作者:@Web3Mario

摘要:上周风险资产市场均面临了一定压力,特别是周五在公布了美国8月非农就业以及失业率等关键数据后出现了较大幅度的回撤,但是从数据来看,虽然不及预期,但是并没有特别糟糕,所以对于这种价格走势还是需要抽丝剥茧,来看下到底发生了什么。因此笔者在周末时间总结了一下相关逻辑,有一些心得体会,与诸君分享。总的来说,这轮下跌的核心原因,表面上是美国非农就业数据的“反弹不及预期”,一定程度上引发了市场对美国衰退的担忧,本质上是伴随着英伟达的二季度财报的公布,业绩增长速度放缓,作为这轮牛市的核心驱动力的英伟带开始了杀估值,由此资本加快了在科技股板块去杠杆的步伐,以规避风险。

美国非农数据虽低于预期,但也不是特别糟糕

首先简单来看下作为周五加密市场下跌的非农就业以及失业率等数据的变动,在周五公布的8月美国新增就业人数增加了142000人,高于7月的89000人。这表明就业市场出现了好转,然而与预期的16.5万人仍有一些差距。而失业率则出现了一定下滑,从7月份的4.3%下降到4.2%。这也符合市场的预期。

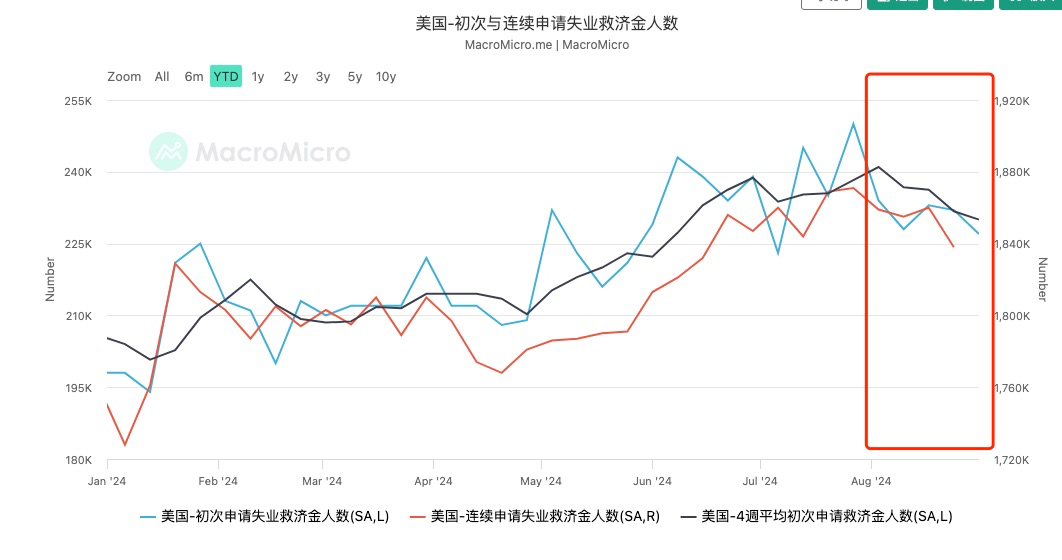

我在之前的文章中已经分析了其实这个数据其实可以通过周初次申请失业救济金人数的变化中被提前观测出来。可以看到在8月份,无论是初领人数还是连续申请人数均呈现了下滑的趋势,这就表明就业市场得到了不错的恢复,因此说非农数据远超预期,引发市场对衰退的严重恐慌,我个人是保持观望的态度,因此引发的加密市场下跌,大概率是作为一个导火索而对去杠杆周期的一种反馈。

那么这样一份看起来并不特别糟糕的数据,为什么会引发加密市场的剧烈波动呢。我认为本质原因还是在于受英伟达Q2财报增长放缓引发的去杠杆操作的一种反馈。

连续放缓的业绩增长率无法满足资本的预期,英伟达开始杀估值,科技板块去杠杆加速

可以说本轮牛市的核心驱动力就是以英伟达为代表的AI板块的增长,在8月29日公布了2024年Q2财报,虽然依然呈现了增长的态势,但是却引发了市场的抛售,核心原因在于EPS增长率的加速下滑,引发了恐慌,市场开始杀估值。在这里稍微解释一下背后的逻辑,通常情况下,股票的价格是市场对该公司的估值的反馈,通过各种财务数据、预测和市场信息来评估资产的价值。股票估值的核心目标是判断一家公司是否值得投资,价格是否与其潜在的盈利能力或资产状况匹配。一个最基础的估值方法就是计算市盈率(P/E Ratio),并结合对公司所处行业的平均水平进行比较,从而判断当前股票价格是被高估还是低估。市盈率的计算方法是用股票的价格除美股收益,也就是EPS,因为股票的核心价值是分红权。

其实这个值也理解成你投资一个股票,光靠公司分红的前提下,用几年可以赚回本金。通常情况下,科技行业由于具有高成长性的特点,市场会给出更高的市盈率标准,这也是容易理解的,因为市场相信随着高成长性的不断兑现,公司的分红增长将会越来越快。因此这个对未来增长的贴水将反映在市场对高股价的容忍上。

在理清楚这些背景后,我们来看英伟达的财报反映了什么问题。其实本质就是EPS的加速下滑引发了市场对估值过高的担忧,从这张图中我们能够明显看出这个影响,上半部分是英伟达的股价,下半部分是EPS的年同比增长率,可以看出二季度的EPS增长率相较于一季度的表现出现了明显的下滑,且下滑的趋势加大。

大家回忆一下在过去的半年内,市场对于英伟达的股价是否高估就已经产生了比较广泛的讨论,在每次临近季度财报公布时都会出现价格上的波动,然而每次英伟达都用一份亮眼的增长数据打破市场的质疑,通过远超预期的业绩增长表现让市盈率回归。这就让市场有了一定的思维惯性,即使是它的市值一度已经来到了第一的位置,这种高增长预期也依然保持。当然这也与由于当前处于限制性利率中,大部分行业均承载了不小的压力。所以这样一个增长的独苗显然受到了资本的青睐,资本选择抱团取暖对抗高息环境有一定关系。然而这次的增长表现看起来并不能满足资本被不断强化的预期,并没有如期将PE拉回到46附近这一看起来是合理的区间,这就意味着股票价格看起来被高估,因此市场开始了杀估值。所以可以看到当市场充分消化了8月29日的财报信息后,英伟达股价在美国劳动节后9月3日开盘后迅速下跌,使得市盈率调整到了46附近。然而后续是否进一步下跌,还是要看各种机构给出自己的展望,目前看来,各方的态度似乎还是比较乐观,并没有进一步看跌的信息。

在之前的文章中已经提到了日元作为整个高息环境下的廉价资金来源,以及日本半导体产业与英伟达之前的关系,因此在英伟达股价的推升过程中,日元是核心的杠杆资金的来源,而伴随着杀估值的展开,我们可以看到尽管日本央行一再安抚,市场已经事实上再次开启了去杠杆以规避风险的操作。从9月3日开始,美元日元汇率从147快速放量下跌到142,挑战年初的低点140压力位。

日元的快速升值引发的杠杆资金成本的进一步垫高,又会进一步挤压套利操作的利润,而这又会进一步刺激去杠杆操作,因此我们需要警惕由此带来的负反馈风险。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。