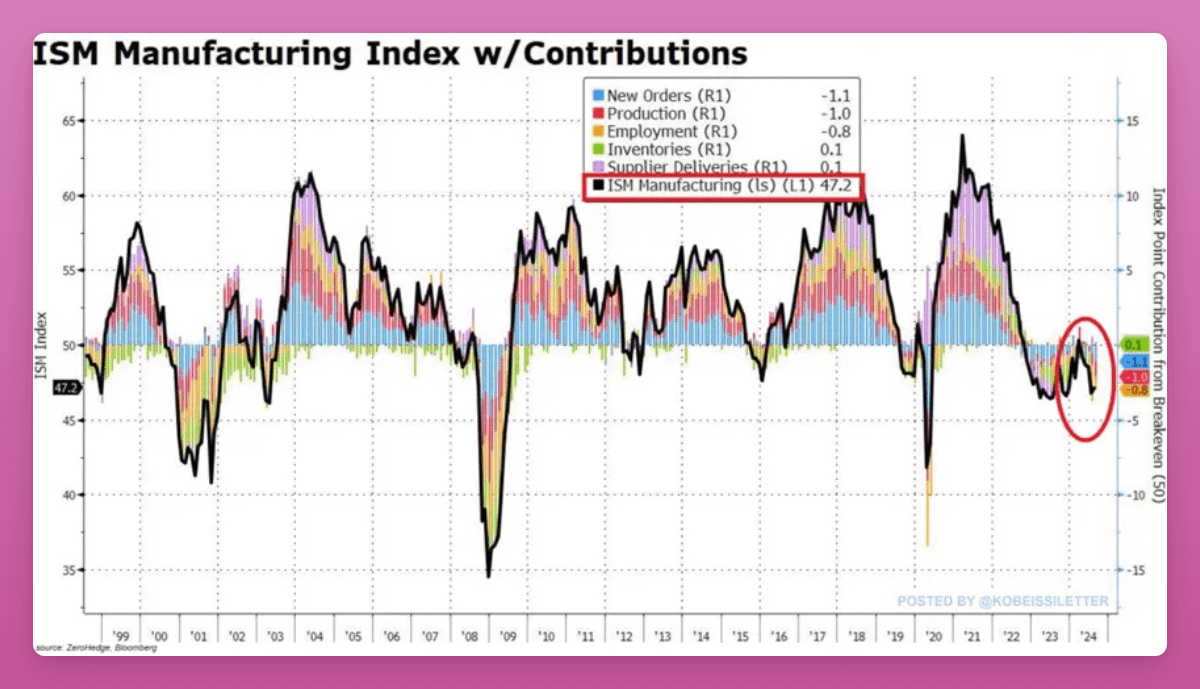

U.S. manufacturing has contracted for the fifth consecutive month, with the index falling to 47.2 points. The ISM Manufacturing PMI index did not reach the expected 47.5 points from the previous month. Source: The Kobeissi Letter

The U.S. ISM index affects cryptocurrency by influencing economic sentiment, risk appetite, and the strength of the dollar. A weak index may lead to reduced risk investment and selling, while a strong index will enhance market confidence.

Additionally, it also affects inflation and currency policy expectations, with interest rate hikes or a stronger dollar typically having a negative impact on cryptocurrencies.

If the U.S. ISM is one of the best indicators for predicting asset prices, we need to closely monitor the trend to seize the opportunity for a bullish reversal.

Cryptocurrency ETFs

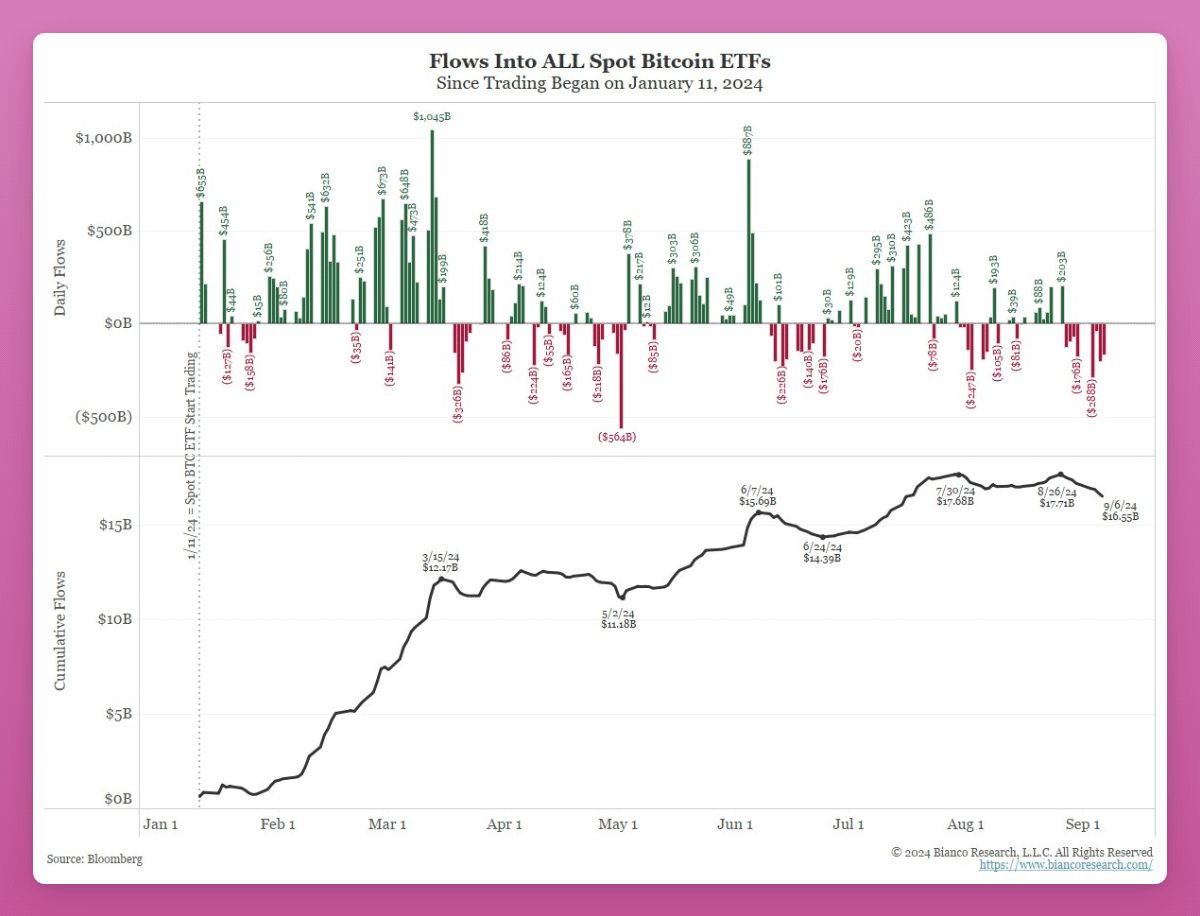

Our new ETFs are facing a tough period.

In the past 9 days, there have been 8 days of total outflows of $1 billion from BTC ETFs, the longest period of negative outflows since the ETF's launch.

The situation has worsened.

On Friday, the closing price of spot BTC was $52,900, resulting in a record $2.2 billion unrealized loss for ETF holders, equivalent to a 16% loss, according to Jim Bianco. The situation has slightly improved at the time of writing.

He also pointed out that the buyers of the ETFs are not institutions or baby boomers, but small "tourist" retail investors with an average transaction amount of $12,000.

According to cryptocurrency quantitative analysis, most of the inflows into spot BTC ETFs come from on-chain holders transferring funds back to traditional financial accounts, so the "new" funds entering the cryptocurrency market are very limited.

The participating institutions are mainly focused on carry trades (profiting from interest rate differentials) rather than directional investments. Wealth advisors are not very interested in this.

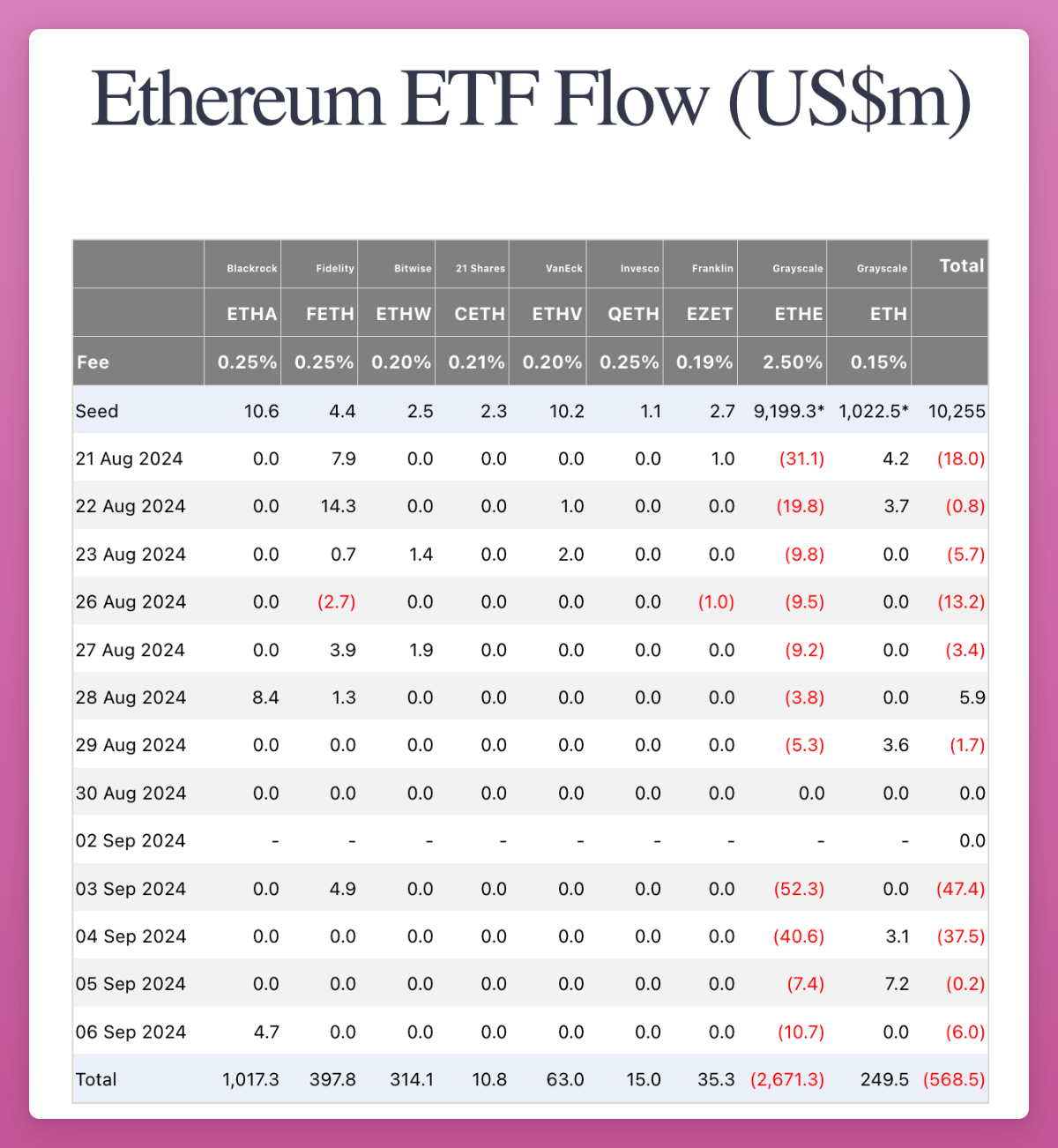

However, the situation is worsening. Just look at the fund flows of ETH ETFs.

Do you notice those zeros?

ETH ETFs have not even attracted retail interest. Even Blackrock's ETHA has only seen inflows on two days in the past 13 days. And the cumulative fund flows of all ETF issuers are negative.

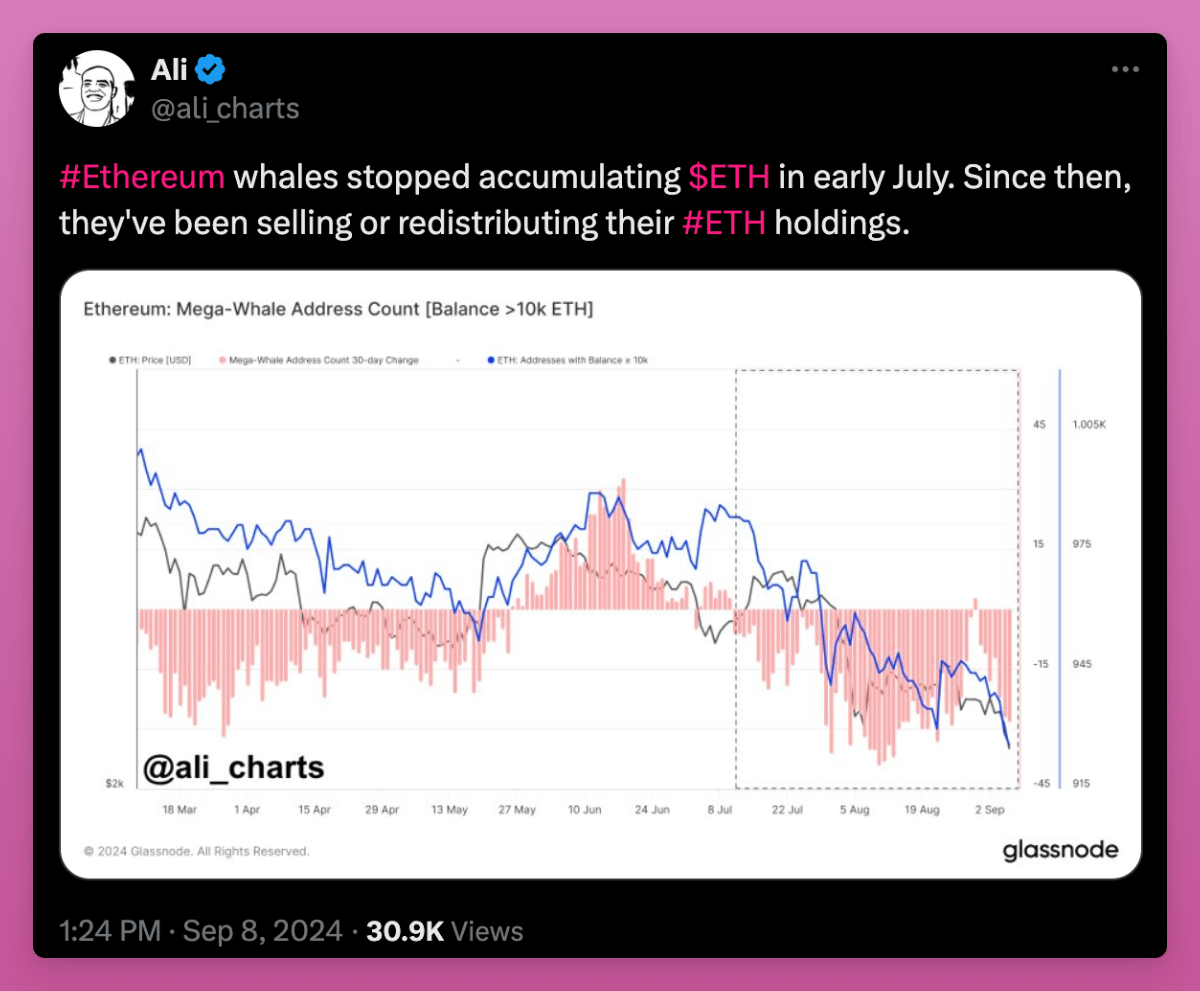

Since July, the selling by large ETH holders has dealt another blow to the market.

The only good news is that Grayscale ETHE has not sold ETH on a large scale. Grayscale still holds $5 billion worth of ETH, but the demand from ETFs is not enough to absorb these outflows, as daily inflows are less than $10 million.

Despite the seemingly unfavorable data, I will share my optimistic view on ETH below. Since that post, discussions about the ETH roadmap and the increasing value of L2 to L1 have become more intense. I am optimistic that the community can finally start focusing on the value accumulation of L1.

What are venture capital firms doing?

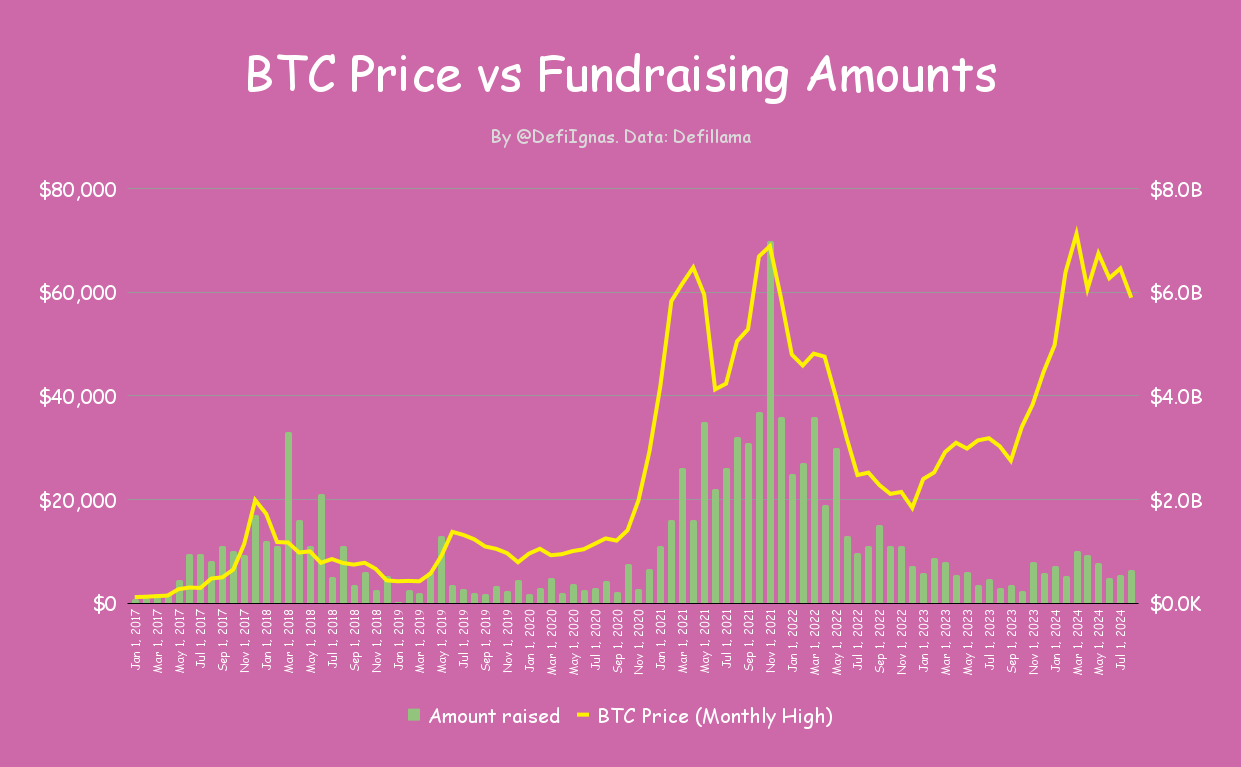

One of the most confusing issues in this cycle is the relatively low fundraising amount. Although BTC has rebounded, fundraising activities are still lagging, and I have been continuously updating the chart below to reflect this situation.

Venture capital firms may understand some situations, so they are not very optimistic about this industry, or they are chasing highs like retail investors. My conversations with some venture capitalists show that they are like retail investors, but with more abundant funds.

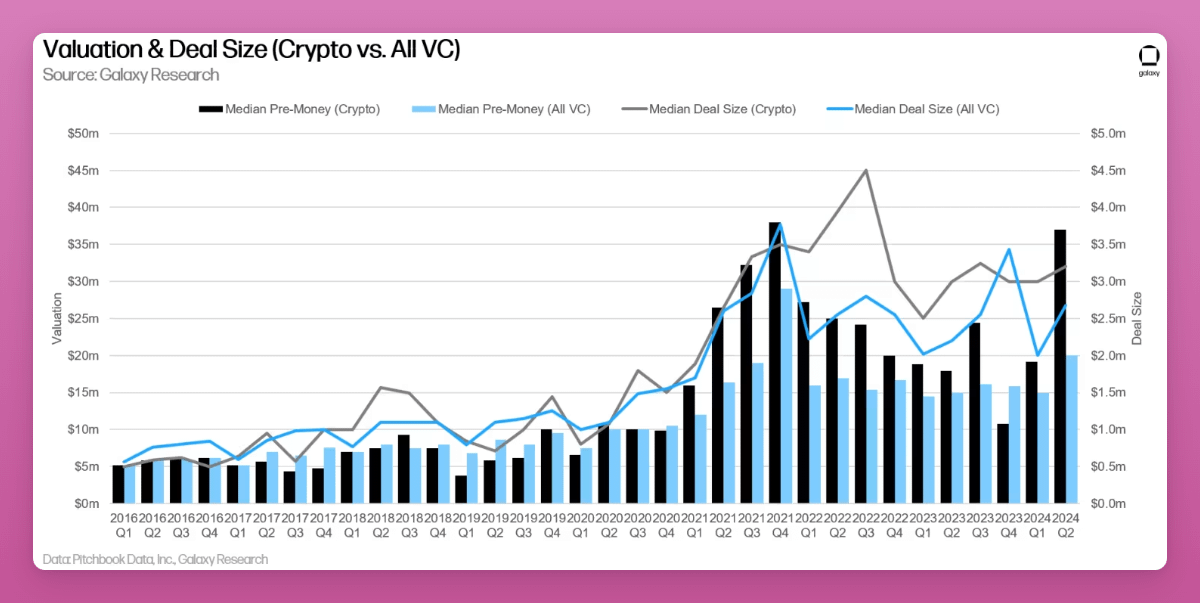

Although the total amount raised is much lower than in 2021, the median pre-funding valuation has almost doubled, from $19 million in the first quarter to $37 million in the second quarter, approaching a historical high.

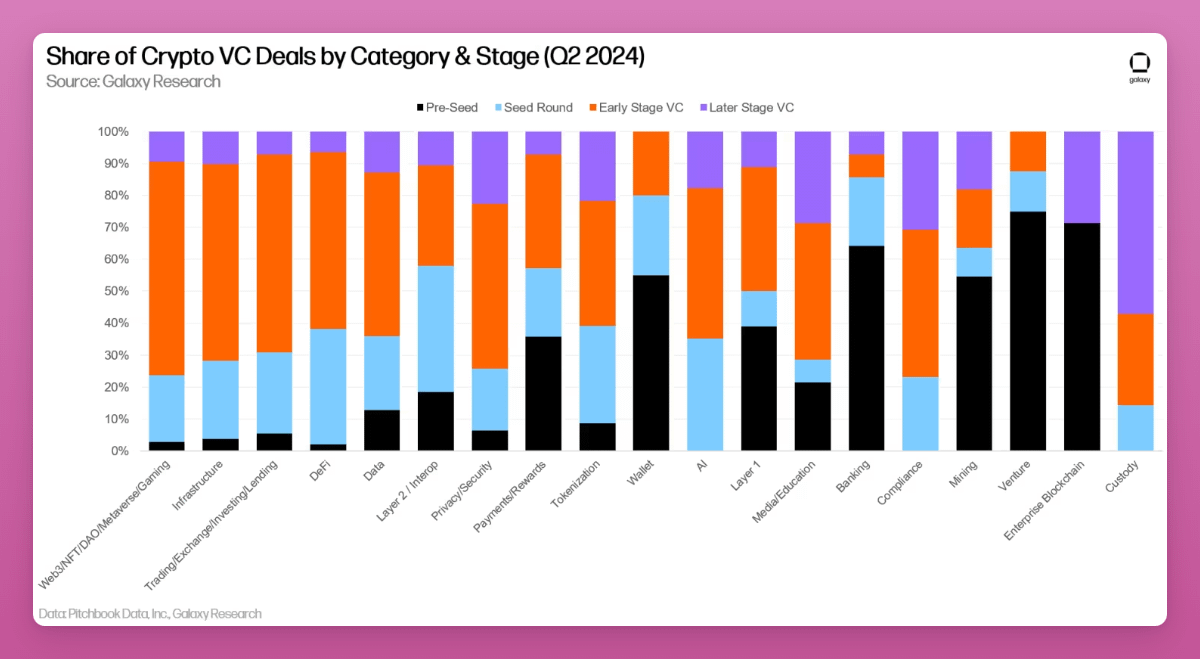

According to Galaxy's Q2 2024 venture capital report, despite limited available funds, competition and FOMO have driven up valuations, especially in early-stage startups.

This phenomenon is understandable. As cryptocurrency prices rebound, venture capitalists are rushing to invest in a few high-quality protocols. For example, Paradigm chose to support its competitor Symbiotic after failing to participate in Eigenlayer's investment.

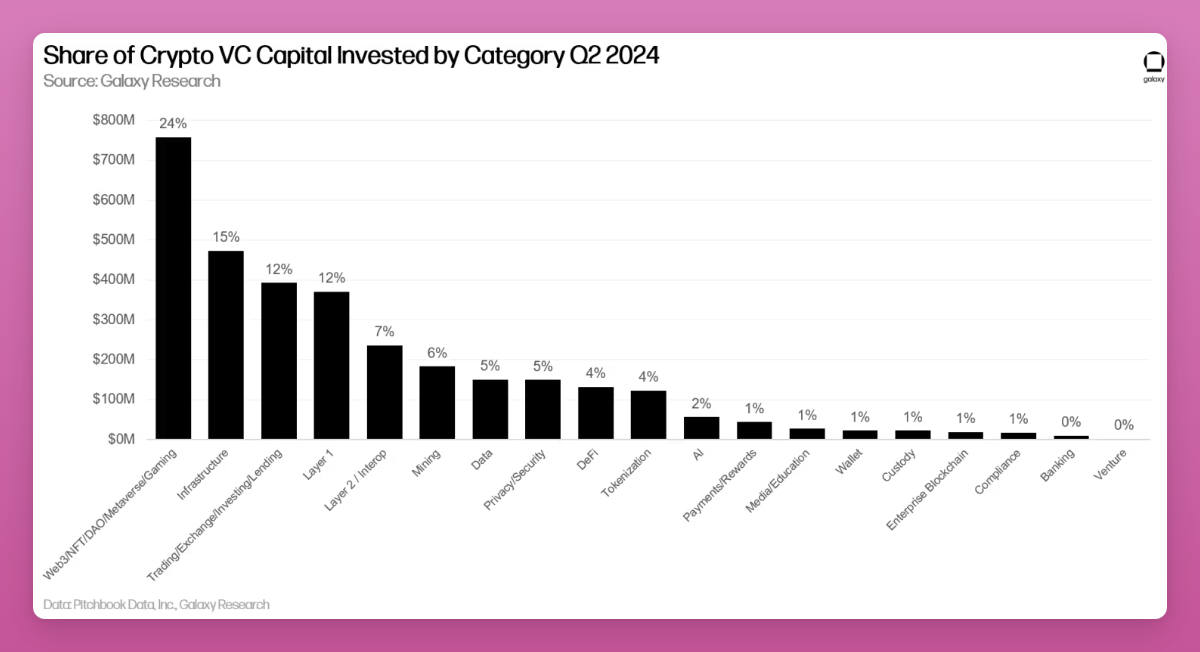

Another interesting phenomenon is that, despite low retail interest, Web3, NFT, DAO, metaverse, and gaming projects are leading in fundraising, raising a total of $758 million in the second quarter, accounting for 24% of total venture capital.

The two largest transactions were Farcaster ($150 million) and Zentry ($140 million). Infrastructure, Layer 1, and exchange categories followed closely. It is worth noting that the combination of cryptocurrency and AI still only attracts a small amount of capital.

I feel that the current market demand for gaming and the metaverse is low. At my DeFi creative agency, Pink Brains, we once hired someone to research and build communities for GameFi and the metaverse, but we had to pause the project due to low interest in gaming.

Interestingly, Bitcoin L2 raised $94.6 million in this quarter, a 174% increase year-on-year, indicating increasing interest from venture capitalists in the BTCFi ecosystem.

Investors are still optimistic about the Bitcoin ecosystem, expecting more composable block space to attract the return of DeFi and NFT patterns to the Bitcoin ecosystem. —Excerpt from Galaxy's Q2 2024 venture capital report.

Additionally, the Galaxy report indicates that early-stage transactions accounted for nearly 80% of investment capital in the first quarter, with seed-stage transactions accounting for 13%. This indicates optimism in the market's outlook for cryptocurrency.

Although late-stage companies face challenges, new innovative ideas continue to attract venture capital attention.

I personally feel that fundraising activities have decreased, as I rarely receive new private messages inviting me to participate in KOL rounds.

However, I usually do not participate in KOL round investments because I believe I do not have a particular advantage in the private placement market. I prefer to choose investments with higher liquidity and hope to maintain the independence of my content.

The Current State of L2 — Base Shines, Others Lag Behind

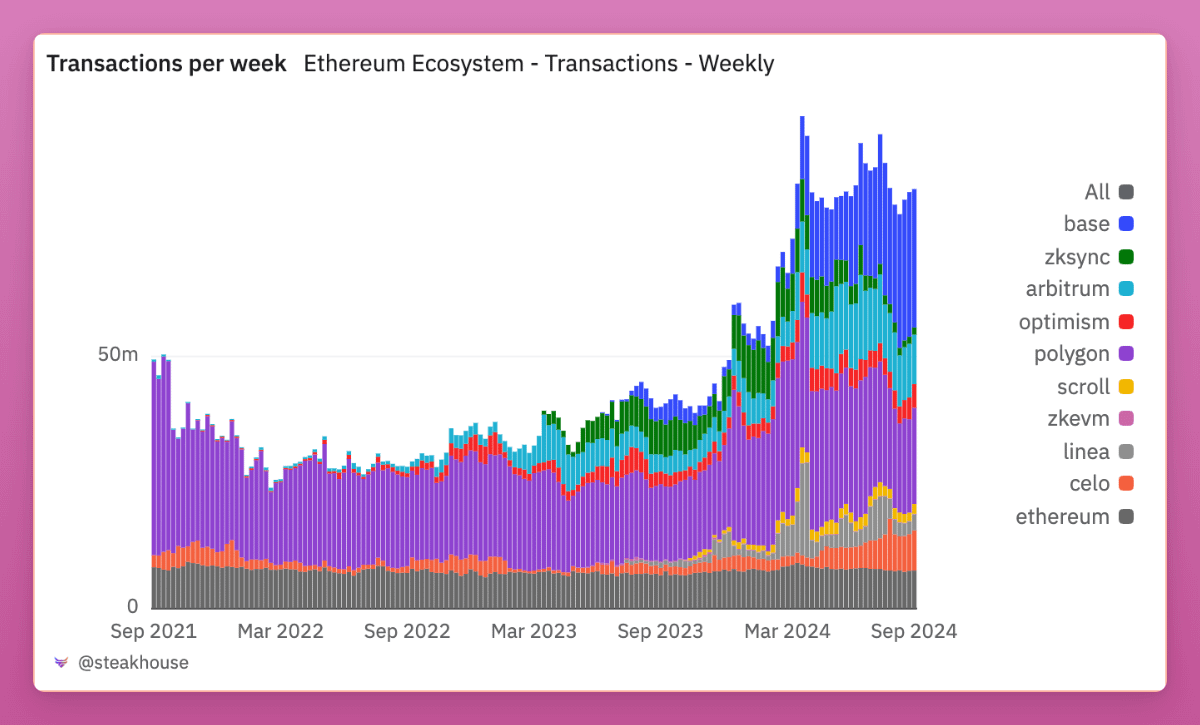

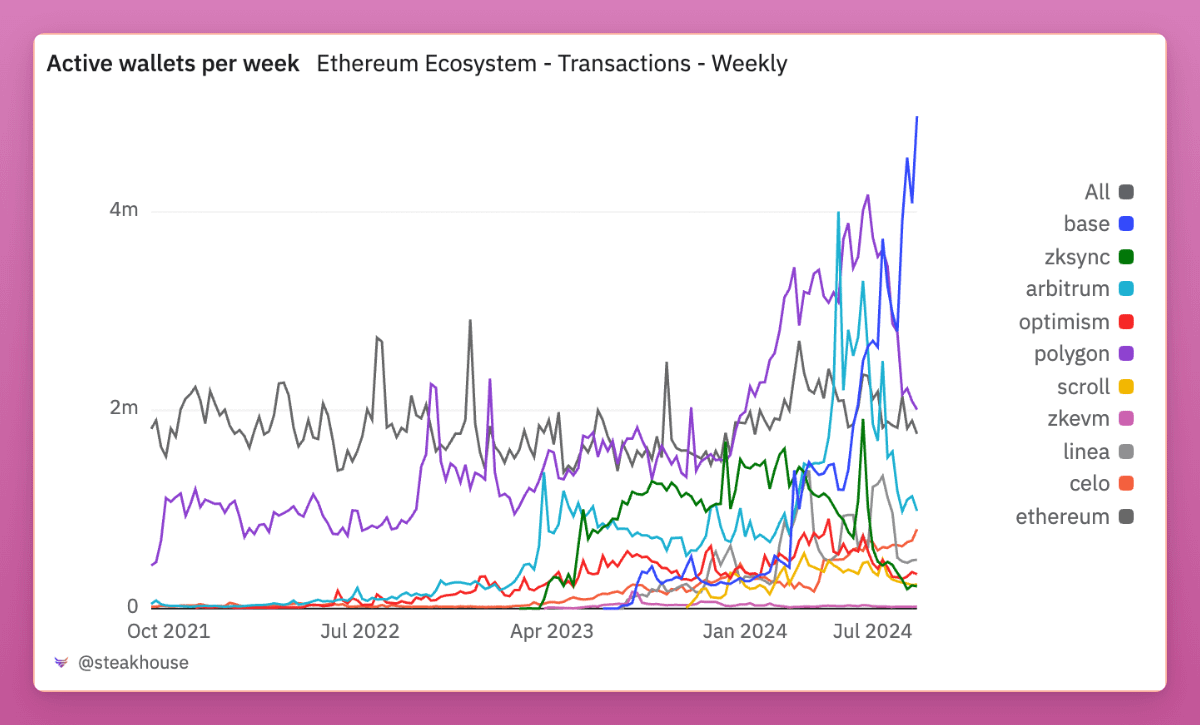

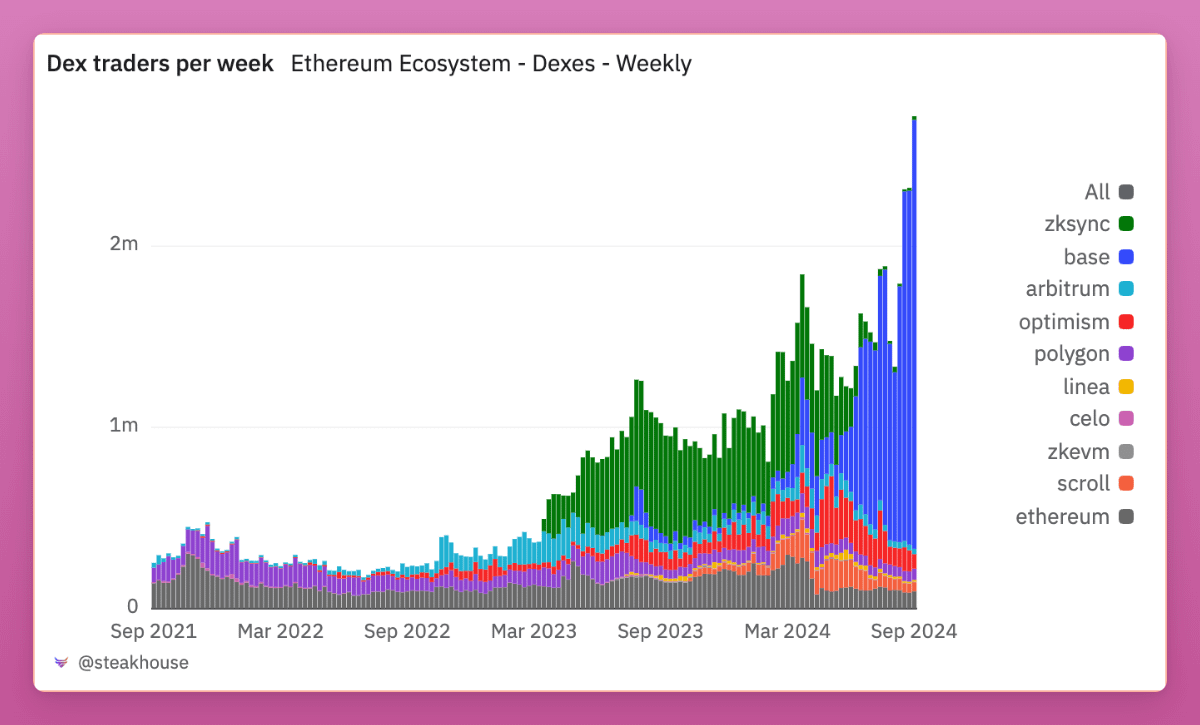

The good news is: activity on L2 is growing rapidly. The number of active wallets and weekly transaction counts are increasing, and trading volume on decentralized exchanges has been on the rise for a year.

However, Base's growth far exceeds others. Please see the blue line in the chart representing the number of active wallets per week.

Base continues to attract new users, while other L2s are losing users. This increasingly dominant position is particularly evident in the number of traders on decentralized exchanges, with Base occupying a market share as high as 87%!

So, what's going on?

Base introduced a smart wallet for the first time during the Onchain Summer event. Although the feature of creating wallets through Passkeys is novel, I mainly used the application to mint multiple NFTs just for the experience.

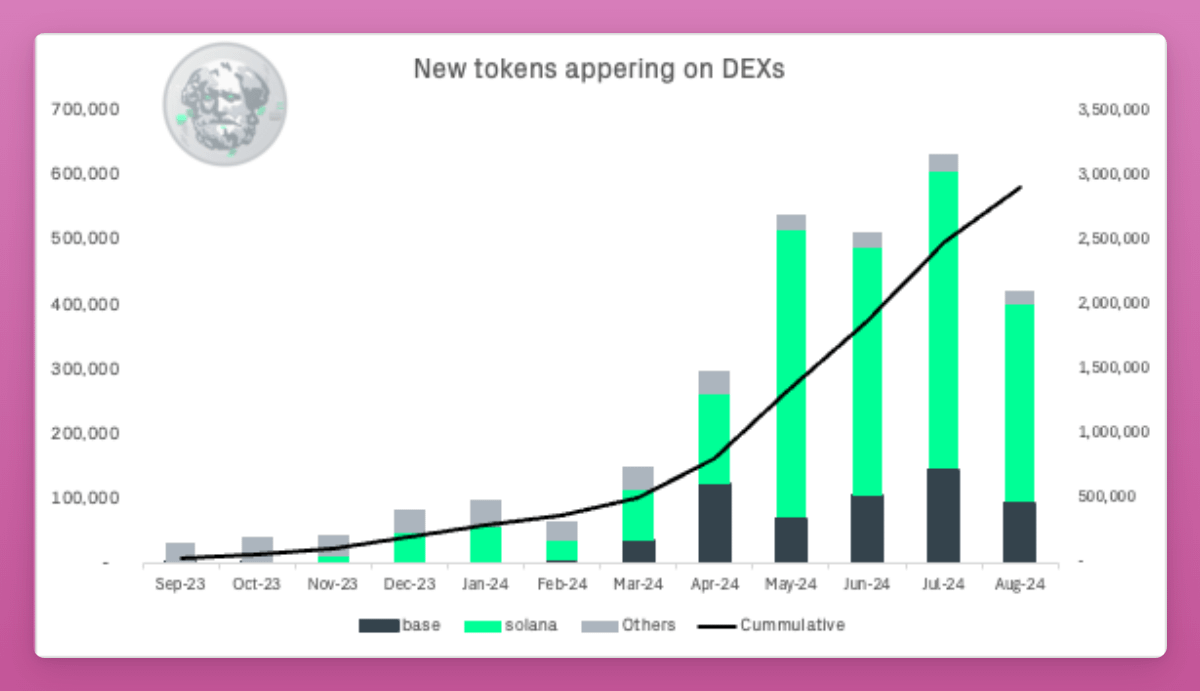

However, the real highlight for Base this summer was the speculative activity around meme coins, which greatly boosted trading volume and the number of wallets to historic highs. It can be seen that Base and Solana are the main drivers of most new token issuances on decentralized exchanges.

Source: Archimed Capital

Surprisingly, even though the hype around meme coins has subsided and summer has ended, trading volume remains high.

This may also be related to airdrop activities: several insiders I met during KBW speculated that the launch of Base Token is highly likely. Therefore, be sure to create your smart wallet and try using one or two applications. Farcaster might be a good choice :)

About SocialFi

Although I am somewhat dissatisfied with Racer and Friend Tech, SocialFi is another area with significant user growth.

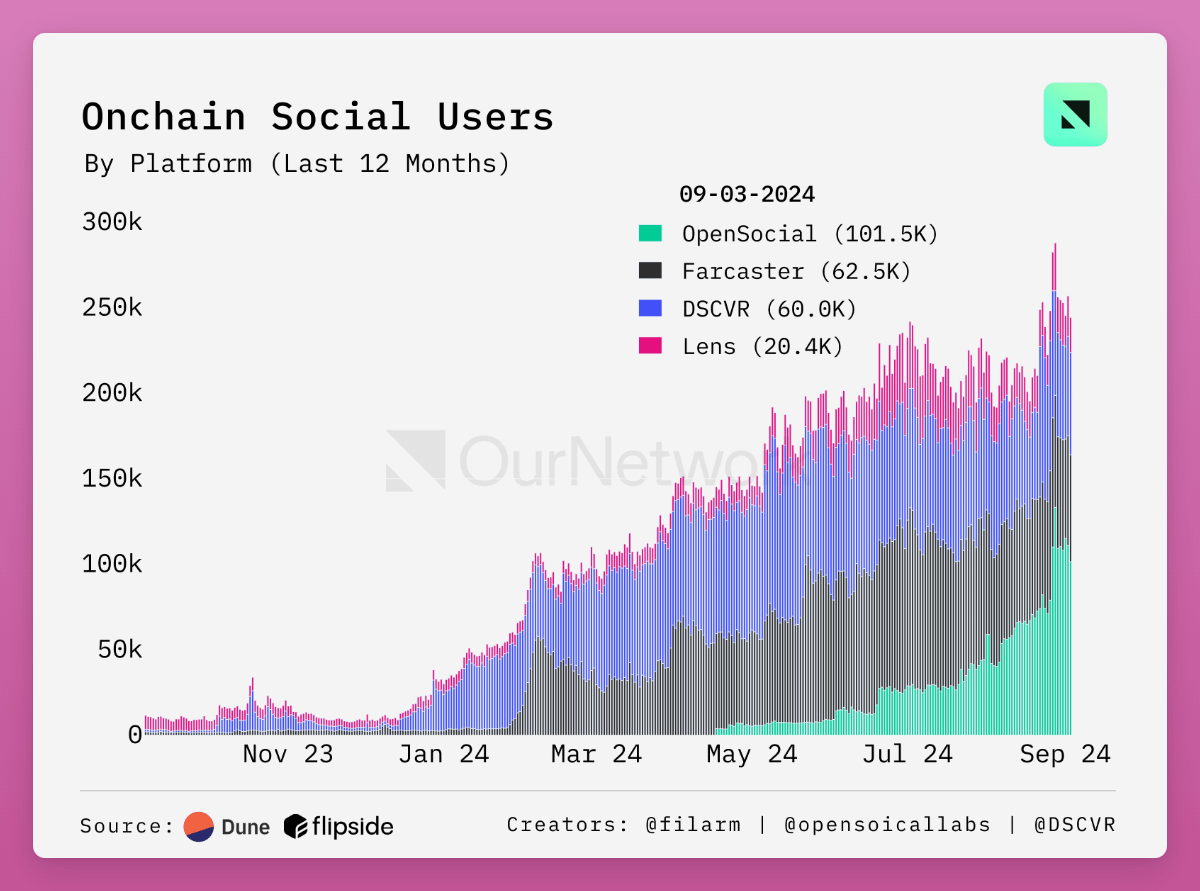

Although Farcaster and Lens have high attention on X, APAC's OpenSocial Protocol recently reached 100,000 daily active users, surpassing the total of 65,000 for Farcaster and 25,000 for Lens. However, it seems that few people on X understand the specific functions of OpenSocial. Solana-supported DSCVR has quietly reached 60,000 daily active users, but has almost gone unnoticed.

Despite my losses on Friend.tech, I still have high hopes for SocialFi. SocialFi is one of the few industries in the cryptocurrency field that goes beyond pure speculation. Vitalik Buterin mentioned in an AMA that he is most optimistic about the decentralized social media field.

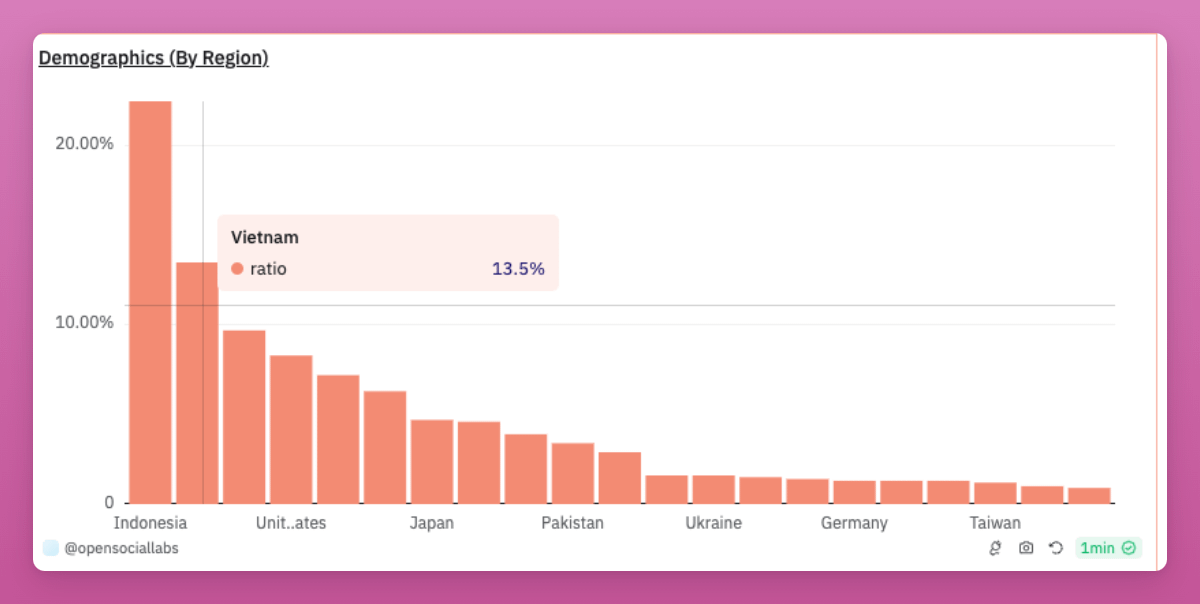

Yano pointed out that OpenSocial is being overlooked because the cryptocurrency news media and X are primarily dominated by the West, while OpenSocial originates from Asia: Indonesia, Vietnam, and India are its main user sources, with the United States ranking fourth.

OpenSocial is dedicated to building a decentralized social platform that allows creators and communities to fully control their social networks and data. Users can autonomously build and manage their own social applications, communities, and assets without relying on large platforms like Facebook or Twitter. This provides users with more control, ownership, and opportunities to profit from content interaction, making social media more open and fair.

Similar to Lens and Farcaster, OpenSocial is a platform that hosts multiple applications and interfaces. Among them, Social Monster (SoMon) leads in daily active users. You can try it here, although the current experience still has many flaws…

It is important to note that the narrative of cryptocurrency is often dominated by Western audiences, but in reality, real users from around the world may use cryptocurrency in ways different from those described by cryptocurrency OG on X.

Understanding the Current Market Situation Through Quick Charts

I want to share some data points to help everyone understand our current market status.

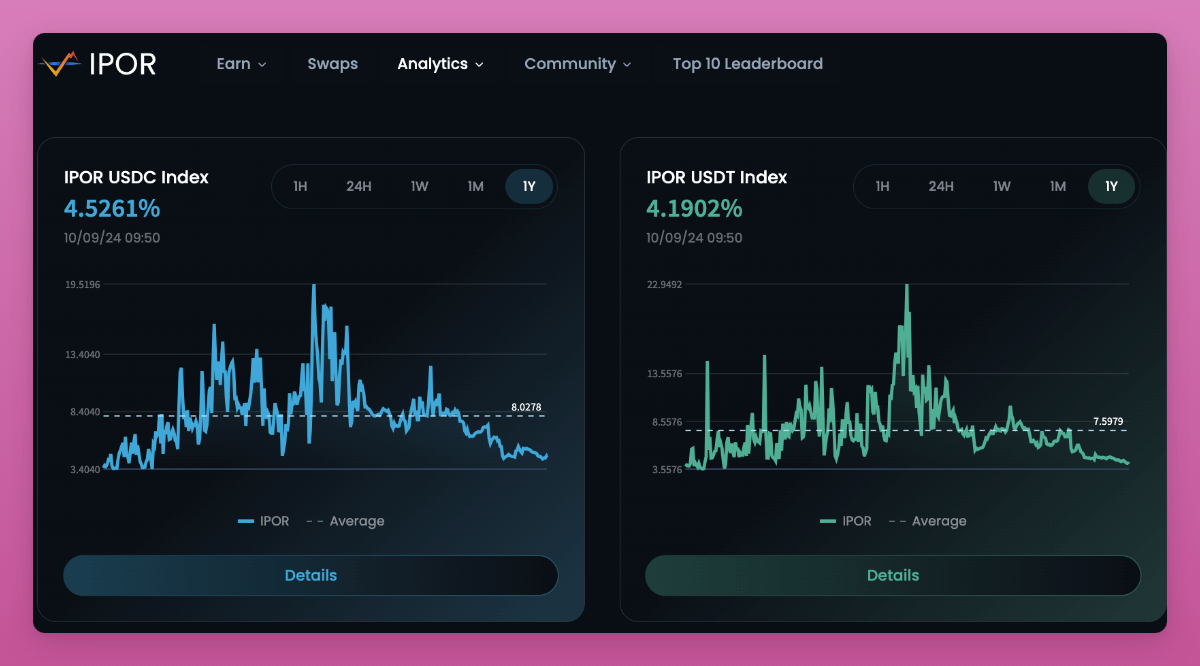

According to the IPOR Stablecoin Index, on-chain leverage has receded as borrowing rates have returned to pre-2023 market rally levels. During the active airdrop period, borrowing rates surged, but due to poor airdrop effects, many investors chose to close their carry positions.

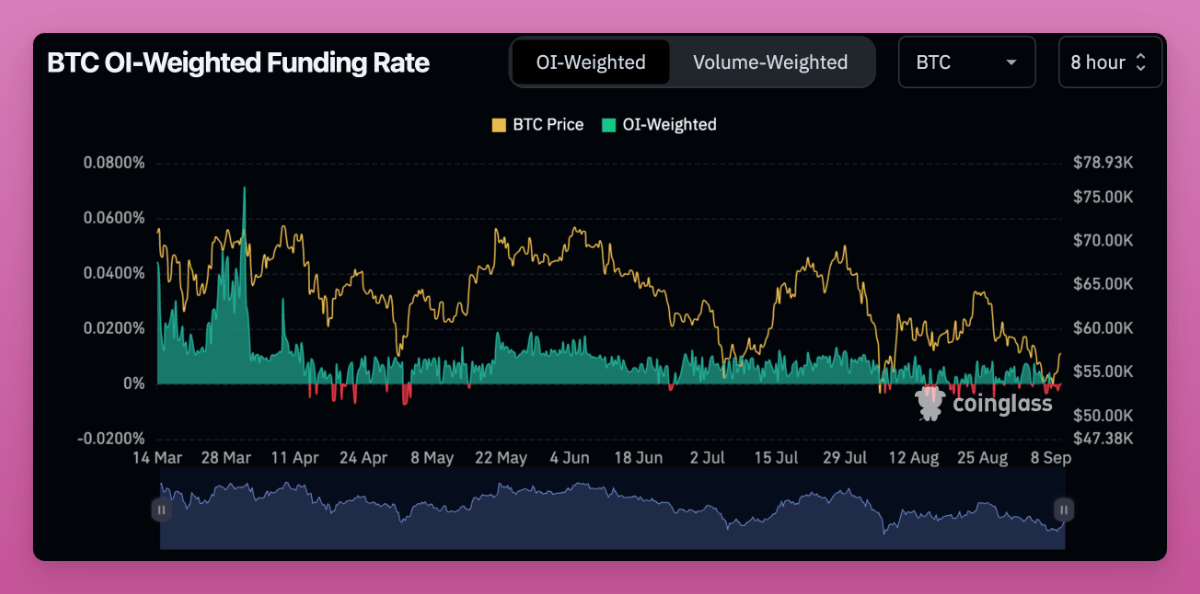

We can also observe a significant reset in leverage for Bitcoin open interest (OI).

Please note that the funding rate was high in March, turned negative in April, and turned negative again in July and August. A negative rate means that shorts need to pay longs, which usually indicates traders' expectations of a market decline. However, open interest (OI) has now returned to positive values.

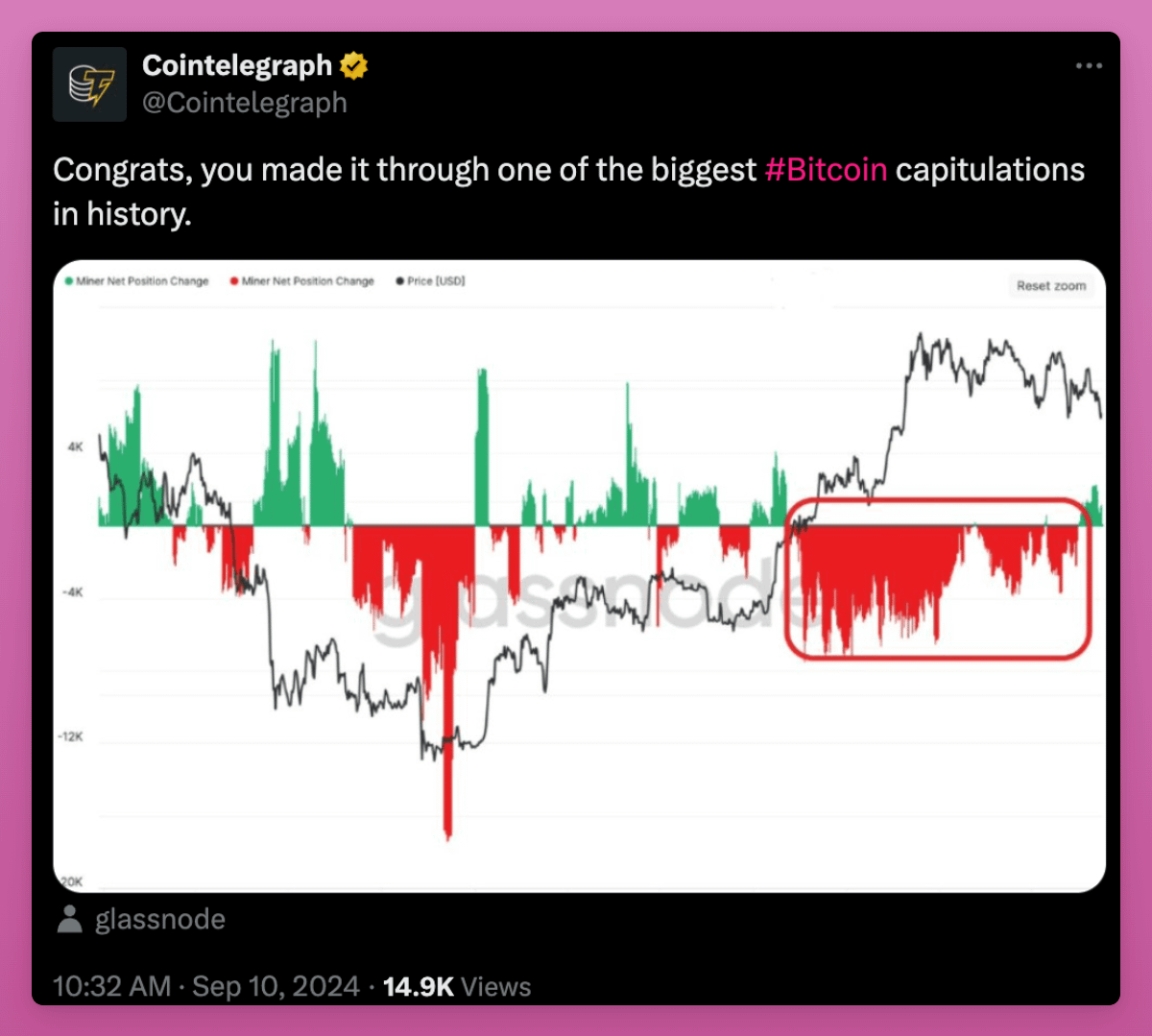

Another bullish indicator is miners' selling behavior. Miners seem to have stopped selling and have begun accumulating Bitcoin again.

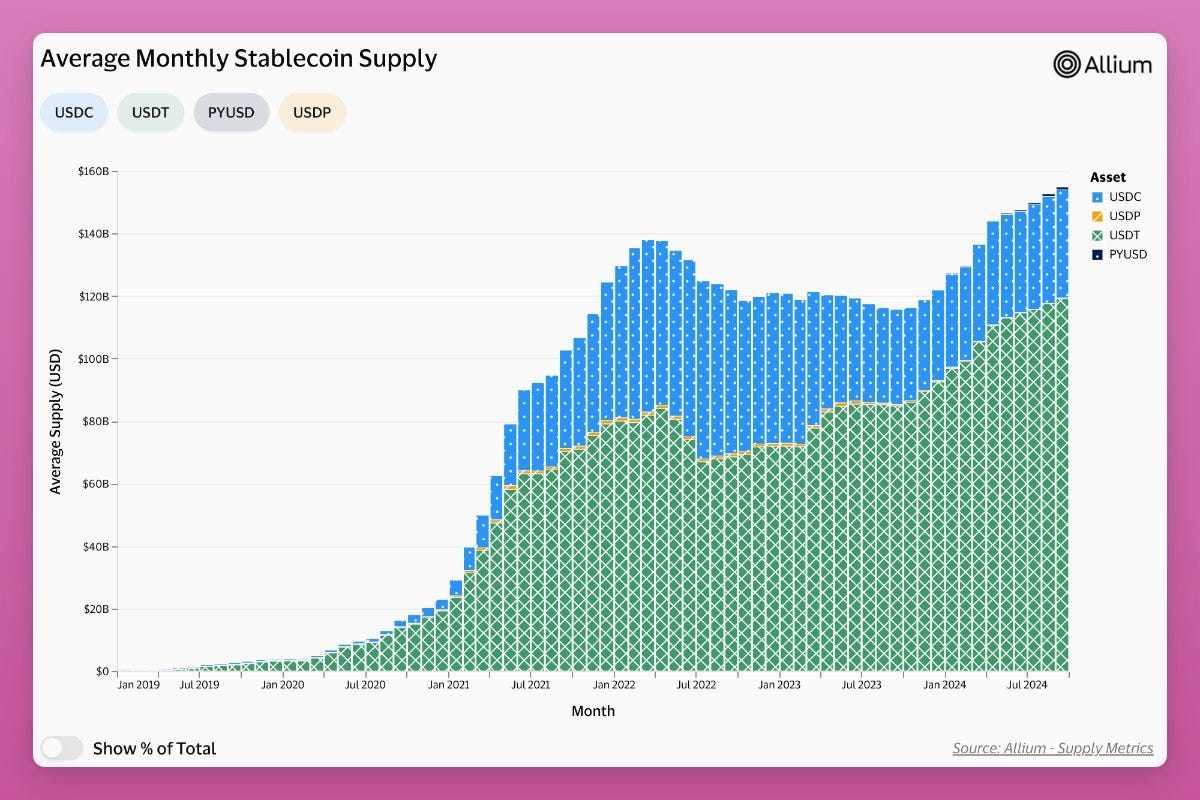

Perhaps the most bullish chart is the supply of stablecoins: the total supply is continuously growing.

However, the biggest difference is that the supply of USDT is increasing, while the supply of USDC has decreased from $55 billion to $34 billion. Why is this happening?

First, the collapse of Silicon Valley has led to the decoupling of USDC, marking the peak of USDC supply. Nic Carter has proposed another possible explanation: U.S. policies are prompting investors to turn to less regulated offshore stablecoins, causing the growth of USDC to stagnate while USDT is expanding.

If this is the case, the pro-cryptocurrency regulatory policies in the U.S. could be a favorable factor driving the rise of USDC.

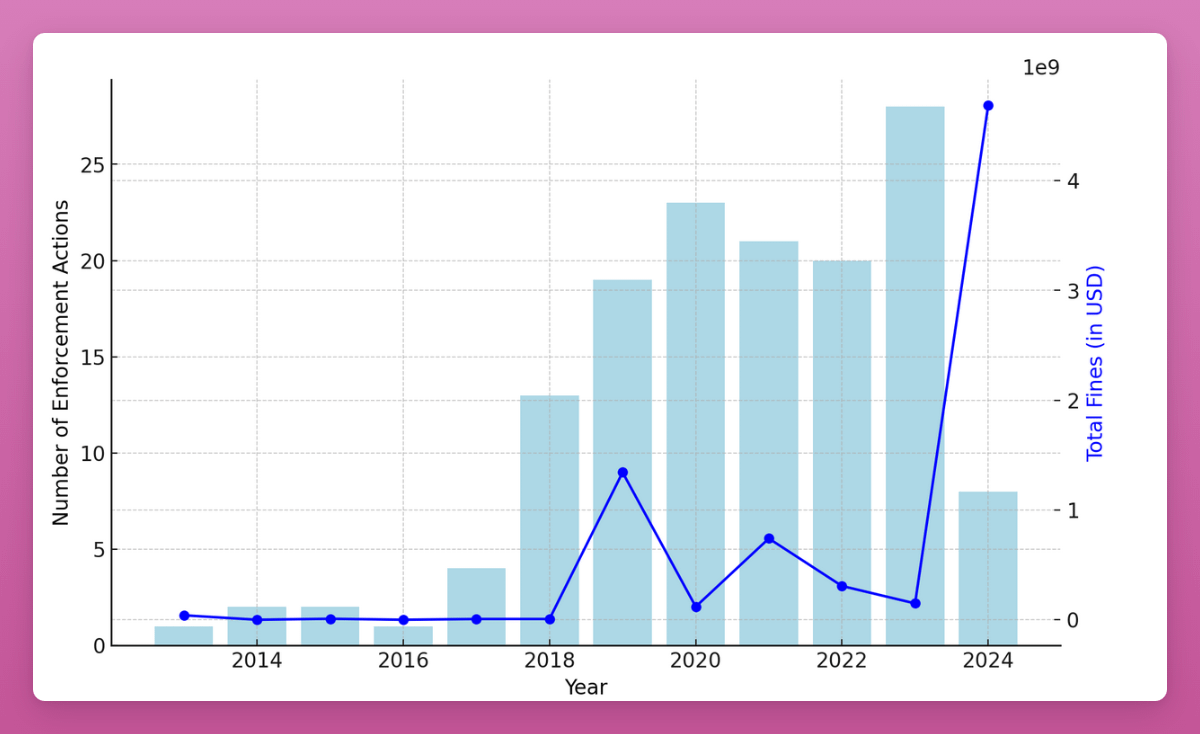

In terms of regulation, the U.S. Securities and Exchange Commission (SEC) collected $4.7 billion from cryptocurrency companies in 2024. This is 30 times higher than in 2023.

This money could have been used for cryptocurrency investments, but instead flowed to government officials rather than the true victims in the cryptocurrency field.

Most of this was from the $4.47 billion settlement with Terra. The good news is that a report from Social Capital indicates, "The SEC is reducing the frequency of fines but increasing the amount, focusing on impactful enforcement actions to set a precedent for the entire industry."

This is not a good sign. We need the current government to change its negative attitude towards cryptocurrency, or new policies to replace it.

Summary: Will the Market Rise or Fall?

The current situation seems less than optimistic.

The ISM index is declining, demand for ETH ETFs is weak, and venture capitalists are cautious, which is not an ideal market environment. However, this is the process of the market self-repairing. In fact, when everyone is in panic, it often means that we may be closer to the market bottom than we imagine.

Although there are many bearish data points, there are also many positive signals. L2 solutions are performing well (especially Base), social platforms like Farcaster and OpenSocial are continuously growing, and market leverage has been cleared. Despite the decrease in market heat, some key areas remain active.

The current regulatory environment is quite chaotic. The SEC has been exerting pressure on the cryptocurrency field. We need a change in the U.S. regulatory policy towards cryptocurrency, or a change in leadership, to curb this situation. Supportive regulatory policies for cryptocurrency could be a catalyst for a market rally. Until then, the pressure remains. However, even if the Democratic Party comes to power, they may need to increase the money supply to fulfill their promises. In such an environment, Bitcoin is the most advantageous asset.

Ultimately, the market does not develop in a straight line. We are in a phase of unstable market sentiment, but this is not a big problem. Stay focused, pay attention to the data, and do not be influenced by market noise.

Bullish trends are often not obvious until they are obvious. In conclusion, I still have a positive outlook on the market.

Of course, I could be wrong.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。